|

市场调查报告书

商品编码

1636592

中东和非洲 AS/RS:市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle East And Africa Automated Storage And Retrieval System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

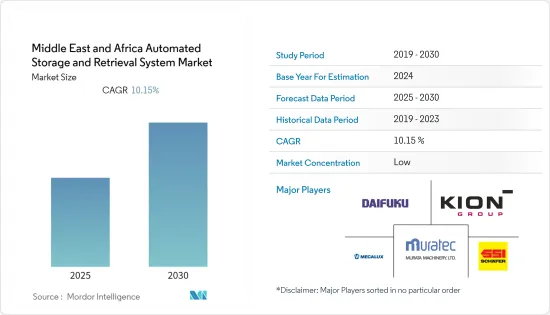

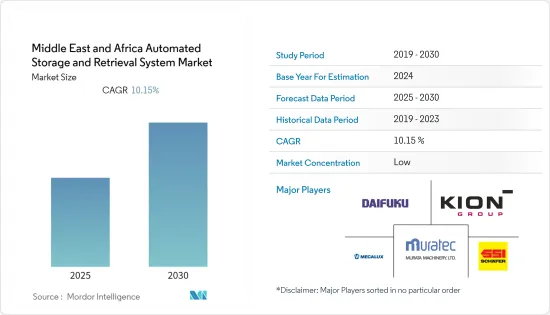

预计中东和非洲的 AS/RS(自动储存和检索)市场在预测期内的复合年增长率将达到 10.15%。

主要亮点

- AS/RS 系统部署在仓库和配送站,用于识别和拾取选定的货物进行处理。由于企业每天要处理大量订单,因此对快速且有效率的作业系统的需求日益增长。

- 此外,公司正在实施先进的自动化系统来取代人力并提高系统效率。因此,AS/RS 系统在这些应用中越来越受欢迎。随着亚马逊、eBay、阿里巴巴等许多公司大力投资电子商务,ASRS 市场预计也将实现健康成长。

- 沙乌地阿拉伯的汽车工业仍处于起步阶段。作为 2030 愿景改革计画的一部分,我们目前正致力于开发汽车製造城市。预计此举将增加对 AS/RS 硬体的需求。利用这些系统的停车解决方案专注于高效利用停车位,预计在预测期内将在该地区变得更加普及。

- 以色列也正在成为汽车製造商的热点。此外,福特和雷诺-日产在该地区建立了专业中心,以增强其自动驾驶能力。预计此举将促进对 AS/RS 设备的需求。

- 此外,UniPay、PayPal等更便捷的跨境付款方式也促进了电商平台的交易。可靠、便利的跨境贸易和电子商务的蓬勃发展,使得消费者放弃了实体店购物。因此,线上零售市场正在扩大,各公司正在大力投资改进其技术。仓库和配送站已经成为电子商务领域的关键点,因为物流在网路零售中扮演关键角色。

中东和非洲的 AS/RS(自动化仓库)市场趋势

食品和饮料预计将占据较大的市场占有率

- 特别是在食品和饮料行业,集中製造和产品分销到全球的趋势日益明显,导致了大型仓储和配送中心的出现。消除污染风险、降低人事费用和追踪生产资料是食品和饮料产业使用 AS/RS 的主要驱动力。

- 此外,该行业正在积极使用码垛解决方案来降低处理成本并改善处理。使用 AS/RS 有助于库存管理。此外,该地区的各食品分销公司正在采用 AS/RS(自动化仓库)。

- 推动 AS/RS 市场发展的另一个因素是它们能够提供警报,通知用户库存时间过长且可能即将到期的产品。此通知功能由 AS/RS 提供的库存管理软体实现,使企业能够透过消除浪费实现更具成本效益的营运。

- 2020年10月,Swisslog为杜拜一家饮料公司完成了整个AS/RS(自动化仓库)的建置。两家公司表示,自从实施资料驱动的物流ASRS 以来,Mai Dubai 的生产和储存能力提高了一倍,同时也降低了人事费用。

- 此外,2020年7月,阿联酋最大的消费合作社Union Coop开设了Coop Factory,这是中东最大的货物仓库之一,以及销售食品和非食品产品的批发分店。该仓库和 UnionCo-op分店的总建筑面积约为 424,442 平方英尺。该设施配备了最先进的现代化技术,以确保产品库存永续,满足不同情况下的所有需求。预计这些发展将推动食品和饮料行业的 ASRS 进一步成长。

预计南非将占据主要市场占有率

- 南非是非洲大陆最大的经济体之一。此外,预计该地区的行业和製造单位数量的增加将推动对自动化的需求。

- 此外,非洲内部贸易正在成长。非洲国家签署了名为「非洲大陆自由贸易区」(AfCFTA)的贸易协定,允许取消 90% 商品的关税,逐步实现服务贸易自由化,并解决一系列其他非关税壁垒。预计此类协议将增加对自动化的需求,以简化货物管理。

