|

市场调查报告书

商品编码

1636162

北美绿建筑:市场占有率分析、产业趋势与成长预测(2025-2030)North America Green Buildings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

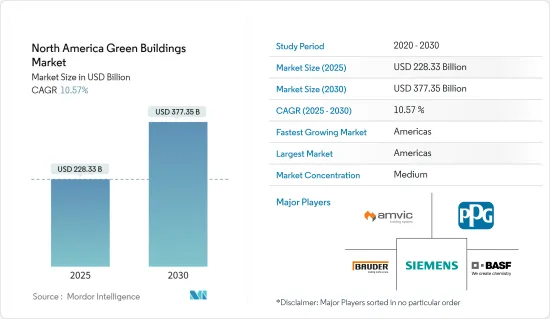

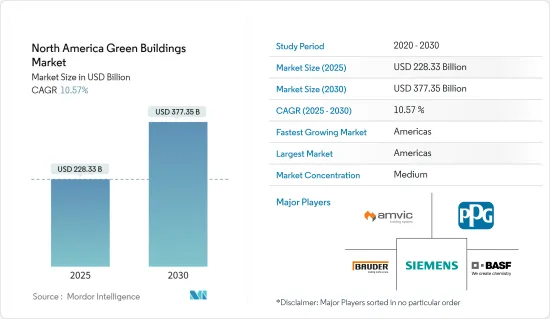

北美绿建筑市场规模预估至2025年为2,283.3亿美元,预估至2030年将达3,773.5亿美元,预测期内(2025-2030年)复合年增长率为10.57%。

在美国和加拿大,联邦、州和地方环境法规鼓励绿建筑实践。建筑规范、能源效率标准和排放法规促进永续建设和维修计划。

由美国绿色建筑委员会 (USGBC) 和 Green Globe 建立的 LEED(能源与环境设计先锋奖)等认证项目为永续的设计、施工和运营提供了基准和标准。这些计划鼓励绿色建筑实践并奖励环保计划。

绿色建筑技术的进步,例如节能暖通空调系统、智慧建筑自动化、可再生能源解决方案(例如太阳能电池板和风力发电机)以及永续材料(例如回收材料和低排放气体产品),提高了建筑性能和永续性。

补贴、退税、税收抵免和税额扣抵等财政激励措施鼓励对绿色建筑计划的投资。政府、公用事业和金融机构提供这些奖励来提高能源效率、可再生能源的采用和永续性。

许多政府为各种绿色建筑措施提供税额扣抵。例如,美国联邦政府为太阳能係统提供投资税额扣抵(ITC),允许企业和住宅从税中扣除安装太阳能板成本的一定部分。具体来说,根据国会2022年颁布的《通货膨胀削减法案》,ITC在2033年之前为太阳能光电系统成本的30%,并逐渐减少,直到2035年到期。

同样,一些州为节能建筑升级提供税额扣抵,例如安装隔热材料、节能窗户和暖通空调系统。

北美绿建筑市场趋势

整合智慧建筑和物联网以提高效率和效能

- 智慧建筑和物联网技术的整合正在彻底改变建筑的设计、建造和运作方式。随着建筑业主和营运商寻求提高效率、降低成本和提高居住者舒适度,这一趋势在美国迅速发展。

- 根据产业专家预测,2022年美国将消耗约100.4兆英热单位的初级能源,较2021年成长2.62%。不过,业内专家也报告称,2023年美国温室气体造成的气候变迁污染将减少近2%,这是一个正面的改变。

- 美国能源局也表示,感测器、致动器和控制器是智慧建筑能源管理系统的支柱。智慧系统是网路物理技术,可透过集中设备进行控制,以即时监控和优化室内空气品质和能源等因素。对此类系统的投资对于实现能源价格充足和实现减排目标至关重要。

