|

市场调查报告书

商品编码

1636496

海上钻机 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Offshore Drilling Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

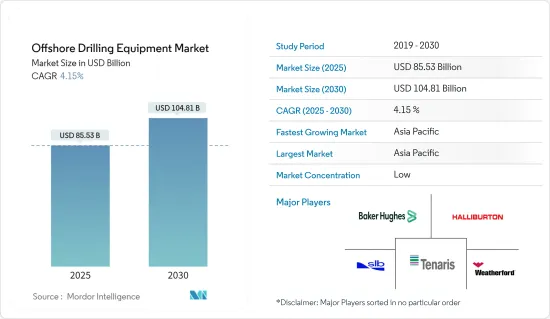

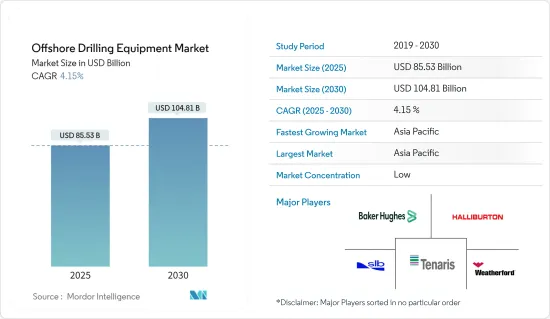

预计2025年海上钻机市场规模为855.3亿美元,2030年将达1,048.1亿美元,预测期间(2025-2030年)复合年增长率为4.15%。

主要亮点

- 从中期来看,海上石油和天然气探勘活动的增加、天然气需求的成长以及天然气基础设施的新兴市场预计将推动市场发展。

- 然而,清洁能源技术的日益普及可能会阻碍未来几年的市场成长。

- 已开发市场和新兴市场尚未开发的石油和天然气潜力可能为市场提供重大机会。

- 在所有地区中,由于中国和印度等国家增加对石油和天然气上游产业的投资,亚太地区可能会主导市场。

海洋钻孔机市场趋势

钻机作为重要板块

- 配备先进工具和机械的钻机对于在海底打井以开采宝贵的石油和天然气蕴藏量至关重要。这些结构主要在传统陆上钻井不可行的海上运作。

- 在全球石油和天然气需求快速成长的推动下,海上钻油平臺市场正在持续成长。随着陆上蕴藏量的减少,勘探正在进一步扩展到海洋水域。公司正在巴西、墨西哥湾和西非等拥有大量未开发蕴藏量的地区大力投资海上计划。

- 2024年3月,全球钻机数量从上月的958台增加到971台。由于全球公司在离岸领域的投资增加,预计这种成长将持续下去。

- 钻机设计的最新技术进步集中在提高自动化、效率和安全性。自动化钻井系统减少了对体力劳动的依赖,提高了安全性,并限制了人为错误。此外,预测维修系统透过利用资料分析和即时监控来帮助操作员预测设备故障,从而最大限度地减少停机时间。

- 例如,阿布达比国家石油公司(ADNOC)于2024年7月订单了三座价值7.33亿美元的岛屿钻机订单。这些钻机将加强位于阿拉伯联合大公国海岸的扎库姆油田的运作。 ADNOC Drilling 与宏华集团 (HH) 合作建造了这些技术先进的钻机。此次伙伴关係旨在在这些下一代设备的设计和营运中利用人工智慧、数位化和最尖端科技。

- 随着全球能源需求的成长,海上钻探市场前景依然乐观。然而,该行业正在努力应对日益严格的环境法规,这些法规要求钻机遵守更严格的排放气体和安全标准,使操作复杂化并增加成本。儘管存在这些挑战,深海探勘仍将在未来的石油发现中发挥关键作用。

- 鑑于全球能源需求的快速增长以及易于获取的陆上蕴藏量的枯竭,钻井钻机将在未来的海上石油和天然气探勘中发挥至关重要的作用。由于技术进步以及深海和超深海新蕴藏量的发现,市场呈上升趋势。

亚太地区主导市场

- 由于积极进军海上油气探勘和生产,中国的海上钻机市场正处于大幅扩张的边缘。随着中海油和中石化等国有巨头大力投资海上企业,特别是在南海,对先进钻井技术和设备的需求将会激增。

