|

市场调查报告书

商品编码

1636464

东南亚国协电动车电池分离器:市场占有率分析、产业趋势、成长预测(2025-2030)ASEAN Countries Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

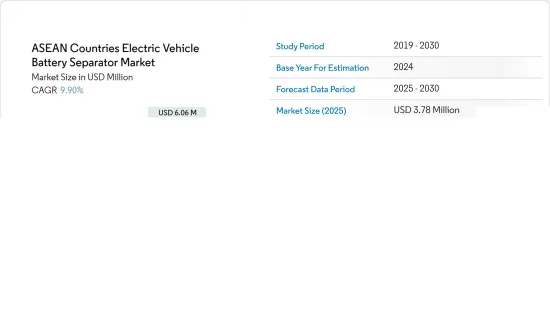

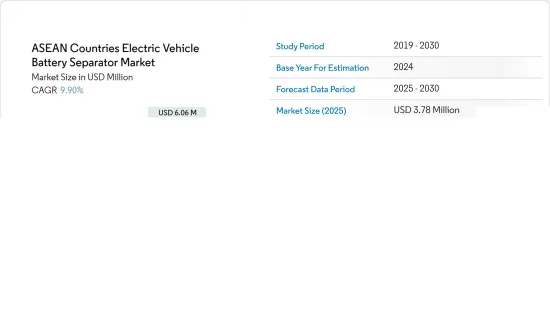

2025年,东南亚国协电动车电池隔膜市场规模预计为378万美元,预计2030年将达到606万美元,预测期内(2025-2030年)复合年增长率为9.9%。

主要亮点

- 从中期来看,电动车的普及和锂离子电池价格的下降预计将在预测期内推动市场发展。

- 另一方面,一些国家的垄断造成的电池材料供应链的差异(例如原料短缺和分销瓶颈)预计将抑制未来的市场成长。

- 其他电池化学材料(例如固体电池、先进锂离子化学材料和钠离子电池)的研发进展预计将为未来的市场提供机会。

- 在东南亚国协的电动车电池分离市场中,由于电动车在全部区域的渗透率不断提高,泰国预计将显着成长。

东南亚国协电动车电池隔膜市场趋势

锂离子电池类型主导市场

- 锂离子电池以其高能量密度、长循环寿命和低自放电率而闻名,是电动车(EV)的首选。这种压倒性的偏好不仅推动了电动车电池隔膜市场的成长,也塑造了电动车产业更广泛的发展轨迹。

- 主要市场参与企业正在增加研发投资和产能,加剧竞争并降低价格。彭博社 NEF 指出,虽然电动车电池组和电池能源储存系统(BESS) 的平均价格普遍上涨,但到 2023 年将大幅下降 13% 至 139 美元/kWh。据预测,这种下降预计将持续下去,到2025年将达到113美元/千瓦时,并在2030年进一步降至80美元/千瓦时。

- 泰国、菲律宾、马来西亚、印尼和越南等东南亚国协正成为全球锂离子电池供应链的主要企业。战略定位、政府激励措施和丰富的自然资源成功吸引了对电池製造的投资。

- 2024 年 7 月,印尼推出了第一家电动车电池工厂。印尼是东南亚最大的经济体,拥有全球最大的镍蕴藏量,在全球电动车供应链中发挥重要作用。该工厂是韩国巨头 LG Energy Solution (LGES) 和现代汽车集团的合资企业,电池单元年产能为 10 吉瓦时 (GWh)。这些倡议预计将在未来几年加强该地区的锂离子电池生产。

- 此外,锂离子电池技术的进步,例如增加的能量密度、改进的安全特性和更快的充电速度,正在刺激创新隔膜材料的开发。这些隔膜对于满足锂离子电池的能源和热需求至关重要,在确保安全性和可靠性方面发挥关键作用,从而推动隔膜市场的创新和需求。

- 2023 年 6 月,辉能宣布推出突破性电池架构,标誌着锂离子技术 30 年来的重大演进。透过用陶瓷取代传统的聚合物隔膜,辉能在电动车锂离子电池领域树立了新标准。此类创新有望推动该地区对先进锂电池隔膜的需求。

