|

市场调查报告书

商品编码

1636192

动物运输:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Animal Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

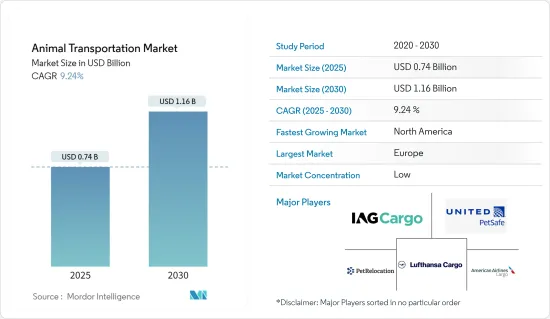

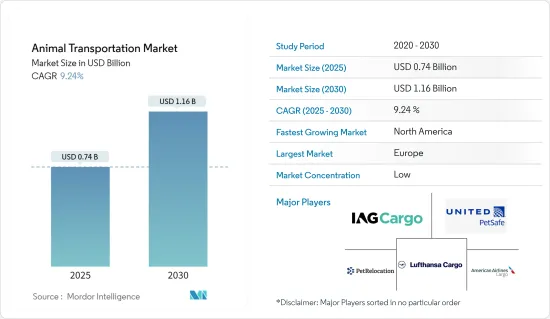

预计2025年动物运输市场规模为7.4亿美元,2030年将达11.6亿美元,预测期间(2025-2030年)复合年增长率为9.24%。

主要亮点

- 多年来,动物运输市场经历了显着的成长和转型。在全球化和宠物拥有迅速增长趋势的推动下,对安全可靠的动物运输的需求正在迅速增加。这个市场涵盖各个领域,从国内和国际宠物运输到牲畜运输,甚至异国风动物运输。

- 在这种充满活力的背景下,航空业已成为专门从事宠物运输的关键参与者。现在许多航空公司都提供专门针对宠物旅行的特别计划,凸显了他们对宠物饲主的承诺。这些倡议涵盖国内和全球旅行,凸显了航空公司致力于确保宠物的安全和舒适。为此,航空公司严格遵守行业法规和准则,并优先考虑运输途中动物的健康。

- 除了航空公司之外,专门从事宠物运输服务的专业宠物运输公司也正在兴起。这些公司提供全面的门到门服务并处理所有物流,从安排航班到完成文书工作,确保您的动物在整个旅程中感到舒适。

- 在牲畜运输领域,农业处于领先地位。此外,异国风动物运输在这个市场中形成了一个独特的部分。一般来说,该领域满足动物园、野生动物保护区和研究设施的需求。运送这种独特的生物需要仔细规划、遵守法规和特殊处理,所有这些都是为了保护动物的健康。

动物运输市场趋势

宠物收养率提高

拥有宠物不仅为您的家带来欢乐和陪伴,而且对收容所动物的生活也产生巨大影响。

大多数美国家庭都以拥有宠物为荣,但狗往往比猫更受欢迎。令人惊讶的是,从收容所找到家的猫比狗还多。养宠物的吸引力在千禧世代尤其强烈,他们最有可能养宠物,占 33%。

每年约有 630 万隻动物被安置在收容所,但不幸的是,只有约三分之二(410 万隻)找到新家。这些动物最终因各种原因被安置在收容所,包括失落、被发现、被投降,甚至出生在收容所。

对于那些对特定品种有特殊要求的人来说,值得注意的是,对于纯种狗来说,庇护所的选择是有限的。

美国约有 9,050 万个家庭(即 70% 的家庭)拥有宠物。值得注意的是,家庭饲养的狗多于猫。动物收容所每年收容的猫比狗还多。然而,猫的收养率高于狗。

狗和猫的安乐死率显着下降,从 2011 年的 260 万隻狗和猫减少到每年约 92 万隻狗。每年,大约有 410 万隻动物透过收容所收养找到新家。每年成功与饲主团聚的流浪狗比猫多,但差异尚未确定。

欧洲主导动物运输市场并实现强劲成长

欧洲农业部门实力强劲,其特点是对肉类、乳製品和家禽等畜产品的强劲需求。这项需求强调了对简化且可靠的牲畜运输系统的需求,这对于将牲畜从农场运送到市场和加工中心至关重要。

宠物拥有量正在增加,许多欧洲人将宠物视为重要的家庭成员。这一趋势,加上宠物消费支出的增加,正在推动该行业达到新的收益高度。

欧盟 (EU) 推出了严格的法规和标准,以确保动物在运输过程中的福利和安全。这些规定涵盖旅行时间、车辆状况、处理程序以及食物、水和休息。实施这些标准增强了欧洲作为动物福利领导者的声誉,并有助于吸引其他地区的业务。

动物运输产业概述

动物运输市场竞争激烈,多家公司争夺市场头把交椅。

市场上一些顶级的参与者包括 IAG Cargo、联合航空 PetSafe、美国航空货运、汉莎航空货运和 Pet Relocation。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态

- 目前的市场状况

- 市场动态

- 促进因素

- 宠物拥有量的增加推动市场

- 动物福利意识的提高推动市场发展

- 抑制因素

- 遵守影响市场的法规

- 影响市场的出行方式的变化

- 机会

- 市场驱动的技术进步

- 全球化与宠物海外迁徙

- 促进因素

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 市场技术进步

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 家畜

- 宠物

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 南美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- IAG Cargo

- United Airlines PetSafe

- American Airlines Cargo

- Lufthansa Cargo

- Pet Relocation

- Happy Tail Travels

- Air Animal Pet Movers

- Starwood Animal Transport Services

- Pet Express

- Pet Air Carrier

- 其他公司

第七章 市场的未来

第8章附录

- 总体经济指标

- 按部门分類的 GDP 分布

The Animal Transportation Market size is estimated at USD 0.74 billion in 2025, and is expected to reach USD 1.16 billion by 2030, at a CAGR of 9.24% during the forecast period (2025-2030).

