|

市场调查报告书

商品编码

1636443

印度电动车电池分离器:市场占有率分析、产业趋势与统计、成长预测(2025-2030)India Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

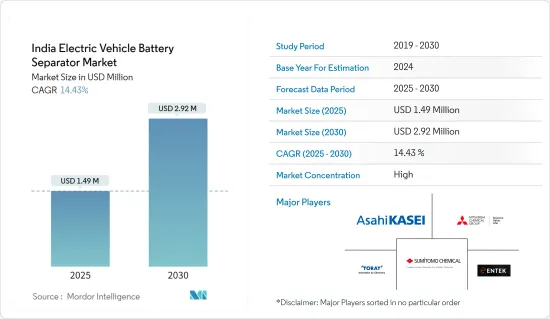

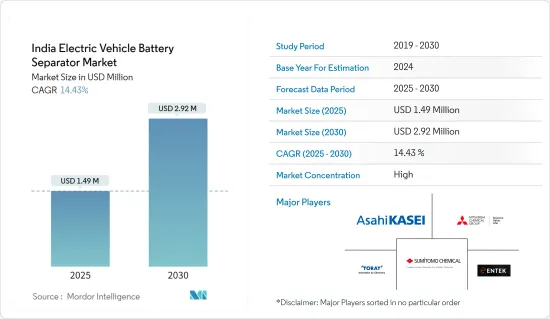

印度电动车电池隔膜市场规模预计到2025年为149万美元,预计2030年将达到292万美元,预测期内(2025-2030年)复合年增长率为14.43%。

主要亮点

- 从中期来看,电动车需求增加和政府支持措施等因素预计将在预测期内推动市场发展。

- 另一方面,国内参与者的有限参与可能会阻碍预测期内的市场成长。

- 技术创新和永续材料的开发预计将在未来几年为市场带来重大机会。

印度电动车电池隔膜市场趋势

电动车需求增加

- 印度是世界上排名前五的二氧化碳排放国之一。为了解决紧迫的空气污染问题,印度政府正积极推行促进电动车(EV)普及的措施。电动车製造商协会 (SMEV) 报告称,2023 年印度电动车销量将达到 167 万辆。

- 希望安装充电站的企业正在从政府得到明确的讯息。此外,政府还制定了一个雄心勃勃的目标,即到 2030 年所有新车销售均实现纯电动化。

- 到2030年,印度政府的目标是电动车占私家车销量的30%、商用车销量的70%、两轮和三轮车销量的80%。这些雄心勃勃的目标正在增加印度对电池的需求,并增加对高品质电池隔离膜的需求,这对于确保电池效率和寿命至关重要。

- 2019年4月,印度启动了「印度电动车快速采用和製造」(FAME India)计画第二阶段。该措施旨在降低混合动力汽车和电动车的购买价格,特别关注公共运输(巴士、人力车、计程车等)和私人两轮车。

- 2024年2月,政府宣布FAME II计画的投资额将从1,000亿印度卢比(12.065亿美元)增加到1,150亿印度卢比(13.874亿美元)。该计划不仅着重于促进电动车的普及,还注重提供必要的充电基础设施。此外,政府还将补贴奖励从每千瓦时 10,000 印度卢比提高到 15,000 印度卢比。这些措施预计将显着加速印度电动车的普及,导致锂离子电池的需求相应增加。

- 为了应对这种快速增长的需求,电池製造商正在积极安装电池零件生产设备。例如,印度Himadri Specialty Chemicals于2024年2月宣布计画兴建一座2,000吨/年的锂离子电池零件製造工厂。该计划预计耗资 480 亿印度卢比(5.791 亿美元),预计将在约六年内推出。

- 鑑于电动车产业的动态发展以及对创新和性能的高度重视,电池隔离膜已成为推动印度市场成长的关键参与企业。随着电动车市场继续呈上升趋势,对这些关键电池组件的需求预计将激增。

