|

市场调查报告书

商品编码

1636231

惠而浦涡轮机 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Whirlpool Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

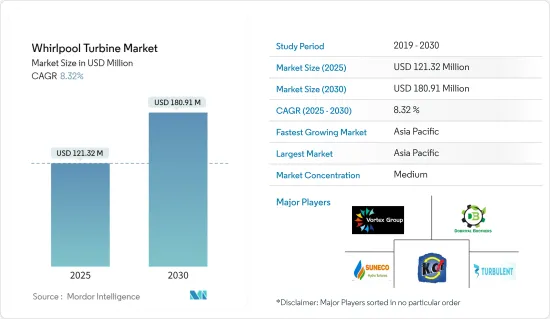

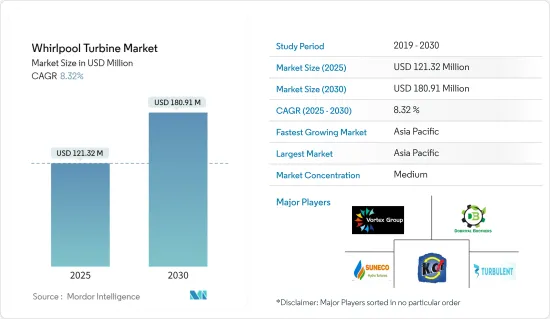

惠而浦涡轮机市场规模预计到2025年为1.2132亿美元,预计到2030年将达到1.8091亿美元,预测期内(2025-2030年)复合年增长率为8.32%。

主要亮点

- 从长远来看,对清洁能源计划的需求不断增长,以及资本密集度较低的新可再生能源技术的成长和采用,预计将在预测期内推动惠而浦涡轮机市场的发展。

- 另一方面,低流量条件、淤泥和碎片堆积等挑战将在预测期内抑制惠而浦涡轮机市场。

- 然而,河流、运河、湖泊和洋流的巨大能源潜力为涡流涡轮机製造商和相关基础设施建设公司提供了巨大的机会。

- 亚太地区因其巨大的河流潜力和新技术适应而在市场上占据主导地位。

惠而浦涡轮机市场趋势

离网住宅应用领域主导市场

- 鑑于风能和太阳能光伏生产和投资的间歇性,低水头水力发电在当今环境中变得越来越重要,儘管没有许多可行的技术,但大多数国家都大力推动采用清洁、排放碳能源来源。水力发电是一种有吸引力且有趣的能源供应解决方案。

- 随着人口的成长以及城市和小镇的扩张,对电力的需求也不断增加。根据能源研究所《2024年世界能源统计回顾》资料,2023年全球电力消耗量达到29,924.75兆瓦时,比2022年发电量29,188.08兆瓦时增加2.5%。因此,离网领域惠而浦水涡轮机市场成长潜力大。

- 当安装在偏远或山区时,小型涡流水轮机是利用以前未开发的地表径流水进行离网发电的绝佳选择。这些小型漩涡水轮机易于安装,且所需的资源和时间资本投入较低,使其成为未来偏远地区小型水力的理想来源,资本投入较低。

- 现在许多公司正在进入漩涡浴缸市场,利用水力发电厂为偏远地区带来清洁、廉价的电力,并帮助当地人学习如何维护和使用漩涡浴缸。设计团队创建了一个弯曲的结构,让水在动力来源连续旋转。

- 居民现在可以从河流和运河获得清洁能源,这在以前被认为是不可能的。微型涡流涡轮机可为拥有 50 至 500 户家庭的社区、城市和村庄供电,每年发电约 12 万至 56 万千瓦时。

- 这些涡轮系统具有不需要大型水库、能够在不改变河流流量的情况下连续发电等优点。尤其是非电气化住宅的小规模发电,对环境几乎没有影响。

- 2023年,专门从事涡流涡轮机开发和安装的比利时公司Turbulent Hydro宣布将在欧洲开发多个计划。这些计划包括葡萄牙亚速尔群岛60kW计划、葡萄牙Sobral Pichoro 5kW计划、英国丹佛7.5kW计划等离网住宅计划、私人住宅5.5kW涡流涡轮机计划爱沙尼亚奥泰佩等。

- 因此,从上述几点可以看出,离网领域在惠而浦水轮机市场中占据主导地位。

亚太地区正在经历显着成长

- 由于快速工业化、都市化进程加快导致的电力消耗增加以及政府专注于提高再生能源在能源中的份额,预计亚太地区将主导市场。

- 过去几十年来,亚太国家的电力份额很大一部分来自水力发电。根据国际可再生能源机构2024年的资料,印度水力发电装置容量从2022年的52,005兆瓦增加到2023年的52,117兆瓦。同时,印尼的电力消耗从2022年的6,689MW增加到2023年的6,784MW。这些统计数据清楚地表明,惠而浦涡轮机市场的参与企业存在巨大的机会。