- 这些发展将导致预测期内锂离子电池产量激增以及电动车电池隔膜产能大幅增加。

泰国正在经历显着的成长

- 凭藉强大的汽车工业、战略定位和政府支持,泰国已成为东协地区电动车电池隔膜的最大生产国。随着国家转向清洁能源并采用电动车,企业越来越关注这一重要领域。消费者的兴趣是由日益增强的环保意识、拥有电动车的经济效益以及行业快速的技术进步所驱动的。

- 近年来,电动车(EV)销量在东协地区迅速成长。例如,根据泰国汽车实验室的预测,2023年电池式电动车(BEV)註册数量将达到76,360辆,与2022年相比增长了6.89倍,与2019年相比增长了47.6倍。随着包括纯电动车在内的电动车销量预计增加,该地区对电池和电池隔膜的需求预计将扩大。

- 此外,该地区的电池隔膜正在克服锂离子电池价格下降、需求激增以及电动车应用对安全和效率的迫切需求等挑战。最近,全球主要公司投资了计划,以提高该地区电动汽车锂离子电池的产量。

- 例如,BMW于2024年2月宣布将在泰国罗勇建立新的电动车电池工厂。该倡议预计将加强该国的电池供应链。 BMW将泰国定位为电动车电池的重要出口基地,并瞄准了更大的亚太市场。此举可能会提高泰国的电池产量,并增加未来几年对锂离子电池隔离膜的需求。

- 此外,泰国汽车工业正在加大创新电动车 (EV) 车型的生产。随着全球主要企业将重点转向电动车製造,对高檔电池组件(尤其是隔膜)的需求正在迅速增加。这一趋势凸显了该行业对创新和永续性的承诺。

- 例如,2024 年 8 月,Omoda 和中国汽车製造商奇瑞汽车的子公司 Jaecoo Thai 发布了两款电动车 (EV) 车型,并加强了在泰国的业务。它们是Omoda C5 EV(紧凑型SUV)和Jaecoo 6 EV(越野SUV)。这些倡议正在扩大该地区的电动车阵容,并支持电动车电池隔膜市场的成长。

- 因此,这些计划和倡议将推动电动车需求,并在未来几年显着增加对电动车电池隔膜的需求。

东南亚国协电动汽车电池隔膜产业概况

东南亚国协的电动车电池隔膜市场呈现半分散状态。主要参与企业(排名不分先后)包括三菱化学集团公司、日立化成有限公司、东丽工业公司、住友化学公司和帝人公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 降低电池原物料成本

- 抑制因素

- 供应链缺口

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池

- 锂离子

- 铅酸

- 其他的

- 材料类型

- 聚丙烯

- 聚乙烯

- 其他材料类型

- 地区

- 印尼

- 越南

- 泰国

- 缅甸

- 菲律宾

- 其他东南亚国协

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- Teijin Ltd

- SK Nexilis

- Asahi Kasei

- W-Scope Corporation

- Southeast Asia Manufacturing Co., Ltd

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 增加其他电池化学物质的研究和开发

简介目录

Product Code: 50003731

The ASEAN Countries Electric Vehicle Battery Separator Market size is estimated at USD 3.78 million in 2025, and is expected to reach USD 6.06 million by 2030, at a CAGR of 9.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

- Thailand is anticipated to witness significant growth in the ASEAN countries' electric vehicle battery separation market due to the rising adoption of EVs across the region.

ASEAN Countries Electric Vehicle Battery Separator Market Trends

Lithium-Ion Battery Type to Dominate the Market

- Li-ion batteries, known for their high energy density, long cycle life, and low self-discharge rate, are the preferred choice for electric vehicles (EVs). This dominant preference not only propels the growth of the EV battery separator market but also shapes the broader trajectory of the EV industry.

- Key market players are boosting their R&D investments and production capabilities, intensifying competition and driving prices down. Bloomberg NEF highlights that while average battery pack prices for EVs and battery energy storage systems (BESS) have generally risen, 2023 marked a significant 13% drop, bringing prices down to USD 139/kWh. Projections suggest this decline will persist, with prices anticipated to reach USD 113/kWh by 2025 and plummet further to USD 80/kWh by 2030, driven by relentless technological and manufacturing advancements.

- ASEAN nations, including Thailand, the Philippines, Malaysia, Indonesia, and Vietnam, are emerging as key players in the global lithium-ion battery supply chain. Their strategic locations, government incentives, and abundant natural resources have successfully attracted investments into battery manufacturing.

