|

市场调查报告书

商品编码

1636213

建筑废弃物管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Construction Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

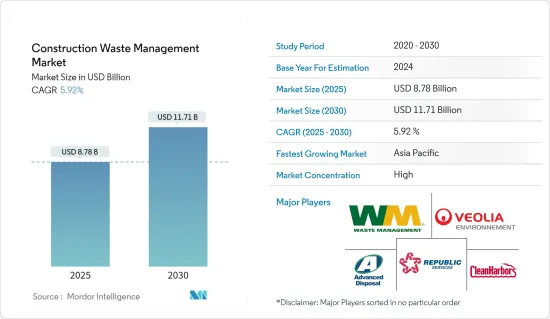

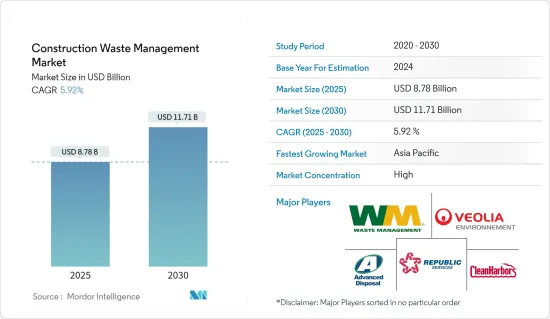

建筑废弃物管理市场规模预计到 2025 年为 87.8 亿美元,预计到 2030 年将达到 117.1 亿美元,预测期内(2025-2030 年)复合年增长率为 5.92%。

主要亮点

- 快速都市化和对永续性的日益重视是建筑废弃物管理市场的主要驱动因素。目前,儘管具有固有价值,但超过 75% 的建筑材料废弃物仍未回收。 2018 年,美国环保署 (EPA) 强调,家庭和企业产生的建筑废弃物是一般废弃物的两倍。美国在家庭废弃物排放方面处于世界领先地位。

- 建筑和拆除 (C&D)废弃物类别涵盖混凝土、沥青、木材、砖块、黏土瓦、石膏干墙、沥青瓦和金属等材料。虽然混凝土和金属很容易回收,但其他材料,特别是砖块、粘土砖和石膏干墙,很难重复利用,并且通常最终被扔进垃圾掩埋场。

- 随着印度快速都市化进程,建筑业越来越被认为是空气污染的主要来源和资源的消耗大户。特别是印度的资源开采率为每英亩1580吨,远高于世界平均450吨。

- 《国家清洁空气计画》为印度131个无污染城市设定了严格目标,即在2026年将颗粒物污染减少40%。因此,有效管理建筑和拆除 (C&D)废弃物对于控制污染程度至关重要。

- 然而,最近的 CSE 审查凸显了一个令人担忧的趋势:许多城市没有能力系统、科学地管理拆除废弃物。此外,2016年《拆建废弃物管理条例》的通过进展缓慢,且执行过程中存在明显差距。这凸显了迫切需要全面的指导,以增强对制度设计和有效实施策略的理解。

- 儘管存在障碍,建筑业在永续性方面取得了进展,成功地再利用了 75% 以上的废弃物。回收活动占废弃物管理业务的 85% 以上,其重要性显而易见,特别是考虑到美国仅回收其总废弃物排放的三分之一。

- 随着监管机构和建设公司加强控制废弃物的力度,建筑废弃物管理市场可望扩大。精实建设和价值工程等方法从计划一开始就致力于减少废弃物,而后期规划服务则提供有效的废弃物清除和处置解决方案。

建筑废弃物管理市场趋势

住宅建筑废弃物占较大市场份额

住宅建筑废弃物是世界建筑废弃物问题的主要原因,凸显了有效废弃物管理的迫切性。预测表明,到 2025 年,全球建筑废弃物将增加到每年 22 亿吨,主要来自住宅计划和重建。

在美国,建筑和拆除 (C&D)废弃物(包括住宅废弃物)占该国废弃物排放的 25%。该统计数据不仅突显了住宅排放的废弃物量,还显示了商业和公共设施产生的废弃物量。

住宅建筑废弃物中常见的材料包括木材、干墙、混凝土和包装材料。令人担忧的是,运送到建筑工地的材料中有大约 30% 变成了废弃物,凸显了该行业的材料效率低下。

建筑废弃物无法管理,影响严重,导致环境污染和资源枯竭。生态系统破坏和随之而来的污染可能会产生深远的后果,影响野生动物和公众健康。

结合回收和再利用材料等永续做法是遏制住宅建筑废弃物快速增加的可行解决方案。精益建筑和健全的废弃物管理计划等策略是显着减少住宅建筑废弃物排放的有希望的方法。

亚太地区占主要市场份额

亚洲的建筑废弃物管理因国家而异。日本、香港和新加坡等国家因其强调回收和妥善处置的先进系统而脱颖而出。韩国的回收率高达97%以上,令人惊嘆,台湾也取得了长足的进步,回收率也超过了50%。相较之下,许多开发中国家的回收率较低,往往依赖露天倾销,这充满了挑战。

