|

市场调查报告书

商品编码

1636604

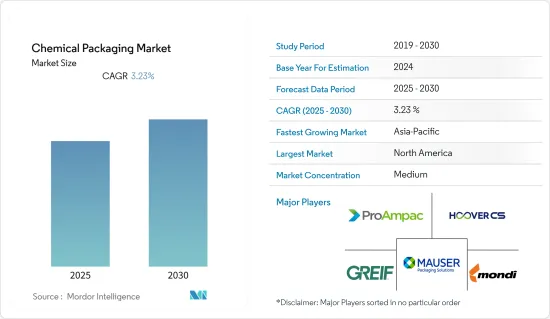

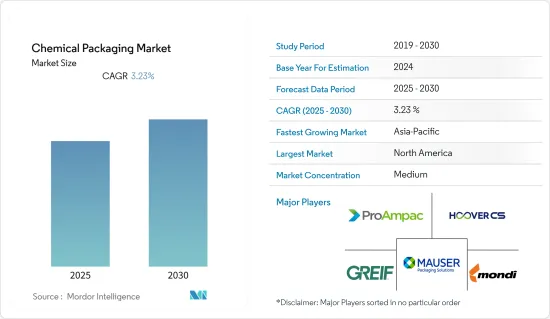

化学包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Chemical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计化学包装市场在预测期内复合年增长率为3.23%

主要亮点

- 化学产品销售的增加预计将增加全球透过传统和线上零售商对化学包装的需求。此外,化学品包装桶和中型散装容器(IBC)的需求正在增加,因为它们可以修復和重复使用,市场预计将扩大。

- 此外,各个地区都在专注于对化学品包装实施严格的监管。考虑到危险品国际运输的ADR欧洲协议,在其有关此类包装的规定中表达了为危险品选择适当包装的重要性,并且IBC和大型包装均规定不得损害或显着削弱危险品物质,不得催化反应。随着人们对包装中常用化学物质(例如双酚 A (BPA) 和全氟烷基物质和多氟烷基物质 (PFAS))的环境和健康影响的认识不断增强,欧盟 (EU) 和美国预计将制定更严格的法规将在未来几年内实施。这导致该地区化学品行业对强大包装解决方案的需求增加。

- 一些新包装满足了安全问题并列出了更环保的足迹。传统上,许多化学品製造商使用桶和桶来运输他们的产品。儘管这些产品与竞争材料相比具有多种优势,但新产品填补了市场上巨大的永续性空白。例如,盒中袋和工业散装容器每个包装可容纳更多产品,并且折迭式,从而减少垃圾掩埋场和运输成本。

- 中型散装容器 (IBC) 是桶的替代品,不仅用于需要安全处理的产品,还用于 3 类、4 类、5 类和 9 类危险材料、可食用液体和润滑剂等产品。工业,因为它可以安全地运输各种固体或液体产品,包括油和精油等其他化学物质。

- 由于公众越来越了解化学品包装在降低化学品洩漏造成的死亡和财产损失风险方面的优势,该市场正在不断扩大。快速的都市化、全球化和现代化也是推动成长的因素。

- 然而,不断变化的监管标准、原材料成本的波动、废物量的增加以及环境废弃物法规的收紧预计将阻碍一些化学包装产品的市场成长。

- 根据美国工业理事会 -19 的数据,有机化学品、无机化学品、塑胶树脂、合成橡胶和人造纤维等基础化学品在疫情初期全球产量增加了 1.4%。然而,特种化学品生产受到严重打击,第一波疫情期间全球产量下降了11.2%,特别是被覆剂等特种化学品,下降了25.2%。

化工包装市场趋势

材料进步可减轻重量并使用永续产品

- 由于世界各地对塑胶包装废弃物的日益关注,纸袋和生物分解性的袋子比塑胶袋和袋子更受青睐。这种情况促使各国政府采用生物分解性包装等替代来源。美国人口仅占全球的 4%,但排放的都市固态废弃物(MSW) 却占全球的 2%。此外,据估计,美国每人每年排放约 106.2 公斤塑胶废弃物。

- 在一些地区,新冠疫情促使各行业的企业重新使用一次性塑胶袋,而不是采用可重复使用的塑胶袋。结果,更多的化学公司停止使用可重复使用的容器,各州也开始暂时取消对塑胶购物袋的禁令。

- 向永续包装解决方案的快速转变进一步激励袋子供应商以创新方式列出用于工业应用的可回收和可持续袋子。例如,埃克森美孚提供各种高性能聚乙烯聚合物,包括埃奇得 XP 和埃克森美孚 HDPE,为差异化的可持续重型袋子解决方案创造了机会。