- 南非是非洲的主要旅游目的地,该国正在大力投资机场建设,使其成为中东和非洲地区规模最大、成长最快的机场产业。南非的三座机场——开普敦机场、德班机场和约翰尼斯堡国际机场——被认为是世界上最好的机场。

- 此外,零售业是需要传送带的主要行业之一,因为分类至关重要。它尤其可以帮助线上零售商对产品进行分类并提高配送效率。此外,零售商也正在采用该技术来处理最后一哩路的交付。

- 此外,电子商务公司的快速成长以及大型仓库储存多种类型产品的需要,导致了零售业对 AS/RS(自动化仓库)的需求庞大。由于电子商务占据了该国消费者的很大一部分,因此预计将推动 AS/AR 的成长。

中东和非洲 AS/RS(自动化仓库)产业概况

由于初始投资较高,中东和非洲的 AS/RS(自动化仓库)市场集中度较高。少数几家大公司主导市场,包括DAIFUKU CO. LTD.、村田机械有限公司、凯傲集团和 Mecalux SA。这些占据了绝对市场份额的大公司正致力于扩大海外基本客群。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。然而,随着技术进步和产品创新,中小企业透过赢得新合约和开拓新市场来扩大其市场占有率。

- 2020 年 10 月 - 随着对线上杂货服务的需求不断增长,在杜拜设有办事处的仓库自动化和软体供应商 Swisslog 与德克萨斯州圣安东尼奥的 HEB 合作,以加速该公司的线上履约。支持越来越多的Swisslog 正在与 HEB 合作部署多个自动化微型仓配中心,以支援该连锁店的路边取货和送货业务。

- 2020 年 3 月 - Böhmer 集团推出新型 BG Sorter Compact CB,这是一款更灵活且占地面积更小的交叉带式分类机。我们的分类和分销技术系列的这一新发展优化了性能和产品生命週期成本。这是由智慧软体和资料分析的可能性确保的。此分选机易于整合、运作能耗低、精度高。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场动态

- 市场驱动因素

- 更加重视职业安全

- 对人事费用的担忧日益加剧

- 市场限制

- 需要熟练劳动力,并担心体力劳动替代

- COVID-19 市场影响

第六章 市场细分

- 依产品类型

- 固定通道系统

- 旋转木马(水平旋转木马+垂直旋转木马)

- 垂直升降模组

- 按最终用户产业

- 飞机场

- 车

- 饮食

- 一般製造业

- 邮政和小包裹

- 零售

- 其他最终用户产业

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 以色列

- 南非

- 其他中东和非洲地区

第七章 竞争格局

- 公司简介

- Daifuku Co. Ltd

- Schaefer Systems International Pvt Ltd

- KION Group AG

- Murata Machinery Ltd

- Mecalux SA

- Honeywell Intelligrated Inc.

- KUKA AG

- Knapp AG

- Kardex AG

- Toyota Industries Corporation

- Viastore Systems GmbH

第八章投资分析

第九章:市场的未来

The Middle East And Africa Automated Storage And Retrieval System Market is expected to register a CAGR of 10.15% during the forecast period.

Key Highlights

- AS/RS systems are deployed in warehouse and delivery stations to identify and retrieve the selected goods for processing. With companies handling many orders daily, the need for fast and efficient operating systems is on the rise.

- Moreover, companies are deploying advanced automated systems to replace human labor and improve the efficiency of the systems. Thus, AS/RS systems are finding growing demand in these applications. With many companies such as Amazon, eBay, and Alibaba investing heavily in e-commerce, the market for ASRS is also expected to grow at a healthy rate.

- The Saudi Arabian automotive industry is still in the nascent stage. Currently, it is developing a car manufacturing city as a part of the 2030 Vision reform plan. This move is expected to increase the demand for AS/RS hardware. Parking solutions using these systems are expected to gain more traction in the region over the forecast period, focusing on efficient parking space use.

- Israel is also emerging as a hotspot for automotive manufacturers. Further, Ford and Renault-Nissan set up specialized centers in this region to enhance their capabilities in autonomous driving. This move is expected to increase the demand for AS/RS equipment.

- Furthermore, more convenient cross-border payments methods like UniPay and PayPal have also boosted the transactions on the e-commerce platforms. With such reliable and convenient cross-border transactions and the boom of e-commerce, consumers have reduced their patronage of brick-and-mortar stores for shopping. This results in the expansion of the online retail market, and companies are thus investing heavily to improve the technology. With logistics playing a significant part in online retail, warehouse and delivery stations are crucial points in the e-commerce segment.

MEA Automated Storage & Retrieval System Market Trends

Food and Beverages is Expected to Hold Significant Market Share

- The growing trend of single-point manufacturing with a global supplier of products, especially in the food and beverage industries, has led to the advent of large-scale storage and distribution centers. The eliminated contamination risk, reduced labor costs, and tracking manufacturing data are some of the major drivers for the usage of AS/RS in the food and beverage industry.

