|

市场调查报告书

商品编码

1636447

亚太地区电动汽车电池分离器:市场占有率分析、产业趋势与成长预测(2025-2030)Asia Pacific Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

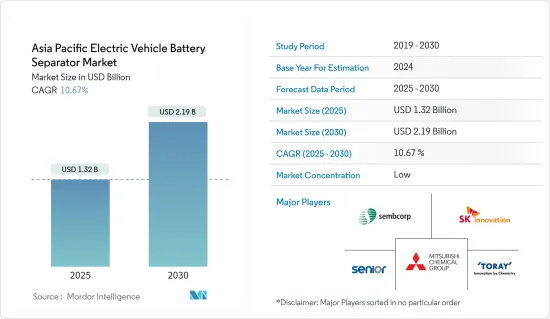

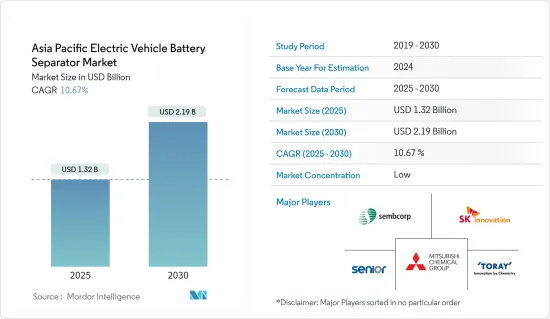

预计2025年亚太地区电动车电池隔膜市场规模为13.2亿美元,2030年将达21.9亿美元,预测期间(2025-2030年)复合年增长率为10.67%。

主要亮点

- 从中期来看,电动车的普及和锂离子电池价格的下降预计将在预测期内推动市场发展。

- 另一方面,先进隔膜,尤其是具有高热稳定性和机械强度的隔膜的製造成本较高,预计将抑制未来市场的成长。

- 其他电池化学材料(例如固态电池、先进锂离子化学材料和钠离子电池)的研发进展预计将为未来的市场提供机会。

- 预计中国将占据重要的市场占有率,这主要是由于其在电动车电池製造能力方面的主导地位。

亚太地区电动汽车电池隔膜市场趋势

锂离子电池领域可望主导市场

- 电池隔膜是多孔膜,对于锂离子电池至关重要。透过将正极和负极分开并仅允许锂离子通过,可以防止电气短路。

- 近年来,锂离子电池凭藉着能量密度高、循环寿命长、效率高等优点,已成为电动车(EV)的主流技术。

- 此外,推动绿色交通正在刺激整个亚太地区电动车产量的增加,其中中国、日本和韩国等国家处于领先地位。

- 随着锂离子电池的价格持续下降,其在电动车中的采用预计会增加,对锂离子电池隔膜的需求预计也会增加。特别是,2023年锂离子电池组的价格将比与前一年同期比较%,稳定在139美元/kWh。

- 持续的研发工作正在提高电池性能、成本效率和安全性,并专注于可提高锂离子电池效率的电池隔膜的进步。

- 例如,2023年5月,SKIET与欣旺达签署了一份谅解备忘录,根据该备忘录,SKIET将供应电池隔膜。该合作伙伴关係还包括一项技术共用协议,旨在加强分离器在技术力、品质和有竞争力的价格方面的供应。

- 鑑于对锂离子电池的需求不断增长以及电动车电池隔膜的进步,该细分市场预计将获得显着的市场占有率。

预计中国将占较大份额

- 中国是亚太地区电动车主要生产国和消费国。中国大力推动电动化,刺激了电动车电池的需求,带动了电池隔膜市场。

- 为促进电动车的普及,中国政府推出了一系列措施和补贴。这些措施包括税收优惠、对电动车製造商的直接财政支持以及对充电基础设施的大量投资,所有这些都正在加强电池隔膜市场。

- 此外,电动车的使用在中国正在迅速扩大,中国致力于减少空气污染,并承诺在 2060 年实现碳中和。这种激增直接扩大了对高性能锂离子电池以及电池隔离膜的需求。

- 国际能源总署的资料显示,2023年中国电动车销量将达810万辆,较2022年的590万辆大幅成长。展望未来,随着中国电动车电池技术的不断创新,电动车电池隔膜的需求预计将增加。国内企业正在投入资源进行研发,旨在生产先进的分离器,以提高安全性、卓越的效率和成本效益。

- 例如,2023年9月,深圳星源材料与布鲁克纳机械製造有限公司合作推出了第五代电池隔膜BSF生产线,年产能达2.5亿平方公尺。此类战略投资预计将增加未来几年对电池隔膜的需求。

- 鑑于电动车的快速普及和技术的持续进步,中国可能在可预见的未来保持其市场主导地位。

亚太地区电动汽车电池隔膜产业概况

亚太地区电动汽车电池隔膜市场呈半截结构。该市场的主要企业包括(排名不分先后)Senior plc、SK Innovation、三菱化学集团公司、东丽工业公司和胜科工业有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府对电池製造的措施和投资

- 电池原物料成本下降

- 抑制因素

- 生产成本高

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子

- 铅酸

- 其他电池类型

- 材料类型

- 聚丙烯

- 聚乙烯

- 其他的

- 地区

- 中国

- 印度

- 澳洲

- 日本

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Senior plc

- SK Innovation Co. Ltd

- Mitsubishi Chemical Group Corporation

- Toray Industries Inc.

