|

市场调查报告书

商品编码

1636465

南美洲的微型电池:市场占有率分析、产业趋势、成长预测(2025-2030)South America Micro Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

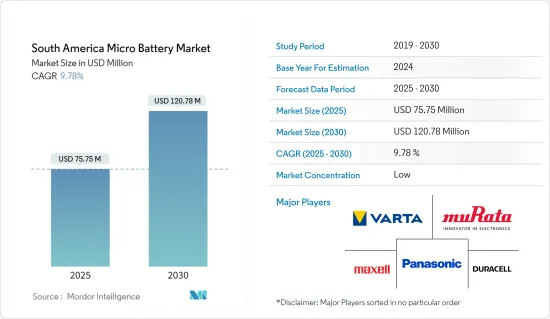

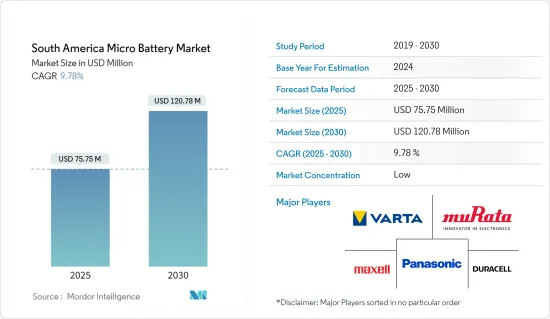

南美洲微电池市场规模预计到2025年为7,575万美元,预计2030年将达到1.2078亿美元,预测期内(2025-2030年)复合年增长率为9.78%。

主要亮点

- 从中期来看,行动装置渗透率的提高以及灵活轻巧的设计预计将在预测期内推动微电池的需求。

- 另一方面,来自圆柱体等其他电池类型的竞争可能会严重抑制南美洲微电池市场的成长。

- 智慧型手錶、无线耳机和智慧手环等穿戴式装置的微电池技术不断创新,预计将在不久的将来为微电池市场的参与企业创造巨大的商机。

- 由于家用电子电器的需求不断增加,预计巴西将在预测期内主导南美微电池市场。

南美洲微电池市场趋势

来自成熟电池技术的竞争限制了市场成长

- 南美洲微电池市场的成长面临一些挑战,主要是由于锂离子电池和铅酸电池等现有电池技术的竞争。这种既定的优势是市场成长的主要限制因素。

- 锂离子、镍镉 (NiCd) 和镍氢 (NiMH) 等成熟电池技术广泛应用于各种应用,包括家用电子电器、电动车和工业设备。这些电池具有高能量密度、长循环寿命和成熟的製造基础设施。

- 此外,近年来,锂离子电池和电池组的价格一直呈下降趋势,这使得它们对终端用户产业具有吸引力。电池价格在2022年经历了小幅上涨,2023年将再次呈下降趋势。锂离子电池组成本下降14%,达到139美元/kWh的历史低点。这种下降是由于原料和零件价格下降以及整个电池价值链产能增加所致。

- 如果锂离子电池的价格继续下降,该地区国家可能会转向超小型电池。圆柱形电池,例如可充电锂亚硫酰氯 (Li-SOCl2) 电池,现在价格更便宜,并且越来越多地用于工业感测器。这种趋势在偏远和危险环境中尤其明显。因此,在可预见的未来,这种转变可能会阻碍固体微电池和锌空气电池的成长。

- 此外,替代圆柱形和棱形电池技术受益于现有的製造流程、供应链以及大规模生产、分销和回收的基础设施。与处于商业化和规模化早期阶段的微电池相比,这种基础设施优势可以降低生产成本,提高规模经济,并提高替代电池技术的竞争力。

- 相比之下,微型电池,例如锂离子微型电池,通常是专用的、小批量生产的,而且可能很昂贵。南美洲的经济状况也可能影响新技术的采用。对成本敏感的市场可能更喜欢成熟的、具有成本效益的解决方案,而不是价格更高的新型微电池。

- 此外,对软性电子产品和穿戴式电子产品不断增长的需求带动了柔性微电池的发展。这些电池可以整合到具有非传统形式和表面的设备中,例如智慧服装、健身追踪器和折迭式智慧型手机。预计这种不断增长的技术创新将在预测期内限制现有的电池技术。

- 为了保持竞争力,超小型电池製造商必须专注于创新、差异化并满足特定的市场需求,以在日益激烈的竞争中开拓利基并推动永续成长。

巴西可望主导市场

- 由于各种应用对紧凑、高效、可靠的电源的需求迅速增长,巴西的超紧凑电池市场正在经历快速增长。消费性电子产品领域在微电池市场占据主导地位,因为它为从智慧型手机、平板电脑到笔记型电脑和穿戴式装置等众多设备提供动力。

