|

市场调查报告书

商品编码

1636483

中东及非洲电动车电池负极市场占有率分析、产业趋势及成长预测(2025-2030)Middle-East And Africa Electric Vehicle Battery Anode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

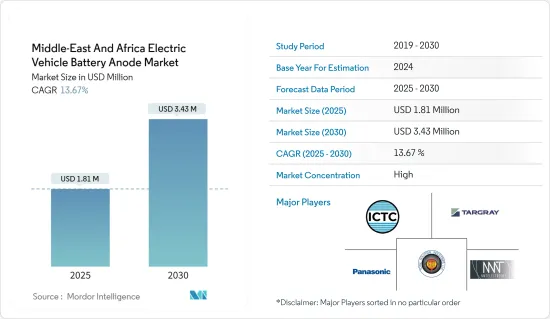

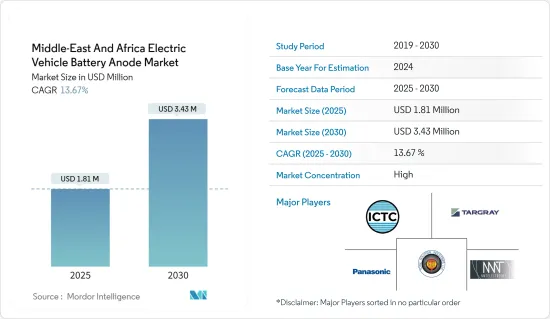

中东和非洲电动车电池负极市场规模预计到2025年为181万美元,预计到2030年将达到343万美元,预测期内(2025-2030年)复合年增长率为13.67%。

主要亮点

- 从中期来看,政府措施和投资预计将加速电动车的普及并推动市场发展。

- 相反,该地区参与负极製造的公司数量有限可能会阻碍市场成长。

- 负极材料的研究和开发目前正在进行中,这为市场带来了广泛的成长机会。

- 研究期间,阿拉伯联合大公国预计将主导中东和非洲的电动车电池负极市场。

中东和非洲电动车电池负极市场趋势

锂离子电池占市场主导地位

- 锂在电动车(EV)电池的生产中发挥重要作用。作为可充电锂离子电池的主要成分,锂的高能量密度有利于延长行驶里程。最近,在中东和非洲,锂离子製造设备的数量迅速增加,特别是负极等电池零件。

- 例如,NextSource Materials 宣布计划于 2024 年 7 月在沙乌地阿拉伯建造一家新的石墨阳极工厂,专注于电动车领域。该合资企业投资超过2.8亿美元,凸显了该公司的全球扩大策略。该厂的目标是每年生产2万吨锂离子电池用石墨负极活性材料,加强该地区电动车电池负极市场。

- 同样,随着锂离子生产设备在中东和非洲的普及,负极的需求也会增加。 2024年3月,沙乌地阿美公司和阿布达比国家石油公司合作从油田盐水中提取锂,显示这个海湾国家希望扩大电动车产量和阳极需求。

- 2023年12月,深圳雷米科技发展公司得标尼日利亚联邦电力部和中国生态环境部监督下的1.5亿美元锂离子电池工厂合约。该计划符合非洲「一带一路」倡议的目标以及全球推动气候变迁技术的努力。

- 从历史上看,随着锂离子电池价格暴跌,阳极等相关零件的需求激增。根据彭博社NEF报道,2023年锂离子电池的平均价格将为139美元/kWh,较2014年下降五倍。此次价格下跌预示着未来负极市场将会蓬勃发展。

- 此外,电动车在阿拉伯联合大公国和南非越来越受欢迎。国际能源总署(IEA)指出,2023年这些国家的电动车销量将达到29,980辆,与前一年同期比较成长53.5%。其他地区国家的电动车需求可能会效仿,阳极市场将从中受益。

- 考虑到锂离子电池和阳极的生产趋势,中东和非洲的电动车电池阳极市场有望成长。

阿拉伯联合大公国是最大市场

- 在政府旨在遏制交通部门碳排放的努力的推动下,阿联酋电动交通正在迅速普及。政府雄心勃勃的目标是到 2030 年让 42,000 辆电动车 (EV) 上路,这突显了这项承诺。

