|

市场调查报告书

商品编码

1636199

邮轮物流:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Cruise Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

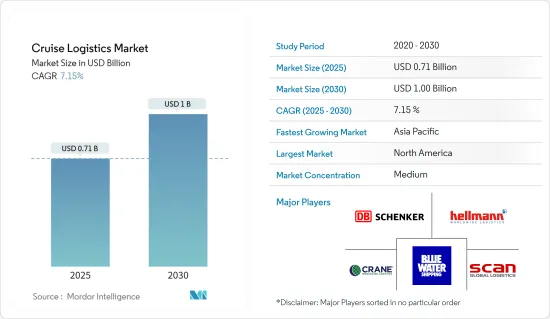

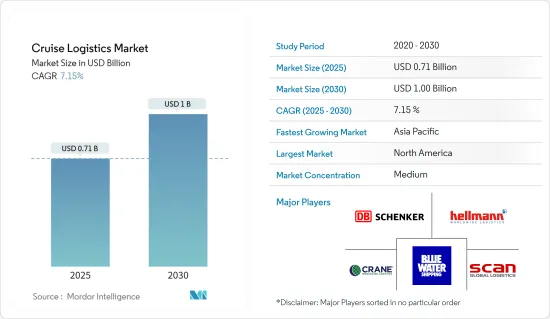

邮轮物流市场规模预计2025年将达到7.1亿美元,预计2030年将达10亿美元,预测期间(2025-2030年)复合年增长率为7.15%。

随着向绿色邮轮营运的转变,以绿色供应和永续燃料选择为特色,物流提供者必须适应新的环境法规和标准。在瑞典,邮轮市场越来越注重永续性,公司优先考虑环保选择并促进负责任的旅游业。

从2023年初开始,斯德哥尔摩港将其工作车辆改用生物柴油(HVO100)取代Mk1柴油,每年减少化石二氧化碳排放约200吨。目标是到 2030 年使斯德哥尔摩港的业务不再使用石化燃料。此外,从 2024 年 7 月起,将鼓励邮轮公司对至少三种类型的废弃物进行分类:塑胶、纸张和金属。

人们正在做出各种努力来尽量减少邮轮上废弃物的产生。例如,Costa Crociere 的 4GOODFOOD 计画旨在将船上的食物废弃物减少一半,符合联合国永续发展议程到 2030 年将食物废弃物减少 50% 的目标。

有效减少邮轮上的食物浪费需要精确的物流管理、先进的低温运输物流和更好的包装,以确保食物品质并最大限度地减少运输和储存过程中的腐败。时间表。这种向永续性的转变解决了生态问题,并在邮轮物流行业培育了更具弹性和前瞻性的方法。

邮轮物流市场趋势

邮轮物流整合与增强的趋势

2023年邮轮客运市场将大幅成长55%,重要的物流公司正在加强服务。 Radiant 物流就是这样一家公司,以其技术主导的全球营运而闻名,于 2024 年 2 月采取了一项策略性倡议。我们收购了两家私人公司: Select 物流和 Select Cartage,这两家公司均位于佛罗里达州多拉尔。自 2007 年收购以来,这些公司一直是 Radiant 的 Adcom Worldwide 品牌的一部分,并已整合到 Radiant 不断扩大的邮轮物流产品组合中。 Radiant的交易结构符合业界标准,将部分付款与被收购公司的未来业绩挂钩。

Radiant的收购策略是基于成长和加强其在邮轮物流的地位。透过将这些营业单位整合到 Adcom Worldwide 品牌中,Radiant 旨在加强其服务套件,特别是运输、仓储和其他对邮轮营运至关重要的关键物流功能。

这些全产业趋势凸显了邮轮产业向物流端到端物流解决方案的转变。透过收购,Radiant 物流等公司准备提供全面的物流支持,涵盖供应、仓储、清关和港口业务。将收购成本与未来业绩联繫起来的重点凸显了该行业对成长和卓越营运的承诺,并符合日益复杂的邮轮物流的需求。

绿色措施正在改变欧洲的邮轮物流

2023年6月,世界上第一艘环保邮轮从比利时安特卫普港启航,展开为期10天的北海环球航行。这艘 300m 长的游轮是同类中的第一艘游轮,旨在迎合具有环保意识的旅行者,提供奢华的体验,同时最大限度地减少对环境的影响。