- 南美洲的医疗产业正在蓬勃发展,尤其是在巴西。糖尿病诊断数量的不断增加正在推动对连续血糖监测 (CGM) 系统和胰岛素帮浦的需求。这些重要的医疗设备依赖可靠且持久的超紧凑电池。巴西卫生部资料显示,2023年成人糖尿病诊断人数将增加10.2%,较2019年增加37.83%。随着糖尿病患者数量的增加,医疗设备对微电池的需求将迅速增加。

- 微型电池市场正在蓬勃发展,这主要是由于对无线耳机的需求不断增长所推动的。从有线型号到无线型号的转变,尤其是真无线立体声 (TWS) 耳机,增加了对更小、更高性能电池的需求。随着该地区的主要製造商纷纷推出尖端的无线耳机,这一趋势变得显而易见。

- 例如,2024年8月,JBL在巴西发布了「Live Beam 3」和「Live Buds 3」耳机,引起了广泛关注。这些采用不仅代表了 JBL 的战略扩张,还突显了降噪和带显示器的机箱等高级功能与更广泛的产品系列的整合。像这样的耳机的进步将扩大对微型电池的需求。

- 巴西微电池市场充满机会,儘管面临现有电池技术的激烈竞争。智慧家庭技术、感测器和互联家用电子电器等物联网设备的快速采用正在增加微电池的重要性,特别是对于这些小型节能设备而言。

- 此外,巴西人口老化导致对便携式医疗设备(从助听器、心律调节器到血糖监测仪)的需求不断增加。这些设备需要小尺寸和可靠的电池,对于提高老年人的生活品质变得越来越重要。这一趋势,加上对可携式设备的广泛需求,显示该地区存在扩大微型电池生产的重大机会。

- 鑑于强劲的国内需求、近期的行业趋势以及新製造工厂的开设,巴西微电池市场预计将在未来几年大幅成长。

南美洲微电池产业概况

南美洲的微电池处于半分裂状态。主要企业(排名不分先后)包括 Duracell Inc.、Panasonic Holding Corporation、Maxell, Ltd.、Varta AG 和 Murata Manufacturing。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 行动装置的扩展

- 锂离子电池价格下降

- 抑制因素

- 原料供需不匹配

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 依电池类型

- 薄膜电池

- 固体晶片电池

- 印刷电池

- 羁扣电池

- 按用途

- 消费性电子产品

- 医疗设备

- 智慧卡

- 无线感测器

- 其他的

- 按类型

- 原电池

- 二次电池

- 按地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Duracell Inc.

- Panasonic Energy Co., Ltd.

- Maxell, Ltd

- Nippo

- Murata Manufacturing Co., Ltd.

- Baterias Moura SA

- Energizer Ltd

- Fabrica Nacional de Acumuladores ETNA SA

- METAFLUX COMPANY PVT. LTD.

- Unicoba Energia SA

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 微电池技术创新进展

简介目录

Product Code: 50003732

The South America Micro Battery Market size is estimated at USD 75.75 million in 2025, and is expected to reach USD 120.78 million by 2030, at a CAGR of 9.78% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the rising adoption of portable devices and flexible & lightweight design are expected to drive the demand for micro batteries during the forecast period.

- On the other hand, competition from other battery types, such as cylindrical, can significantly restrain the growth of the South American micro battery market.

- Nevertheless, the growing technological innovations in micro batteries across wearable devices like smartwatches, wireless earphones, smart bands, and more are expected to create significant opportunities for micro battery market players in the near future.

- Brazil is anticipated to dominate the South American micro battery market during the forecast period due to growing demand for consumer electronics.

South America Micro Battery Market Trends

Competition from Established Battery Technology Restrain the Market Growth

- The growth of the micro battery market in South America faces several challenges, primarily due to competition from established battery technologies like lithium-ion and lead-acid batteries. This established dominance poses a significant restraint on the market's growth.

- Established battery technologies such as lithium-ion, nickel-cadmium (NiCd), and nickel-metal hydride (NiMH) are widely used across various applications, including consumer electronics, electric vehicles, and industrial equipment. These batteries offer high energy density, good cycle life, and a well-established manufacturing infrastructure.

- Additionally, in recent years, the price of lithium-ion batteries and cell packs has been on the decline, which has made them more attractive to end-user industries. After experiencing slight price hikes in 2022, battery prices were once again declining in 2023. The cost of lithium-ion battery packs has decreased by 14% to reach a historic low of USD 139/kWh. This reduction can be attributed to decreases in raw material and component prices, coupled with an expansion in production capacity throughout the battery value chain.

- As lithium-ion battery prices continue to decline, the countries across the region may witness a shift in micro battery usage. The cyclindrical batteries like rechargeable Lithium-Thionyl Chloride (Li-SOCl2) batteries, now more affordable, are increasingly being adopted in industrial sensors. This trend is particularly evident in remote or hazardous environments. Consequently, this shift may hinder the growth of Solid-State Micro Batteries and Zinc-Air Batteries in the foreseeable future.