锂离子电池领域占市场主导地位

- 传统上,锂离子电池为行动电话和电脑等家用电子电器产品提供电力。然而,它的作用已经发生了变化,并已成为混合动力汽车和全电动汽车 (EV) 的首选动力源。这种变化很大程度上归功于电动车的环境效益,它不排放二氧化碳和氮氧化物等温室气体。

- 由于其良好的容量重量比,锂离子电池比其他类型的电池更受欢迎。优越的性能、较长的使用寿命和不断下降的价格进一步推动了锂离子电池的采用。锂离子电池具有高能量密度和长循环寿命,使其成为电动车製造商的首选。在引领全球电动车市场的印度,对锂离子电池和电池隔离膜的需求正在增加。

- 推动这一趋势的一个主要因素是锂离子电池价格的持续下降。在过去的十年中,技术进步、规模经济和製造流程的改进降低了成本。

- 在全球范围内,锂离子电池的价格在过去十年中大幅下降。到2023年,锂离子电池平均价格将达到每千瓦时139美元左右,比2013年下降82%。

- 彭博新能源财经预测,2025年后电池成本将再次下降。这是因为新的采矿和精製能开始发挥作用,锂价格走软。该公司的 2023 年电池价格研究预测,到 2025 年,平均电池组价格将降至 113 美元/千瓦时以下,到 2030 年进一步降至 80 美元/kWh。

- 价格的下降使得在预算内购买电动车变得更加容易,并推动了电动车在印度的普及。随着越来越多的消费者和企业采用电动车,锂离子电池的产量和需求迅速增加,进一步激发了电池隔离膜市场的活力。

- 因此,锂离子电池仍然是印度电动车电池的支柱,推动了对尖端隔膜的需求并巩固了其市场主导地位。

印度电动汽车电池隔膜产业概况

印度电动车电池隔膜市场正走向半固体。主要参与企业(排名不分先后)包括住友化学、三菱化学集团公司、旭化成公司、东丽工业公司和 Entek International LLC。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车需求增加

- 政府支持措施

- 抑制因素

- 有限公司的参与

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 材料类型

- 聚丙烯

- 聚乙烯

- 其他材料类型

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Sumitomo Chemical Co., Ltd.

- Asahi Kasei Corporation

- Mitsubishi Chemical Group Corporation

- Entek International

- Toray Industries Inc.

- 24M Technologies

- Celgard LLC

- SK Innovation Co. Ltd

- UBE Corp

- LG Chem Ltd.

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 新兴电池材料的扩展

简介目录

Product Code: 50003710

The India Electric Vehicle Battery Separator Market size is estimated at USD 1.49 million in 2025, and is expected to reach USD 2.92 million by 2030, at a CAGR of 14.43% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing demand for electric vehicles and supportive government initiatives are expected to drive the market during the forecast period.

- On the other hand, limited domestic company participation is likely to hinder market growth during the forecast period.

- Nevertheless, technological innovations and the development of sustainable materials are expected to provide significant opportunities for the market in the coming years.

India Electric Vehicle Battery Separator Market Trends

Increasing Demand for Electric Vehicles

- India ranks among the world's top five CO2 emitters. In response to the pressing issue of air pollution, the Indian government is actively promoting policies to boost the number of electric vehicles (EVs) on the roads. The Society of Manufacturers of Electric Vehicles (SMEV) reported that India achieved sales of 1.67 million EVs in 2023.

- Entities looking to establish charging stations have received clarity from the government: licensing from the ministry may not be necessary. Furthermore, the government has set an ambitious goal: by 2030, all new vehicle sales will be fully electric.

- By 2030, the Indian government aims for electric vehicles to make up 30% of private car sales, 70% of commercial vehicle sales, and a remarkable 80% of sales for two-and three-wheelers. These ambitious targets are poised to boost the demand for batteries in India and heightened the need for high-quality battery separators, which are crucial for ensuring battery efficiency and longevity.