为了凸显环保洗脑游轮体验日益增长的趋势,欧洲运输与环境联合会发起了一场宣传「100%绿色游轮」的模拟宣传活动,口号是「让不可持续的事情变得可持续」。总部位于瑞士的地中海邮轮 (MSC Cruises) 等公司正在宣传液化天然气 (LNG) 作为石油的绿色替代品,但液化天然气存在环境缺陷。液化天然气燃烧时会排放二氧化碳并洩漏甲烷,就全球暖化潜力而言,甲烷是比二氧化碳更强大的污染物。

绿色邮轮的推动正在创造对环保物流解决方案的需求。这包括有机食品和环保产品等材料的永续采购和运输,以及在燃料管理和废弃物处理方面采用环保做法。随着越来越多的旅客优先考虑永续性以及法规的收紧,物流公司可能需要透过绿色物流认证和定期环境影响审核来遵守这些新标准。

邮轮物流行业概况

邮轮物流市场的竞争格局受到多种因素的影响,包括技术进步、监管障碍和邮轮港口的扩张。领先的公司利用即时追踪、自动化和先进的库存管理来提高业务效率和透明度。 DB Schenker、Hellmann Worldwide 物流和 Klein Worldwide 物流等公司凭藉其广阔的全球影响力和多样化的服务组合而脱颖而出。

儘管面临严峻的营运成本和严格的法规,这些市场领导仍在加倍投入专门的基础设施,特别是温控储存和运输,强调了他们对安全和品质的承诺。此外,市场正在见证永续性措施的激增以及对亚太和南美洲快速成长市场的策略性进入。鑑于该行业的活力,该公司正在巧妙地应对从自然灾害到地缘政治变化再到流行病的供应链中断,并确保无缝交付,支持蓬勃发展的邮轮业。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 洞察供应链/价值链分析

- 产业监管洞察

- 洞察产业技术进步

第五章市场动态

- 市场驱动因素

- 世界各地邮轮港口的扩建

- 邮轮假期越来越受欢迎

- 市场限制因素

- 与维持高标准相关的成本

- 市场机会

- 越来越重视永续性和环境课责

- 将邮轮业扩展到新兴市场

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 依物流服务类型

- 港口业务

- 供应链管理

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东/非洲

- 南美洲

第七章 竞争格局

- 市场集中度概览

- 公司简介

- DB Schenker

- Hellmann Worldwide Logistics

- Crane Worldwide Logistics

- Blue Water Shipping

- Scan Global Logistics

- Southampton Freight Services

- CNS Logistics

- TEFRA Cruise Logistics

- SAS Cruise Logistics

- ATPI*

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

The Cruise Logistics Market size is estimated at USD 0.71 billion in 2025, and is expected to reach USD 1.00 billion by 2030, at a CAGR of 7.15% during the forecast period (2025-2030).

The shift toward greener cruise operations, featuring eco-friendly supplies and sustainable fuel options, requires logistics providers to adapt to new environmental regulations and standards. In Sweden, the cruise market increasingly emphasizes sustainability, with companies prioritizing eco-friendly choices and promoting responsible tourism.

Since the beginning of 2023, Ports of Stockholm has transitioned its work vehicles to biodiesel (HVO100) instead of Mk1 diesel, reducing fossil carbon dioxide emissions by approximately 200 tonnes annually. The aim is to make Ports of Stockholm's operations fossil-free by 2030. Additionally, starting in July 2024, cruise lines are encouraged to segregate and manage at least three types of waste: plastics, paper, and metal.

Various initiatives are in place to minimize waste production on cruise ships. For instance, Costa Crociere's 4GOODFOOD program targets halving food waste on its ships in line with the UN's Sustainable Development Agenda goal of reducing food waste by 50% by 2030, now implemented across eight EU destinations.

Effective food waste reduction on cruise ships requires precise logistics management, advanced cold chain logistics, better packaging solutions, and optimized delivery schedules to ensure food quality and minimize spoilage during transport and storage. This shift toward sustainability addresses ecological concerns and fosters a more resilient and forward-thinking approach within the cruise logistics industry.

