|

市场调查报告书

商品编码

1636208

亚太地区塑胶废弃物管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Asia-Pacific Plastic Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

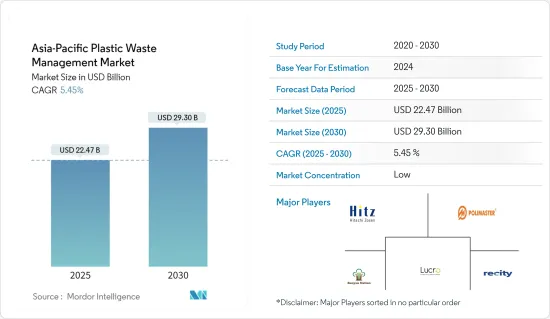

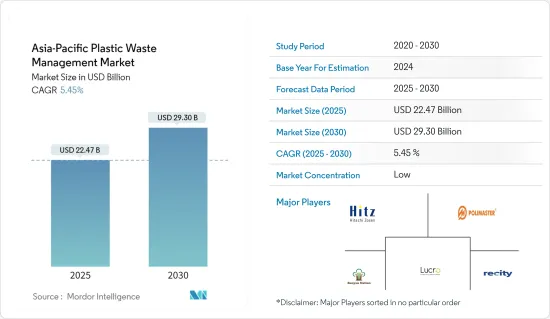

预计2025年亚太地区塑胶废弃物管理市场规模为224.7亿美元,2030年达293亿美元,预测期间(2025-2030年)复合年增长率为5.45%。

亚太地区快速的都市化和工业扩张正在推动塑胶消费和废弃物产生的急剧增加。特别是中国和印度等国家的都市区是塑胶废弃物的主要来源。亚太地区各国政府正采取越来越严格的措施来应对。这包括禁止使用一次性塑胶、引入生产者延伸责任 (EPR) 计划以及鼓励回收的奖励。例如,中国实施了塑胶废弃物进口禁令,印度也推出了自己的塑胶废弃物管理法规。

从先进的分类系统到化学回收再到生物分解性的回收,回收技术的进步正在重塑塑胶废弃物管理的模式。同时,数位废弃物追踪和管理解决方案的采用趋势正在增加。随着社会越来越意识到塑胶污染带来的环境问题,消费者需要更永续的产品和负责任的废弃物管理。因此,公司正在做出更环保的努力,并大力投资回收基础设施。

亚太地区塑胶废弃物管理市场的经济潜力巨大,特别是在收集、分离、回收和废弃物转化能源技术等领域。因此,对回收基础设施和废弃物管理设施的投资正在增加。然而,一些亚太国家仍面临挑战,包括废弃物管理基础设施不足、回收率低以及废弃物普遍存在。应对这些挑战需要基础设施升级并提高公众对废弃物分类的认识和承诺。

亚太地区塑胶废弃物管理市场趋势

快速都市化加剧了亚太地区的塑胶问题

拥有约 40 亿人口的亚太地区 (APAC) 正在经历快速都市化,加剧了日益严重的塑胶问题。根据联合国报告,亚太地区已有 28 个特大城市,估计每天有 12 万人搬迁到该地区的都市区。据预测,到 2050 年,亚太地区将有 33 亿人居住在城市。这一波都市化正在刺激消费,并急剧增加对一次性包装的需求,特别是在软质塑胶领域。如果这一趋势持续下去,到 2030 年,亚太地区将产生 1.4 亿吨塑胶废弃物。

鑑于世界上许多人口最多的国家都位于亚太地区,快速的都市化伴随着生活方式的改变和对包装商品日益增长的需求。包装的灵活性已成为亚太地区的关键问题。相关成本较低,增强了该地区生产(尤其是食品业)的吸引力。 2023年,亚太地区占据软包装市场52.2%的份额。 Uflex 和 Fuji Seal International 等着名公司正在加强该行业在该地区的地位。亚太地区对一次性塑胶包装的偏好,特别是小袋和小袋包装(例如印度的单份水包装),很大程度上是由于这些材料提供的成本优势。

印尼的一次性塑胶袋案例清楚地说明了亚太地区法规的有效性。在23个城市试验成功后,雅加达于2020年7月实施了全面禁止塑胶购物袋的政策。儘管最初遭到企业的反对,但这些规定得到了维持,违规者现在面临罚款,屡犯者面临吊销许可证的风险。

报告的结果显示禁令的成功。 2018年,雅加达每年的塑胶购物袋消费量估计为240-3亿个。到 2021 年,这一消费量下降了 42%,从 11,192 吨减少到 6,452 吨。

在全球范围内,孟加拉率先在2002年实施了全国范围内的塑胶购物袋禁令。中国于 2020 年开始实施禁令,最终阶段定于 2025 年。印度也加入了这项运动,将于 2022 年实施一次性塑胶禁令。

儘管取得了这些进步,亚太地区部分地区仍难以跟上。根据韩国零废弃物运动网的报告显示,韩国每年消耗190亿个塑胶购物袋。另一方面,根据泰国政府的调查,每年大约消耗2000亿个塑胶购物袋,这意味着每人平均每天消耗8个塑胶购物袋。海洋保护协会将泰国列为世界第六大海洋废弃物排放。