亚洲建筑废弃物管理的监管环境多种多样,但它们的通用是都注重地方政府的责任。值得注意的是,印度等国家正在颁布法规以加强对废弃物管理的监督。这些法规是综合立法的一部分,旨在提高建筑废弃物的合规性和效率。

儘管取得了进展,亚洲在建筑废弃物管理方面仍面临持续的挑战。问题包括缺乏资金和标准化做法、非法倾倒和废弃物处理基础设施不足。此外,非正规废弃物产业和复杂的政府责任(尤其是在开发中国家)进一步阻碍了有效的废弃物管理。

亚洲的建筑废弃物管理市场预计未来将会成长。这种成长轨迹是由都市化进程的加速和对永续性的日益关注所推动的。回收技术的预期创新加上更严格的法规预计将显着提高回收率。此外,建设公司和废弃物管理营业单位之间加强合作预计将加强对废弃物管理标准的遵守并促进循环经济。

建筑废弃物行业概况

建筑废弃物管理市场较为分散。几家主要企业正在竞相为建筑计划提供高效且永续的废弃物管理解决方案。该领域的着名公司包括废弃物管理公司、威立雅环境公司、Clean Harbors公司、Republic Services公司和Advanced Disposal Services公司。这些公司提供广泛的服务,包括废弃物收集、回收、垃圾掩埋场管理和环境咨询,帮助建设公司有效管理废弃物,同时遵守监管要求和环境标准。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

- 分析方法

- 调查阶段

第三章执行摘要

第四章市场动态与洞察

- 目前的市场状况

- 市场动态

- 促进因素

- 都市化和人口成长推动市场

- 经济成长带动市场

- 抑制因素

- 影响市场的法律规范

- 回收过程相关的高成本影响市场

- 机会

- 市场驱动的技术进步

- 促进因素

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 废弃物回收服务市场的技术开发

- COVID-19 对市场的影响

第五章市场区隔

- 依废弃物类型

- 有害

- 无危险

- 按来源

- 住宅

- 非住宅

- 按材质

- 混凝土/砖

- 木头

- 金属

- 塑胶

- 玻璃

- 其他材料(土壤、干墙、灰泥涂料等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Waste Management

- Veolia Environment

- Clean Harbors

- Republic Services

- Advanced Disposal Services

- Biffa

- Covanta Holding

- Daiseki

- Hitachi Zosen

- 其他公司

第七章 市场的未来

第8章附录

- 总体经济指标

- 资本流动洞察(建筑业投资)

- 对外贸易统计

The Construction Waste Management Market size is estimated at USD 8.78 billion in 2025, and is expected to reach USD 11.71 billion by 2030, at a CAGR of 5.92% during the forecast period (2025-2030).

Key Highlights

- Rapid urbanization and a growing emphasis on sustainability are the primary drivers of the construction waste management market. Currently, over 75% of construction material waste remains unrecycled despite its inherent value. In 2018, the Environmental Protection Agency (EPA) highlighted that construction waste doubled that of municipal waste from both households and businesses. The United States leads globally in household waste generation.

- The construction and demolition (C&D) waste category spans materials like concrete, asphalt, wood, brick, clay tiles, gypsum drywall, asphalt shingles, and metal. While concrete and metal are readily recyclable, others, especially brick, clay tiles, and gypsum drywall, face reusability challenges, often ending up in landfills.

- In India, amid rapid urbanization, the construction sector is increasingly recognized as a key source of air pollution and a substantial consumer of resources. Notably, India's resource extraction rate, at 1,580 tonnes per acre, far exceeds the global average of 450 tonnes per acre.

- The National Clean Air Programme has set a stringent target for the 131 non-attainment cities in India: a 40% reduction in particulate pollution by 2026. Consequently, effective management of construction and demolition (C&D) waste has become paramount in curbing pollution levels.

- However, a recent CSE review highlights a concerning trend: many cities lack the institutional readiness for systematic and scientific C&D waste management. Moreover, the adoption of the C&D Waste Management Rules of 2016 has been sluggish, with noticeable gaps in their execution. This underscores the urgent need for comprehensive guidance to enhance both the understanding of the system's design and the strategies for its effective implementation.

- Despite hurdles, the construction sector has shown progress in sustainability, managing to repurpose more than 75% of its waste. Notably, recycling activities account for over 85% of waste management jobs, underscoring their significance, especially when considering that the United States recycles only a third of its total waste output.