- Besides, alternate battery technologies in cylindrical and prismatic type benefit from well-established manufacturing processes, supply chains, and infrastructure for mass production, distribution, and recycling. This infrastructure advantage can lower production costs, improve economies of scale, and enhance the competitiveness of alternate battery technologies relative to micro-batteries, which may still be in the early stages of commercialization and scale-up.

- In contrast, micro-batteries like lithium ion micro batteries, often specialized and produced in smaller quantities, can be more expensive. Also, the economic conditions in South America can impact the adoption of new technologies. Cost-sensitive markets may prefer established, cost-effective solutions over newer, potentially more expensive micro batteries.

- Furthermore, the growing demand for flexible and wearable electronics has led to the development of flexible microbatteries. These batteries can be integrated into devices with unconventional shapes and surfaces, such as smart clothing, fitness trackers, and foldable smartphones. This type of rising innovation is expected to restrain established battery technology during the forecast period.

- To remain competitive, micro battery manufacturers must focus on innovation, differentiation, and addressing specific market needs to carve out their niche and drive sustained growth amidst increasing competition.

Brazil Expected to Dominate the Market

- Brazil's micro battery market is experiencing rapid growth, fueled by the surging demand for compact, efficient, and reliable power sources across diverse applications. The Consumer Electronics segment dominates the micro battery landscape, as these batteries power a myriad of devices, from smartphones and tablets to laptops and wearables.

- South America's medical industry has seen a notable uptick, particularly in Brazil. The rising diabetes diagnoses have spurred demand for continuous glucose monitoring (CGM) systems and insulin pumps. These essential medical devices rely on dependable, long-lasting micro batteries. Data from Brazil's Ministerio da Saude indicates a 10.2% uptick in diabetes diagnoses for adults in 2023, marking a 37.83% rise since 2019. With diabetic numbers projected to climb, the demand for micro batteries in medical equipment is set to surge.

- The micro battery market is witnessing a boom, largely propelled by the escalating demand for wireless earphones. The transition from wired to wireless models, especially true wireless stereo (TWS) earbuds, has intensified the need for compact, high-performance batteries. Major regional players have been rolling out cutting-edge wireless headphones, underscoring this trend.

- For example, JBL made waves in August 2024 by launching its Live Beam 3 and Live Buds 3 headphones in Brazil. These introductions not only signify JBL's strategic expansion but also highlight the integration of premium features, like noise cancellation and display-equipped cases, into their broader product lineup. Such advancements in headphones are poised to amplify the demand for micro batteries.

- Despite facing stiff competition from established battery technologies, Brazil's micro battery market is rife with opportunities. The burgeoning adoption of IoT devices-spanning smart home technologies, sensors, and connected appliances-underscores the growing relevance of micro batteries, especially for these compact, energy-efficient devices.

- Additionally, Brazil's aging population is driving a heightened demand for portable medical devices, from hearing aids and pacemakers to glucose monitors. These devices, requiring compact and reliable batteries, are becoming increasingly vital for enhancing the quality of life in the elderly. This trend, coupled with the broader demand for portable devices across industries, signals a robust opportunity for ramping up micro battery production in the region.

- Given the strong domestic demand, recent industry developments, and the establishment of new manufacturing plants, Brazil's micro battery market is poised for significant growth in the coming years.

South America Micro Battery Industry Overview

The South American micro Battery is semi-fragmented. Some of the key players (not in particular order) are Duracell Inc., Panasonic Holding Corporation, Maxell, Ltd., Varta AG, Murata Manufacturing Co., Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Adoption of Portable Devices

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Mismatch of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Battery Type

- 5.1.1 Thin Film Battery

- 5.1.2 Solid State Chip Battery

- 5.1.3 Printed Battery

- 5.1.4 Button Battery

- 5.2 By Application

- 5.2.1 Consumer Electronics

- 5.2.2 Medical Devices

- 5.2.3 Smart Cards

- 5.2.4 Wireless Sensors

- 5.2.5 Others

- 5.3 By Type

- 5.3.1 Primary Battery

- 5.3.2 Secondary Battery

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duracell Inc.

- 6.3.2 Panasonic Energy Co., Ltd.

- 6.3.3 Maxell, Ltd

- 6.3.4 Nippo

- 6.3.5 Murata Manufacturing Co., Ltd.

- 6.3.6 Baterias Moura SA

- 6.3.7 Energizer Ltd

- 6.3.8 Fabrica Nacional de Acumuladores ETNA SA

- 6.3.9 METAFLUX COMPANY PVT. LTD.

- 6.3.10 Unicoba Energia SA

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Technological Innovations In Micro Batteries

02-2729-4219

+886-2-2729-4219