|

市场调查报告书

商品编码

1636426

零废弃物杂货店:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Zero-Waste Grocery Stores - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

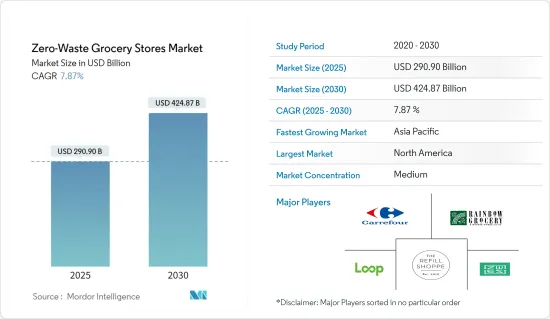

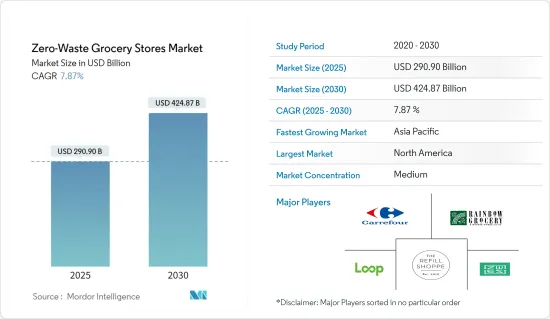

零废弃杂货店市场规模预计到 2025 年为 2,909 亿美元,到 2030 年预计将达到 4,248.7 亿美元,预测期内(2025-2030 年)复合年增长率为 7.87%。

零废弃物商店正在重塑零售格局,为顾客提供无塑胶和包装的购物体验。这些商店主要专注于填充用和散装食品,鼓励消费者自备食品、个人护理和清洁产品容器。全球此类商店的数量正在增加,许多商店现在正在透过线上平台寻求群众集资。除了不使用包装外,零废弃物商店通常具有整体和永续的理念,并以各种本地采购的有机产品为特色。这种独特的方法使我们有别于传统的零售店,并为我们开闢了一个利基市场。

站在永续购物机芯的最前沿,零废弃物杂货店不仅在概念上而且在实践中做出了声明。其影响不仅体现在减少废弃物的努力上,也体现在刺激主要杂货零售连锁店的反应。儘管超级市场仅占美国食品店的 10%,但每年的食品浪费却增加了数十亿美元。此外,光是食品包装就占所有垃圾掩埋废弃物的 23%。

零废弃物杂货店市场趋势

零废弃物杂货店将在超级市场和大卖场激增,推动成长

以提供多样化产品而闻名的超级市场和大卖场越来越多地将零废弃物杂货店纳入其分销管道。这些商店提供了一个独特的机会,透过提供保鲜膜、袋子和吸管等传统包装的替代品来对抗一次性塑胶。儘管如此,传统超级市场和大卖场仍然是受欢迎的购物目的地,尤其是生鲜食品。特别是,随着超级市场不再使用一次性塑胶包装,蔬菜销售量大幅成长。除了环境效益之外,零废弃物还可以透过减少人事费用、能源和处置成本,为企业节省大量成本。

线上零售通路预计在预测期内成长最快。这一势头归因于全球网路购物的增加,显示消费行为发生了明显的转变。

北美市场领先

随着环保意识的增强,塑胶废弃物的影响受到越来越多的关注。美国和加拿大的个人处于永续性运动的最前线。为了支持这项转变,该地区各国政府正在推出管理环境废弃物的倡议,为未来几年的市场大幅成长奠定基础。虽然商店显然正在积极减少废弃物,但大型零售超级市场也拥抱这一趋势。

光是超级市场就占美国每年排放的食物废弃物的 10%。此外,食品包装占垃圾掩埋废弃物的 23%。目标是透过由 Care Food、Kroger 和 Walmart 等领先公司主导的 10x20X30 计划,在未来 10 年内减少食物废弃物。到 2030 年,这些主要零售商的目标是与至少 20 家供应商合作,进一步减少废弃物。随着永续购物的推动势头增强,零废弃物商店可能会成为新常态。

零废弃杂货产业概述

零废弃物杂货店市场呈现出一种半独特的情况,目前只有少数几种选择。本报告深入研究了主要企业的竞争动态,包括: Rainbow Grocery、Loop、Zero Waste Eco Store、家乐福和 The Refill Shoppe。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 环保意识的提高推动市场

- 消费者对环保选择的需求推动市场成长

- 市场限制因素

- 高昂的初始设置成本阻碍了市场成长

- 维持商店卫生标准的物流问题

- 市场机会

- 与当地生产商和供应商的潜在伙伴关係

- 利用数位平台进行线上销售

- 价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察产业技术进步

- COVID-19 对市场的影响

第五章市场区隔

- 按分销管道

- 超级市场/大卖场

- 专卖店

- 网路商店

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Rainbow Grocery

- Loop

- Zero Waste Eco Store

- Carrefour

- The Refill Shoppe

- Just Gaia

- Zero Muda

- EcoRefill

- ecoTopia

- Lidl*

第七章 未来市场趋势

第 8 章 免责声明与出版商讯息

The Zero-Waste Grocery Stores Market size is estimated at USD 290.90 billion in 2025, and is expected to reach USD 424.87 billion by 2030, at a CAGR of 7.87% during the forecast period (2025-2030).