Cruise Logistics Market Trends

Trend Toward Consolidation and Enhanced Capabilities in Cruise Logistics

The cruise passenger market witnessed a remarkable 55% growth in 2023, prompting significant logistics firms to bolster their services. One such player, Radiant Logistics Inc., known for its tech-driven global operations, made a strategic move in February 2024. It acquired two privately held companies, Select Logistics Inc. and Select Cartage Inc., based in Doral, Florida. These firms, part of Radiant's Adcom Worldwide brand since an earlier acquisition in 2007, were integrated into Radiant's expanding cruise logistics portfolio. Radiant's deal structure, aligning with industry norms, tied a portion of the payment to the acquired firms' future performance.

Radiant's acquisition strategy is about growth and consolidating and elevating its position in cruise logistics. By integrating these entities into its Adcom Worldwide brand, Radiant aims to strengthen its suite of services, particularly transportation, warehousing, and other critical logistics functions essential for cruise operations.

This industry-wide trend underscores a shift toward tailored, end-to-end logistics solutions for the cruise sector. Through acquisitions, companies like Radiant Logistics are poised to provide comprehensive logistical support, covering provisioning, warehousing, customs brokerage, and port operations. The emphasis on tying acquisition costs to future performance highlights the industry's commitment to growth and operational excellence, aligning with the increasingly complex demands of cruise logistics.

Eco-friendly Initiatives Transforming European Cruise Logistics

In June 2023, the world's first green cruise ship embarked on its maiden voyage from the Port of Antwerp, Belgium, for a 10-day tour of the North Sea. This 300-m-long vessel is the first of its kind, offering a luxury experience with minimal environmental impact, catering to eco-conscious travelers.

To highlight the increasing trend of greenwashed cruise experiences, the European Federation for Transport and Environment launched a mock campaign promoting a '100% green cruise' with the slogan 'sustain the unsustainable.' While companies like MSC Cruises, based in Switzerland, advocate for liquefied natural gas (LNG) as a greener alternative to oil, LNG has its environmental drawbacks. It emits CO2 when burned and leaks methane, a pollutant far more potent than CO2 in terms of global warming potential.

This push for green cruising is creating a demand for eco-friendly logistics solutions. This includes sourcing and transporting sustainable supplies such as organic food and environmentally friendly products and adopting greener practices in fuel management and waste disposal. With more travelers prioritizing sustainability and regulations becoming stricter, logistics companies must comply with these new standards, potentially through certifications for green logistics and regular environmental impact audits.

Cruise Logistics Industry Overview

The competitive landscape in the cruise logistics market is influenced by several factors, notably technological advancements, regulatory hurdles, and the widening scope of cruise destinations. Leading players capitalize on real-time tracking, automation, and advanced inventory management to boost operational efficiency and transparency. Companies like DB Schenker, Hellmann Worldwide Logistics, and Crane Worldwide Logistics stand out, leveraging their expansive global reach and diverse service portfolios.

Despite facing steep operational costs and stringent regulations, these market leaders are doubling on specialized infrastructure investments, particularly in temperature-controlled storage and transportation, underscoring their commitment to safety and quality. Moreover, the market is witnessing a surge in sustainability initiatives and a strategic push into burgeoning markets in Asia-Pacific and South America. Given the sector's dynamism, companies are adeptly navigating supply chain disruptions, from natural calamities to geopolitical shifts or pandemics, ensuring seamless delivery to bolster the thriving cruise industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights on Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Expansion of Global Cruise Ports

- 5.1.2 The Rising Popularity of Cruise Vacations

- 5.2 Market Restraints

- 5.2.1 Costs Associated With Maintaining High Standards

- 5.3 Market Opportunities

- 5.3.1 Growing Emphasis on Sustainability and Environmental Accountability

- 5.3.2 The Cruise Industry's Expansion into Emerging Markets

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type of Logistics Services

- 6.1.1 Port Operations

- 6.1.2 Supply Chain Management

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.5 South America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 DB Schenker

- 7.2.2 Hellmann Worldwide Logistics

- 7.2.3 Crane Worldwide Logistics

- 7.2.4 Blue Water Shipping

- 7.2.5 Scan Global Logistics

- 7.2.6 Southampton Freight Services

- 7.2.7 CNS Logistics

- 7.2.8 TEFRA Cruise Logistics

- 7.2.9 SAS Cruise Logistics

- 7.2.10 ATPI*

- 7.3 Other Companies