|

市场调查报告书

商品编码

1636455

南美洲电动汽车电池製造设备:市场占有率分析、产业趋势、成长预测(2025-2030)South America Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

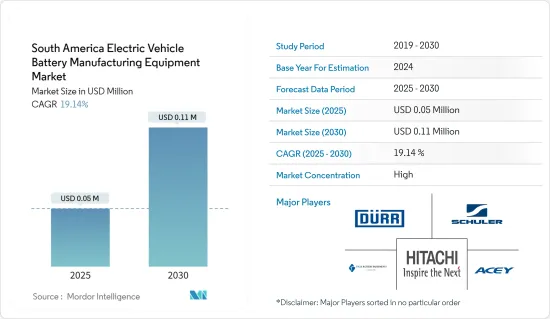

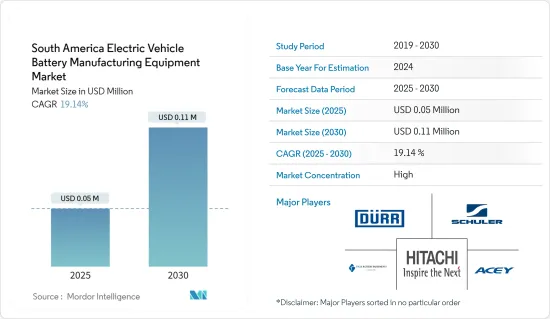

南美洲电动车电池製造设备市场规模预计到2025年为5,000万美元,预计2030年将达到11万美元,预测期内(2025-2030年)复合年增长率为19.14%。

主要亮点

- 从中期来看,电动车普及率的提高和该地区原材料丰富等因素预计将成为预测期内南美电动车电池製造设备市场的最大推动力之一。

- 另一方面,亚太地区等现有电池市场正在竞争。这对预测期内的南美洲电动车电池製造设备市场构成威胁。

- 南美国家不断努力建立合作伙伴关係,预计未来将为市场创造许多机会。

- 由于政府加大力度建立电池製造和电动车普及率不断提高,预计巴西将主导市场并在预测期内实现最高成长。

南美洲电动汽车电池製造设备市场趋势

锂离子电池实现显着成长

- 随着南美洲转向更永续的交通并加大对绿色技术的投资,该地区电动车 (EV) 製造的锂离子电池市场有望大幅成长。锂离子电池以其高能量密度、长循环寿命和低重量而闻名,已成为电动车的首选电池。由于这种日益增长的偏好,对锂离子电池专业製造设备的需求不断增加。

- 随着汽车製造商扩大电动车以满足更严格的排放法规和消费者对环保选择日益增长的需求,这一趋势没有放缓的迹象。与其他电池技术相比,锂离子化学技术在电动车领域脱颖而出,具有能量密度高、循环寿命长、自放电率低等优点。

- 技术资料表强调,锂离子电池的比能量密度达到90-190Wh/kg。锂离子电池的能量密度比铅电池高约2.5倍,比镍氢电池高1.5倍以上。由于具有如此优异的性能,锂离子电池在各种应用中越来越偏好。

- 在南美洲,巴西、智利和阿根廷已成为电动车领域的重要参与企业。在政府旨在减少碳排放的激励措施和措施的推动下,这些国家不仅拥有丰富的锂离子电池必需的锂资源,而且还具有在全球供应链中占据一席之地的战略地位,我们正在加强本地製造能力。

- 阿根廷第一座锂电池工厂由 Y-TEC(阿根廷国家石油公司 YPF 的子公司)投资,计划于 2023 年 9 月开始运营,这也反映了这一势头。该工厂将使用美国Livent 公司在地采购的锂,该公司于今年稍早签署了供应协议。

- 这些措施将重塑阿根廷电动车电池製造设备市场。透过加强本地生产并减少对进口的依赖,在对国产电池和设备的需求不断增长的推动下,市场正处于成长边缘。此举与阿根廷巩固其在全球电动车供应链中地位的雄心完美契合。