- 亚太国家河流数量最多,海岸景观丰富,对河川水梯度要求较高。因此,由于这样的地理优势,亚太地区的惠而浦透平市场潜力巨大。

- 中国有河流总长度22万公里。有河流1500多条,流域面积1000多平方公里。印度十大主要河流的高度均超过35,000公里。除了主要河流外,亚洲和东南亚国家还有许多小河流和溪流,与传统水力发电大坝相比,漩涡涡轮机市场可再生无限的可再生能源。

- 像印尼、台湾和菲律宾这样的小岛屿国家也对新兴的涡流水轮机涡流技术感兴趣,因为它们的河流水生系统活跃、常年活跃,这可以帮助他们避免大型水力发电大坝计划的影响。

- 2023年,Turbulent Hydro宣布了一个正在进行的计划,为菲律宾棉兰老岛的小型水力漩涡水坝和140kW农村电气化计划提供漩涡涡轮机和相关技术。

- 2022年底,我们利用13千瓦涡流涡轮机及相关技术完成了电网互联计划,为印尼峇里岛阿勇河附近的一所绿色学校提供电力。

- 因此,随着村庄、小镇以及运河和河流附近的城镇越来越多地安装漩涡涡轮机,预计该地区在预测期内将出现显着增长。

惠而浦涡轮机产业概述

涡流涡轮机市场正在变得半固体。市场上的主要参与企业包括(排名不分先后)Suneco Hydro、Turbulent Hydro、Dobriyal Brothers、Kourispower Pty. Ltd.、Vortex Hydro Energy LLC、Vortex Hydrokinetics LLC、Vortex Hydropower Systems Design and Manufacturing NZ 和 Aex Hydrokinetics LLC、Vortex Hydropower Systems Design and Manufacturing NZ 和 AES Hydro。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义和

- 研究场所

第二章调查方法

第三章 调查概述

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 清洁能源计划需求不断成长

- 采用新的再生能源来源,财务困难较少

- 抑制因素

- 技术挑战

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 按容量

- 15kW以下

- 15~50kW

- 50kW以上

- 按用途

- 离网住宅

- 併网工业

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 南非

- 埃及

- 奈及利亚

- 其他中东/非洲

- 亚太地区

- 中国

- 印度

- 日本

- 越南

- 泰国

- 印尼

- 马来西亚

- 其他亚太地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 俄罗斯

- 土耳其

- 欧洲其他地区

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- 市场参与企业

- Vortex Group

- Suneco Hydro

- Turbulent Hydro

- Dobriyal Brothers

- Kourispower Pty. Ltd

- Vortex Hydro Energy LLC

- AES Hydro

- 市场参与企业

- 市场排名分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 水上球场的巨大潜力

The Whirlpool Turbine Market size is estimated at USD 121.32 million in 2025, and is expected to reach USD 180.91 million by 2030, at a CAGR of 8.32% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the rising demand for clean energy projects and the growth and adoption of new and less finance-intensive renewable energy technology are expected to drive the whirlpool turbine market during the forecast period.

- On the other hand, challenges like low flow conditions, silt, and debris accumulation will restrain the whirlpool turbine market during the forecast period.

- However, the immense energy potential of water flow in rivers, canals, lakes, and oceans provides a huge opportunity for whirlpool turbine manufacturing companies and associated infrastructure construction companies.

- Asia-Pacific will dominate the market due to huge river potential and emerging technology adaptations.

Whirlpool Turbine Market Trends

The Off-grid Residential Application Segment to Dominate the Market

- In today's environment, where a majority of countries are vigorously pushing for the adoption of clean, carbon-free emitting energy sources, considering the intermittency of wind and solar production and investments, hydropower is an attractive and intriguing solution to supply energy, despite their not many types of viable technologies for low-head hydropower.

- With the rising population and expansion of cities and small towns, the demand for electricity has also risen. According to Energy Institute Statistical Review of World Energy 2024 data, the global electricity consumption in 2023 reached 29,924.75 terawatt-hours, rising by 2.5% from 29,188.08 terawatt-hours of electricity generation in 2022, thus citing a huge potential for the growth of the whirlpool turbine market in the off-grid segment.

- When installed in remote or mountainous areas, small-scale whirlpool vortex turbines offer an excellent option for off-grid electricity generation by harnessing surface run-off water, previously untapped. These small-scale vortex turbines are easy to install and require less capital investment of resources and time, thus providing a perfect future small-scale hydroelectric power source in remote areas with less capital inputs.

- Many companies are now working in the whirlpool turbine market, bringing clean and affordable electricity to remote locations using hydropower plants and helping the locals learn how to maintain and use the whirlpool turbines. The design team utilizes natural streams to power their project, creating a curving construction that allows the water to spin continuously.

- The residents can now harness clean energy from rivers and canals, previously thought impossible. The micro-vortex whirlpool turbines can power communities, cities, and villages with 50 to 500 households, generating around 120,000 to 560,000 kWh per year turbine, thus providing an excellent option for off-grid electricity generation.

