|

市场调查报告书

商品编码

1636137

中国第三方物流(3PL) -市场占有率分析、产业趋势与统计、成长预测(2025-2030)China Third-Party Logistics (3PL) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

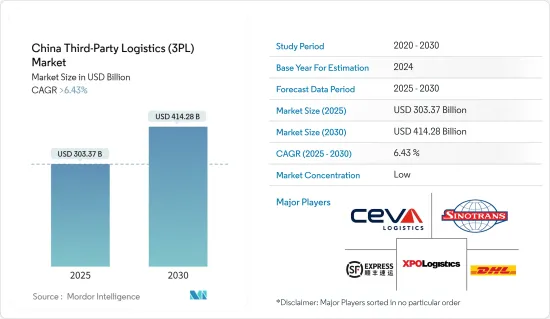

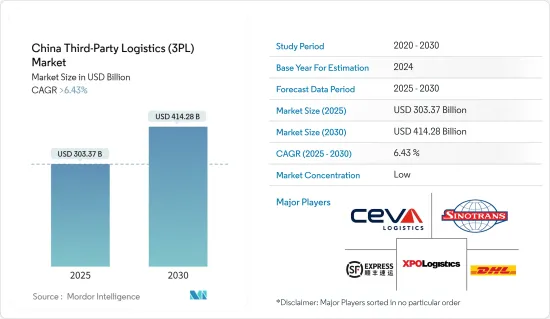

预计2025年中国第三方物流市场规模将达3,033.7亿美元,预估2030年将达4,142.8亿美元,预测期内(2025-2030年)复合年增长率将超过6.43%。

主要亮点

- 中国第三方物流市场主要受到电子商务活动增加和可支配收入增加的推动。

- 中国的电子商务市场正在重塑国家的经济格局。数位经济对于拉动中国GDP的作用日益重要。到2023年,网上购物将占中国消费品销售的四分之一以上,超过全球平均。此外,电子商务凭藉其丰富的劳动力,成为中国主要的就业引擎。

- 2024年上半年,中国电子商务产业实现显着成长,增强了世界第二大经济体消费復苏的动力。在此期间,网路零售额达到7.1兆元(约9,960亿美元),年增9.8%。商务部公布的资料显示,全年商品零售额5.96兆元,成长8.8%。

- 中国电子商务巨头阿里巴巴和京东在2024年「双11」购物节期间销售强劲,凸显了中国消费市场的稳定復苏。

- 阿里巴巴集团旗下平台淘宝和天猫宣布「双11」期间销售额显着成长。销售额过亿元的品牌总合589个,较2023年成长46.5%。该公司强调,消费者参与度将在 2024 年达到前所未有的高峰。

- 总部位于北京的京东透露,直播收入激增,较 2023 年成长 3.8 倍。超过 17,000 个品牌的销售额成长超过 5 倍。淘宝和天猫的成长跨越各个领域,特别是在家用电子电器和装饰用品领域。这一势头使得超过139个品牌的销售额突破了亿元大关,9,600个品牌的销售额从2023年开始翻了一番。因此,随着电商销售量的激增,国内3PL物流的需求也随之增加。

中国第三方物流(3PL)市场趋势

高附加价值仓储业配送业成长显着

- 随着中国进入工业4.0时代,製造业仍是物流成长的重要驱动力。由于高科技製造商的激增,对甲级仓库的需求显着增加。

- 太阳能电池产量大幅增加 54.2%,新能源汽车 (NEV) 大幅成长 30.4%,凸显了这一趋势。根据中国乘用车协会预测,2023年中国新能源汽车渗透率将达36.2%,不少品牌正在设立或扩大生产基地。

- 租赁趋势因地区而异:华南地区的轻工业企业重视仓储业务的灵活性。在引领低碳经济转型的华东地区,越来越多拥有LEED认证的环保仓库如雨后春笋般出现。同时,在中国西部,新能源汽车的快速成长带动了仓库租赁的稳定需求。

- 2023年,31个主要城市非保税甲级仓库存量将超过9,000万平方公尺。华东地区占有压倒性优势,占国内总存量的三分之一以上。近年来,随着供应量持续增加,一些开发商采取租金的方式来缓衝不断上升的空置率。

- 华北地区,尤其是廊坊、天津、北京等城市,2021年开始新增供应量激增。相反,中国西部地区自2020年以来成长逐渐放缓,并已能消化空置房间库存。

- 在跨境电商强劲需求的推动下,华南地区已达到供应高峰,尤其是广州和东莞。同时,中部地区在维持交通和消费需求稳定的同时,也因近三年的供应流入而面临空置压力。这证实了各行业对仓库空间的巨大需求。

电商快速成长带动市场

- 中国电子商务市场迎来了中国经济的转型时代。如今,数位经济对中国GDP的拉动发挥着越来越重要的作用。到2023年,中国超过四分之一的消费品将在网路上购买,显着高于全球平均。此外,由于其庞大的劳动力,电子商务是中国就业的重要动力。

- 过去十年,中国已成为电子商务的主导力量,销售额落后美国超过4,860亿美元。目前,中国拥有全球最多的数位买家。近年来,直播、加急配送等功能已融入中国电商领域,进一步丰富了客户体验。

