|

市场调查报告书

商品编码

1636131

欧洲储槽保护:市场占有率分析、产业趋势、成长预测(2025-2030)Europe Tank Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

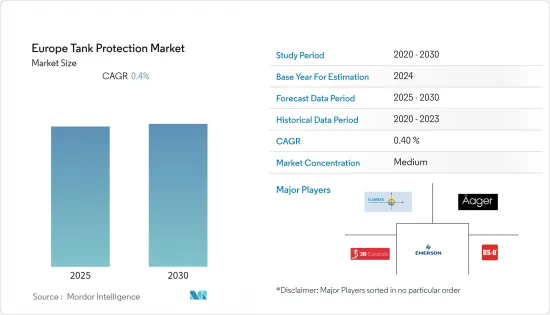

欧洲储槽保护市场预计在预测期内复合年增长率为 0.4%

主要亮点

- 下游领域投资的增加和海上石油探勘活动的活性化是推动市场成长的关键因素。

- 同时,原材料价格波动和越来越多地采用清洁替代燃料是市场的主要限制因素。

- 控制流程自动化需求的不断增长预计将为预测期内的市场参与企业提供巨大的机会。

- 德国地区在市场上占据主导地位,并且在预测期内也可能表现出最高的复合年增长率。

欧洲储罐保护市场的趋势

石油和天然气是主要细分市场

- 随着天然气在能源结构中所占份额不断增加,全球天然气需求的不断增长预计将成为全球油气市场成长的关键驱动力。过去十年,随着各国从煤炭转向天然气作为清洁能源的初级能源来源,天然气的全球生产和消费发生了重大变化。

- 根据BP 2022统计年鑑,2021年欧洲精製吞吐量为11,453,000桶/日,高于2015年的1,281,000桶/日。这一增长是由欧洲石油和天然气需求推动的。

- 与世界其他地区的类似计划相比,欧洲海上石油和天然气计划的盈亏平衡价格较高,这使得它们在当前动盪时期的弹性较差。该地区的大多数海上计划位于北海和北极大陆架,这些地区的极端天气条件可能是盈亏平衡价格高的主要原因之一。因此,石油和天然气计划的增加将导致预测期内欧洲储罐保护市场的成长。

- 截至2022年3月,俄罗斯有44家运作中的炼油厂,总合约为每天700万桶。该国大多数炼油厂的运作苏联时代或更早时期。该国炼油厂运转率在相当长一段时间内保持在较低水平,并于2019年开始上升。

- 因此,鑑于上述几点,石油和天然气行业投资的增加将在预测期内推动市场。

德国坦克防护市场快速成长

- 德国是欧洲最大的天然气市场,该国大部分天然气供应来自俄罗斯。在有潜力增加进口能力的欧洲市场中,德国计划增加最多的再气化能力,预计将达到 13.2 MTPA。

- 2022年2月,德国计划在布伦斯比特尔和威廉港建造两个液化天然气接收站,以减少对俄罗斯天然气的依赖。威廉港LNG接收站将由德国能源巨头 Uniper 建造和营运。 FSRU 的容量为 7.3 MTPA,预计未来将满足德国约 8% 的天然气需求。该计划计划分两期完成,年终和2025年终完成。

- 2022年5月,挪威国营营运商Gassco授予工程公司Wood一份合同,支持将天然气从挪威大陆棚(NCS)安全运输到美国和欧洲国家。根据一项为期三年的协议,Wood 正在与 Gassco 合作对其天然气接收设施进行现代化改造。该公司将负责为英国伊辛顿、比利时泽布吕赫、法国敦克尔克、德国多纳姆和德国埃姆登的天然气接收站提供工程、采购和施工管理服务。

- 根据英国石油公司《2022年统计回顾》的数据,2021年,德国精製能力达到212.1万桶/日,高于2015年的204.9万桶/日。

- 因此,随着炼油和石化业务的扩张以及即将开展的计划,德国储罐保护市场的需求预计将增加。

欧洲储槽保护产业概况

欧洲坦克保护市场是细分的。该市场的主要企业包括(排名不分先后)艾默生电气有限公司、Flammer GmbH、Aager GmbH、BS&B Innovations, Limited 和 3B Controls Ltd。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2027年之前的市场规模与需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 加大下游产业投资力度

- 海上石油探勘活动增加

- 抑制因素

- 更多采用更清洁的替代燃料

- 机会

- 控制过程中对自动化的需求不断增加

- 促进因素

第五章:更多采用清洁替代燃料

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 石油和天然气产业

- 上游

- 下游

- 中产阶级

- 应用

- 新计画(新订单)

- 现有计划(替代项目)

- 装置

- 阀门

- 发洩

- 阻火器

- 地区

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 欧洲其他地区

第七章 竞争格局

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Braunschweiger Flammenfilter GmbH

- Flammer GmbH

- INNOVA SRL

- Emerson Electric Co.

- 3B Controls Ltd

- KITO Armaturen GmbH

- Motherwell Tank Protection

- BS&B Innovations, Limited

- Oil Conservation Engineering Company(OCECO)

- Elmac Technologies

第八章 市场机会及未来趋势

简介目录

Product Code: 5000228

The Europe Tank Protection Market is expected to register a CAGR of 0.4% during the forecast period.