Zero waste stores are reshaping the retail landscape, offering customers a plastic and packaging-free shopping experience. These stores primarily focus on refill and bulk options, encouraging shoppers to bring their containers for food, personal care, and cleaning products. The global count of such stores has surpassed, with many new ones seeking crowdfunding on online platforms. Beyond being packaging-free, zero-waste stores often champion a holistic, sustainable ethos, showcasing a range of local and organic products. This distinctive approach sets them apart from traditional retailers, carving a niche for themselves.

Zero-waste grocery stores, at the forefront of the sustainable shopping movement, are making a statement not just in concept but also in practice. Their impact is evident, not only in their waste reduction efforts but also in catalyzing responses from major retail grocery chains. Despite accounting for just 10% of food outlets, US supermarkets add massive billions of dollars to the total yearly food waste. Furthermore, food packaging alone constitutes 23% of all landfill waste.

Zero-Waste Grocery Stores Market Trends

Zero-Waste Grocery Stores Proliferate in Supermarkets and Hypermarkets, Propelling Growth

Supermarkets and hypermarkets, known for their diverse product offerings, have seen a surge in the inclusion of zero-waste grocery stores within their distribution channels. These stores present a unique opportunity to combat single-use plastic by offering alternatives to traditional packaging, such as plastic wraps, bags, and straws. Despite this, traditional supermarkets and hypermarkets remain popular shopping destinations, especially for fresh produce. Notably, supermarkets that transitioned away from single-use plastic packaging witnessed a remarkable surge in vegetable sales. Beyond the environmental benefits, going zero-waste also translates to significant cost savings for businesses, cutting down on labor, energy, and disposal expenses.

The online retail channel is poised for the swiftest growth during the forecast period. This momentum is fueled by the global uptick in online shopping, indicating a clear shift in consumer behavior.

North America Leading the Market

As environmental consciousness rises, so does the scrutiny of the repercussions of plastic waste. Individuals in the United States and Canada are spearheading the movement toward sustainability. Bolstering this shift, governments in the region have rolled out initiatives to manage environmental waste, setting the stage for significant market growth in the coming years. While it's evident that stores are actively reducing waste in their operations, major retail supermarket chains are also embracing this trend.

Supermarkets alone contribute to 10% of food waste produced annually in the United States. Additionally, food packaging constitutes a significant 23% of landfill waste. Through the "10x20X30 Initiative," spearheaded by major players like Kea Food, Kroger, and Walmart, the goal is to slash food waste over the next decade. By 2030, these leading retailers aim to collaborate with at least 20 suppliers each, furthering their waste reduction efforts. As the push for sustainable shopping gains momentum, zero-waste stores are set to become the new norm.

Zero-Waste Grocery Stores Industry Overview

The zero-waste grocery store market exhibits a semi-consolidated landscape, with only a handful of options available presently. The report delves into the competitive dynamics, highlighting key players such as Rainbow Grocery, Loop, Zero Waste Eco Store, Carrefour, and The Refill Shoppe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Environmental Consciousness Driving the Market

- 4.2.2 Consumer Demand for Eco-friendly Options Fuels Growth of the Market

- 4.3 Market Restraints

- 4.3.1 Higher Initial Setup Costs Hinder Growth of the Market

- 4.3.2 Logistical Challenges in Maintaining Hygiene Standards in Stores

- 4.4 Market Opportunities

- 4.4.1 Potential Partnerships with Local Producers and Suppliers

- 4.4.2 Leveraging Digital Platforms for Online Sales

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Distribution Channel

- 5.1.1 Supermarkets/Hypermarkets

- 5.1.2 Speciality Stores

- 5.1.3 Online Stores

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Italy

- 5.2.2.6 Spain

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Rainbow Grocery

- 6.2.2 Loop

- 6.2.3 Zero Waste Eco Store

- 6.2.4 Carrefour

- 6.2.5 The Refill Shoppe

- 6.2.6 Just Gaia

- 6.2.7 Zero Muda

- 6.2.8 EcoRefill

- 6.2.9 ecoTopia

- 6.2.10 Lidl*