- 随着数位化快速渗透到生活的方方面面,越来越多的中国企业开始转向线上。凭藉庞大的製造业和政府支持,中国拥有全球最大的B2B电子商务市场。然而,儘管线上零售业蓬勃发展,但 B2B 电子商务成长最近有所放缓。跨境贸易已成为中国B2B的重要组成部分,且以出口为主。

- 中国是一些全球最大的电子零售商的所在地,其电子商务销售额持续成长。随着网路的快速普及,网路购物的普及率已超过80%。行动装置的使用正在迅速增加,使用智慧型手机和平板电脑购物已变得司空见惯。疫情带来的社会限制和封城,加速了快商、线上外卖、社区团购等线上和线下业务的兴起。人工智慧的进步正在再形成电子零售并优化营运和客户互动。此外,扩增实境(AR)和虚拟实境(VR)技术的采用正在丰富购物体验,从而提高客户满意度并增加销售额。

中国第三方物流(3PL)产业概况

中国的第三方物流(3PL)市场高度细分,有许多本地、区域和全球参与企业。主要参与企业包括Ceva Logistics、中国外运、DHL Supply Chain、XPO Logistics 和顺丰速运。

为了充分利用巨大的潜力,公司正在变得更具竞争力。因此,国际公司正在进行策略性投资,以建立区域物流网络,包括新的物流中心和智慧仓库。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场动态

- 市场驱动因素

- 服饰及配件线上销售需求旺盛

- 快速消费品需求驱动市场

- 市场限制因素/问题

- 影响市场的监管挑战

- 劳动短缺和成本上涨影响市场

- 市场机会

- 市场驱动的技术进步

- 市场驱动因素

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 政府法规和措施

- 仓储市场的整体趋势

- CEP、最后一公里配送、低温运输物流等其他细分市场的需求

- 对电子商务业务的见解

- 物流领域的技术开发

- 地缘政治与疫情如何影响市场

第五章市场区隔

- 按服务

- 国内运输管理

- 国际运输管理

- 增值仓储/配送

- 按最终用户

- 航太

- 车

- 消费品/零售、能源

- 医疗保健

- 製造业

- 科技

- 其他的

第六章 竞争状况

- 市场集中度概览

- 公司简介

- Ceva Logistics

- Sinotrans

- DHL Supply Chain

- XPO Logistics

- SF Express

- XPO Logistics

- YTO Express

- ZTO Express

- JD Logistics

- Kerry Logistics*

- 其他公司

第七章 市场的未来

第8章附录

- 宏观经济指标(GDP分布、活动、运输和仓储业对经济的贡献)

- 对外贸易统计-出口与进口(分产品)

- 深入了解主要出口目的地和进口原产国

The China Third-Party Logistics Market size is estimated at USD 303.37 billion in 2025, and is expected to reach USD 414.28 billion by 2030, at a CAGR of greater than 6.43% during the forecast period (2025-2030).

Key Highlights

- The Chinese third-party logistics market is mainly driven by the rise in e-commerce activities and rising disposable income.

- China's e-commerce market is reshaping the nation's economic landscape. The digital economy is becoming ever more crucial in propelling China's GDP. In 2023, online purchases accounted for more than a quarter of China's consumer goods sales, outpacing the global average. Additionally, with its extensive workforce, e-commerce stands out as a major employment engine in the country.

- In the first half of 2024, China's e-commerce sector experienced significant growth, bolstering the momentum for consumption recovery in the world's second-largest economy. During this period, online retail sales jumped 9.8 percent year-on-year, totaling 7.1 trillion yuan (approximately USD 996 billion). Of this, retail sales of goods accounted for CNY 5.96 trillion, reflecting an 8.8 percent increase, as per data released by the Ministry of Commerce (MOC).

- Chinese e-commerce giants Alibaba and JD.com reported robust sales during the 2024 "Double 11" shopping festival, underscoring the steady recovery of China's consumer market.

- Alibaba Group's platforms, Taobao and Tmall, announced a notable surge in sales during the 'Double 11' event. A total of 589 brands surpassed the CNY 100 million sales mark, marking a 46.5 percent uptick from 2023. The company highlighted that consumer engagement reached an unprecedented peak in 2024.

- Beijing-based JD.com revealed that its live-streaming sales had skyrocketed, boasting a 3.8-fold increase from 2023. Over 17,000 brands celebrated sales growth exceeding five times. Taobao and Tmall's growth spanned various sectors, notably in home appliances and decoration. This momentum propelled over 139 brands past the 100-million-yuan sales milestone, with 9,600 brands experiencing a sales doubling from 2023. Hence, as e-commerce sales surge rapidly, the demand for 3PL logistics in the country is rising in tandem.

China Third-Party Logistics (3PL) Market Trends

Value-added warehousing and distribution experiencing substantial growth

- As China embraces the Industry 4.0 era, its manufacturing sector remains a key catalyst for logistics growth. The surge of high-tech manufacturers is driving a notable uptick in demand for Grade A warehouses.