总之,儘管亚太地区国家在塑胶监管方面取得了重大进展,但该地区仍需要克服塑胶消费和废弃物管理方面的重大挑战。严格的执法和创新的解决方案对于解决这个问题至关重要,特别是考虑到该地区快速的都市化。

中国在废弃物管理方面取得了长足进步

2023年,由浙江省6000多名个人和200家企业主导的一项中国倡议因其在解决海洋塑胶废弃物上的突破而被授予联合国环境最高奖。该计划使海洋塑胶回收过程更加透明,帮助当地渔民,并显着减少沿海水域的污染。自计划启动以来,已有超过61,600人参与,收集了约10,936吨海洋垃圾。

中国对废弃物管理的承诺透过对基础设施和技术的大量投资可见一斑。我们正在努力减轻垃圾掩埋场的负担,包括废弃物焚化发电厂和最先进的回收中心。中国东部的浙江省宣布了浙江省外带塑胶废弃物零计划,旨在减少和回收外带塑胶。该倡议旨在2023年终建立食品配送塑胶「零废弃物」模式,特别是在大学等关键部门。到 2025 年,这个模式将推广到学校、商业空间和当地社区。

浙江的策略包括协同努力,联合宅配平台、商家、大学、废弃物处理公司和回收协会等相关人员,形成反对马苏宅配塑胶垃圾的统一战线。浙江还计划在塑胶垃圾高发地区设立废弃物收集设施,并将要求宅配平台在大学宿舍、咖啡简餐店等场所设置此类设施并进行维护。

总体而言,中国解决废弃物问题的努力体现了中国在应对塑胶污染方面的创新和协作努力,浙江省的零塑胶废弃物计画就反映了这一点。这些倡议具有开创性,为更广泛的亚太地区制定了蓝图。

亚太地区塑胶废弃物管理产业概览

亚太地区塑胶废弃物管理市场高度分散,既有本地企业,也有全球企业。这种多样性是由于各国独特的废弃物管理要求和法规结构不同而造成的。该领域的主要企业有日立造船、Polimaster、Banyan Nation、Lucro、Recity等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 塑胶消费量增加

- 加强法规和政策以减少塑胶废弃物

- 市场限制因素

- 与建立和维护设施相关的高成本

- 市场机会

- 回收技术创新

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- PESTLE分析

- 对市场创新的见解

第五章市场区隔

- 由聚合物

- 聚丙烯(PP)

- 聚乙烯(PE)

- 聚氯乙烯(PVC)

- 对苯二甲酸酯 (PET)

- 其他聚合物

- 按来源

- 住宅

- 商业的

- 工业的

- 其他(建筑、医疗保健等)

- 透过加工

- 回收

- 化学处理

- 垃圾掩埋场

- 其他加工

- 按国家/地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

第六章 竞争状况

- Market Concetration Overview

- 公司简介

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc.

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co. Ltd

第7章 未来趋势

The Asia-Pacific Plastic Waste Management Market size is estimated at USD 22.47 billion in 2025, and is expected to reach USD 29.30 billion by 2030, at a CAGR of 5.45% during the forecast period (2025-2030).

Rapid urbanization and industrial expansion in Asia-Pacific are fueling a surge in plastic consumption and waste production. Notably, urban centers in countries like China and India stand out as primary plastic waste generators. Governments in the APAC region are responding with increasingly stringent measures. These include bans on single-use plastics, the introduction of extended producer responsibility (EPR) programs, and incentives to promote recycling. For instance, China has enforced a ban on plastic waste imports, while India has rolled out its own set of plastic waste management regulations.

Technological advancements in recycling, spanning from sophisticated sorting systems to chemical and biodegradable recycling methods, are reshaping the plastic waste management landscape. Simultaneously, there is a rising trend in adopting digital waste tracking and management solutions. As public awareness of environmental issues surrounding plastic pollution grows, consumers demand more sustainable products and responsible waste management. This, in turn, pushes companies toward eco-friendly practices and substantial investments in recycling infrastructure.

The economic potential of the plastic waste management market in Asia-Pacific is vast, especially in areas like collection, sorting, recycling, and waste-to-energy technologies. As a result, investments in recycling infrastructure and waste management facilities are rising. However, challenges persist, including inadequate waste management infrastructure in several APAC nations, low recycling rates, and the prevalence of mixed and contaminated plastic waste. Addressing these challenges will require infrastructure upgrades and heightened public awareness and engagement in waste segregation.

Asia-Pacific Plastic Waste Management Market Trends

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

With a population of approximately 4 billion, Asia-Pacific (APAC) is witnessing rapid urbanization, exacerbating its escalating plastic predicament. A UN report highlights that APAC already hosts 28 megacities, and an estimated 120,000 individuals are relocating to urban centers in the region daily. Projections suggest that a staggering 3.3 billion people will live in cities in Asia-Pacific by the year 2050. This surge in urbanization has fueled consumption, notably spiking the demand for single-use packaging, especially in the flexible plastic segment. If the current trajectory persists, APAC is set to generate a colossal 140 million tonnes of plastic waste by 2030.