- These turbine systems offer several benefits, including continuous electricity generation without the need for large water-holding reservoirs or altering the course of the river. They have minimal to no environmental impact, especially when generating electricity for off-grid residential small-scale segments.

- In 2023, Turbulent Hydro, a Belgian company specializing in the development and installation of whirlpool turbines, announced the development of several projects in Europe. These projects include a 60 kW project in Azores, Portugal, a 5 kW project in Sobral Pichorro, Portugal, off-grid residential projects such as a 7.5 kW project in Denver, United Kingdom, and a 5.5 kW vortex turbine project for a private house in Otepaa, Estonia.

- Thus, the aforementioned points show that the off-grid segment will dominate the whirlpool turbine market.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific is expected to dominate the market due to rapid industrialization, increasing electricity consumption due to growing urbanization, and the focus of the respective governments on increasing the share of renewables in their energy share.

- In previous decades, the majority of the electricity share in Asia-Pacific countries has been driven by hydro energy. According to International Renewable Energy Agency 2024 data, India's hydro energy installed capacity rose from 52,005 MW in 2022 to 52,117 MW in 2023. Meanwhile, in Indonesia, the capacity grew from 6,689 MW in 2022 to 6.784 MW in 2023. These statistics clearly show a huge opportunity for the whirlpool turbine market players.

- The Asian-Pacific countries have the maximum number of rivers, substantial coastal landscapes, and a much-required river water gradient. Thus, with such geographical advantages, Asia-Pacific boasts a huge potential in the whirlpool turbine market.

- China abounds in rivers totaling 220,000 km in length. There are over 1,500 rivers, each with an over 1,000 square km drainage area. The top 10 major rivers in India occupy a height of over 35,000 km. Apart from the major rivers, both Asian and Southeast Asian countries contain numerous small rivers and rivulet systems, which can provide an infinitely renewable energy potential to the whirlpool turbine market with zero emissions and a minimum amount of investment compared to traditional hydroelectric dams.

- Even smaller countries in the island nations like Indonesia, Taiwan, and the Philippines have also shown interest in the emerging whirlpool turbine vortex technology due to their active and perennial river water systems, thus helping them to avoid the repercussions of large-scale hydroelectric dam projects.

- In 2023, Turbulent Hydro announced ongoing projects that provided whirlpool turbines and associated technologies to small-scale hydro vortex dams and the 140 kW Rural Electrification project in Mindanao, Philippines.

- In late 2022, Turbulent Hydro completed a 13 KW grid-connected whirlpool turbines and associated technologies project for providing electricity to Green School, located next to the Ayung River in Bali, Indonesia.

- Thus, with the rising installations of whirlpool turbines in villages, small towns, and towns near canals and rivers, the region is expected to grow significantly during the forecast period.

Whirlpool Turbine Industry Overview

The whirlpool turbine market is semi-consolidated. Some of the major players in the market (in no particular order) include Suneco Hydro, Turbulent Hydro, Dobriyal Brothers, Kourispower Pty. Ltd, Vortex Hydro Energy LLC, Vortex Hydrokinetics LLC, Vortex Hydropower Systems Design and Manufacturing NZ, and AES Hydro.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition and

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising demand to for clean energy projects

- 4.5.1.2 Adoption of new and less finance intesive renewable energy sources

- 4.5.2 Restraints

- 4.5.2.1 Technological challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Capacity

- 5.1.1 Less than 15 kW

- 5.1.2 15 kW to 50 kW

- 5.1.3 Above 50 kW

- 5.2 By Application

- 5.2.1 Off-grid Residential

- 5.2.2 On-grid Industrial

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Colombia

- 5.3.2.4 Rest of South America

- 5.3.3 Middle East and Africa

- 5.3.3.1 Saudi Arabia

- 5.3.3.2 United Arab Emirates

- 5.3.3.3 Qatar

- 5.3.3.4 South Africa

- 5.3.3.5 Egypt

- 5.3.3.6 Nigeria

- 5.3.3.7 Rest of Middle East and Africa

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 India

- 5.3.4.3 Japan

- 5.3.4.4 Vietnam

- 5.3.4.5 Thailand

- 5.3.4.6 Indonesia

- 5.3.4.7 Malaysia

- 5.3.4.8 Rest of Asia-Pacific

- 5.3.5 Europe

- 5.3.5.1 Germany

- 5.3.5.2 France

- 5.3.5.3 United Kingdom

- 5.3.5.4 Spain

- 5.3.5.5 NORDIC

- 5.3.5.6 Russia

- 5.3.5.7 Turkey

- 5.3.5.8 Rest of Europe

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Market Players

- 6.3.1.1 Vortex Group

- 6.3.1.2 Suneco Hydro

- 6.3.1.3 Turbulent Hydro

- 6.3.1.4 Dobriyal Brothers

- 6.3.1.5 Kourispower Pty. Ltd

- 6.3.1.6 Vortex Hydro Energy LLC

- 6.3.1.7 AES Hydro

- 6.3.1 Market Players

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 High potential in the water course