- Moreover, the industry aggressively uses palletizing solutions to reduce handling costs and improve handling. The use of AS/RS helps in handling inventories. Further, various food distribution companies embrace automatic storage and retrieval systems (AS/RS) in the region.

- Another factor pushing the market for AS/RS is their ability to provide alert capabilities that notify the user about a product kept in the inventory for too long and possibly reaching its expiration date. The notification function is enabled by the inventory management software available with the AS/RS, and it allows the companies to achieve cost-effective operations by reducing wastage.

- In October 2020, Swisslog completed constructing a fully automated storage and retrieval system (ASRS) for a drinks company in Dubai. Following implementing the data-driven intralogistics ASRS, Mai Dubai has benefited with a double production, storage capacity, and reduced labor costs, as stated by the companies.

- Moreover, in July 2020, Union Coop, the largest consumer cooperative in the UAE, opened 'Coop Factory' - one of the largest commodity warehouses in the Middle East and its wholesale branch to sell food and non-food commodities. The total area of the warehouse and the Union Coop branch is around 424,442 sq ft. The facility is equipped with the best modern technology to secure a sustainable commodity stock that meets all needs in different circumstances. All such developments are expected to increase the growth of ASRS in the industry's food and beverages industry.

South Africa is Expected to Account For Significant Market Share

- South Africa is one of the largest economies on the African continent. Moreover, the increasing number of industries and manufacturing units is expected to drive the demand for automation in the region.

- Further, the Intra-Africa trade is on the rise. African countries signed a trade agreement called the African Continental Free Trade Area Agreement (AfCFTA), which permitted countries to remove tariffs on 90% of goods, progressively liberalize trade in services, and address a host of other non-tariff barriers. These kinds of agreements are expected to increase the need for automation to easier the management of goods.

- Being a major tourist attraction in Africa, South Africa is investing heavily in airports and is the single largest and fastest-growing segment in the MEA. Three South African Airports, Cape Town, Durban, and Johannesburg's international airports, were considered the best airports globally.

- Moreover, Retail is one of the significant industries requiring conveyors, and sortation is essential. It especially helps online retailers to sort goods and increase good delivery efficiency. Furthermore, retail companies are also adopting this technology to perform last-mile delivery.

- Additionally, the rapid growth of e-commerce companies, which maintain large warehouses for numerous types of products, created a massive demand for automated storage and retrieval systems in the retail industry. E-commerce is expected to drive the growth for AS/AR, as it constitutes a significant portion of the consumers in the country.

MEA Automated Storage & Retrieval System Industry Overview

The automated storage and retrieval system market in the Middle East and Africa are moderately concentrated due to higher initial investments. It is dominated by a few significant players like Daifuku Co. Ltd, Murata Machinery Ltd, KION Group AG, and Mecalux SA. With a prominent share in the market, these considerable players are focusing on expanding their customer base across foreign countries. These companies are leveraging strategic collaborative initiatives to increase their market share and increase their profitability. However, with technological advancements and product innovations, mid-size to smaller companies are growing their market presence by securing new contracts and tapping new markets.

- October 2020 - As demand for online grocery services continues to accelerate, Swisslog, a warehouse automation and software provider having its local office in Dubai, has partnered with H-E-B in San Antonio, Texas, to support the company's growing demand for online fulfillment. Swisslog is working with H-E-B to deploy several automated micro-fulfillment centers to support the chain's curbside pick-up and delivery business.

- March 2020 - BEUMER Group presented a new compact cross-belt sorter named BG Sorter Compact CB, which is more flexible with a tight footprint. This newly developed system from the sortation and distribution technology range optimizes performance and product life-cycle costs. This is ensured by the intelligent software and the possibility of data analysis. The sorter is easy to integrate and operates with low energy consumption and high precision.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Emphasis on Workplace Safety

- 5.1.2 Increasing Concerns about Labor Costs

- 5.2 Market Restraints

- 5.2.1 Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 5.3 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Fixed Aisle System

- 6.1.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 6.1.3 Vertical Lift Module

- 6.2 By End-User Industry

- 6.2.1 Airports

- 6.2.2 Automotive

- 6.2.3 Food and Beverage

- 6.2.4 General Manufacturing

- 6.2.5 Post and Parcel

- 6.2.6 Retail

- 6.2.7 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Israel

- 6.3.4 South Africa

- 6.3.5 Rest of Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Daifuku Co. Ltd

- 7.1.2 Schaefer Systems International Pvt Ltd

- 7.1.3 KION Group AG

- 7.1.4 Murata Machinery Ltd

- 7.1.5 Mecalux SA

- 7.1.6 Honeywell Intelligrated Inc.

- 7.1.7 KUKA AG

- 7.1.8 Knapp AG

- 7.1.9 Kardex AG

- 7.1.10 Toyota Industries Corporation

- 7.1.11 Viastore Systems GmbH