- 此外,波兰也是中东欧重要的化学工业国家。根据中央统计局统计,波兰化工产业僱用了约30万人,占波兰全部工业就业人数的11%。在波兰化学工业的发展中,未来波兰最大的突破是精製、石化和塑胶加工业的发展。这些趋势可能会导致对袋子和麻袋的需求增加。

- 此外,根据波兰中央统计局的数据,去年纸袋和麻袋的产量约为16.2万吨,比上年的约15.5万吨增加了4.52%。产值的增加表明纸袋和麻袋作为可持续的选择而受到青睐。

- 关注产品对环境的影响是既定的现象。人们对永续性的兴趣重新燃起,并明确关注包装。它反映在国家和地方政府的法规、消费者态度以及透过包装传达的品牌所有者的价值观中。随着永续性成为消费者的重要动力,品牌越来越重视能够体现其对环境承诺的包装材料和设计。

亚太地区占主要市场占有率

- 在亚太地区,由于工业发展、外国直接投资(FDI)增加和外汇升值,市场将扩大。此外,中国、印度等多个国家注重化学产品的生产和消费,增加了该地区化学包装材料的需求和消费。

- 中国对钢桶和中型散货箱(IBC)的需求受到贸易活动支出增加和化学品包装需求增加的推动。例如,中国的化学工业是全世界最收益的。过去二十年,该产业贡献了全球化工市场成长的一半,也是中国经济快速成长的重要推手。

- 危险化学品储存和运输过程中发生的事故数量不断增加,预计将进一步推动中型散货箱和钢桶的消费,因为它们被认为是安全的包装解决方案。此外,对防止化学品造成的健康风险以及在洩漏或浸出时暴露于外部环境的解决方案的需求不断增长,继续推动该地区的市场成长。

- 此外,随着全球化学工业格局的变化,中国预计将透过技术创新和贸易来引领化学工业进入下一个发展阶段,从而在国际市场上获得优势。

化工包装行业概况

化学包装市场竞争适中,由多个全球和地区参与企业组成。这些参与企业拥有重要的市场占有率,并致力于在全球范围内扩大基本客群。这些参与企业专注于研发活动、策略联盟以及其他有机和无机成长策略,以在预测期内保持在市场环境中。

2022 年 11 月,Greif, Inc. 签订了一项具有约束力的协议,收购 Lee Container Corporation, Inc.。 Lee Container Corporation, Inc. 主要在化学品领域生产高性能阻隔容器和传统吹塑成型容器。 Lee的收购加强了公司在油桶和小塑胶瓶领域的扩张力度,为公司带来了新的成长引擎。

2022 年 8 月,Mauser Packaging Solutions 宣布继续扩大 Infinity 系列的产品生产范围,同时投资于促进循环经济的机械和软体。最近,该公司投资了一台新型多层塑胶桶机,以加速其 Infinity 系列塑胶桶产品线中回收树脂的使用。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对化学包装市场的影响

- 工业和製造业活动下降的影响

- 因应高成长市场的供给方挑战

- 部分地区贸易活动变化

- 与区域市场相关的宏观经济因素等

- 涵盖主要市场化工产业的现况与成长轨迹

- 化学包装领域的关键创新与进步

第五章市场动态

- 市场驱动因素

- 工业设施中对固定式中型散装容器的需求不断增长,推动了需求的成长

- 工业和製造业活动的復苏预示着市场成长

- 材料进步可减轻重量并使用永续产品

- 市场问题

- 由于依赖原物料价格而导致价格波动

- 加强环境废弃物法规

第六章 市场细分

- 依产品类型

- 袋/麻袋

- 中型散装容器(IBC)

- 桶和桶

- 柔性IBC及相关软包装产品

- 其他的

- 按用途

- 通用化学品

- 特种化学品

- 石化

- 其他用途(高级化学品等)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Grief Inc.

- Mauser Packaging Solutions

- Mondi Group

- ProAmpac

- Environmental Packaging Technologies

- Hoover CS

- ALPLA-Werke Alwin Lehner GmbH & Co. KG

- SolvChem Custom Packaging

- Bulk-Pack Group

- LC Packaging Group

- Brainerd Chemicals Group

第八章投资分析

第9章市场的未来

The Chemical Packaging Market is expected to register a CAGR of 3.23% during the forecast period.

Key Highlights

- The increasing sales of chemicals are anticipated to stimulate the need for chemical packaging through traditional and online retailers globally. Additionally, due to their ability to be repaired or reused, the rising demand for drums and intermediate bulk containers (IBCs) in chemical packaging is anticipated to expand the market.