Key Highlights

- Increasing investment in the downstream sector and rising offshore Oil exploration activities are major factors expected to drive the market's growth.

- On the other hand, Volatile raw material prices and rising adoption of cleaner alternatives are the major restraints for the market.

- Nevertheless, the growing demand for automation in the control process is expected to create an excellent opportunity for the market players in the forecast period, as these projects are paving the way for the line pipe industry to grow more.

- Germany region dominates the market and is also likely to witness the highest CAGR during the forecast period.

Europe Tank Protection Market Trends

Oil and gas is major segment in the market

- The growth of natural gas demand globally, in line with the increasing share of natural gas in the energy mix, is expected to be a primary driver for the growth of the global oil & gas market. Natural gas witnessed a significant change in its global production and consumption, owing to the countries shifting from coal to natural gas as a primary energy source for cleaner energy during the last ten years.

- According to BP statistical review 2022, In 2021, Oil refining throughput in Europe is 11453 Thousand barrels per day, increasing from 12810 Thousand barrels per day in 2015. This increase is due to the European region's demand for oil and gas.

- Offshore oil & gas projects in Europe have higher breakeven prices compared to similar projects in other parts of the world, making them less resilient in the current turbulent times. Most of the offshore projects in the region are in the North Sea and Arctic shelf, and the extreme weather conditions in these areas can be one of the primary reasons for the higher breakeven prices. Thus, an increase in oil and gas projects will lead to a rise in the Europe tank protection market during the forecast period.

- As of March 2022, there were 44 active refineries in Russia, with a combined capacity of about 7 million barrels per day. Most of the oil refineries in the country were commissioned in the Soviet Era and before that. Refinery utilization in the country has remained low for quite some time and started increasing in 2019.

- Hence, owing to the above points, increasing investment in the oil and gas sector will drive the market during the forecast period.

Germany fastest growing region in the Tank protection market

- Germany is the largest gas market in Europe, and most of the country's gas supply is from Russia. Among the European markets with potential additional import capability, Germany has plans to add the most regasification capacity, at a projected 13.2 MTPA.

- In February 2022, Germany plans to build two LNG terminals in Brunsbuttel and Wilhelmshaven, to reduce its dependence on Russian gas. German energy major Uniper will build and operate the LNG terminal at Wilhelmshaven. The FSRU, with a capacity of 7.3 MTPA, is expected to cover around 8% of Germany's gas demand in the future. The project is expected to be completed in two phases i.e., by the end of 2022 and 2025, respectively.

- In May 2022, Norwegian state-owned operator Gassco awarded a contract to engineering firm Wood to support secure gas transportation from the Norwegian Continental Shelf (NCS) to the United Kingdom and European countries. Under the three-year contract, Wood will work with Gassco to modernize the gas-receiving facilities. The company will be responsible for providing engineering, procurement, and construction management services for gas-receiving terminals in Easington, UK; Zeebrugge, Belgium; Dunkerque, France; Dornum, Germany; and Emden, Germany.

- According to BP statistical review 2022, In 2021, Oil refining capcity in germany is 2121 Thousand barrels per day increased from 2049 Thousand barrels per day in 2015.

- Hence, with the expansion of the refinery and petrochemical business and the upcoming project, the country is expected to witness an increase in the demand for tank protection markets.

Europe Tank Protection Industry Overview

The Europe Tank protection market is fragmented. Some of the key players in this market (in no particular order) include are Emerson Electric Co., Flammer GmbH, Aager GmbH, BS&B Innovations, Limited, and 3B Controls Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing investment in the downstream sector

- 4.5.1.2 Rising offshore Oil exploration activities

- 4.5.2 Restraints

- 4.5.2.1 Rising adoption of cleaner alternatives

- 4.5.3 Oppurtunities

- 4.5.3.1 Growing demand for automation in the control process

- 4.5.1 Drivers

5 Rising adoption of cleaner alternatives

- 5.1 Porter's Five Force Analysis

- 5.1.1 Bargaining Power of Suppliers

- 5.1.2 Bargaining Power of Consumers

- 5.1.3 Threat of New Entrants

- 5.1.4 Threat of Substitutes Products and Services

- 5.1.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 Oil & Gas - Sector

- 6.1.1 Upstream

- 6.1.2 Downstream

- 6.1.3 Midstream

- 6.2 Application

- 6.2.1 New Project (New Orders)

- 6.2.2 Existing Project (Replacement Orders)

- 6.3 Equipment

- 6.3.1 Valves

- 6.3.2 Vents

- 6.3.3 Flame Arrestors

- 6.4 Geography

- 6.4.1 Germany

- 6.4.2 United Kingdom

- 6.4.3 Italy

- 6.4.4 France

- 6.4.5 Spain

- 6.4.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 7.2 Strategies Adopted by Key Players

- 7.3 Company Profiles

- 7.3.1 Braunschweiger Flammenfilter GmbH

- 7.3.2 Flammer GmbH

- 7.3.3 INNOVA SRL

- 7.3.4 Emerson Electric Co.

- 7.3.5 3B Controls Ltd

- 7.3.6 KITO Armaturen GmbH

- 7.3.7 Motherwell Tank Protection

- 7.3.8 BS&B Innovations, Limited

- 7.3.9 Oil Conservation Engineering Company (OCECO)

- 7.3.10 Elmac Technologies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219