- 近年来,中国投入了大量资源来加强其海上钻探基础设施、技术和专业知识。 2023年5月,1.2万吨级巨型海上油气钻探平臺完工,实现突破。该平台是中国渤中19-6天然气田的组成部分,该气田将成为中国东部第一个大型互联天然气田,蕴藏量超过惊人的1000亿立方米。

- 2024年9月,中国海油在中国沿海超深水碳酸盐岩首次成功,实现了天然气探勘的里程碑。中海油透露,在位于珠江口盆地的超深水荔湾4-1构造中钻探了一口天然气井。该井在测试期间显示出令人印象深刻的产量,每天生产 43 万立方米天然气。

- 为了加强专属经济区内的海洋探勘,印度政府推出了旨在吸引外资的措施。印度政府推出了旨在吸引外资加强其专属经济区内海上探勘的措施,孟买高区块和克里希纳戈达瓦里盆地成为海上钻探的黄金地点。印度有着明确的雄心,正如《印度 2025 年碳氢化合物愿景》中所详述的。

- 为了吸引海上钻探领域的投资,印度政府推出了一系列政策改革。开放土地许可政策 (OALP) 和碳氢化合物勘探和许可政策 (HELP) 等着名措施不仅简化了许可流程,还为企业提供了更大的灵活性。这些经过深思熟虑的改革旨在重振浅水和深水特许权的探勘和生产活动。

- 透过开发这些新兴市场,该地区有望在未来一段时间内引领市场。

海洋钻机产业概况

海上钻机市场已减少一半。主要参与企业(排名不分先后)包括 Baker Hughes Co、Schlumberger NV、Weatherford International PLC、Halliburton Company 和 Tenaris SA。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 海上石油和天然气探勘活动增加

- 天然气需求增加和天然气基础设施发展

- 抑制因素

- 采用更清洁的替代燃料

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 类型

- 钻机

- 钻探平臺

- 钻头

- 页岩振动筛

- 防喷器

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 挪威

- 欧洲其他地区

- 亚太地区

- 印度

- 中国

- 马来西亚

- 泰国

- 印尼

- 越南

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 埃及

- 奈及利亚

- 卡达

- 南非

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Schlumberger NV

- Weatherford International PLC

- Baker Hughes Co

- Halliburton Company

- Tenaris SA

- Transocean Ltd.

- Nabors Industries Ltd.

- Vallourec SA

- Aker Solutions ASA

- Stabil Drill

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 已开发市场和新兴市场尚未开发的石油和天然气潜力

简介目录

Product Code: 50003775

The Offshore Drilling Equipment Market size is estimated at USD 85.53 billion in 2025, and is expected to reach USD 104.81 billion by 2030, at a CAGR of 4.15% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing offshore oil and gas exploration activities and growing demand for natural gas and developing gas infrastructure are expected to drive the market.

- However, increasing adoption of clean energy technology is likley to hinder the market growth in the upcoming years.

- Untapped oil and gas potential in developed and emerging market is likley to create significant opportunities for the market.

- Among all the regions, Asia-Pacific is likley to dominate the market due to increasing investment in the oil and gas upstream sector by countries like China and India.

Offshore Drilling Equipment Market Trends

Drilling Rig as a Significant Segment

- Drilling rigs, equipped with advanced tools and machinery, are pivotal in drilling wells on the ocean floor to extract valuable oil and gas reserves. These structures predominantly operate in offshore locations, where traditional land-based drilling proves unfeasible.

- The offshore drilling rig market has witnessed consistent growth, fueled by a surging global demand for oil and gas. As onshore reserves dwindle, exploration ventures deeper into more remote waters. Regions like Brazil, the Gulf of Mexico, and West Africa, boasting vast untapped reserves, have seen companies pour significant investments into offshore projects.

- In March 2024, the global drilling rig count rose to 971, up from 958 the previous month. This uptick is anticipated to continue, driven by escalating investments from global companies in the offshore sector.

- Recent technological strides in drilling rig design emphasize heightened automation, efficiency, and safety. Automated drilling systems have diminished the reliance on manual labor, bolstering safety and curtailing human error. Moreover, predictive maintenance systems leverage data analytics and real-time monitoring, enabling operators to anticipate equipment failures, thus minimizing downtime.

- For instance, in July 2024, Abu Dhabi National Oil Company (ADNOC) secured a USD 733 million contract for three island drilling rigs. These rigs will bolster operations at the Zakum oil field, situated off the coast of the United Arab Emirates (UAE). ADNOC Drilling collaborated with Honghua Group (HH) for the construction of these technologically advanced rigs. This partnership aims to leverage AI, digitization, and cutting-edge technology in designing and operating these next-generation units.