更多办公室优先考虑永续建筑设计

- 为了减少商店营运中的能源消耗,公司正在实施节能技术和方法。这包括 LED 照明维修、具有运作感测器的智慧 HVAC 系统以及用于监控和优化能源使用的能源管理系统。这些努力降低了营运成本并体现了对永续性的承诺。

- 许多公司正在投资可再生能源解决方案为其商店供电。安装在商店屋顶和停车场的太阳能板可产生清洁的可再生能源,减少对石化燃料的依赖并减少碳排放。一些零售商也参与异地可再生能源计划或购买可再生能源积分以抵消其碳足迹。

- 例如,亚马逊公司在全球超过 237 个履约设施都配备了屋顶太阳能发电系统,可为设施高达 80% 的能源使用提供电力。我们的第二个总部位于维吉尼亚阿灵顿,采用 100%可再生能源供电。到2022年,我们将建造16个使用低碳混凝土的资料中心和10个使用低碳钢的资料中心。

北美绿建筑产业概况

在北美,绿建筑市场竞争激烈。主要参与者包括英特飞 (Interface) 和欧文斯科宁 (Owens Corning) 等建筑製造商,它们提供永续建筑材料和技术。美国绿色建筑委员会 (USGBC)、LEED 认证和绿色建筑倡议 (GBI) 等认证机构为行业标准做出了贡献。此外,地区法规、奖励、消费者对能源效率的需求以及环境责任正在推动该市场的竞争和创新。相关人员之间的合作、技术进步以及对永续性的关注正在进一步塑造竞争格局。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 绿建筑产业供应链/价值链分析洞察

- 预製建筑业使用的不同结构概述

- 绿建筑产业成本结构分析

- COVID-19 的影响

第五章市场动态

- 市场驱动因素

- 建筑能源效率

- 灵活性和自订选项

- 市场限制因素

- 适合建设的土地有限

- 与传统建筑相比品质较低

- 市场机会

- 各领域需求

- 节能建筑

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 副产品

- 外饰商品

- 室内装潢产品

- 其他产品(建筑系统、太阳能係统等)

- 按最终用户

- 住宅

- 办公室

- 零售

- 设施

- 其他最终用户

- 按地区

- 美国

- 加拿大

- 墨西哥

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Amvic Inc.

- PPG Industries

- Siemens

- BASF SE

- Bauder Limited

- Forbo International SA

- Owens Corning SA

- CEMEX

- Alumasc Group PLC

- Cold Mix Inc.

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

The North America Green Buildings Market size is estimated at USD 228.33 billion in 2025, and is expected to reach USD 377.35 billion by 2030, at a CAGR of 10.57% during the forecast period (2025-2030).

Federal, state, and local environmental regulations in the United States and Canada incentivize green building practices. Building codes, energy efficiency standards, and emissions regulations promote sustainable construction and renovation projects.

Certification programs such as LEED (Leadership in Energy and Environmental Design), formed by the US Green Building Council (USGBC) and Green Globes, provide benchmarks and standards for sustainable building design, construction, and operation. These programs encourage adopting green building practices and offer recognition for environmentally responsible projects.

Advancements in green building technologies, including energy-efficient HVAC systems, smart building automation, renewable energy solutions (such as solar panels and wind turbines), and sustainable materials (such as recycled content and low-emission products), enhance building performance and sustainability.

Financial incentives such as grants, rebates, tax credits, and low-interest loans encourage investment in green building projects. Governments, utilities, and financial institutions offer these incentives to promote energy efficiency, renewable energy adoption, and sustainability.

Many governments provide tax credits for various green building initiatives. For instance, the U.S. federal government offers the Investment Tax Credit (ITC) for solar energy systems, allowing businesses and homeowners to deduct a particular portion of installing solar panels from their taxes. Specifically, as per the Inflation Reduction Act implemented by Congress in 2022, the ITC is 30% of the solar system cost until 2033 and will gradually reduce until it expires in 2035.