- 鑑于这些动态,锂离子电池领域预计将在预测期内引领市场。

巴西主导市场

- 受战略经济倡议、丰富的自然资源和国内对永续交通不断增长的需求的推动,巴西在电动车电池生产设备市场上处于南美领先地位。作为该地区最大的经济体,在政府和私营营业单位对当地製造业的大量投资的支持下,巴西的工业部门有望从世界转向电动车的趋势中受益。

- 巴西东北部州蕴藏量丰富的锂,这是锂离子电池的关键成分。这些蕴藏量不仅将满足快速成长的电动车需求,还将减少巴西对电池和零件进口的依赖,加剧国际市场竞争。

- 根据能源研究所《世界能源统计年鑑》显示,巴西锂蕴藏量将从2022年的2,600吨达到2023年的4,900吨,大幅增加88.5%。这一激增凸显了巴西庞大的锂蕴藏量,并对不断扩大的电池材料市场(尤其是电动车)来说是个好兆头。

- 巴西政府正在实施促进电动车普及的措施,包括税收减免、购车补贴、充电基础设施投资等。这些倡议旨在刺激当地电动车市场并吸引製造商在巴西设立生产设施。

- 2023 年 12 月,巴西政府宣布了包含汽车产业新指令的临时措施。这些指令不仅为车队设定了永续性目标,也为培育创新技术提供了奖励。到2024年,将为专注于脱碳并符合该计画标准的公司提供7亿美元的税收优惠。

- 计划进一步扩大这项优惠待遇。 2025年将达到高峰7.61亿美元,2026年将达7.8亿美元,2027年将达8亿美元,2028年将达8.2亿美元。这些金额将转换为金融信贷,该计划预计将分配超过 39 亿美元的信贷。相比之下,到 2022 年 Rota 2030 计画的平均年度奖励为 3.4 亿美元。

- 鑑于这些发展,巴西有望在未来几年内实现强劲成长。

南美洲电动汽车电池製造设备产业概况

南美洲电动车电池製造设备市场适度整合。该市场的主要企业(排名不分先后)包括Durr AG、Schuler AG、日立、厦门天迈电池设备有限公司和ACEY新能源科技。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 原料丰富

- 抑制因素

- 与现有市场的竞争

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 过程

- 混合物

- 涂层

- 日历

- 狭缝/电极加工

- 其他的

- 电池

- 锂离子

- 铅酸

- 镍氢电池

- 其他电池

- 地区

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Duerr AG

- Schuler AG

- Hitachi Ltd.

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- IPG Photonics Corporation

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 区域合作

简介目录

Product Code: 50003722

The South America Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 0.05 million in 2025, and is expected to reach USD 0.11 million by 2030, at a CAGR of 19.14% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing adoption of electric vehicles in the region coupled with the abundance of raw materials in the region are expected to be among the most significant drivers for the South American Electric Vehicle Battery Manufacturing Equipment Market during the forecast period.

- On the other hand, established battery markets such as Asia Pacific are competing. This poses a threat to the South American Electric Vehicle Battery Manufacturing Equipment Market during the forecast period.

- Nevertheless, continued efforts to create collaborations and partnerships between South American countries are expected to create several opportunities for the market in the future.

- Brazil is expected to dominate the market and will likely register the highest growth during the forecast period due to the government's rising efforts to establish battery manufacturing and the growing adoption of electric vehicles.

South America Electric Vehicle Battery Manufacturing Equipment Market Trends

Lithium-ion Battery to Witness Significant Growth

- As South America increasingly embraces sustainable transportation and invests in green technologies, the region's lithium-ion battery market for electric vehicle (EV) manufacturing is set for significant growth. Renowned for their high energy density, long cycle life, and lightweight nature, lithium-ion batteries have emerged as the top choice for electric vehicles. This surge in preference is driving a heightened demand for specialized manufacturing equipment tailored for these batteries.

- As automakers expand their electric vehicle offerings to align with stringent emissions regulations and growing consumer demand for eco-friendly options, this trend shows no signs of slowing. Lithium-ion chemistry stands out in the electric vehicle realm, boasting advantages like high energy density, extended cycle life, and a lower self-discharge rate when stacked against other battery technologies.

