|

市场调查报告书

商品编码

1636203

亚太地区废弃物管理:市场占有率分析、产业趋势和成长预测(2025-2030)Asia-Pacific Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

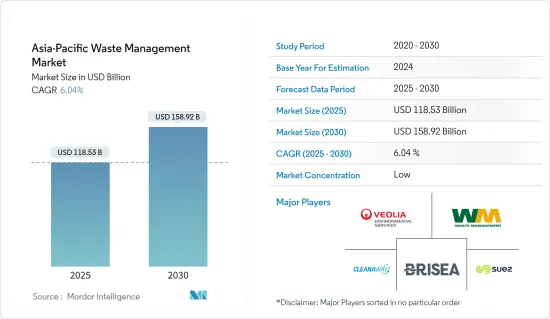

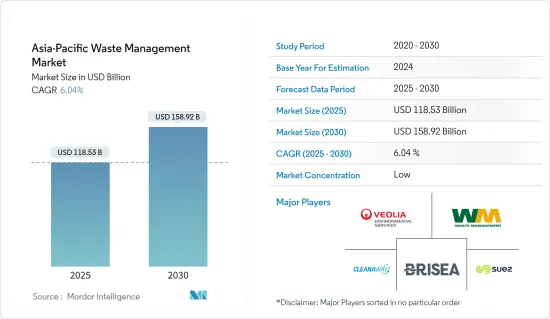

预计2025年亚太地区废弃物管理市场规模为1,185.3亿美元,预估2030年将达1,589.2亿美元,预测期间(2025-2030年)复合年增长率为6.04%。

过去 50 年来,各国的废弃物产生量均有所增加。然而,日本和韩国最近却出现了下滑。例如,韩国正在进行的生产者延伸责任(EPR)系统要求产品製造商收集和回收其产品中的废弃物。这些政府措施和法规有助于废弃物处理公司在该国有效运作。

在废弃物管理流程中采用物联网、人工智慧和机器人等最尖端科技正在为产业带来革命性的变化。 2023 年 9 月,印度梅加拉亚邦推出了人工智慧驱动的废弃物管理方法。一艘支援人工智慧的机器人船捡起了倾倒在湖中的大量垃圾。与手动方法相比,此过程更有效且耗时更少。

亚太地区对再生材料的需求正在增加。各国正在投资先进的回收技术,将废弃物加工成可重复使用的材料,为回收商创造新的市场机会。

例如,2024年5月,蔚山大学(UC)和蔚山国际发展合作中心(UIDCC)与联合国环境规划署国际环境技术中心合作,在韩国蔚山共同举办了为期五天的能力建设计画。该活动展示了塑胶回收再利用技术的进步,并强调了社区对环保措施的参与。

亚太地区废弃物管理市场趋势

塑胶废弃物推动亚太地区的废弃物管理

- 亚太地区正遭受大量未经管理的塑胶废弃物的困扰,全球对更有效的废弃物管理解决方案的需求不断增长。这种紧迫性正在推动对先进废弃物管理技术和基础设施增强的需求。这鼓励私人组织和政府增加对尖端废弃物处理和回收技术的开发和实施的投资。

- 例如,到2024年,中国将在塑胶废弃物不当方面领先亚太国家,估计数量将达到5,500万吨。同年,纽西兰脱颖而出,产生了 8,410 吨处理不当的塑胶废弃物。

- 2024年6月,澳洲联邦委员会提出了22项建议,以应对该国水域的塑胶污染。 2022年11月,澳洲加入终结塑胶污染远大志向联盟,进一步强调其遏止塑胶污染的承诺。该联盟旨在透过一项新条约到 2040 年消除全球塑胶污染。

- 这些行动塑造了亚太地区废弃物管理的格局,并凸显了对先进回收技术、加强废弃物收集系统和创新废弃物减少策略的迫切需求。

中国的废弃物管理措施推动市场成长和创新

- 中国国家统计局资料显示,截至2022年,中国约有444个卫生垃圾掩埋场。过去十年,中国废弃物排放稳定成长,2022年将达到约2.445亿吨。

- 此外,到2022年,中国普通工业废弃物固态废弃物产生量将达到410亿吨。废弃物排放的激增凸显了中国对先进废弃物管理技术和服务的迫切需求,这一趋势预计将推动亚太地区废弃物管理市场的成长和创新。