- In April 2019, India rolled out the second phase of its "Faster Adoption and Manufacturing of Electric Vehicles in India" (FAME India) scheme. This initiative aims to lower the purchase price of hybrid and electric vehicles, particularly focusing on public transportation (like buses, rickshaws, and taxis) and private two-wheelers.

- In February 2024, the government announced a boost in investment for the FAME II scheme, raising it from INR 10,000 crore (USD 1206.5 million) to INR 11,500 crore (USD 1387.4 million). This scheme not only focuses on enhancing the adoption of electric vehicles but also emphasizes the establishment of essential charging infrastructure. Additionally, the government has upped the subsidy incentives from Rs 10,000 per kWh to Rs 15,000 per kWh. Such measures are anticipated to significantly bolster the adoption of electric vehicles in India, subsequently driving up the demand for lithium-ion batteries.

- In light of this surging demand, battery manufacturers are proactively setting up facilities for battery component production. For example, in February 2024, Himadri Speciality Chemicals, an Indian firm, unveiled plans for a lithium-ion battery component manufacturing facility, boasting a capacity of 2 lakh tonnes per annum. The project, estimated at INR 4,800 crore (USD 579.1 million), is set to unfold over approximately six years.

- Given the dynamic evolution of the EV industry, with its strong focus on innovation and performance, battery separators are emerging as pivotal players, propelling market growth in India. As the EV market continues its upward trajectory, the demand for these vital battery components is set to surge.

Lithium-Ion Batteries Segment to Dominate the Market

- Traditionally, lithium-ion batteries powered consumer electronics like mobile phones and PCs. However, their role has evolved, becoming the preferred power source for hybrid and fully electric vehicles (EVs). This shift is largely attributed to the environmental benefits of EVs, which produce no CO2, nitrogen oxides, or other greenhouse gases.

- Lithium-ion batteries are outpacing other battery types in popularity, thanks to their favorable capacity-to-weight ratio. Their adoption is further fueled by superior performance, extended shelf life, and plummeting prices. With high energy density and long cycle life, lithium-ion batteries have become the go-to choice for EV manufacturers. As India spearheads the global EV market, the demand for lithium-ion batteries-and by extension, battery separators-is on the rise.

- A major factor bolstering this trend is the consistent drop in lithium-ion battery prices. Over the last decade, technological advancements, economies of scale, and refined manufacturing processes have driven down costs.

- On a global scale, lithium-ion battery prices have seen a dramatic decline over the past decade. In 2023, an average lithium-ion battery was priced at approximately USD 139 per kWh, marking an impressive 82% drop from 2013 levels.

- Looking ahead, BloombergNEF projects a renewed decline in battery costs starting 2025. This is attributed to the activation of new extraction and refinery capacities, leading to a softening of lithium prices. Their 2023 Battery Price Survey forecasts the average pack price to dip below USD 113/kWh by 2025 and further down to USD 80/kWh by 2030.

- This price reduction has made electric vehicles more budget-friendly, spurring their widespread adoption in India. With a growing number of consumers and businesses embracing EVs, the surge in lithium-ion battery production and demand has further bolstered the market for battery separators.

- Consequently, lithium-ion batteries remain central to India's EV battery landscape, propelling the demand for cutting-edge separators and solidifying their dominant market position.

India Electric Vehicle Battery Separator Industry Overview

The Indian electric vehicle battery separator market is semi-consolidated. Some of the major players (not in particular order) include Sumitomo Chemical Co., Ltd., Mitsubishi Chemical Group Corporation, Asahi Kasei Corporation, Toray Industries, Inc., and Entek International LLC among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand of Electric Vehicles

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Limited Company Participation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Sumitomo Chemical Co., Ltd.

- 6.3.2 Asahi Kasei Corporation

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Entek International

- 6.3.5 Toray Industries Inc.

- 6.3.6 24M Technologies

- 6.3.7 Celgard LLC

- 6.3.8 SK Innovation Co. Ltd

- 6.3.9 UBE Corp

- 6.3.10 LG Chem Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expansion in Emerging Battery Materials

02-2729-4219

+886-2-2729-4219