|

市场调查报告书

商品编码

1636478

东协国家电动车电池电解:市场占有率分析、产业趋势、成长预测(2025-2030)ASEAN Countries Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

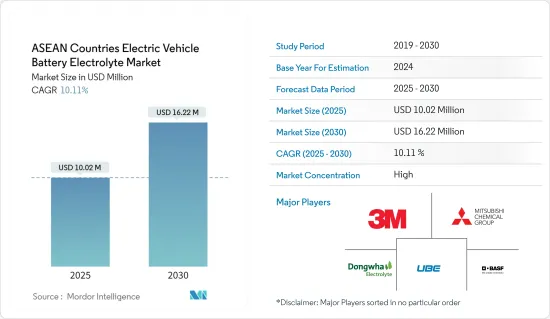

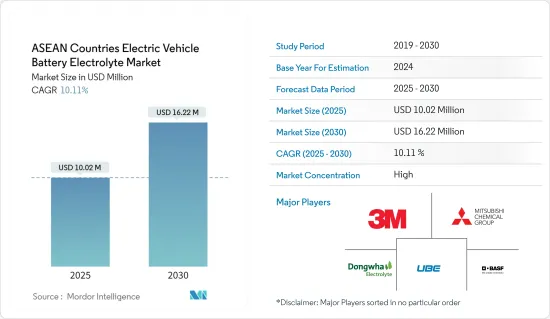

预计2025年东南亚国协电动车电池电解市场规模为1,002万美元,预计2030年将达1,622万美元,预测期间(2025-2030年)复合年增长率为10.11%。

主要亮点

- 从中期来看,在电动车(EV)的快速采用和政府支持措施的推动下,市场将会成长。

- 相反,供应链中断可能对成长构成挑战。

- 然而,电解质配方的进步在不久的将来为市场提供了利润丰厚的机会。

- 在该地区,新加坡脱颖而出,由于共同努力加强该国的电动车生态系统,预计将显着成长。

东南亚国协电动车电池电解市场趋势

锂离子电池领域占市场主导地位

- 在电动车的快速普及和电池技术创新的推动下,锂离子电池领域已成为东协地区电动车(EV)电池电解市场的重要组成部分。

- 随着地方政府支持环保交通以及消费者对电动车的偏好增加,对高效能、高性能电池的需求不断增加。电解质在增强电池性能、确保安全和延长寿命方面发挥着重要作用。

- 锂离子电池市场扩张的关键驱动力是电池成本的大幅下降。例如,2023年锂离子电池的平均价格已降至每千瓦时(kWh)约139美元,较2013年大幅下降82%以上。根据预测,2025年可能降至113美元/度以下,2030年达到80美元/度。

- 电池价格的下降趋势不仅使电动车对消费者更实惠,而且鼓励製造商致力于先进的电池技术和优质电解液,从而扩大市场需求。

- 此外,永续性已成为锂离子电池领域的关键力量。随着环保意识的增强,製造商正在转向采用永续材料製成的环保电解质解决方案。这种绿色转变不仅符合消费者的偏好,也符合旨在遏制电池生产对环境足迹的监管要求。

- 2024 年 7 月,LG Energy Solution 和现代汽车公司在印尼开设了一座 10GWh 产能的电动车电池製造工厂。 2024 年 10 月,印尼进一步实现了成为世界电动车中心的雄心,宣布与中国宁德时代新能源科技有限公司 (CATL) 成立合资企业,承诺投资 12 亿美元在东南亚生产锂离子电池。

- 总之,在投资增加和价格下降的推动下,该地区锂离子技术的采用将加速,为未来几年市场的大幅成长铺路。

新加坡可望发挥重要作用

- 新加坡在东协电动车充电基础设施方面处于领先地位,拥有超过 1,800 个公共充电点。新加坡政府计划在 2030年终再安装 6 万个充电站。

- 从2021年到2025年,新加坡政府已累计2,200万美元来促进电动车的采用。该倡议旨在增加私人土地上的充电桩数量并加强整体充电基础设施。同时,新加坡将自己定位为电动车领域的重要研发中心,吸引跨国公司和新兴企业的投资,并培育当地电动车生态系统。

- 新加坡政府致力于遏制污染,并支持电动车。此次促销活动预计将增加电动车销量。特别是,新加坡的目标是到 2040 年从内燃机汽车过渡到清洁能源汽车。这背后的动力是新成立的国家消费电子和汽车中心(NEVC),它将引导新加坡实现2040年绿色能源汽车目标。这种转变将在不久的将来增加对电池材料,特别是对电解质的需求。

- 根据陆路交通管理局的报告,新加坡的电动车销售正在上升。 2024 年 1 月至 7 月期间,新加坡註册了 6,019 辆纯电动车。这比 2023 年同期的 1,892 个註册单位大幅增加 32.4%。

- 电动车市场的快速成长不仅提供了环境效益,例如透过零排放和减少温室气体排放来改善空气质量,而且在世界应对气候变迁方面发挥着重要作用。

- 鑑于消费者偏好和监管支持的一致,新加坡对电动车电池电解的需求可能会在未来一段时间内增加。

东南亚国协电动车电解电解液产业概况

东南亚国协电动车电池电解市场正走向半固体。主要参与企业包括(排名不分先后)三菱化学集团公司、3M、Dongwha Eletrolyte、 BASF SE、UBE Corp.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 普及率提高

- 政府支持措施

- 抑制因素

- 供应链中断

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 电解质类型

- 液体电解质

- 凝胶电解质

- 固体电解质

- 地区

- 马来西亚

- 泰国

- 印尼

- 新加坡

- 其他东南亚国协

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Mitsubishi Chemical Group

- 3M

- Dongwha Eletrolyte

- UBE Corp.