- In July 2024, Indonesia launched its first-ever EV battery plant. As Southeast Asia's largest economy and the custodian of the world's most extensive nickel reserves, Indonesia is carving out a significant role in the global electric vehicle supply chain. This plant, a joint venture between South Korean titans LG Energy Solution (LGES) and Hyundai Motor Group, boasts a robust annual capacity of 10 Gigawatt hours (GWh) for battery cell production. Such initiatives are poised to bolster lithium-ion battery production in the region in the coming years.

- Moreover, advancements in lithium-ion battery technology, such as heightened energy density, improved safety features, and accelerated charging, are spurring the development of innovative separator materials. These separators, crucial for meeting the energy and thermal demands of Li-ion batteries, play a vital role in ensuring safety and reliability, thereby driving innovation and demand in the separator market.

- In June 2023, ProLogium unveiled a groundbreaking battery architecture, marking a significant evolution in three decades of lithium-ion technology. By substituting the traditional polymer separator film with a ceramic alternative, ProLogium has set a new standard in the lithium-ion battery sector for electric vehicles. Such innovations are poised to amplify the demand for advanced lithium battery separators in the region.

- Given these developments, the production of lithium-ion batteries is set to surge, leading to a substantial increase in the capacity of EV battery separators during the forecast period.

Thailand to Witness Significant Growth

- Thailand, with its robust automotive industry, strategic positioning, and government support, has emerged as the top producer of EV battery separators in the ASEAN region. As the country shifts towards clean energy and embraces electric vehicles, companies are sharpening their focus on this crucial segment. Rising consumer interest is driven by increased environmental awareness, the economic advantages of EV ownership, and swift technological progress in the industry.

- Recently, electric vehicle (EV) sales have surged in the ASEAN region. For instance, the Thailand Automotive Institute reported that in 2023, registered battery electric vehicles (BEVs) reached 76.36 thousand units, marking a 6.89-fold increase from 2022 and a staggering 47.6-fold jump since 2019. With EV sales, including BEVs, projected to rise, the demand for batteries and battery separators in the region is set to amplify.

- Additionally, battery separators in the region are navigating challenges like falling lithium-ion battery prices, escalating demand, and the crucial need for safety and efficiency in EV applications. Recently, leading global companies have invested in projects to enhance lithium-ion battery production for EVs in the region.

- For example, in February 2024, BMW announced a new battery factory for electric vehicles in Rayong, Thailand. This initiative is expected to strengthen the country's battery supply chains. BMW sees Thailand as a key export center for its EV batteries, aiming at the larger Asia Pacific market. Such moves are likely to boost battery production in Thailand and heighten the demand for lithium-ion battery separators in the coming years.

- Furthermore, Thailand's automotive industry is ramping up the production of innovative electric vehicle (EV) models. As global leaders pivot to include EV manufacturing, there's a notable surge in demand for premium battery components, especially separators. This trend highlights the industry's commitment to innovation and sustainability.

- For instance, in August 2024, Omoda and Jaecoo Thailand, a branch of the Chinese automaker Chery Automobile, strengthened their presence in Thailand by launching two electric vehicle (EV) models. The debut included two versions for each model: the compact SUV Omoda C5 EV and the rugged off-road SUV Jaecoo 6 EV, making its global debut in a right-hand drive variant. Such initiatives are expanding their electric vehicle offerings in the region, fueling the growth of the EV battery separator market.

- Consequently, these projects and initiatives are poised to boost EV demand and substantially elevate the need for EV battery separators in the coming years.

ASEAN Countries Electric Vehicle Battery Separator Industry Overview

ASEAN Countries' electric vehicle battery separator market is semi-fragmented. Some key players (not in particular order) are Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, Toray Industries Inc., Sumitomo Chemical Co. Ltd, Teijin Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 Indonesia

- 5.3.2 Vietnam

- 5.3.3 Thailand

- 5.3.4 Myanmar

- 5.3.5 Philippines

- 5.3.6 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group Corporation

- 6.3.2 Hitachi Chemical Company Ltd

- 6.3.3 Toray Industries Inc.

- 6.3.4 Sumitomo Chemical Co. Ltd

- 6.3.5 Teijin Ltd

- 6.3.6 SK Nexilis

- 6.3.7 Asahi Kasei

- 6.3.8 W-Scope Corporation

- 6.3.9 Southeast Asia Manufacturing Co., Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development of Other Battery Chemistries

02-2729-4219

+886-2-2729-4219