|

市场调查报告书

商品编码

1636132

南美洲石油和天然气储存槽:市场占有率分析、产业趋势、统计、成长预测(2025-2030)South America Oil And Gas Storage Tank - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

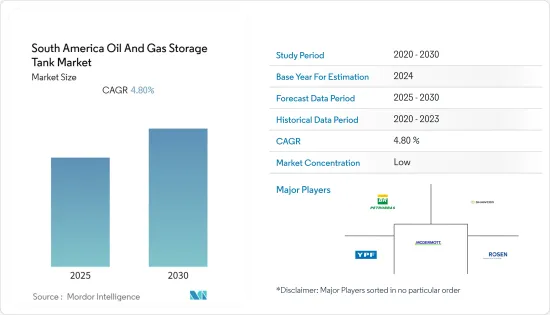

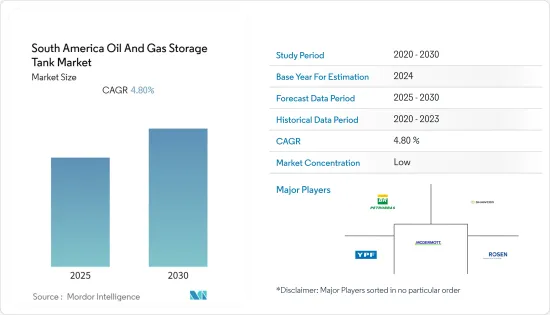

南美洲油气储存槽市场预计在预测期内复合年增长率为4.8%。

预计消费量成长和石油产量成长将推动预测期内对石油和天然气储存槽的需求。

然而,高昂的投资和维护成本预计将阻碍油气储存槽市场的成长。

开发仓储设施和新管道以提高储存槽容量将为预测期内的石油和天然气储存槽市场创造充足的机会。

在南美洲油气储存槽市场,巴西是预测期内成长最快的国家。

南美洲油气储存槽市场趋势

中游市场预计将显着成长

- 南美洲是世界上最大、最古老的石油生产国。该地区也是最大的石油和天然气市场之一。巴西、委内瑞拉、阿根廷和哥伦比亚是该地区石油和天然气工业的主要国家。

- 中游部分涉及开采石油和天然气的运输和储存。这包括天然气加工厂、天然气液化厂、原油和天然气管道以及液化气和再气化储存等基础设施。基础设施老化以及石油和天然气产量的增加推动了对新中游基础设施的需求,从而增加了对储存槽的需求。

- 与世界各地的类似计划相比,南美洲的海上石油和天然气计划的损益平衡价格较低,投资回收期也具有竞争力。预计到 2023 年,该地区将启动 30 多个海上石油和天然气计划,需要约 500 亿美元的待开发区投资。这些计划由国家石油公司(NOC)和大型独立公司营运。

- 根据BP统计,2021年南美洲天然气产量增加11.3%。这将增加对南美洲天然气生产和仓储设施的投资。

- 因此,鑑于上述几点,中游产业在预测期内可能会出现显着的市场成长。

巴西可望主导市场

- 巴西原油产量约290万桶/日,到2021年将成为全球第十大石油生产国。根据美国能源资讯署(EIA)的数据,巴西90%以上的石油产量是从深海油田开采的。 EIA预计,2021年巴西探明原油蕴藏量预计为127亿桶,位居南美洲第二位,仅次于委内瑞拉。

- 预计巴西将在海上石油和天然气产业从动盪的2020年復苏中发挥关键作用,特别是在浮体式生产市场。该国计划在 2025 年之前安装约 18 座浮体式海上石油和天然气生产、储存和货运设施(FPSO)。

- 2022年5月,新加坡吉宝船厂在巴西国家石油公司为巴西Buzios油田计划建造的两艘FPSO的工程、采购和建造(EPC)合约竞标中提交了最佳竞标。吉宝分别以 29.8 亿美元收购 A 地块和 B 地块,胜科海事的提案为 36.6 亿美元和 37.3 亿美元。

- 截至2021年,巴西75%以上的管线基础设施位于陆上,其余管线基础设施连接浮体式再气化终端和在巴西营运的海上油气平台。巴西有五个正在运作的LNG接收站。其中三个归巴西国家石油公司所有。其余两处为私人所有。塞尔希培港码头由塞尔希培州的 CELSE 拥有,里约热内卢的阿库港码头由 GNA 拥有。

- 综上所述,预计巴西石油和天然气储存槽市场在预测期内将显着成长。

南美洲油气储存槽产业概况

油气储存槽市场适度整合。该市场的主要企业(排名不分先后)包括 Mcdermott International ltd、Petroleo Brasileiro SA、Shawcor Ltd、YPF SA 和 ROSEN Group。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 加大下游产业投资力度

- 海上石油探勘活动增加

- 抑制因素

- 更多采用更清洁的替代燃料

- 机会

- 控制过程中对自动化的需求不断增加

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 部门

- 川上

- 在河里

- 下游

- 类型

- 地上

- 地下

- 国家名称

- 委内瑞拉

- 阿根廷

- 巴西

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 合併、收购、联盟和合资企业

- 主要企业策略

- 公司简介

- Sener

- Mcdermott International Ltd

- Shawcor

- Petrobras SA

- YPF SA

- Rosen Group

- Caldwell Tanks Inc.

