|

市场调查报告书

商品编码

1636169

欧洲液流电池:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Flow Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

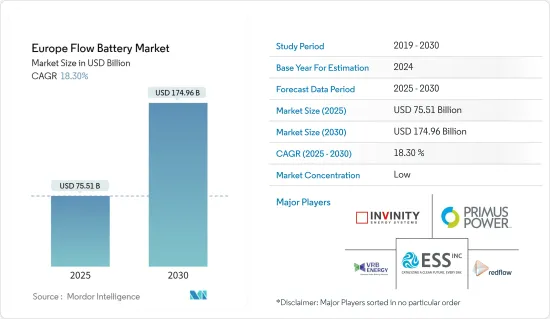

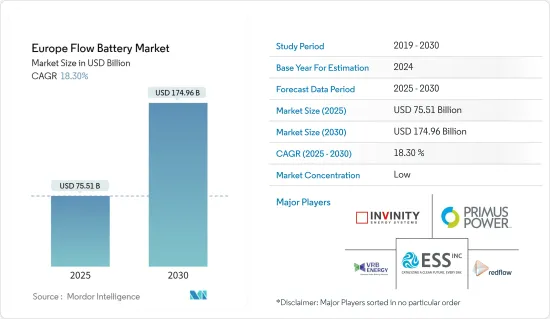

预计2025年欧洲液流电池市场规模为755.1亿美元,预估至2030年将达1,749.6亿美元,预测期间(2025-2030年)复合年增长率为18.3%。

主要亮点

- 从中期来看,该技术在再生能源系统等长寿命能源储存应用中的渗透率不断提高,以及该技术的使用寿命更长,预计将在预测期内推动市场发展。

- 另一方面,低能量密度等因素预计将对未来市场产生负面影响。

- 新兴的创新透过新的商业领域使液流电池系列多样化,为市场成长创造了巨大的机会。

- 由于许多即将推出的可再生能源和电力储存计划,英国预计在预测期内将出现显着的市场成长。

欧洲液流电池市场趋势

全钒氧化还原液流电池预计将显着成长

- 钒氧化还原液流电池 (VRFB) 是一种氧化还原液流电池 (RFB),分别使用负极和正极半电池中的钒 V2+/V3+ 和 V4+/V5+氧化还原电对对来储存能量。这些电池的功率和能量额定值彼此无关,每种电池都可以针对不同类型的应用进行最佳化。

- 与其他液流电池相比,全钒氧化还原液流电池(VRFB) 的优点包括高比能量和输出、高达20,000 次充电/放电循环的极长寿命、较低的平准能源成本,且不存在过度充电或深度放电的问题。

- 此外,全钒氧化还原液流电池(VRB)是一种很有前景的能源储存系统,适用于大型太阳能整合式电动车充电站。因此,这些电池在电动车产业中发挥着重要作用。

- 根据欧洲环境署的数据,到 2023 年,电动车将占欧洲所有汽车的 23.6%,高于 2022 年的 21.6%。因此,随着电动车比例的增加,预计电动车对这些电池的需求将会增加,从而推动市场成长。

- 此外,提高钒氧化还原液流电池效率的技术发展预计将在预测期内增加这些电池的使用量。例如,2024年3月,Enel Green Power在西班牙Son Orlandis太阳能发电厂安装了1.1MW/5.5MWh钒氧化还原液流电池。

- 因此,由于使用这些电池的好处以及研究和开发活动,钒氧化还原液流电池预计将显着增长。

英国受访市场预计将显着成长

- 近年来,英国对液流电池的需求大幅增长,特别是从2021年开始,许多计划已运作併提案在不久的将来运作。

- 液流电池可用于整合ES系统中以储存可再生能源。该国的可再生能源容量不断增加,这为液流电池市场带来了积极的空间。根据国际可再生能源机构统计,截至2023年,英国可再生能源产业总装置容量为55,561MW,年成长率为4.7%。

- 2024年5月,英国基础设施银行宣布向Invinity Energy Systems PLC投资2,500万欧元(约2,700万美元),用于开发新一代全钒液流电池产品。此外,2023年1月,StorTera Ltd开发了一款单液流电池,结合了锂离子技术和长寿命可再生能源储存系统的优点。

- 此外,2023 年 4 月,Invinity Energy Systems PLC 在较长持续时间储能示范竞赛第二阶段获得能源储存安全和净零部授予的1,100 年合同,并宣布已获得10,000 欧元(约合11.88 欧元)的资金。利用这笔资金,该公司将安装30MWh钒液流电池,使其成为英国最大的液流电池和Invinity最大的交付。

- 整体而言,透过上述计划,预计国内液流电池的供需将显着成长,主要得益于该领域投资的增加和研发力度的加大。

欧洲液流电池产业概况

欧洲液流电池市场已被削减一半。市场主要企业包括(排名不分先后)VRB Energy、RedFlow Ltd、Invinity Energy Systems PLC、Primus Power Corporation 和 ESS Tech Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 长期能源储存应用技术的扩展

- 增加可再生能源的部署

- 抑制因素

- 电池单元低能量

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 类型

- 全钒氧化还原液流电池

- 溴化锌液流电池

- 铁液流电池

- 锌铁液流电池

- 地区

- 英国

- 法国

- 德国

- 俄罗斯

- 西班牙

- 北欧的

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- VRB Energy

- ESS Tech Inc.