- With regulatory bodies and construction companies intensifying their efforts to curb waste, the construction waste management market is set for expansion. Approaches like lean construction and value engineering are honing in on waste reduction from the project's inception, while post-planning services are offering efficient waste removal and disposal solutions.

Construction Waste Management Market Trends

Residential Construction Waste Holds a Significant Share of the Market

Residential construction waste is a significant contributor to the global construction debris challenge, emphasizing the urgency of effective waste management. Projections suggest that annual construction waste worldwide will escalate to 2.2 billion tons by 2025, largely driven by residential projects and renovations.

Within the United States, construction and demolition (C&D) debris, including residential waste, constitute a striking 25% of the nation's total waste output. This statistic not only underscores the substantial waste from residential endeavors but also highlights the significant contributions from commercial and institutional construction.

Common materials in residential construction waste encompass wood, drywall, concrete, and packaging materials. Alarmingly, around 30% of materials delivered to construction sites end up as waste, accentuating the sector's material inefficiency.

The ramifications of unmanaged construction waste are dire, leading to environmental pollution and resource depletion. Ecosystem disruptions and subsequent pollution can have far-reaching consequences, affecting both wildlife and public health.

Embracing sustainable practices, like material recycling and reusing, presents a viable solution to curbing the surge in residential construction waste. Strategies such as lean construction and robust waste management plans hold promise in significantly reducing waste output during residential endeavors.

Asia-Pacific Holds a Significant Share of the Market

Construction waste management practices in Asia exhibit significant disparities across nations. Countries like Japan, Hong Kong, and Singapore stand out for their advanced systems, emphasizing recycling and proper disposal. South Korea boasts an impressive recycling rate exceeding 97%, while Taiwan has also made strides, surpassing a 50% recycling rate. In contrast, many developing nations grapple with low recycling rates, often resorting to open dumping, a practice laden with challenges.

Asia's regulatory landscape for construction waste management is diverse, with a common thread: a focus on local authorities' responsibilities. Notably, countries like India are enacting regulations to bolster oversight of waste management practices. These regulations, part of comprehensive acts, aim to enhance compliance and efficiency in handling construction waste.

Despite progress, Asia faces persistent challenges in construction waste management. Issues range from funding shortages and a lack of standardized practices to illegal dumping and inadequate waste processing infrastructure. Moreover, informal waste industries and complex governmental responsibilities further hinder effective waste management, particularly in developing nations.

Looking forward, Asia's construction waste management market is set for growth. This trajectory is fueled by rising urbanization and an amplified focus on sustainability. Anticipated innovations in recycling technologies, coupled with stricter regulations, are poised to significantly boost recycling rates. Moreover, increased collaboration between construction firms and waste management entities is expected to bolster compliance with waste management standards and foster a circular economy.

Construction Waste Management Industry Overview

The construction waste management market is fragmented in nature. Several key players are competing to provide efficient and sustainable waste management solutions for construction projects. Some notable companies in this space include Waste Management, Veolia Environment, Clean Harbors, Republic Services, and Advanced Disposal Services. These companies offer a range of services such as waste collection, recycling, landfill management, and environmental consulting to help construction firms effectively manage their waste while adhering to regulatory requirements and environmental standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Urbanization and Population Growth Driving the Market

- 4.2.1.2 Economic Growth Driving the Market

- 4.2.2 Restraints

- 4.2.2.1 Regulatory Frameworks Affecting the Market

- 4.2.2.2 High Costs Associated with the Recycling Process Affecting the Market

- 4.2.3 Opportunities

- 4.2.3.1 Technological Advancements Driving the Market

- 4.2.1 Drivers

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Developments in the Waste Recycling Services Market

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Waste Type

- 5.1.1 Hazardous

- 5.1.2 Non-hazardous

- 5.2 By Source

- 5.2.1 Residential

- 5.2.2 Non-residential

- 5.3 By Material

- 5.3.1 Concrete & Bricks

- 5.3.2 Wood

- 5.3.3 Metal

- 5.3.4 Plastics

- 5.3.5 Glass

- 5.3.6 Other Materials (Soil, Drywall, Plaster, etc.)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Waste Management

- 6.2.2 Veolia Environment

- 6.2.3 Clean Harbors

- 6.2.4 Republic Services

- 6.2.5 Advanced Disposal Services

- 6.2.6 Biffa

- 6.2.7 Covanta Holding

- 6.2.8 Daiseki

- 6.2.9 Hitachi Zosen

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators

- 8.2 Insights into Capital Flows (Investments in Construction Sector)

- 8.3 External Trade Statistics