- Vitol Tank Terminals International BV(VTTI)

第七章 市场机会及未来趋势

The South America Oil And Gas Storage Tank Market is expected to register a CAGR of 4.8% during the forecast period.

Increasing consumption and growing oil production are expected to drive the demand for Oil and gas storage tanks during the forecast period.

However, high investment and maintenance cost is expected to hinder the growth of the Oil and gas storage tank market.

Development of storage facilities and new pipelines for improving the storage tank capacity creates ample opportunities for the oil and gas storage tank market in the forecast period.

Brazil is the fastest-growing country in the South America Oil and gas storage tank market during the forecast period.

South America Oil And Gas Storage Tank Market Trends

Midstream Sector Segment Expected to Witness Significant Growth

- South America is the largest and oldest oil-producing country in the world. The region is also one of the largest oil and gas markets. Brazil, Venezuela, Argentina, and Colombia are some of the major countries in the region's oil and gas industry.

- The midstream sector is involved with transporting and storing extracted crude oil and natural gas. It includes infrastructure such as gas treatment plants, natural gas liquefaction plants, crude oil and natural gas pipelines, and liquefied gas and regasification storage. The requirement for new midstream infrastructure is fueled by the aging infrastructure and rising oil and gas output, which raises the need for storage tanks.

- Offshore oil & gas projects in South America have lower breakeven prices and competitive payback times compared to similar projects worldwide. Over 30 offshore oil and gas projects are anticipated to launch throughout the region by 2023, requiring a greenfield investment of about USD 50 billion. These projects are operated by a mix of national oil companies (NOCs) and major independent companies.

- According to BP statistics, Natural gas production in South America has increased by 11.3% in 2021. This, in turn, will increase investment in natural gas production and storage facilities in South America.

- Hence, owing to the above points, the Midstream segment will likely see significant market growth during the forecast period.

Brazil Expected to Dominate the Market

- Brazil accounts for about 2.9 million barrels per day of crude oil production and will be the tenth-largest oil-producing country in the world in 2021. According to the United States Energy Information Administration (EIA), more than 90% of Brazil's oil production is extracted from deep-water oil fields offshore. According to EIA, Brazil is estimated to have 12.7 billion barrels of proven crude reserves in 2021, the second largest in South America after Venezuela.

- Brazil is expected to play a significant role in the offshore oil and gas industry's recovery from a tumultuous 2020, especially in the floating production market. The country is expected to deploy around 18 Floating Production Storage and Offloading (FPSOs) by 2025.

- In May 2022, Singapore's Keppel Shipyard submitted the best bids in a Petrobras tender for the engineering, procurement, and construction (EPC) contracts for two FPSOs planned for Brazil's Buzios field. Keppel offered USD 2.98 billion each in lot A and lot B, beating the proposals of Sembcorp Marine, which offered USD 3.66 billion and USD 3.73 billion.

- As of 2021, more than 75% of the pipeline infrastructure in the country is located onshore, and the remaining pipeline infrastructure connects the floating regasification terminals and offshore oil & gas platforms operating in Brazil. Brazil has five LNG terminals in operation. Three of them are owned by Petrobras. The other two are privately owned: CELSE's Porto de Sergipe terminal in Sergipe state; and the Porto de Acu terminal in Rio de Janeiro, which GNA owns.

- Hence, owing to the above points, Brazil is expected to see significant market growth in the Oil and gas storage tank market during the forecast period.

South America Oil And Gas Storage Tank Industry Overview

The Oil and gas storage tank market is moderately consolidated. Some of the key players in this market (in no particular order)include Mcdermott international ltd, Petroleo Brasileiro S.A, Shawcor Ltd, YPF S.A, and ROSEN Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing investment in the downstream sector

- 4.5.1.2 Rising offshore Oil exploration activities

- 4.5.2 Restraints

- 4.5.2.1 Rising adoption of cleaner alternatives

- 4.5.3 Oppurtunities

- 4.5.3.1 Growing demand for automation in the control process

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Sector

- 5.1.1 Upstream

- 5.1.2 Midstream

- 5.1.3 Downstream

- 5.2 Type

- 5.2.1 Above ground

- 5.2.2 Underground

- 5.3 Countries

- 5.3.1 Venezuela

- 5.3.2 Argentina

- 5.3.3 Brazil

- 5.3.4 Columbia

- 5.3.5 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Sener

- 6.3.2 Mcdermott International Ltd

- 6.3.3 Shawcor

- 6.3.4 Petrobras SA

- 6.3.5 YPF S.A

- 6.3.6 Rosen Group

- 6.3.7 Caldwell Tanks Inc.

- 6.3.8 Vitol Tank Terminals International BV (VTTI)