|

市场调查报告书

商品编码

1636209

北美都市固态废弃物管理 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America Municipal Solid Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

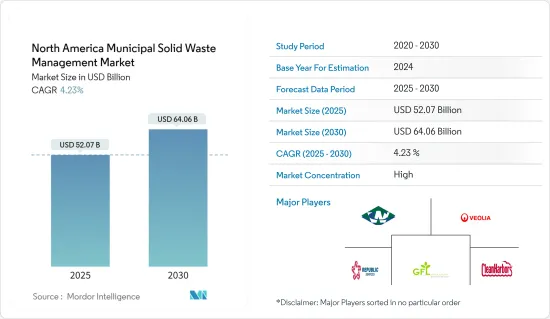

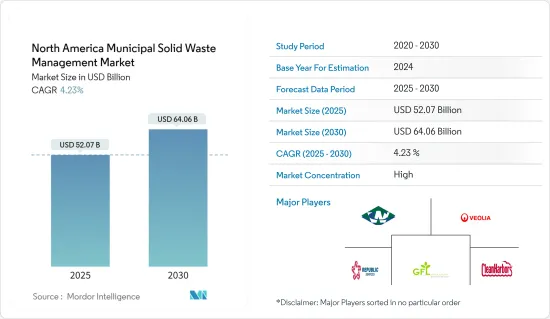

北美都市固态废弃物管理市场规模预计到 2025 年为 520.7 亿美元,预测期内(2025-2030 年)复合年增长率为 4.23%,到 2030 年预计将达到 640.6 亿美元。

北美城市固态废弃物(MSW)管理市场在环境服务业中至关重要。该市场包括住宅、商业和工业设施中固态废弃物的收集、运输、处理、回收和处置。北美,特别是美国和加拿大,对城市固体废弃物管理市场做出了巨大贡献。考虑到废弃物产生量的增加和先进废弃物管理技术的采用,预计未来几年市场将稳定成长。

美国的都市固态废弃物(MSW)管理总体令人满意。民间组织主要负责城市生活垃圾的运输和处置,资金充足。美国每年排放约 2.58 亿吨都市固体废弃物。其中约 53% 进入垃圾掩埋场,且这一数字保持稳定。目前,34.6% 的都市固体废弃物被回收利用,12.8% 被焚烧用于能源产出。

美国、州和地方各级严格的环境法规,例如《资源保护和回收法案》(RCRA),强调了适当废弃物管理的重要性。都市化和人口成长与废弃物产生量的增加直接相关,因此需要可扩展的废弃物管理解决方案。

公众意识和政府措施正在推动回收、减少废弃物和废弃物能源的推广。自动分类和基于物联网的废弃物收集等技术创新正在提高废弃物管理流程的效率。此外,随着经济的发展和收入水准的提高,消费量和随之而来的废弃物产生也在增加,进一步增加了对先进废弃物管理服务的需求。

北美城市废弃物管理市场趋势

食物废弃物的增加是都市固态废弃物成长的关键驱动因素

美国人每年产生数十亿磅的食物废弃物,对环境和经济产生巨大影响。美国平均每年丢掉超过 400 磅(181 公斤)的食物,占美国整个食物供应量的 30-40%。有几个因素导致了这个令人震惊的趋势,包括食品供应链中不可持续的做法、零售商和消费者设定的严格美学标准,以及往往无知的消费行为。

这种废弃物的影响是深远的,包括增加温室气体排放、浪费水资源和严重的经济倒退。然而,向食物银行和教会等组织捐赠剩余食物等措施正在打击食物浪费并解决该国的粮食不安全问题。家庭堆肥也正在成为一项重要策略,可以减少垃圾垃圾掩埋场的食物并减少温室气体排放。

美国的食物浪费规模令人震惊:美国每年浪费的食物高达 1,080 亿磅,而且这个数字还在稳定增加中。这种废弃物导致了不可持续的粮食生产和运输方式、对水果和蔬菜近乎完美的美学的痴迷以及无数的消费习惯。这种猖獗的食物浪费的后果是可怕的,导致二氧化碳和甲烷的大量排放、水资源的污染和枯竭以及重大的经济损失。但透过重新分配剩余食物和促进家庭堆肥,美国可以显着减少每年的食物浪费。

在美国,食物废弃物的地位不光彩,是垃圾掩埋场的主要废弃物,占所有城市固态废弃物的24.1%。美国人浪费了 46% 的蔬菜和水果、35% 的鱼贝类、21% 的肉类和 17% 的乳製品。在美国,每年有 30% 到 40% 的食品供应被浪费。