- 2017年,中国发起了全国性的废弃物分类宣传活动,以应对这项废弃物挑战。到2020年,80多个城市全面实施或测试了废弃物、可回收物、危险废弃物和剩菜等分类的城市垃圾分类规定。计划从 2025 年到 2030 年将这种隔离系统扩展到所有城市。该倡议预计将刺激废弃物管理领域的成长和创新,并推动整个亚太地区的投资和技术进步。

亚太地区废弃物管理产业概况

亚太地区废弃物管理市场由提供废弃物收集、回收和危险废弃物处理等服务的本地和全球公司主导。苏伊士环境公司、威立雅环境服务公司和废弃物管理公司等行业巨头处于领先地位,利用其丰富的专业知识和最尖端科技在全部区域提供全面的废弃物管理解决方案。

同时,澳洲的 Cleanaway Waste Management 和日本的 Daiseki 等区域性公司也占据了显着的市场占有率,提供针对当地需求和法规结构的服务。 BRISEA Group Inc.、Attero 和 Remondis AG &Co.Kg 等着名公司支援先进的回收和废弃物处理技术。这些公司正在共同重塑这一领域,实施全球最佳实践,倡导永续性,并满足亚太地区对有效废弃物管理解决方案日益增长的需求。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场洞察

- 目前的市场状况

- 科技趋势

- 洞察供应链/价值链分析

- 产业监管洞察

- 洞察产业技术进步

第五章市场动态

- 市场驱动因素

- 快速都市化和人口成长

- 政府法规和倡议

- 市场限制因素

- 文化和行为障碍

- 农村地区缺乏基础设施

- 市场机会

- 不断成长的回收市场

- 废弃物技术

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第六章 市场细分

- 依废弃物类型

- 工业废弃物

- 都市固态废弃物

- 电子废弃物

- 塑胶废弃物

- 医疗废弃物及其他废弃物(包括建筑废弃物)

- 依废弃方法分类

- 掩埋

- 焚化

- 回收

- 其他处置方法

- 按国家/地区

- 中国

- 日本

- 印度

- 韩国

- 其他亚太地区

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Suez Environment SA

- Waste Management Inc.

- Cleanaway Waste Management

- Veolia Environmental Services

- BRISEA Group Inc.

- Attero

- Remondis AG & Co. Kg

- Daiseki Co. Ltd

- Averda

- Clean Harbors Inc.*

- 其他公司

第八章 市场机会及未来趋势

第九章 附录

The Asia-Pacific Waste Management Market size is estimated at USD 118.53 billion in 2025, and is expected to reach USD 158.92 billion by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

Over the past 50 years, waste generation has risen across all nations. However, Japan and Korea have recently shown a decline. For example, Korea's ongoing Extended Producer Responsibility (EPR) scheme mandates that product manufacturers collect and recycle the waste from their products. These governmental initiatives and regulations have helped waste management companies to operate effectively within the country.

Adopting cutting-edge technologies such as IoT, AI, and robotics in waste management processes is revolutionizing the industry. In September 2023, the Indian state of Meghalaya introduced an AI-enabled waste management method. The AI-enabled robotic boat collects vast quantities of garbage dumped in a lake. Compared to manual labor, this process is effective and less time-consuming.

The APAC region is seeing an increase in the demand for recycled materials. Countries are investing in advanced recycling technologies to process waste into reusable materials, creating new market opportunities for recycling businesses.

For instance, in May 2024, Ulsan College (UC) and the Ulsan International Development Cooperation Center (UIDCC) hosted a five-day capacity-building program in Ulsan, Republic of Korea, in partnership with the UNEP's International Environmental Technology Center. This event showcased advancements in plastic recycling technologies and emphasized community involvement in environmental initiatives.

Asia-Pacific Waste Management Market Trends

Plastic Waste Driving Waste Management in Asia-Pacific

- The Asia-Pacific region grapples with a staggering volume of mismanaged plastic waste, propelling a global call for more effective waste management solutions. This urgency accentuates the demand for advanced waste management technologies and infrastructure enhancements. Driven by this, private entities and governments increasingly invest in developing and deploying cutting-edge waste processing and recycling technologies.

