|

市场调查报告书

商品编码

1636181

SLI用铅酸电池隔离膜的全球市场:市场占有率分析、产业趋势与成长预测(2025-2030年)Global Lead-Acid Battery Separator For SLI Applications - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

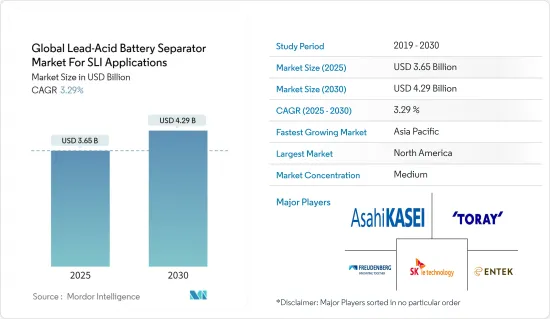

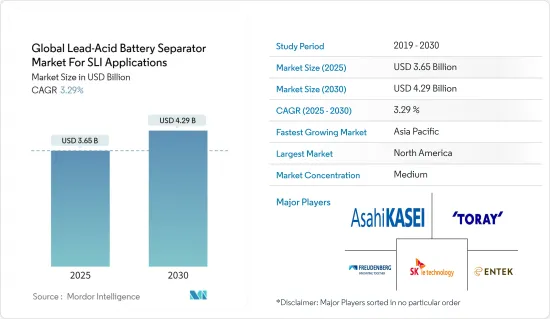

用于 SLI 应用的铅酸电池隔膜的全球市场预计将从 2025 年的 36.5 亿美元增长到 2030 年的 42.9 亿美元,预测期内(2025-2030 年)复合年增长率为 3.29%。

主要亮点

- 从中期来看,自动化领域成长率的上升和铅酸电池的成本效益等因素预计将成为预测期内SLI应用的铅酸电池隔膜全球市场的最大驱动力之一。

- 同时,电池隔膜製造的复杂供应链限制威胁着预测期内的市场研究。

- 人们不断努力开发增强型电池隔膜材料。由于这个因素,全球铅酸电池隔膜市场预计未来将为SLI应用创造多个机会。

- 预计亚太地区将出现强劲成长,并可能在预测期内实现最高的复合年增长率。这是因为该地区电池及相关设备和材料的製造业规模较大。

全球铅酸电池隔离膜市场趋势

聚丙烯细分市场实现显着成长

- 聚丙烯最近已成为全球铅酸电池隔膜市场不可或缺的一部分,特别是在启动、照明和点火 (SLI) 应用领域。这种多功能热塑性聚合物具有优异的性能,包括优异的耐化学性、高机械强度和良好的电绝缘性。

- 聚丙烯的多功能性允许添加各种添加剂和表面处理,以增强其性能特征并延长电池寿命。这种适应性使聚丙烯成为寻求提高产品效率和耐用性的电池製造商的有吸引力的选择。随着汽车产业面临生产更有效率、更环保车辆的压力,对高性能 SLI 电池的需求不断增长,进一步巩固了聚丙烯在隔膜市场的地位。

- 随着全球汽车产量的增加,SLI应用的电池需求迅速增加,对聚丙烯作为电池隔膜材料的需求也不断增加。这是由于电动和混合动力汽车的产量不断增加,需要高效、耐用的电池组件。此外,电池技术的进步进一步推动了对高品质聚丙烯隔膜的需求。

- 根据国际汽车工业协会的数据,全球汽车产量已超过疫情前的水准。预计未来还将继续保持同样的成长趋势。例如,2019年至2023年,年产能增幅超过2%,2022年至2023年,成长超过10%,显示汽车产量正在扩张。

- 持续的研究和开发重点是改进聚丙烯隔膜技术。目前正在进行研究以增强聚丙烯隔膜已经令人印象深刻的能力,包括开发奈米复合材料和先进的表面改质。这些创新旨在提高电池性能、寿命和安全性,以满足汽车产业和其他依赖铅酸电池技术的领域不断变化的需求。

- 例如,2024年2月,仁川大学的科学家开创了一种提高电池隔膜稳定性和性能的方法。此方法是涂上一层二氧化硅和其他特殊分子。这项研究结果发表在《能源储存材料》杂誌上,证明了聚丙烯(PP)隔膜的有效接枝聚合可以引入一致的二氧化硅(SiO2)层。