- Vanadis Power GmbH

- Primus Power Corporation

- RedFlow Ltd

- Invinity Energy Systems PLC

- Dalian Rongke Power Co. Ltd

- CellCube Energy Storage Systems Inc.

- Stryten Energy

- H2 Inc.

- 市场排名/份额(%)分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 新的创新使液流电池多样化

简介目录

Product Code: 50002397

The Europe Flow Battery Market size is estimated at USD 75.51 billion in 2025, and is expected to reach USD 174.96 billion by 2030, at a CAGR of 18.3% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, growing penetration of the technology in long-duration energy storage applications, such as renewable power systems, and their long service lives are expected to drive the market during the forecast period.

- On the other hand, factors like low energy density are expected to negatively impact the market in the future.

- Nevertheless, the new technological innovations that diversify the scope of flow batteries in new commercial areas create tremendous opportunities for market growth.

- The United Kingdom is expected to experience significant growth in the market during the forecast period due to many upcoming renewable energy and storage projects.

Europe Flow Battery Market Trends

Vanadium Redox Flow Batteries are Expected to Witness Significant Growth

- A vanadium redox flow battery (VRFB) is a redox flow battery (RFB) that stores energy by using V2+/V3+ and V4+/V5+ redox couples of vanadium in the negative and positive half-cells, respectively. The power ratings and energy ratings of these batteries are not related to each other, and each can be optimized for a different type of use.

- The advantages of using vanadium redox flow battery (VRFB) over other flow batteries are higher specific energy and power, a very long lifespan with up to 20,000 charge and discharge cycles, a reduced levelized cost of energy, and no problems with overcharging and deep discharge.

- Furthermore, vanadium redox flow batteries (VRBs) are promising energy storage systems suitable for large-scale solar-battery integrated electric vehicle charging stations. Thus, these batteries are of significant use in EV industry.

- According to the European Environment Agency, in 2023, the share of electric cars accounted for 23.6% of the total cars in Europe, increased from 21.6% share in 2022. Thus, with an increase in the percentage of EVs, the use of these batteries in EVs is expected to be in demand, thereby driving the market's growth.

- Moreover, with technological developments to increase the efficiency of vanadium redox flow batteries, the use of these batteries is expected to increase during the forecast period. For example, in March 2024, Enel Green Power installed 1.1 MW/5.5 MWh vanadium redox flow battery in its Son Orlandis solar PV plant in Spain.

- Thus, owing to the advantages of using these batteries, along with research and development activities, vanadium redox flow batteries are expected to witness significant growth.

The United Kingdom is Expected to Witness Significant Growth in the Market Studied

- The United Kingdom witnessed significant growth in the demand for flow batteries in recent years, particularly after 2021, with a number of projects coming online and proposed to come online in the near future.

- Flow batteries can be used in an integrated ES system to store renewable energy. The country's renewable energy capacity has been increasing consistently, creating a positive scope for the flow battery market. According to the International Renewable Energy Agency, as of 2023, the total capacity installed by the UK renewable energy industry accounted for 55,561 MW, an annual growth rate of 4.7%.

- In May 2024, the UK Infrastructure Bank announced EUR 25 million (~USD 27 million) investment into Invinity Energy System Plc to develop next generation vanadium flow battery products. Furthermore, in January 2023, StorTera Ltd developed a single liquid flow battery that combines the advantages of lithium-ion technology and a long-duration renewable energy storage system.

- Moreover, in April 2023, Invinity Energy Systems PLC announced that it received EUR 11 million (~USD 11.88 million) in funding from the Department for Energy Security and Net Zero under Phase 2 of the Longer Duration Energy Storage Demonstration Competition. Using the funds, the company will deploy a 30 MWh vanadium flow battery, the UK's largest flow battery, and Invinity's largest delivery.

- Overall, owing to the above projects, the country is expected to witness significant growth in the demand and supply of flow batteries, mainly driven by increasing investments in the sector combined with increasing research and development.

Europe Flow Battery Industry Overview

The European flow battery market is semi-fragmented. Some of the major players in the market are, in no particular order, VRB Energy, RedFlow Ltd, Invinity Energy Systems PLC, Primus Power Corporation, and ESS Tech Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Penetration of the Technology in Long-Duration Energy Storage Applications

- 4.5.1.2 Increasing Adoption of Renewable Energy

- 4.5.2 Restraints

- 4.5.2.1 Low Energy of Battery Cells

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Vanadium Redox Flow Batteries

- 5.1.2 Zinc Bromine Flow Batteries

- 5.1.3 Iron Flow Batteries

- 5.1.4 Zinc Iron Flow Batteries

- 5.2 Geography

- 5.2.1 United Kingdom

- 5.2.2 France

- 5.2.3 Germany

- 5.2.4 Russia

- 5.2.5 Spain

- 5.2.6 NORDIC

- 5.2.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 VRB Energy

- 6.3.2 ESS Tech Inc.

- 6.3.3 Vanadis Power GmbH

- 6.3.4 Primus Power Corporation

- 6.3.5 RedFlow Ltd

- 6.3.6 Invinity Energy Systems PLC

- 6.3.7 Dalian Rongke Power Co. Ltd

- 6.3.8 CellCube Energy Storage Systems Inc.

- 6.3.9 Stryten Energy

- 6.3.10 H2 Inc.

- 6.4 Market Ranking/Share(%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The New Technological Innovations to Diversify the Scope of Flow Batteries

02-2729-4219

+886-2-2729-4219