- For instance, in 2024, China led the Asia-Pacific nations in mismanaged plastic waste, with an estimated 55 million metric tons. New Zealand stood out in the same year, accounting for 8.41 thousand metric tons of mismanaged plastic waste.

- In June 2024, an Australian federal committee made 22 recommendations to combat plastic pollution in the nation's water bodies. In November 2022, Australia's commitment to curbing plastic pollution was further underscored as it joined the High Ambition Coalition to End Plastic Pollution. This coalition aims to eradicate global plastic pollution by 2040 through a new treaty.

- These actions shape the waste management landscape in the Asia-Pacific and emphasize the pressing need for advanced recycling technologies, enhanced waste collection systems, and innovative waste reduction strategies.

China's Waste Management Initiatives Propel Market Growth and Innovation

- Data from the National Bureau of Statistics of China revealed that the nation had around 444 sanitary landfill sites as of 2022. Over the past decade, China has steadily increased its waste output, reaching approximately 244.5 million tons by 2022.

- Furthermore, the volume of regular solid industrial waste produced in China amounted to 41 billion metric tons in 2022. This surge in waste generation underscores the urgent need for advanced waste management technologies and services in China, a trend expected to drive growth and innovation in the APAC waste management market.

- China launched a nationwide waste sorting campaign in 2017 to address this waste challenge. By 2020, over 80 cities had fully implemented or were piloting mandatory sorting of municipal waste into categories such as food waste, recyclables, hazardous waste, and residuals. The plan is to extend this sorting system to all cities between 2025 and 2030. This initiative is expected to spur growth and innovation in the waste management sector, encouraging investments and technological advancements throughout the APAC region.

Asia-Pacific Waste Management Industry Overview

Local and global entities dominate the waste management market in Asia-Pacific, offering services spanning waste collection, recycling, and hazardous waste treatment. Industry behemoths like Suez Environment SA, Veolia Environmental Services, and Waste Management Inc. stand at the forefront, harnessing their vast expertise and cutting-edge technologies to deliver holistic waste management solutions across the region.

Meanwhile, regional players like Australia's Cleanaway Waste Management and Japan's Daiseki Co. Ltd also command notable market shares, tailoring their services to local demands and regulatory frameworks. Noteworthy entities such as BRISEA Group Inc., Attero, and Remondis AG & Co. Kg are championing advanced recycling and waste processing technologies. Collectively, these firms are reshaping the sector, infusing global best practices, championing sustainability, and meeting the surging need for effective waste management solutions in Asia-Pacific.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Insights into Supply Chain/Value Chain Analysis

- 4.4 Insights into Governement Regualtions in the Industry

- 4.5 Insights into Technological Advancements in the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Urbanization and Population Growth

- 5.1.2 Government Regulations and Initiatives

- 5.2 Market Restraints

- 5.2.1 Cultural and Behavioral Barriers

- 5.2.2 Lack of Infrastructure in Rural Areas

- 5.3 Market Opportunities

- 5.3.1 Growing Recycling Market

- 5.3.2 Waste-to-Energy Technologies

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Waste Type

- 6.1.1 Industrial Waste

- 6.1.2 Municipal Solid Waste

- 6.1.3 E-waste

- 6.1.4 Plastic Waste

- 6.1.5 Biomedical and Other Waste Types (Including Construction Waste)

- 6.2 By Disposal Methods

- 6.2.1 Landfill

- 6.2.2 Incineration

- 6.2.3 Recycling

- 6.2.4 Other Disposal Methods

- 6.3 By Country

- 6.3.1 China

- 6.3.2 Japan

- 6.3.3 India

- 6.3.4 South Korea

- 6.3.5 Rest of Asia-Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Suez Environment SA

- 7.2.2 Waste Management Inc.

- 7.2.3 Cleanaway Waste Management

- 7.2.4 Veolia Environmental Services

- 7.2.5 BRISEA Group Inc.

- 7.2.6 Attero

- 7.2.7 Remondis AG & Co. Kg

- 7.2.8 Daiseki Co. Ltd

- 7.2.9 Averda

- 7.2.10 Clean Harbors Inc.*

- 7.3 Other Companies