- As global energy demand escalates, the market outlook for offshore drilling remains optimistic. However, the industry grapples with tightening environmental regulations, mandating rigs to adhere to stringent emissions and safety standards, complicating operations and inflating costs. Despite these challenges, deepwater exploration is poised to play a significant role in future oil discoveries.

- Given the surging global energy demand and the depletion of easily accessible onshore reserves, drilling rigs are set to play a pivotal role in the future of offshore oil and gas exploration. With technological advancements and the discovery of new reserves in deep and ultra-deep waters, the market is on an upward trajectory.

Asia Pacific to Dominate the Market

- China's offshore drilling equipment market is on the brink of significant expansion, driven by the country's aggressive foray into offshore oil and gas exploration and production. With state-owned behemoths like CNOOC and Sinopec investing heavily in offshore ventures, particularly in the South China Sea, the appetite for advanced drilling technologies and equipment is set to surge.

- In recent years, China has poured substantial resources into bolstering its offshore drilling infrastructure, technology, and expertise. A landmark achievement came in May 2023, with the completion of a colossal 12,000-tonne offshore oil and gas drilling platform. This platform is instrumental to China's Bozhong 19-6 gas field, marking eastern China's inaugural major interconnected gas field, and flaunting reserves surpassing a staggering 100 billion cubic meters.

- In September 2024, CNOOC achieved a milestone in natural gas exploration, marking its inaugural success in ultra-deepwater carbonate rocks off China's coastline. CNOOC revealed the drilling of a natural gas well in the ultra-deepwater Liwan 4-1 structure, nestled in the Pearl River Mouth Basin. The well showcased an impressive output, producing 430,000 cubic meters of natural gas per day during testing.

- To enhance offshore exploration within its exclusive economic zone, the Indian government has introduced policies aimed at attracting foreign investments. Prime offshore drilling locales encompass the Mumbai High Field and the Krishna-Godavari Basin. As detailed in the India Hydrocarbon Vision 2025, there's a clear ambition: to assess the entirety of India's sedimentary expanse, both onshore and offshore.

- In a concerted effort to lure investments into the offshore drilling sector, the Indian government has rolled out a suite of policy reforms. Highlighted initiatives, such as the Open Acreage Licensing Policy (OALP) and the Hydrocarbon Exploration and Licensing Policy (HELP), have not only streamlined the licensing process but also bestowed companies with greater operational flexibility. These calculated reforms aim to rejuvenate exploration and production activities across both shallow and deepwater blocks.

- Given these developments, the region is poised to lead the market in the foreseeable future.

Offshore Drilling Equipment Industry Overview

The offshore drilling equipment market is semi-fragmented. Some key players (not in particular order) are Baker Hughes Co, Schlumberger NV, Weatherford International PLC, Halliburton Company, and Tenaris S.A, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, until 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Offshore Oil and Gas Exploration Activities

- 4.5.1.2 Growing Demand for Natural Gas and Developing Gas Infrastructure

- 4.5.2 Restraints

- 4.5.2.1 Adoption of Cleaner Alternatives

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Drilling Rig

- 5.1.2 Drilling Platforms

- 5.1.3 Drill Bits

- 5.1.4 Shale Shakers

- 5.1.5 Blowout Preventers

- 5.1.6 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Spain

- 5.2.2.3 NORDIC Countries

- 5.2.2.4 Turkey

- 5.2.2.5 Russia

- 5.2.2.6 Norway

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Malaysia

- 5.2.3.4 Thailand

- 5.2.3.5 Indonesia

- 5.2.3.6 Vietnam

- 5.2.3.7 South Korea

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 Egypt

- 5.2.5.4 Nigeria

- 5.2.5.5 Qatar

- 5.2.5.6 South Africa

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Schlumberger NV

- 6.3.2 Weatherford International PLC

- 6.3.3 Baker Hughes Co

- 6.3.4 Halliburton Company

- 6.3.5 Tenaris S.A

- 6.3.6 Transocean Ltd.

- 6.3.7 Nabors Industries Ltd.

- 6.3.8 Vallourec SA

- 6.3.9 Aker Solutions ASA

- 6.3.10 Stabil Drill

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Untapped oil and gas potential in developed and emerging markets

02-2729-4219

+886-2-2729-4219