Key Highlights

- Over the years, the animal transportation market has experienced notable growth and transformation. Driven by globalization and the surging trend of pet ownership, the demand for secure and dependable animal transportation has soared. This market encompasses diverse sectors, spanning from domestic and international pet transportation to livestock and even transportation for exotic animals.

- Amidst this dynamic backdrop, the airline industry emerges as a pivotal player, with a notable focus on pet transportation. Many airlines now offer specialized programs, designed exclusively for pet travel, underscoring their commitment to pet owners. These initiatives, tailored for both local and global journeys, underscore the airlines' dedication to ensuring pets' safety and comfort. To this end, airlines rigorously follow industry regulations and guidelines, prioritizing the well-being of animals in transit.

- Beyond airlines, specialized pet transport companies have emerged, solely focusing on pet transportation services. These companies offer comprehensive door-to-door services, handling all logistics, from flight arrangements to documentation, and ensuring the animals' comfort throughout the journey.

- In the realm of livestock transportation, the agricultural industry takes the lead. Additionally, the transportation of exotic animals forms a distinct segment within this market. Typically, this segment caters to the needs of zoos, wildlife sanctuaries, and research facilities. Transporting these unique creatures mandates meticulous planning, adherence to regulations, and specialized handling, all aimed at safeguarding their well-being.

Animal Transportation Market Trends

Growing pet adoption rates

Adopting a pet not only brings joy and companionship to a household but also significantly impacts the lives of shelter animals.

While the majority of American households proudly own a pet, dogs tend to be the more favored choice over cats. Surprisingly, it's cats that find homes from shelters more frequently than their canine counterparts. The allure of pet ownership is particularly strong among millennials, who boast the highest share of pet ownership at 33%.

Annually, approximately 6.3 million animals find themselves in shelters, but regrettably, only about two-thirds (4.1 million) find new homes. These animals end up in shelters for various reasons, ranging from being lost or found to being surrendered or even born within the shelter's confines.

For those with a penchant for specific breeds, it's worth noting that shelters typically have limited options when it comes to purebreds.

Approximately 90.5 million homes in the United States, accounting for 70% of households, are home to a pet. It is worth noting that dogs are more prevalent in households than cats. Animal shelters receive a higher number of cats compared to dogs each year. However, the adoption rate for cats surpasses that of dogs.

The euthanasia rates for dogs and cats have seen a significant decline, dropping from 2.6 million in 2011 to approximately 920,000 annually. Each year, roughly 4.1 million animals find new homes through shelter adoptions. While more stray dogs than cats are successfully reunited with their owners each year, the gap is not specified.

Europe dominates animal transportation market, poised for strong growth

Europe's agricultural sector is robust, marked by a significant appetite for livestock products, including meat, dairy, and poultry. This demand underscores the necessity for streamlined and dependable animal transportation systems, which are crucial for ferrying livestock from farms to both markets and processing centers.

With most European populace treating their pets as cherished family members, pet ownership has seen a notable uptick. This trend, coupled with a growing consumer expenditure on pets, is propelling the industry to new revenue heights.

The European Union (EU) has implemented strict regulations and standards to ensure the welfare and safety of animals during transportation. These regulations cover journey duration, vehicle conditions, handling procedures, and food, water, and rest access. Enforcing these standards enhances Europe's reputation as a leader in animal welfare and attracts business from other regions.

Animal Transportation Industry Overview

The animal transportation market is quite competitive, with several players vying for top position in the market.

The top players in the market include IAG Cargo, United Airlines PetSafe, American Airlines Cargo, Lufthansa Cargo, Pet Relocation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing pet ownership driving the market

- 4.2.1.2 Increased awareness of animal welfare driving the market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Compliances affecting the market

- 4.2.2.2 Changing travel patters affecting the market

- 4.2.3 Opportunities

- 4.2.3.1 Technological advancements driving the market

- 4.2.3.2 Globalization and international pet relocation

- 4.2.1 Drivers

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Advancements in the Market

- 4.6 Impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Livestock

- 5.1.2 Pets

- 5.1.3 Others

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Middle East & Africa

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 IAG Cargo

- 6.2.2 United Airlines PetSafe

- 6.2.3 American Airlines Cargo

- 6.2.4 Lufthansa Cargo

- 6.2.5 Pet Relocation

- 6.2.6 Happy Tail Travels

- 6.2.7 Air Animal Pet Movers

- 6.2.8 Starwood Animal Transport Services

- 6.2.9 Pet Express

- 6.2.10 Pet Air Carrier*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 GDP Distribution by Sector