- 2024年8月,美国Mullen Automotive与阿联酋Bolt Mobility签署价值约2.1亿美元的合约。根据协议,阿联酋将在2025年终前购买3,000辆1级和3级电动车。电动车的成长预计将增加对电池和阳极等零件的需求,从而刺激市场成长。

- 2024年6月,全电动叫车平台BluSmart进入阿联酋。此举使 BluSmart 成为阿联酋首个 100% 电动高级豪华轿车服务,突显了该国对永续交通的承诺。随着电动车预计将变得更加流行,对电池和阳极等基本部件的需求正在增加。

- 2024 年 5 月,Al Ghurair Motors 与欧洲製造商 TAM-Europe 建立经销商合作伙伴关係,专注于电动商用车。这项合作不仅突显了 Al Ghurair Motors 对阿联酋 2050 年净零排放目标的承诺,也预示着更绿色的交通格局和蓬勃发展的电动车电池阳极市场。

- 阿联酋的电动车销量正在上升。国际能源总署的资料显示,2023年阿联酋电动车销量为28,900辆,与前一年同期比较增长了53%,增幅惊人。鑑于这种势头,电动车的需求以及电动车电池负极市场可能会大幅成长。

- 随着这些新兴市场的发展,电动车电池负极市场预计在未来几年将大幅成长。

中东和非洲电动车电池负极产业概况

中东和非洲电动车电池负极市场正走向半固体。主要企业(排名不分先后)包括 ICTC Egypt、Total Solution Industries LLC、Panasonic Holdings Corp、Targray 和 NMT Electrodes。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 至2029年市场规模及需求预测(单位:十亿美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府支持电动车引进的措施

- 锂离子电池价格下降

- 抑制因素

- 该地区存在参与企业

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 铅酸电池

- 锂离子电池

- 其他电池类型

- 材料

- 锂

- 石墨

- 硅

- 其他的

- 地区

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 卡达

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- ICTC Egypt

- NMT Electrodes

- Panasonic Holdings Corp

- Total Solution Industries LLC

- Gamma Anode

- Zinc Egypt

- TAQAT Development

- NextSource

- Emirates Global Aluminium

- Targray

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 负极材料的研发

简介目录

Product Code: 50003752

The Middle-East And Africa Electric Vehicle Battery Anode Market size is estimated at USD 1.81 million in 2025, and is expected to reach USD 3.43 million by 2030, at a CAGR of 13.67% during the forecast period (2025-2030).

Key Highlights

- In the medium term, government policies and investments are likely to boost the adoption of electric vehicles, subsequently driving the market.

- Conversely, the market's growth may be stunted by the limited involvement of companies in anode manufacturing within the region.

- Ongoing research and development in anode materials present promising growth opportunities for the market.

- During the study's focus period, the United Arab Emirates is projected to dominate the electric vehicle battery anode market in the Middle East and Africa.

Middle-East And Africa Electric Vehicle Battery Anode Market Trends

Lithium-ion Batteries to Dominate the Market

- Lithium plays a crucial role in manufacturing batteries for electric vehicles (EVs). As the key ingredient in rechargeable lithium-ion batteries, lithium's high energy density facilitates extended driving ranges. Recently, the Middle East and Africa have seen a surge in lithium-ion manufacturing units, particularly for battery components like anodes.

- For example, in July 2024, NextSource Materials announced plans for a new graphite anode plant in Saudi Arabia, focusing on the electric vehicle sector. With an investment exceeding USD 280 million, this venture highlights the company's global expansion strategy. The plant aims to produce 20,000 tonnes of graphite anode active material annually, specifically for lithium-ion batteries, bolstering the region's electric vehicle battery anode market.

- Similarly, as lithium-ion manufacturing units proliferate in the Middle East and Africa, the demand for anodes is set to rise. In March 2024, Saudi Aramco and the Abu Dhabi National Oil Company teamed up to extract lithium from oilfield brine, signaling Gulf states' ambitions in electric vehicle production and the growing anode demand.