- BASF SE

- Hitachi, Ltd.

- Cabot Corporation

- Umicore NV

- 市场排名/份额分析

- 其他知名公司名单

第七章 市场机会及未来趋势

- 电解液配方的创新

简介目录

Product Code: 50003746

The ASEAN Countries Electric Vehicle Battery Electrolyte Market size is estimated at USD 10.02 million in 2025, and is expected to reach USD 16.22 million by 2030, at a CAGR of 10.11% during the forecast period (2025-2030).

Key Highlights

- In the medium term, the market is poised for growth, fueled by the surging adoption of electric vehicles (EVs) and supportive government initiatives.

- Conversely, disruptions in the supply chain may pose challenges to this growth.

- However, advancements in electrolyte formulations present lucrative opportunities for the market in the near future.

- Within the region, Singapore stands out, anticipating notable growth, thanks to its concerted efforts to bolster the country's EV ecosystem.

ASEAN Countries Electric Vehicle Battery Electrolyte Market Trends

Lithium-Ion Batteries Segment to Dominate the Market

- The lithium-ion battery segment stands as a pivotal component of the electric vehicle (EV) battery electrolyte market in the ASEAN region, propelled by the swift uptake of electric vehicles and innovations in battery technology.

- With regional governments championing greener transportation and a growing consumer preference for EVs, the appetite for efficient, high-performance batteries is on the rise. Electrolytes play a vital role in boosting battery performance, ensuring safety, and extending longevity.

- A key driver behind the lithium-ion battery segment's expansion is the notable drop in battery costs. For example, in 2023, the average price of lithium-ion batteries dipped to approximately USD 139 per kilowatt-hour (kWh), marking a remarkable decline of over 82% since 2013. Forecasts suggest prices might slide below USD 113/kWh by 2025 and could touch USD 80/kWh by 2030.

- This downward trajectory in battery prices not only enhances the affordability of electric vehicles for consumers but also spurs manufacturers to delve into advanced battery technologies and premium electrolytes, amplifying market demand.

- Moreover, sustainability is emerging as a pivotal force in the lithium-ion battery segment. With a surge in environmental consciousness, manufacturers are pivoting towards eco-friendly electrolyte solutions crafted from sustainable materials. This green shift not only resonates with consumer preferences but also dovetails with regulatory mandates aimed at curbing the environmental footprint of battery production.

- In July 2024, LG Energy Solution and Hyundai Motor Corp inaugurated a 10 GWh capacity EV battery manufacturing facility in Indonesia. Furthering its ambition to be a global EV hub, Indonesia, in October 2024, unveiled a joint venture with China's Contemporary Amperex Technology Co Ltd (CATL), committing a substantial USD 1.2 billion towards lithium-ion battery production in the Southeast Asian landscape.

- In conclusion, driven by increasing investments and declining prices, the adoption of lithium-ion technology is set to accelerate in the region, paving the way for substantial market growth in the years ahead.

Singapore Expected to Play a Key Role

- Singapore has been at the forefront of EV charging infrastructure in ASEAN, with more than 1,800 public charging points available. The Government of Singapore plans to install 60,000 more charging points by the end of 2030.

- From 2021 to 2025, the Singapore government has earmarked USD 22 million to boost EV adoption. This initiative aims to bolster the number of chargers on private properties, enhancing the overall charging infrastructure. Concurrently, Singapore has positioned itself as a pivotal R&D hub for the EV sector, attracting investments from multinationals and startups alike, thereby nurturing a robust local EV ecosystem.

- With a commitment to curbing pollution, the Singapore government is championing electric mobility. This push is anticipated to drive up EV sales. Notably, Singapore aims to transition from internal combustion engines to cleaner-energy vehicles by 2040. Leading this charge is the newly established National Electric Vehicle Centre (NEVC), steering efforts towards Singapore's 2040 green energy vehicle goal. This shift is poised to elevate the demand for battery materials, particularly electrolytes, in the near future.

- As reported by the Land Transport Authority, EV sales in Singapore are on the rise. Between January-July 2024, the country registered 6,019 battery electric vehicles. This marks a significant jump from 1,892 registrations during the same period in 2023, representing an 32.4% increase.

- The swift growth of the EV market not only benefits the environment-due to zero emissions improving air quality and curbing greenhouse gases-but also plays a vital role in the global fight against climate change.

- Given the alignment of consumer preferences and regulatory support, the demand for electric vehicle battery electrolytes in Singapore is set to rise in the foreseeable future.

ASEAN Countries Electric Vehicle Battery Electrolyte Industry Overview

The ASEAN Countries' electric vehicle battery electrolyte market is semi-consolidated. Some of the major players include (not in particular order) Mitsubishi Chemical Group, 3M, Dongwha Eletrolyte, BASF SE, and UBE Corp. among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Electric Vehicle (EV) Adoption

- 4.5.1.2 Supportive Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Disruptions

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 Malaysia

- 5.3.2 Thailand

- 5.3.3 Indonesia

- 5.3.4 Singapore

- 5.3.5 Rest of ASEAN Countries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group

- 6.3.2 3M

- 6.3.3 Dongwha Eletrolyte

- 6.3.4 UBE Corp.

- 6.3.5 BASF SE

- 6.3.6 Hitachi, Ltd.

- 6.3.7 Cabot Corporation

- 6.3.8 Umicore N.V

- 6.4 Market Ranking/Share Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovations in Electrolyte Formulations

02-2729-4219

+886-2-2729-4219