Given that many of the world's most populous countries reside in the APAC region, the surge in urbanization is accompanied by shifting lifestyles and heightened appetites for packaged goods. Flexibility in packaging emerges as a focal concern in APAC. The region's allure for production, especially in the food sector, is bolstered by its lower associated costs. In 2023, APAC commanded a 52.2% share in the flexible packaging market. Noteworthy players like Uflex and Fuji Seal International fortify the industry's standing in the region. APAC's penchant for single-use plastic packaging, notably in pouches and sachets (e.g., single-serve water packages in India), is largely due to the cost advantage these materials offer.

The case of single-use plastic bags in Indonesia vividly illustrates the efficacy of APAC regulations. Following a successful trial in 23 cities and municipalities, Jakarta enforced a blanket ban on plastic bags in July 2020. Despite initial pushback from businesses, the regulation was upheld, with non-compliant companies facing fines and repeat offenders risking permit revocation.

The reported results indicate the ban's success. In 2018, Jakarta consumed an estimated 240-300 million plastic bags annually. By 2021, this consumption had dropped by 42%, from 11,192 tons to 6,452 tons.

On a global scale, Bangladesh led the way by implementing a national plastic bag ban in 2002. China initiated its ban in 2020, with the final phase set for 2025. India also joined the movement, implementing a ban on single-use plastics in 2022.

Despite these advancements, parts of the Asia-Pacific (APAC) region are struggling to keep pace. South Korea consumes a staggering 19 billion plastic bags each year, as reported by the Korea Zero Waste Movement Network. Meanwhile, Thailand's government survey revealed an annual consumption of around 200 billion plastic bags, translating to an average of eight bags per citizen per day. The Ocean Conservancy highlights Thailand as the sixth-largest contributor to global marine waste.

The conclusion is that despite notable progress in plastic regulation across various APAC nations, the region still needs to overcome significant plastic consumption and waste management challenges. Stringent enforcement and innovative solutions are imperative to address this, especially given the region's rapid urbanization.

China is Making Strides in Waste Management

In 2023, China's initiative, spearheaded by over 6,000 individuals and 200+ enterprises from Zhejiang, clinched the UN's top environmental accolade for its strides in tackling marine plastic waste. The program offers a transparent view of marine plastics' recycling journey, aiding local fishermen and notably curbing pollution in coastal waters. Since its inception, the project has engaged over 61,600 participants and collected approximately 10,936 tons of marine debris, 2,254 tons of which were plastic waste.

China's commitment to waste management is evident through substantial investments in infrastructure and technology. The nation is pioneering initiatives like waste-to-energy plants and cutting-edge recycling centers to slash landfill contributions. Zhejiang Province in eastern China unveiled the "Zhejiang Food Delivery Plastic Zero Waste Program," targeting reducing and recycling plastics used in food delivery. The initiative was aimed at establishing a "zero waste" model for food delivery plastics in key sectors, notably universities, by the end of 2023. By 2025, this model will be rolled out across schools, commercial spaces, and communities.

Zhejiang's strategy involves a collaborative effort, uniting stakeholders like food delivery platforms, merchants, universities, disposal firms, and recycling associations to form a unified front against plastic waste in food delivery. Zhejiang also plans to install waste collection facilities in areas with heightened plastic waste, tasking food delivery platforms with setting up these facilities in locations like university dorms and cafeterias, with the universities handling their maintenance.

Overall, China's commitment to tackling waste, which is evident in Zhejiang's "Plastic Zero Waste Program," showcases the nation's innovative and collaborative efforts to combat plastic pollution. These initiatives are pioneering and establishing a blueprint for the broader APAC region.

Asia-Pacific Plastic Waste Management Industry Overview

In Asia-Pacific, the plastic waste management market is highly fragmented, featuring a mix of local and global players. This diversity stems from the unique waste management requirements and regulatory frameworks that vary from country to country. Some of the key players in this sector are Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, and Recity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Plastic Consumption

- 4.2.2 Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 4.3 Market Restraints

- 4.3.1 High Cost Associated with Establishing and Maintaining Facilities

- 4.4 Market Opportunities

- 4.4.1 Innovations in Recycling Technologies

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights into Technological Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Polymer

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene (PE)

- 5.1.3 Polyvinyl Chloride (PVC)

- 5.1.4 Terephthalate (PET)

- 5.1.5 Other Polymers

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Other Sources (Construction, Healthcare, etc.)

- 5.3 By Treatment

- 5.3.1 Recycling

- 5.3.2 Chemical Treatment

- 5.3.3 Landfill

- 5.3.4 Other Treatments

- 5.4 By Country

- 5.4.1 India

- 5.4.2 China

- 5.4.3 Japan

- 5.4.4 Australia

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.2 Polimaster

- 6.2.3 Banyan Nation

- 6.2.4 Lucro

- 6.2.5 Recity

- 6.2.6 SUEZ

- 6.2.7 Waste Management Inc.

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.9 Plastic Bank

- 6.2.10 Agilyx

- 6.2.11 GreenTech Environmental Co. Ltd