- Technical data sheets highlight that lithium-ion batteries achieve a specific energy density between 90 to 190 Wh/kg. This achievement is noteworthy: lithium-ion batteries deliver energy densities nearly 2.5 times that of lead-acid counterparts and over 1.5 times that of NiMH batteries. Such superior performance cements lithium-ion batteries' growing preference across diverse applications.

- In South America, Brazil, Chile, and Argentina are emerging as pivotal players in the electric vehicle landscape. Bolstered by government incentives and policies targeting carbon emission reductions, these nations are not only rich in lithium resources-crucial for lithium-ion batteries-but are also strategically enhancing their local manufacturing capabilities to carve a niche in the global supply chain.

- Highlighting this momentum, Argentina's first lithium battery plant, a venture by Y-TEC (a subsidiary of the Argentine state oil firm YPF), is set to kick off operations in September 2023. This plant will harness lithium sourced locally from Livent Corp, a US entity, which inked a supply agreement earlier this year.

- Such strides are poised to reshape the Electric Vehicle Battery Manufacturing Equipment Market in Argentina. By bolstering local production and curbing reliance on imports, the market stands on the brink of growth, fueled by surging demand for domestically produced batteries and equipment. This move dovetails seamlessly with Argentina's ambition to solidify its stature in the global electric vehicle supply chain.

- Given these dynamics, the lithium-ion battery segment is primed to lead the market during the forecast period.

Brazil to Dominate the Market

- Brazil leads South America in the electric vehicle battery manufacturing equipment market, propelled by strategic economic policies, rich natural resources, and a rising domestic demand for sustainable transportation. As the region's largest economy, Brazil's industrial sector is poised to benefit from the global pivot towards electric mobility, bolstered by substantial investments from both the government and private entities in local manufacturing.

- Brazil's northeastern states boast extensive lithium reserves, a crucial component for lithium-ion batteries. These reserves not only cater to the surging electric vehicle demand but also position Brazil to lessen its dependence on imported batteries and components, boosting its global market competitiveness.

- According to the Energy Institute Statistical Review of World Energy, Brazil's lithium reserves reached 4.9 thousand tonnes in 2023, up from 2.6 thousand tonnes in 2022, marking a remarkable 88.5% growth. This surge highlights Brazil's significant lithium reserves, a boon for the expanding battery material market, especially for electric vehicles.

- The Brazilian government has rolled out policies to promote electric vehicle adoption, including tax breaks, purchase subsidies, and charging infrastructure investments. These initiatives aim to invigorate the local electric vehicle market and attract manufacturers to establish production facilities in Brazil.

- In December 2023, the Brazilian government unveiled a provisional measure with fresh directives for the automotive sector. These directives not only set sustainability goals for fleets but also offer incentives to nurture innovative technologies. For 2024, the tax incentive for companies focusing on decarbonization and meeting program criteria is pegged at USD 700 million.

- This incentive is slated to grow: USD 761 million in 2025, USD 780 million in 2026, USD 800 million in 2027, and peak at USD 820 million in 2028. These amounts will be transformed into financial credits, with the program anticipated to distribute credits surpassing USD 3.9 billion. For perspective, the Rota 2030 program averaged annual incentives of USD 340 million until 2022.

- Given these developments, Brazil is poised for substantial growth in the coming years.

South America Electric Vehicle Battery Manufacturing Equipment Industry Overview

The South America Electric Vehicle Battery Manufacturing Equipment Market is moderately consolidated. Some of the key players in this market (in no particular order) are Duerr AG, Schuler AG, Hitachi Ltd., Xiamen Tmax Battery Equipments Limited, and ACEY New Energy Technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Abundance of Raw Materials

- 4.5.2 Restraints

- 4.5.2.1 Competition From Established Markets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendaring

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Process

- 5.2 Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-Acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

- 5.3 Geography

- 5.3.1 Brazil

- 5.3.2 Argentina

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd.

- 6.3.4 Xiamen Tmax Battery Equipments Limited

- 6.3.5 ACEY New Energy Technology

- 6.3.6 IPG Photonics Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Regional Collaboration

02-2729-4219

+886-2-2729-4219