- 因此,鑑于上述情况,聚丙烯隔膜材料领域预计在预测期内将成长。

亚太地区主导市场

- 亚太地区主导全球铅酸电池隔离膜市场,特别是在 SLI 应用的聚丙烯领域。这一增长的关键因素是该地区蓬勃发展的汽车工业、快速工业化以及日益增长的能源储存需求。

- 根据国际汽车工业组织预测,2022年至2023年亚太地区汽车产量将大幅成长。 2023年,该地区生产汽车55,115,837辆,恢復10%的成长速度。 2019年至2023年的复合年增长率超过12%,显示该地区对齿轮的需求不断增加。

- 中国、日本、韩国和印度处于这一市场扩张的前沿。这些国家强大的製造业和不断增长的国内汽车需求对聚丙烯电池隔膜的采用做出了重大贡献。

- 尤其是中国,在塑造该地区的市场动态方面发挥关键作用。中国作为全球最大的汽车市场和铅酸电池的重要生产国,近年来对高品质聚丙烯隔膜的需求激增。中国对电动车和混合动力技术的推动反而增强了其 SLI 电池市场。

- 日本和韩国以其技术力实力而闻名,引领了聚丙烯隔膜製造的创新。这些国家的公司致力于开发具有增强性能的隔膜材料,例如提高抗穿刺性和降低电阻。这些进展不仅为国内市场做出了贡献,而且对向区域内外国家出口高品质隔膜发挥了重要作用。

- 例如,2024年1月,韩国仁川大学的科学家开发了一项可提高隔膜稳定性和性能的技术。透过结合二氧化硅层和其他特殊分子,使用这种隔膜的电池提高了性能并抑制了侵入性根状结构的生长。这项突破将促进更安全电池的开发,这对于电动车和尖端能源储存解决方案的广泛使用至关重要。

- 因此,如前所述,亚太地区预计将在预测期内主导市场。

全球铅酸蓄电池隔膜产业概况

SLI 应用的全球铅酸电池隔离膜市场处于半断开状态。该市场的主要企业(排名不分先后)包括旭化成公司、东丽电池隔膜、Freudenberg Performance Materials、SKie Technology Corporation Ltd 和 Entek International。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 汽车工业的成长

- 成本效益

- 抑制因素

- 供应链限制

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 材料

- 聚乙烯

- 聚丙烯

- 其他的

- 2029 年之前的市场规模和需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 南非

- 其他中东/非洲

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- Asahi Kasei Corporation

- Toray Battery Separator Film Co. Ltd

- Freudenberg Performance Materials

- SK ie Technology Corporation Ltd

- Entek International

- Sumitomo Chemical Co. Ltd

- Ube Maxell Co. Ltd

- W-Scope Corporation

- Daramic

- Amer SIL

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 强化隔膜材料的开发

The Global Lead-Acid Battery Separator Market For SLI Applications Industry is expected to grow from USD 3.65 billion in 2025 to USD 4.29 billion by 2030, at a CAGR of 3.29% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in the automation sector and the cost-effectiveness of lead-acid batteries are expected to be among the most significant drivers for the global lead-acid battery separator market for SLI applications during the forecast period.

- On the other hand, complex supply chain constraints for manufacturing battery separators threaten the market studied during the forecast period.

- Nevertheless, continued efforts are being made to develop enhanced battery separator materials. This factor is expected to create several opportunities for SLI applications in the global lead-acid battery separator market in the future.

- Asia-Pacific is expected to witness significant growth and will likely register the highest CAGR during the forecast period. This is due to the region's considerable battery and associated equipment and materials manufacturing industry.

Global Lead-Acid Battery Separator Market Trends

Polypropylene Segment to Witness Significant Growth

- Polypropylene has become essential in the global lead-acid battery separator market, especially for Starting, Lighting, and Ignition (SLI) applications in recent years. This versatile thermoplastic polymer offers optimal properties, including excellent chemical resistance, high mechanical strength, and good electrical insulation.

- Polypropylene's versatility allows for incorporating various additives and surface treatments, enhancing its performance characteristics and extending battery life. This adaptability has made it an attractive option for battery manufacturers looking to improve their products' efficiency and durability. As the automotive industry faces increasing pressure to produce more efficient and environmentally friendly vehicles, the demand for high-performance SLI batteries has grown, further solidifying polypropylene's position in the separator market.

- As global automobile manufacturing escalates, the demand for batteries in SLI applications is set to surge, consequently boosting the need for polypropylene in battery separator materials. This increase is driven by the growing production of electric and hybrid vehicles requiring efficient and durable battery components. Additionally, advancements in battery technology are further propelling the demand for high-quality polypropylene separators.