Similarly, some states offer tax credits for energy-efficient building upgrades, such as installing insulation, energy-efficient windows, or HVAC systems.

North America Green Buildings Market Trends

Leveraging Smart Buildings and IoT Integration for Enhanced Efficiency and Performance

- Integrating smart buildings and IoT technologies is revolutionizing how buildings are designed, constructed, and operated. This trend is rapidly gaining momentum in the United States as building owners and operators seek to improve efficiency, reduce costs, and enhance occupant comfort.

- According to industry experts, the United States consumed approximately 100.4 quadrillion British thermal units of primary energy in 2022, a 2.62% increase from 2021. However, industry experts also reported that climate-altering pollution from greenhouse gasses in the United States decreased by nearly 2% in 2023, a positive change.

- The U.S. Department of Energy also states that sensors, actuators, and controllers are the backbone of Smart building energy management systems. Smart systems are cyber-physical technologies that can be controlled from a centralized device, allowing for real-time monitoring and optimization of factors like indoor air quality and energy. Investing in these systems is critical to achieving energy affordability and meeting reduction goals.

Offices Are Increasingly Prioritizing Sustainable Building Designs

- Organizations are implementing energy-efficient technologies and practices to reduce energy consumption in-store operations. These include LED lighting retrofits, smart HVAC systems with occupancy sensors, and energy management systems to monitor and optimize energy usage. These initiatives lower operating costs and demonstrate a commitment to sustainability.

- Many organizations are investing in renewable energy solutions to power their stores. Solar panels installed on store rooftops or parking lots generate clean, renewable energy, reducing reliance on fossil fuels and lowering carbon emissions. Some retailers also participate in offsite renewable energy projects or purchase renewable energy credits to offset their carbon footprint.

- For instance, Amazon.com Inc.'s 237+ global fulfillment facilities have rooftop solar installations, which can power up to 80% of a facility's energy use. Its second headquarters is in Arlington, Virginia, and is powered by 100% renewable energy. In 2022, it constructed 16 data centers using lower-carbon concrete and 10 data centers using lower-carbon steel.

North America Green Buildings Industry Overview

In North America, the green building market is highly competitive. Key players include construction manufacturers like Interface and Owens Corning, which offer sustainable building materials and technologies. Certification bodies like the US Green Building Council (USGBC), LEED certification, and the Green Building Initiative (GBI) contribute to industry standards. Additionally, regional regulations, incentives, consumer demand for energy efficiency, and environmental responsibility drive competition and innovation in this market. Collaboration among stakeholders, technological advancements, and a focus on sustainability further shape the competitive landscape.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis of the Green Buildings Industry

- 4.4 Brief on Different Structures Used in the Prefabricated Buildings Industry

- 4.5 Cost Structure Analysis of the Green Buildings Industry

- 4.6 Impact of COVID 19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Energy Efficiency in Construction

- 5.1.2 Flexibility and Customization Options

- 5.2 Market Restraints

- 5.2.1 Limited Availability of Suitable Land for Construction

- 5.2.2 Lower Quality Compared to Traditional Construction

- 5.3 Market Opportunities

- 5.3.1 Demand Across Various Sectors

- 5.3.2 Energy Efficient Construction

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 Exterior Products

- 6.1.2 Interior products

- 6.1.3 Other Products (Building Systems, Solar Systems, etc.)

- 6.2 By End User

- 6.2.1 Residential

- 6.2.2 Office

- 6.2.3 Retail

- 6.2.4 Institutional

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Amvic Inc.

- 7.2.2 PPG Industries

- 7.2.3 Siemens

- 7.2.4 BASF SE

- 7.2.5 Bauder Limited

- 7.2.6 Forbo International SA

- 7.2.7 Owens Corning SA

- 7.2.8 CEMEX

- 7.2.9 Alumasc Group PLC

- 7.2.10 Cold Mix Inc.*

- 7.3 Other Companies