- Sembcorp Industries Ltd

- UBE Corporation

- Teijin Ltd

- Hitachi Chemical Company Ltd

- Yunnan Enjie New Materials Co. Ltd

- Cangzhou Mingzhu Plastic Co. Ltd

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 增加其他电池化学物质的研究和开发

简介目录

Product Code: 50003714

The Asia Pacific Electric Vehicle Battery Separator Market size is estimated at USD 1.32 billion in 2025, and is expected to reach USD 2.19 billion by 2030, at a CAGR of 10.67% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, high production cost, especially for advanced separators with higher thermal stability and mechanical strength, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- China is poised to command a substantial market share, primarily due to its dominance in electric vehicle battery manufacturing capacity.

Asia Pacific Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment is Expected to Dominate the Market

- A battery separator, a porous membrane, is vital in lithium-ion batteries. It prevents electrical short circuits by isolating the cathode and anode, allowing only lithium ions to pass through.

- Recently, lithium-ion batteries have become the dominant technology in electric vehicles (EVs), thanks to their high energy density, long cycle life, and efficiency.

- Moreover, as countries like China, Japan, and South Korea lead the way, the push for greener transportation has spurred a rise in EV production across the Asia-Pacific (APAC) region.

- As lithium-ion battery prices continue to decline, their adoption in EVs is set to rise, subsequently increasing the demand for lithium-ion battery separators. Notably, in 2023, lithium-ion battery pack prices dropped by 14% from the previous year, settling at USD139/kWh.

- Ongoing R&D efforts are enhancing battery performance, cost efficiency, and safety, spotlighting advancements in battery separators that boost lithium-ion battery efficacy.

- For example, in May 2023, SKIET and Sunwoda inked a memorandum of understanding, with SKIET set to supply battery separators. The collaboration also includes a technology-sharing agreement, aiming to enhance separator supply in terms of technological prowess, quality, and competitive pricing.

- Given the rising demand for lithium-ion batteries and advancements in battery separators for EVs, this segment is poised to capture a substantial market share.

China is Expected to have a Significant Share

- China stands as the leading producer and consumer of electric vehicles in the Asia-Pacific region. The nation's vigorous push towards electrification has spurred a significant demand for electric vehicle batteries, subsequently propelling the market for battery separators.

- To promote the adoption of EVs, the Chinese government has rolled out a series of policies and subsidies. These measures encompass tax incentives, direct financial support to EV manufacturers, and substantial investments in charging infrastructure, all of which fortify the battery separator market.

- Moreover, with a heightened emphasis on curbing air pollution and a commitment to achieving carbon neutrality by 2060, China's embrace of EVs is rapidly escalating. This surge is directly amplifying the demand for high-performance lithium-ion batteries and, consequently, battery separators.

- Data from the International Energy Agency reveals that China's EV car sales reached 8.1 million units in 2023, a notable rise from 5.9 million units in 2022. Looking ahead, as the nation continues to innovate in electric vehicle battery technology, the appetite for EV battery separators is set to grow. Domestic firms are pouring resources into R&D, aiming to craft advanced separators that promise enhanced safety, superior efficiency, and cost-effectiveness.

- As an illustration, in September 2023, Shenzhen Senior Technology Material Co., Ltd., in collaboration with Bruckner Maschinenbau, launched a 5th generation BSF production line for battery separators, boasting an impressive annual capacity of 250 million square meters. Such strategic investments are poised to amplify the demand for battery separators in the coming years.

- Given the surging adoption of EVs and ongoing technological advancements, China is poised to maintain its market dominance in the foreseeable future.

Asia Pacific Electric Vehicle Battery Separator Industry Overview

The Asia Pacific electric vehicle battery separator market is semi-fragmented. Some of the major players in the market (in no particular order) include Senior plc, SK Innovation Co. Ltd, Mitsubishi Chemical Group Corporation, Toray Industries Inc., and Sembcorp Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Policies and Investments towards battery manufacturing

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 High Production Cost

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Other Battery Types

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Australia

- 5.3.4 Japan

- 5.3.5 Malaysia

- 5.3.6 Thailand

- 5.3.7 Indonesia

- 5.3.8 Vietnam

- 5.3.9 Rest of Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Senior plc

- 6.3.2 SK Innovation Co. Ltd

- 6.3.3 Mitsubishi Chemical Group Corporation

- 6.3.4 Toray Industries Inc.

- 6.3.5 Sembcorp Industries Ltd

- 6.3.6 UBE Corporation

- 6.3.7 Teijin Ltd

- 6.3.8 Hitachi Chemical Company Ltd

- 6.3.9 Yunnan Enjie New Materials Co. Ltd

- 6.3.10 Cangzhou Mingzhu Plastic Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Increasing Research and Development of Other Battery Chemistries

02-2729-4219

+886-2-2729-4219