|

市场调查报告书

商品编码

1636151

冰箱压缩机:市场占有率分析、产业趋势、成长预测(2025-2030)Refrigerator Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

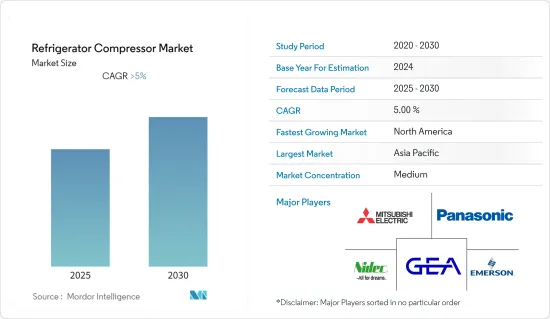

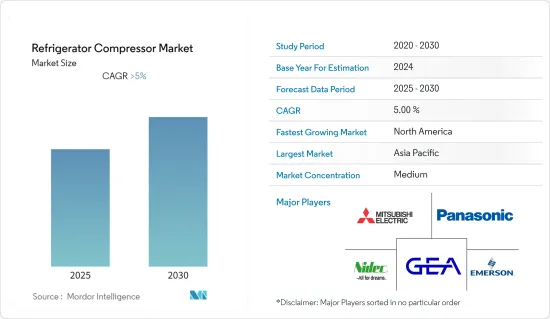

冰箱压缩机市场预计在预测期内复合年增长率将超过 5%

主要亮点

- 从长远来看,全球快速消费品(FMCG)出口的增加、零售店数量的增加以及物流和供应链中冷冻压缩机的采用增加等因素预计将成为市场的主要驱动力。

- 另一方面,高昂的初始成本和农村地区的电力供应有限极大地限制了该市场的成长。

- 技术的进步,特别是现代冰箱中的物联网 (IoT),正在将它们转变为智慧型设备,其功能不仅仅是冷却物品,这可能在未来创造巨大的商机。

- 由于中国、印度和日本等国家快速消费品市场的快速发展,预计亚太地区在不久的将来将成为研究市场的一个重要区域。

冰箱压缩机市场趋势

消费品(FMCG)的快速扩张正在推动市场

- 过去十年,包括美国、中国和印度在内的世界许多国家都出现了前所未有的都市化。由于都市化和快速发展,消费品(FMCG)的需求快速增长,导致冷藏产品的使用。

- 许多快速消费品容易腐烂,需要冷藏。同样,包装食品和饮料也需要适当的冷冻系统来储存。过去几十年来,对快速消费品的需求不断增长,预计这一趋势将在未来几年持续下去。

- 製造商也在扩大产能、建造新设施并采用冷冻压缩机等尖端储存技术来满足不断增长的需求。随着世界各地对快速消费品的需求增加,对冷冻压缩机的需求也会增加,因为它们在整个系统中循环冷媒并向迴路中较热的部分施加压力。

- 2022年,英国消费者在食品和非酒精饮料上的支出为1,567.61亿美元,高于前一年的1,516.96亿英镑。这显示快消品领域对冰箱的需求正在快速增加,进一步推动了冰箱压缩机的普及。

- 此外,2022 年 11 月,丹佛斯宣布扩大其 Optyma A2L 冷凝机组产品系列。 Optyma Plus 冷凝机组冷却能力范围的最新扩展,加上与 A2L 相容的 DMLE 和 DCLE 密封过滤干燥机的推出,将使食品和饮料行业受益。

- 由于上述几点和近期趋势,食品和饮料行业的快速扩张预计将推动全球对冷冻压缩机的需求。

亚太地区预计将主导市场

- 工业基础设施发展在亚太地区十分普遍。由于人口不断增加,对冷冻压缩机的需求迅速增加,使其成为冷冻压缩机的主要地区之一。

- 中国正致力于加强其製药业。是合成化学药品、製剂、医疗设备、卫生材料、包装材料、製药机械等主要产业之一。中国的医药产业需要冰箱来储存药品和药品,这反过来又有助于开拓市场。

- 此外,中国的食品出口业正在迅速扩张。在物流中心、生产设施、车辆等安装冰箱,以改善出口食品的冷却储存设施。由于压缩机是冰箱的关键部件,对压缩机不断增长的需求可能会推动全部区域冰箱压缩机市场的成长。

- 此外,在印度,根据「印度製造」计划,政府计划将该国打造成世界地图上的製造地。根据印度品牌资产基金会预测,到2025年,该国製造业规模可能达到1兆美元。冰箱透过降低温度来帮助去除大型製程和材料中的热量。这可能会增加研究期间对冰箱压缩机的需求。

- 基于以上几点和近期趋势,亚太地区预计将主导冰箱压缩机市场。

冰箱压缩机产业概况

冰箱压缩机市场适度细分。在该市场营运的主要企业包括(排名不分先后)三菱电机公司、松下公司、GEA Group AG、艾默生电气公司和日本电产公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:百万美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 消费品出口增加

- 物流和供应链中越来越多地采用冷冻压缩机

- 抑制因素

- 农村地区初始成本高且电力供应有限

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场区隔

- 产品类型

- 离心式

- 往復运动

- 旋转螺桿

- 其他的

- 按用途

- 住宅

- 商务用

- 医疗保健

- 工业的

- 运输

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 卡达

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Mitsubishi Electric Corporation

- Panasonic Corporation

- GEA Group AG

- Emerson Electric Co

- Nidec Corporation

- Carrier Corporation

- LG Electronics Inc.