- According to the International Organization of Motor Vehicle Manufacturers, global automobile manufacturing has surpassed the pre-pandemic level. It is expected to continue on a similar growth trend in the coming years. For instance, between 2019 and 2023, the annual production capacity increased by more than 2%, whereas the growth rate between 2022 and 2023 was over 10%, signifying the growing production of automobiles.

- Ongoing research and development efforts are focused on improving polypropylene separator technology. Areas of exploration include developing nanocomposite materials and advanced surface modifications to enhance polypropylene separators' already impressive capabilities. These innovations aim to improve battery performance, longevity, and safety, meeting the evolving needs of the automotive industry and other sectors reliant on lead-acid battery technology.

- For instance, in February 2024, Scientists at Incheon National University pioneered a method to enhance battery separators' stability and properties. Their approach involves applying a layer of silicon dioxide and other specialized molecules. The findings, detailed in a publication in Energy Storage Materials, showcase the effective graft polymerization on a polypropylene (PP) separator, introducing a consistent layer of silicon dioxide (SiO2).

- Therefore, as per the above points, the polypropylene separator material segment is expected to grow during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific region has emerged as a dominant force in the global lead-acid battery separator market, particularly in the polypropylene segment for SLI applications. This growth is primarily driven by the region's booming automotive industry, rapid industrialization, and increasing energy storage needs.

- According to the International Organization of Motor Vehicle Manufacturers, automobile manufacturing in Asia-Pacific significantly rose between 2022 and 2023. In 2023, the region manufactured 55,115,837 automobiles, resuming a 10% growth rate. The annual average growth rate between 2019 and 2023 was over 12%, signifying the rising demand for gears in the region.

- China, Japan, South Korea, and India are at the forefront of this market expansion. Their robust manufacturing sectors and growing domestic vehicle demand contribute significantly to the uptake of polypropylene battery separators.

- China, in particular, plays a crucial role in shaping the regional market dynamics. As the world's largest automobile market and a significant producer of lead-acid batteries, China's demand for high-quality polypropylene separators has surged in recent years. The country's push toward electric vehicles and hybrid technologies has paradoxically bolstered the SLI battery market, as these vehicles still require traditional lead-acid batteries for their 12V systems.

- Japan and South Korea, known for their technological prowess, have driven innovations in polypropylene separator manufacturing. Companies in these countries have focused on developing separator materials with enhanced performance characteristics, such as improved puncture resistance and reduced electrical resistance. These advancements have served their domestic markets and positioned them as key exporters of high-quality separators to other countries in the region and beyond.

- For instance, in January 2024, Incheon National University scientists in South Korea pioneered a technique to enhance separator stability and characteristics. By incorporating a layer of silicon dioxide and other specialized molecules, batteries utilizing these separators showcased enhanced performance and curbed the growth of intrusive root-like structures. This breakthrough sets the stage for developing high-safety batteries, which are crucial for the widespread acceptance of electric vehicles and cutting-edge energy storage solutions.

- Therefore, as mentioned above, the Asia-Pacific region is expected to dominate the market during the forecast period.

Global Lead-Acid Battery Separator Industry Overview

The global lead-acid battery separator market for SLI applications is semi-fragmented. Some key players in this market (in no particular order) are Asahi Kasei Corporation, Toray Battery Separator Film Co. Ltd, Freudenberg Performance Materials, SK ie Technology Corporation Ltd, and Entek International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growth in Automotive Industry

- 4.5.1.2 Cost Effectiveness

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyethylene

- 5.1.2 Polypropylene

- 5.1.3 Others

- 5.2 Geography [Market Size and Demand Forecast till 2029 (for regions only)]

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Russia

- 5.2.2.8 Turkey

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 South Korea

- 5.2.3.6 Malaysia

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Vietnam

- 5.2.3.10 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 Saudi Arabia

- 5.2.4.2 United Arab Emirates

- 5.2.4.3 Nigeria

- 5.2.4.4 Egypt

- 5.2.4.5 Qatar

- 5.2.4.6 South Africa

- 5.2.4.7 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Colombia

- 5.2.5.4 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 Asahi Kasei Corporation

- 6.3.2 Toray Battery Separator Film Co. Ltd

- 6.3.3 Freudenberg Performance Materials

- 6.3.4 SK ie Technology Corporation Ltd

- 6.3.5 Entek International

- 6.3.6 Sumitomo Chemical Co. Ltd

- 6.3.7 Ube Maxell Co. Ltd

- 6.3.8 W-Scope Corporation

- 6.3.9 Daramic

- 6.3.10 Amer SIL

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Enhanced Separator Materials