- In December 2023, SHENZEN LEMI Technology Development Company, with oversight from Nigeria's Federal Ministry of Power and China's Ministry of Ecology and Environment, secured a deal for a USD 150 million lithium-ion battery plant in Nigeria. This project aligns with the Belt and Road Initiative's goals in Africa and global efforts to advance climate technology.

- Historically, as lithium-ion battery prices have plummeted, the demand for related components like anodes has surged. Bloomberg NEF reported the average lithium-ion battery price in 2023 at USD 139 USD/kWh, marking a fivefold drop since 2014. This price decline suggests a buoyant future for the anode market.

- Furthermore, electric vehicle adoption has been on the rise in the United Arab Emirates and South Africa. The International Energy Agency noted that 2023 saw electric car sales in these nations hit 29,980 units, a 53.5% leap from the prior year. With other regional countries likely to follow suit in EV demand, the anode market stands to benefit.

- Given the trends in lithium-ion batteries and anode production, the electric vehicle battery anode market in the Middle East and Africa is poised for growth.

United Arab Emirates to be the Largest Market

- The United Arab Emirates (UAE) is witnessing a swift embrace of e-mobility, bolstered by government initiatives aimed at curbing carbon emissions from the transportation sector. The government's ambitious goal of having 42,000 electric vehicles (EVs) on the roads by 2030 underscores this commitment.

- In August 2024, Mullen Automotive, a US-based firm, sealed a deal worth around USD 210 million with UAE's Volt Mobility. As per the agreement, the UAE is set to purchase 3,000 Class 1 and Class 3 electric vehicles by the end of 2025. This uptick in electric vehicles is poised to drive demand for batteries and components like anodes, fueling the market growth.

- In June 2024, BluSmart, an all-electric ride-hailing platform, made its entry into the UAE. This move establishes BluSmart as the UAE's first-ever 100% electric, premium limousine service, highlighting the nation's commitment to sustainable transport. The anticipated rise in electric vehicle adoption will drive demand for batteries and essential components like anodes.

- In May 2024, Al Ghurair Motors forged a dealership partnership with European manufacturer TAM-Europe, centering on electric commercial vehicles. This alliance not only emphasizes Al Ghurair Motors' commitment to the UAE's 2050 net-zero emissions goal but also heralds a greener transportation landscape and a thriving market for electric vehicle battery anodes.

- Electric vehicle sales in the UAE have been on an upward trajectory. Data from the International Energy Agency reveals that 2023 saw sales of 28,900 electric cars in the UAE, marking a staggering 53% jump from the prior year. Given this momentum, the demand for electric vehicles-and by extension, the electric vehicle battery anode market-is poised for significant growth.

- Given these developments, the electric vehicle battery anode market is set for a robust surge in the coming years.

Middle-East And Africa Electric Vehicle Battery Anode Industry Overview

The Middle East and Africa Electric Vehicle battery anode market is semi-consolidated. Some of the major players (not in particular order) include ICTC Egypt, Total Solution Industries LLC, Panasonic Holdings Corp, Targray, and NMT Electrodes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government policies supporting adoption of electric vehicles

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Presence of limited players in the Region

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead Acid Batteries

- 5.1.2 Lithium-ion Batteries

- 5.1.3 Other Battery Types

- 5.2 Material

- 5.2.1 Lithium

- 5.2.2 Graphite

- 5.2.3 Silicon

- 5.2.4 Others

- 5.3 Geography

- 5.3.1 Saudi Arabia

- 5.3.2 South Africa

- 5.3.3 United Arab Emirates

- 5.3.4 Nigeria

- 5.3.5 Egypt

- 5.3.6 Qatar

- 5.3.7 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ICTC Egypt

- 6.3.2 NMT Electrodes

- 6.3.3 Panasonic Holdings Corp

- 6.3.4 Total Solution Industries LLC

- 6.3.5 Gamma Anode

- 6.3.6 Zinc Egypt

- 6.3.7 TAQAT Development

- 6.3.8 NextSource

- 6.3.9 Emirates Global Aluminium

- 6.3.10 Targray

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Research & Development in anode material

02-2729-4219

+886-2-2729-4219