- Midea Group

- Frascold SpA

第七章市场机会与未来趋势

- 冰箱物联网 (IoT) 等技术进步

简介目录

Product Code: 50001221

The Refrigerator Compressor Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- Over the long term, factors such as increasing exports of fast-moving consumer goods (FMCG) globally, increasing retail outlets, and rising adoption of refrigeration compressors in logistics and supply chains are expected to be major drivers for the market.

- On the other note, high initial costs and limited electricity access in rural areas are majorly restraining the growth of the market studied.

- Nevertheless, the advancement in technology, especially the Internet of Things (IoT) in modern-day refrigerators, which are not just about cooling but have transformed into smart devices, may create great opportunities in the future.

- Asia Pacific is expected to be the prominent geography in the market studied, with the rapid development of FMCG in countries like China, India, and Japan in the near future.

Refrigerator Compressor Market Trends

Rapid Expansion of Fast-Moving Consumer Goods (FMCG) to Drive the Market

- Over the past decade, many countries across the world, such as the United States, Germany, China, and India, have seen an unprecedented rate of urbanization. With urbanization and rapid development, the demand for fast-moving consumer goods (FMCG) has witnessed immense growth, resulting in the usage of refrigerated products.

- Many FMCG goods require cold-temperature storage because of their perishable nature. Similarly, packaged beverages and foods need proper refrigeration systems for storage. During the last few decades, there has been a growth in demand for fast-moving consumer goods items, and the trend is likely to continue during the coming years.

- Also, the manufacturers are expanding their production capacity, building new facilities, and adopting cutting-edge storage technologies such as refrigeration compressors to meet this growing demand. With the growing need for FMCG products across the world, the demand for refrigeration compressors also increases since they circulate the refrigerant throughout the system and add pressure to the warm part of the circuit.

- In 2022, consumer spending in the United Kingdom on food and non-alcoholic drinks accounted for USD 1,56,761 million, which is comparatively higher than GBP 1,51,696 million from the previous year. This, in turn, indicates that the need for refrigerators in FMCG is rapidly growing and further indicates the promotion of refrigerator compressors.

- Moreover, in November 2022, Danfoss announced the extension of the range of its Optyma A2L condensing units. The latest extension of the Optyma Plus condensing units' cooling capacity range, combined with the launch of A2L-compatible DMLE and DCLE hermetic filter driers, will serve the food and beverage industry.

- Owing to the above points and the recent developments, the rapid expansion of the food and beverage industries is expected to drive the demand for refrigerator compressors across the globe.

Asia Pacific Region is Expected to Dominate the Market

- Asia Pacific is witnessing a widespread development of industrial infrastructure. It is one of the leading regions for refrigeration compressors because of its growing population, leading to a surge in demand for refrigeration compressors.

- China is committed to strengthening its pharmaceutical sector. It is one of the leading industries covering synthetic chemicals and drugs, prepared medicines, medical devices, apparatus and instruments, hygiene materials, packing materials, and pharmaceutical machinery. The pharmaceutical industry in the country needs refrigerators to store medicines and drugs, which will, in turn, aid the development of the market.

- Moreover, China's food export industry is expanding rapidly. Refrigerators are placed in distribution centers, manufacturing facilities, and vehicles to provide improved cooling storage facilities for food export. Since the compressor is a crucial part of refrigerators, the growing demand for compressors may aid the growth of the refrigerator compressor market across the region.

- Further, in India, under the Make in India program, the government plans to place the country on the world map as a manufacturing hub. According to the Indian Brand Equity Foundation, the manufacturing sector in the country has the potential to reach USD 1 trillion by 2025. Refrigerators help remove heat from large-scale processes or materials by reducing the temperature. This may increase the demand for refrigerator compressors during the study period.

- Owing to the above points and the recent developments, the Asia-Pacific region is expected to dominate the refrigerator compressor market.

Refrigerator Compressor Industry Overview

The refrigerator compressor market is moderately fragmented. Some of the key players operating in the market (in particular order) include Mitsubishi Electric Corporation, Panasonic Corporation, GEA Group AG, Emerson Electric Co., and Nidec Corporation, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Exports of Fast Moving Consumer Goods

- 4.5.1.2 Rising Adoption of Refrigeration Compressors in Logistics and Supply Chains

- 4.5.2 Restraints

- 4.5.2.1 High Initial Costs and Limited Electricity Access in Rural Areas

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Centrifugal

- 5.1.2 Reciprocating

- 5.1.3 Rotary Screw

- 5.1.4 Others

- 5.2 By Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Healthcare

- 5.2.4 Industrial

- 5.2.5 Transportation

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Asia Pacific

- 5.3.2.1 China

- 5.3.2.2 India

- 5.3.2.3 Japan

- 5.3.2.4 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 United Kingdom

- 5.3.3.2 Germany

- 5.3.3.3 France

- 5.3.3.4 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Qatar

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Electric Corporation

- 6.3.2 Panasonic Corporation

- 6.3.3 GEA Group AG

- 6.3.4 Emerson Electric Co

- 6.3.5 Nidec Corporation

- 6.3.6 Carrier Corporation

- 6.3.7 LG Electronics Inc.

- 6.3.8 Midea Group

- 6.3.9 Frascold SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technology Advancement like Integrating Internet of Things (IoT) in Refrigerators

02-2729-4219

+886-2-2729-4219