美国的食物浪费规模令人震惊,对环境和经济造成了重大影响。透过粮食再分配和家庭堆肥等措施解决此问题可以显着减轻其影响,促进永续性并减少粮食不安全。

不断增长的城市人口推动了美国城市固态废弃物管理市场的成长

美国城市固态废弃物管理市场受到可支配收入增加导致城市人口增加的推动,预计这一趋势将对市场成长产生重大影响。

在美国各地,大多数垃圾都被掩埋或焚烧。焚烧可减少 90% 的废物体积和 75% 的重量。然而,焚烧和掩埋都对环境构成重大威胁。因此,许多州的政策制定者越来越倡导永续废弃物管理,特别关注回收。在回收过程中,分离的废弃物被重新加工成各种有用的材料。

美国城市废弃物管理市场正在显着改善。旨在促进环保废弃物处理的严格法规正在加强市场。目前,各地区正在增加对AD回收和堆肥产业的投资。

COVID-19 大流行为美国的废弃物管理公司带来了挑战。需要提供援助来维持劳动力连续性和业务效率,特别是考虑到关闭期间废弃物处理的后勤复杂性。

限制塑胶使用的法规影响了纸张和纸板的消费,特别是包装和报纸、杯子和薄纸等非耐用产品。另一方面,牛奶盒、袋子、瓦楞纸箱等产品属于包装/容器,具有较高的可回收性,导致需求迅速增加,应用范围扩大。

根据美国环保署的数据,纸张和纸板的回收率约为 65%,是所有材料中最高的。此外,这些材料的焚烧对环境的影响最小,进一步增加了对废弃物处理的偏好。

美国西部、中南部、南大西洋、东北部和太平洋各州总合占美国城市废弃物管理市场占有率的 65% 以上。由于对先进废弃物处理技术的日益关注,该市场有望显着成长。

城市化、可支配收入的增加和环保法规正在推动美国着名的城市废弃物管理市场的成长。在强调永续废弃物管理实践的支持下,市场对回收和堆肥的投资不断增加,这将加速市场的成长轨迹。

北美都市固态废弃物管理产业概况

北美城市固态废弃物管理市场表现出高度集中,少数参与企业俱有重大影响力。该市场的主要企业包括 Waste Connection、Veolia、GFL Environmental、Republic Services 和 Clean Harbors。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究成果

- 研究场所

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 人们对环境问题的认识不断增强

- 快速的市政化和人口成长

- 市场限制因素

- 初始投资和营运成本高

- 市场机会

- 采用先进的废弃物管理技术

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- PESTLE分析

- 对市场创新的见解

第五章市场区隔

- 依废弃物类型

- 纸/纸板

- 电子废弃物

- 塑胶废弃物

- 金属废弃物

- 玻璃碎片

- 其他废弃物

- 按来源

- 住宅废弃物

- 商业的

- 建筑废弃物

- 其他的

- 依废弃方法分类

- 掩埋

- 焚化

- 回收

- 其他处置方法

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Waste Management

- Republic Services

- Waste Connections

- Casella Waste Systems

- Advanced Disposal Services

- Clean Harbors

- GFL Environmental

- Veolia

- Covanta Holding Corporation

- Stericycle

- Rumpke Waste & Recycling

- EDCO Disposal Corporation

第7章 未来趋势

The North America Municipal Solid Waste Management Market size is estimated at USD 52.07 billion in 2025, and is expected to reach USD 64.06 billion by 2030, at a CAGR of 4.23% during the forecast period (2025-2030).

The North American municipal solid waste (MSW) management market is pivotal in the environmental services industry. It encompasses the collection, transportation, processing, recycling, and disposal of solid waste from residential, commercial, and industrial sources. North America, particularly the United States and Canada, significantly contributes to the MSW management market. Given the rising waste generation and the adoption of advanced waste management practices, the market is poised for steady growth in the coming years.

Managing municipal solid waste (MSW) in the United States is generally satisfactory. Private entities predominantly handle the transportation and disposal of MSW, ensuring adequate funding. Annually, Americans produce around 258 million tons of MSW. Of this, roughly 53% finds its way to landfills, a figure that has stabilized. Presently, 34.6% of MSW is recycled, while 12.8% is incinerated for energy generation.

Stringent environmental regulations at the federal, state, and local levels, such as the US Resource Conservation and Recovery Act (RCRA), underscore the importance of proper waste management. Urbanization and population growth are directly linked to increased waste generation, necessitating scalable waste management solutions.

Public awareness and government initiatives drive the push for recycling, waste reduction, and waste-to-energy practices. Technological innovations, like automated sorting and IoT-based waste collection, are enhancing the efficiency of waste management processes. Also, as economic development and income levels rise, so does consumption and subsequent waste generation, further bolstering the demand for advanced waste management services.

North America Municipal Solid Waste Management Market Trends

The Primary Driver of Growth in Municipal Solid Waste is the Increasing Generation of Food Waste

Every year, Americans generate billions of pounds of food waste, significantly impacting the environment and the economy. On average, an American discards over 400 lbs (181 kg) of food annually, equating to a staggering 30%-40% of the entire US food supply. Several factors contribute to this alarming trend, including unsustainable practices in the food supply chain, stringent aesthetic standards set by retailers and consumers, and often uninformed consumer behavior.

