|

市场调查报告书

商品编码

1636429

再生塑胶:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Recycled Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

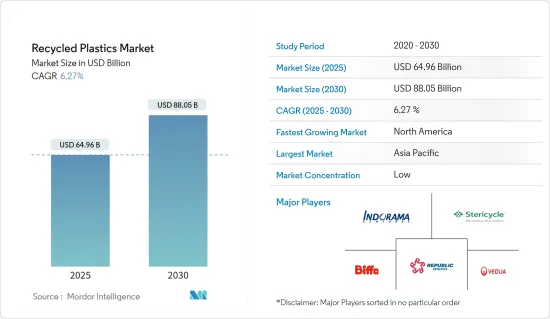

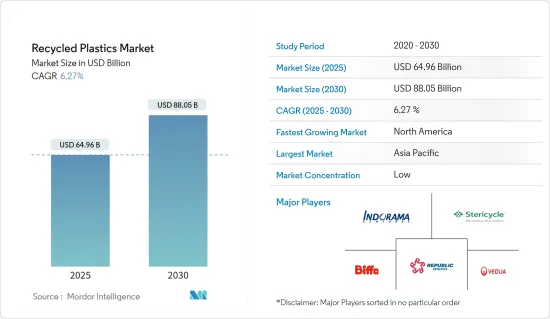

再生塑胶市场规模预计到2025年为649.6亿美元,预计2030年将达到880.5亿美元,预测期内(2025-2030年)复合年增长率为6.27%。

再生塑胶是指被重新利用为有价值的东西的废弃塑胶。该过程包括对塑胶进行分类、清洗、挤压、再加工和识别。随着非生物分解塑胶问题在全球日益严重,回收成为应对聚合物在环境中累积的重要解决方案。

回收技术的进步是推动再生塑胶市场的关键因素。化学回收和改进的分选方法等创新技术显着提高了再生塑胶的效率和品质。此外,随着消费者越来越重视永续性,从汽车到消费品的所有行业的製造商都在采用回收材料。这种变化在各种产品的生产中都很明显,包括汽车零件、包装和家庭用品。随着这些进步以及对永续解决方案不断增长的需求,市场预计在未来几年将实现显着成长。

再生塑胶市场趋势

包装行业越来越多地采用再生塑料

汽车、电气和电子以及包装行业的主要企业对再生塑胶越来越感兴趣,从而推动了对这些材料的需求。这些行业每年总合消耗近 600 万吨塑胶包装。食品和饮料行业处于食品安全包装要求的前沿,并正在推动可回收聚合物的使用。当用作包装屏障时,这些聚合物不仅可以确保食品安全,还可以透过提供传统塑胶的永续替代品来扩大其市场范围。

再生聚对苯二甲酸乙二醇酯 (PET) 成为製造水瓶和饮料瓶的首选。除了食品用途外,回收聚合物还用于玩具、时尚配件和体育用品的包装,使这些产品更加耐用。其惰性特性也增加了对洗髮精、肥皂和界面活性剂等个人保健产品包装的需求。随着再生塑胶在消费品包装中的应用不断增加,再生塑胶市场有望进一步成长。

亚太地区再生塑胶市场的成长

回顾期内,在都市化、工业化和经济成长的推动下,亚太地区在再生塑胶市场上处于领先地位。在汽车行业的成长及其在建筑业中不断扩大的作用的支持下,该地区工业部门的塑胶使用量显着增加。基础设施的大规模投资以及住宅和商业建筑的激增进一步支持了这一趋势。

此外,严格的政府法规、日益增长的环境问题以及全球对永续性的推动正在刺激采用再生塑胶的创新解决方案。例如,印度政府推出了《印度塑胶公约》,这是世界自然基金会印度分会与印度工业联合会之间的合作成果,并得到了英国研究与创新中心 (UKRI) 和 WRAP 的支持。该协议旨在实现雄心勃勃的目标,包括转向 100% 可重复使用或可回收塑胶包装,以及在预测期内有效回收 50% 的塑胶包装。

再生塑胶行业概况

再生塑胶市场分散,国内外参与者多。市场的主要企业正专注于成长策略,例如投资研发中心、扩大塑胶回收再利用业务以及发展基础设施以增加其影响力。主要参与者包括 Biffa、Stericycle、Republic Services、Veolia 和 Indorama Ventures。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态与洞察

- 市场概况

- 市场驱动因素

- 人们对永续塑胶废弃物管理的认识不断增强

- 掩埋法规的实施

- 市场限制因素

- 优先考虑原生塑料而不是再生塑料

- 塑胶废弃物分类和处置效率低下

- 市场机会

- 监理法规推动再生塑胶的采用

- 塑胶回收再利用技术的进步

- 价值链分析

- 产业吸引力波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 洞察产业技术进步

- COVID-19 对市场的影响

第五章市场区隔

- 按类型

- 聚乙烯

- 聚氯乙烯

- 聚对苯二甲酸乙二酯

- 聚丙烯

- 聚苯乙烯

- 其他的

- 排放来源

- 形式

- 电影

- 瓶子

- 纤维

- 其他的

- 按最终用户

- 建筑/施工

- 包装

- 电力/电子

- 车

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲

- 北美洲

第六章 竞争状况

- 市场集中度概况

- 公司简介

- Biffa

- Stericycle

- Republic Services

- Veolia

- Indorama Ventures

- Loop Industries

- Plastipak Holdings

- KW Plastics

- B&B Plastics

- Green Line Polymers*

第七章 市场趋势

第 8 章 免责声明与出版商讯息

The Recycled Plastics Market size is estimated at USD 64.96 billion in 2025, and is expected to reach USD 88.05 billion by 2030, at a CAGR of 6.27% during the forecast period (2025-2030).