- Highlighting this trend, solar cell production has seen a remarkable growth rate of 54.2%, while New Energy Vehicles (NEVs) have surged by 30.4%. According to the China Passenger Car Association (CPCA), NEV penetration in China hit 36.2% in 2023, leading many brands to either set up or expand their manufacturing bases.

- Leasing trends differ across regions: Southern China's light manufacturing firms are emphasizing flexibility in their warehouse operations. In Eastern China, a leader in the nation's shift towards a low-carbon economy, a flurry of eco-friendly warehouses boasting LEED certifications are springing up. On the other hand, Western China's rapid NEV growth is bolstering a steady demand for warehouse leases.

- In 2023, the stock of non-bonded Grade A warehouses in 31 major cities exceeded 90 million sqm. Eastern China emerged as a dominant player, representing over a third of the nation's total stock. As supply consistently flowed in recent years, some developers resorted to rental trade-offs to mitigate rising vacancy rates.

- Northern China, especially in cities like Langfang, Tianjin, and Beijing, saw a surge in new supply beginning in 2021. Conversely, Western China has been gradually slowing down since 2020, allowing it to absorb its vacant stock.

- Southern China reached a supply zenith, particularly in Guangzhou and Dongguan, spurred by strong demand from cross-border e-commerce. Meanwhile, Central China maintained steady demand for transportation and consumption, yet still grappled with vacancy pressures due to the influx of supply over the last three years. This underscores a pronounced demand for warehousing spaces across the industry.

Surge in e-commerce activities driving the market

- China's e-commerce market has ushered in a transformative era for the nation's economy. Today, the digital economy plays an increasingly pivotal role in bolstering China's GDP. In 2023, over a quarter of China's consumer goods were purchased online, significantly surpassing the global average. Moreover, e-commerce is a key driver of employment in the country, thanks to its vast workforce.

- For the past decade, China has led the e-commerce charge, outstripping the U.S. by over USD 486 billion in revenue. Currently, China boasts the world's largest population of digital buyers. Recent years have seen the integration of features like live streaming and swift delivery into China's e-commerce realm, further enriching the customer experience.

- With the rapid digitalization permeating every facet of life, a growing number of Chinese businesses are transitioning online. Bolstered by its vast manufacturing sector and governmental backing, China proudly hosts the globe's largest B2B e-commerce market. Yet, while the online retail sector flourishes, B2B e-commerce growth has recently decelerated. Cross-border transactions have emerged as a vital segment of China's B2B landscape, predominantly leaning towards exports, with the U.S. standing out as the primary destination for Chinese B2B goods.

- China, home to some of the world's largest e-retailers, has seen consistent growth in e-commerce sales. Rapid internet adoption has propelled online shopping penetration to over 80%. With the surge in mobile device usage, shopping via smartphones and tablets has become commonplace. The pandemic-induced social restrictions and lockdowns accelerated the rise of online-to-offline ventures, including quick commerce, online food delivery, and community group-buying. AI advancements are reshaping e-retail, optimizing operations and customer interactions. Furthermore, the adoption of augmented reality (AR) and virtual reality (VR) technologies is enriching shopping experiences, leading to heightened customer satisfaction and boosted sales.

China Third-Party Logistics (3PL) Industry Overview

The China third-party logistics (3PL) market is highly fragmented with a lot of local, regional, and global players. Some of the major players include Ceva Logistics, Sinotrans, DHL Supply Chain, XPO Logistics, SF Expres etc.

Companies are getting more competitive to capitalize on the enormous possibility. As a result, international firms are making strategic investments to build a regional logistics network, such as new distribution centers, smart warehouses, and so on.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS & DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.1.1 Robust demand for online clothing and accessories

- 4.2.1.2 Demand for FMCG products driving the market

- 4.2.2 Market Restraints/challenges

- 4.2.2.1 Regulatory challenges affecting the market

- 4.2.2.2 Labour shortages and rising costs affecting the market

- 4.2.3 Market Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.1 Market Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Government Policies and Regulations

- 4.6 General Trends in Warehousing Market

- 4.7 Demand From Other Segments, such as CEP, Last Mile Delivery, Cold Chain Logistics Etc.

- 4.8 Insights on Ecommerce Business

- 4.9 Technological Developments in the Logistics Sector

- 4.10 Impact of Geopolitics and Pandemics on the Market

5 MARKET SEGMENTATION

- 5.1 By Services

- 5.1.1 Domestic Transportation Management

- 5.1.2 International Transportation Management

- 5.1.3 Value-added Warehousing and Distribution

- 5.2 By End User

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Consumer and Retail, Energy

- 5.2.4 Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Technology

- 5.2.7 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Ceva Logistics

- 6.2.2 Sinotrans

- 6.2.3 DHL Supply Chain

- 6.2.4 XPO Logistics

- 6.2.5 SF Express

- 6.2.6 XPO Logistics

- 6.2.7 YTO Express

- 6.2.8 ZTO Express

- 6.2.9 JD Logistics

- 6.2.10 Kerry Logistics*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity, Contribution of Transport and Storage Sector to economy)

- 8.2 External Trade Statistics - Exports and Imports, by Product

- 8.3 Insights into Key Export Destinations and Import Origin Countries