The repercussions of this waste are far-reaching, encompassing heightened greenhouse gas emissions, squandered water resources, and substantial economic setbacks. However, initiatives like redirecting surplus food to entities such as food banks and churches combat food waste and address food insecurity in the nation. Also, household composting emerges as a pivotal strategy, diverting food from landfills and curbing greenhouse gas emissions.

The US food waste scale is staggering, with Americans squandering a colossal 108 billion lbs (49 billion kg) annually, steadily climbing. This waste contributes to unsustainable food production and transportation practices, the insistence on near-perfect aesthetics for fruits and vegetables, and a myriad of consumer habits. The consequences of this rampant food waste are dire, leading to significant carbon dioxide and methane emissions, contamination and depletion of water resources, and substantial economic losses. However, the nation can significantly reduce its annual food waste output by redistributing excess food and encouraging household composting.

Food waste in the United States holds the dubious distinction of being the primary material in landfills, constituting a substantial 24.1% of all municipal solid waste. Americans discard 46% of fruits and vegetables, 35% of seafood, 21% of meat, and 17% of dairy products. The United States discards 30% to 40% of its food supply annually.

The scale of food waste in the United States is alarming, with significant environmental and economic repercussions. Addressing this issue through initiatives like food redistribution and household composting can substantially mitigate its impact, promoting sustainability and reducing food insecurity.

An Expanding Urban Population is Driving Growth in the US Municipal Solid Waste Management Market

The US municipal solid waste management market is driven by a growing urban population with rising disposable incomes, a trend poised to impact market growth significantly.

Across the United States, most trash is either landfilled or incinerated. Incineration reduces waste volume and weight by 90% and 75%, respectively. However, both incineration and landfilling pose notable environmental threats. Consequently, policymakers in many states increasingly advocate for sustainable waste management, strongly focusing on recycling. In the recycling process, segregated waste is reprocessed into various useful materials.

The US municipal waste management market has seen marked improvements. Stringent regulatory mandates aimed at promoting eco-friendly waste disposal have bolstered the market. Regions are now ramping up investments in recycling and composting AD industries.

The COVID-19 pandemic raised challenges for waste management companies in the United States. They needed help maintaining workforce continuity and operational efficiency, especially given the logistical complexities of waste disposal during lockdowns.

Regulations that discourage plastic use have impacted the consumption of paper and paperboard, especially in packaging and non-durable goods like newspapers, cups, and tissue paper. On the other hand, products like milk cartons, bags, and corrugated boxes fall under packaging and containers and are highly recyclable, leading to a surge in demand and application scope.

According to the US Environmental Protection Agency, the recycling rate for paper and paperboard stood at nearly 65%, the highest among all materials. Moreover, incinerating these materials has minimal environmental impact, further fueling their preference for waste management.

The West, South Central, South Atlantic, Northeast, and Pacific States collectively hold over 65% of the US municipal waste management market share. This market is poised for substantial growth, driven by a heightened focus on advanced waste treatment technologies.

Urbanization, rising disposable incomes, and eco-friendly regulations fuel notable US municipal solid waste management market growth. The market is witnessing heightened investments in recycling and composting, underpinned by a robust emphasis on sustainable waste management practices, all set to amplify its growth trajectory.

North America Municipal Solid Waste Management Industry Overview

In North America, the municipal solid waste management market exhibits a notable concentration, with a handful of critical players holding significant sway. Some key players in this market are Waste Connection, Veolia, GFL Environmental, Republic Services, and Clean Harbors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened Public Awareness of Environmental Concerns

- 4.2.2 Rapid Urbanization and Growing Population

- 4.3 Market Restraints

- 4.3.1 High Initial Investment and Operational Costs

- 4.4 Market Opportunities

- 4.4.1 Adoption of Advanced Waste Management Technologies

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Porter's Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 PESTLE Analysis

- 4.8 Insights on technology Innovation in the Market

5 MARKET SEGMENTATION

- 5.1 By Waste Type

- 5.1.1 Paper and Cardboard

- 5.1.2 E-waste

- 5.1.3 Plastic Waste

- 5.1.4 Metal Waste

- 5.1.5 Glass Waste

- 5.1.6 Other Waste Types

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Construction

- 5.2.4 Other Sources

- 5.3 By Disposal Methods

- 5.3.1 Landfill

- 5.3.2 Incineration

- 5.3.3 Recycling

- 5.3.4 Other Disposal Methods

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concetration Overview

- 6.2 Company Profiles

- 6.2.1 Waste Management

- 6.2.2 Republic Services

- 6.2.3 Waste Connections

- 6.2.4 Casella Waste Systems

- 6.2.5 Advanced Disposal Services

- 6.2.6 Clean Harbors

- 6.2.7 GFL Environmental

- 6.2.8 Veolia

- 6.2.9 Covanta Holding Corporation

- 6.2.10 Stericycle

- 6.2.11 Rumpke Waste & Recycling

- 6.2.12 EDCO Disposal Corporation