Recycled plastics are the result of repurposing waste plastic into valuable items. The process involves sorting, cleaning, extruding, reprocessing, and identifying the plastic. With the prevalent global issue of non-biodegradable plastics, recycling stands out as a crucial solution to combat the environmental accumulation of polymers.

Technological advancements in recycling are pivotal in driving the recycled plastics market. Innovations like chemical recycling and improved sorting methods have significantly boosted the efficiency and quality of recycled plastics. Moreover, as consumers increasingly prioritize sustainability, manufacturers across industries, from automotive to consumer goods, are adopting recycled materials. This shift is evident in the production of various items, including car parts, packaging, and household goods. With these advancements and the growing demand for sustainable solutions, the market is poised for substantial growth in the coming years.

Recycled Plastics Market Trends

Increasing Adoption of Recycled Plastic in Packaging Industries

Key players in the automotive, electrical and electronics, and packaging sectors are increasingly turning to recycled plastics, driving the demand for these materials. These sectors collectively consume close to 6 million tons of plastic packaging each year. The food and beverage industry is at the forefront of the push for food-safe packaging, propelling the use of recyclable polymers. These polymers, when employed as packaging barriers, not only ensure food safety but also present a sustainable option to traditional plastics, thereby expanding their market reach.

Recycled polyethylene terephthalate (PET) stands out as the preferred choice for crafting water and beverage bottles. Beyond edibles, recycled polymers are finding applications in packaging for toys, fashion accessories, and sports equipment, enhancing the durability of these items. Their inert characteristics are also driving the demand for packaging personal care products like shampoos, soaps, and surfactants. With their increasing adoption in consumer goods packaging, the market for recycled polymers is poised for further growth.

Rise in Recycled Plastics Market in Asia Pacific

During the review period, Asia-Pacific led the recycled plastics market, propelled by urbanization, industrialization, and economic growth. The region's industrial sector saw a notable uptick in plastic usage, supported by a growing automotive sector and an expanding role in construction. Significant investments in infrastructure, coupled with a surge in residential and commercial constructions, further bolstered this trend.

Additionally, stringent government regulations, rising environmental concerns, and a global push for sustainability have spurred innovative solutions in recycled plastic adoption. For instance, the Indian government introduced the 'India Plastics Pact,' a collaboration between WWF India and the Confederation of Indian Industry, and it was supported by UK Research and Innovation (UKRI) and WRAP. This pact aims for ambitious targets, including transitioning to 100% reusable or recyclable plastic packaging and effectively recycling 50% of plastic packaging during the forecast period.

Recycled Plastics Industry Overview

The recycled plastics market is fragmented, with the presence of several local and global players. Major players in the market are focusing on their growth strategies, such as investing in R&D centers, expansion of plastic recycling operations, and infrastructure development to strengthen their presence. Some of the major players include Biffa, Stericycle, Republic Services, Veolia, and Indorama Ventures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Awareness Regarding Sustainable Plastic Waste Management

- 4.2.2 Implementation of Restrictions on Landfills

- 4.3 Market Restraints

- 4.3.1 Preference for Virgin Plastics Over Their Recycled Alternatives

- 4.3.2 Ineffective Plastic Waste Segregation and Disposal

- 4.4 Market Opportunities

- 4.4.1 Regulations Imposed by Authorities Promote the Adoption of Recycled Plastics

- 4.4.2 Advancements in Plastic Recycling Technologies

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights into Technological Advancements in the Industry

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Polyethylene

- 5.1.2 Polyvinyl Chloride

- 5.1.3 Polyethylene Terephthalate

- 5.1.4 Polypropylene

- 5.1.5 Polystyrene

- 5.1.6 Other Types

- 5.2 By Source

- 5.2.1 Foams

- 5.2.2 Films

- 5.2.3 Bottles

- 5.2.4 Fibers

- 5.2.5 Other Sources

- 5.3 By End User

- 5.3.1 Building and Construction

- 5.3.2 Packaging

- 5.3.3 Electrical and Electronics

- 5.3.4 Automotive

- 5.3.5 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Biffa

- 6.2.2 Stericycle

- 6.2.3 Republic Services

- 6.2.4 Veolia

- 6.2.5 Indorama Ventures

- 6.2.6 Loop Industries

- 6.2.7 Plastipak Holdings

- 6.2.8 KW Plastics

- 6.2.9 B&B Plastics

- 6.2.10 Green Line Polymers*