- Moreover, various regions are focusing on imposing stringent regulations for chemical packaging. The ADR European Agreement considering the International Carriage of Dangerous Goods expresses the importance of choosing the right packaging for dangerous goods in its provisions on such packaging, stating that IBCs and large packaging should not be harmed or significantly weakened by such dangerous goods and should not catalyze a reaction. As awareness of the environmental and health effects of commonly used chemicals in packaging, such as bisphenol-A (BPA) and per- and polyfluoroalkyl substances (PFAS), grows, the European Union and the United States are expected to enforce stricter regulations in the upcoming years. This drives the requirement for robust packaging solutions in the chemicals sector of the region.

- Several new packages satisfy the safety concerns and provide a greener footprint. Traditionally, many chemical manufacturers have used pails and drums to transport their products. While these products have several benefits over competitive materials, new products satisfy a significant market sustainability gap. For instance, bag-in-box and industrial bulk containers allow for more product-per-package and are collapsible, reducing landfill space and transportation costs.

- Intermediate bulk containers (IBCs), which are an alternative to drums, are particularly well suited to the chemical industry because they can safely transport a variety of solid or liquid products, including those that require safe handling as well as those that are classified as hazardous, like classes 3, 4, 5, and 9, as well as other chemicals, like edible liquids, lubricating, and essential oils.

- The market is expanding due to growing public knowledge of the advantages of chemical packaging, which lowers the risk of deaths and asset damage from chemical leaks. Rapid urbanization, globalization, and modernization are additional elements that promote growth.

- However, changing regulatory standards, fluctuations in raw material costs, growing waste levels, and increasing environment wastage regulations are expected to hamper some chemical packaging products' market growth.

- According to the American Chemistry Council, basic chemicals, including organic chemicals, inorganics chemicals, plastic resins, synthetic rubber, and manufactured fibers, witnessed a global production increase of 1.4% during the initial phases of the pandemic and have not seen a substantial impact due to COVID-19. However, the production of specialty chemicals took a significant hit as the global output declined by 11.2%, and especially for specialty chemicals, such as coatings, the show fell by 25.2% during the first wave of the pandemic, which negatively affected the usage of packaging in the specialty chemicals segment.

Chemical Packaging Market Trends

Material Advancements have Led to Lighter Weight Alternatives and Use of Sustainable Products

- Paper and biodegradable sacks are preferred over plastic sacks or bags due to the increasing concern over plastic packaging waste generated worldwide. The circumstances have led to governments adapting to alternative sources such as biodegradable packaging. The United States accounts for only 4% of the world's population and generates 2% of global Municipality Solid Waste (MSW). It is also stated that the United States produces about 106.2 kg of plastic waste per person per year.

- In some regions, COVID stimulated companies from various industries to bring back single-use plastic bags rather than accept reusable ones, mainly due to single-use plastics' ability to reduce the risk of potential viral transmission. Hence, an increasing number of chemical companies have suspended reusable containers, and states have begun to rescind plastic bag bans temporarily.

- The rapid shift toward sustainable packaging solutions further stimulates sack providers to innovate and provide recyclable or sustainable sacks for industrial purposes. For instance, ExxonMobil offers a range of performance PE polymers, including Exceed XP and ExxonMobil HDPE, among other products, to create several opportunities for differentiated, sustainable, heavy-duty sack solutions.

- Furthermore, Poland can be called a significant country in the chemical industry in Central and Eastern Europe. According to the Central Statistical Office, the chemical sector in Poland employs around 300,000 people, which accounts for 11% of employment in the entire industry within Poland. The most significant breakthrough in developing the chemical industry in Poland, which awaits the country in the coming years, is the development of refining, petrochemical, and plastics processing industries. Such a trend may lead to more demand for bags and sacks.

- Moreover, according to the Central Statistical Office of Poland, last year, the production of paper bags and sacks was valued at around 162,000 metric tons, a 4.52% rise in the output from the previous year, which was valued at about 155,000 metric tons. The increasing production value indicates the preference for bags and sacks made of paper as a sustainable option.

- Concern over the environmental impact of products is an established phenomenon. There has been a revived interest in sustainability explicitly focused on packaging. It is reflected in central government and municipal regulations, consumer attitudes, and brand owner values communicated via packaging. As sustainability has become a key motivator for consumers, brands increasingly focus on packaging materials and designs that show their environmental commitment.

Asia Pacific to hold significant market share

- The market will expand in the region due to rising industrial development, increasing foreign direct investment (FDI), and rising exchange rates. Additionally, several nations, like China and India, are concentrating more on manufacturing and consuming chemicals, increasing the demand for and consumption of chemical packaging materials in this region.

- The demand for steel drums and intermediate bulk containers (IBCs) in China is driven by increasing spending on trade activities and growing demand for chemical packaging. For instance, China's chemical industry has been the largest globally, given revenue generation. The sector has contributed to half of the growth of the world chemical market over the past two decades and has played an essential impetus in China's high economic growth.

- The growing incidents of storage and transportation of hazardous chemicals are further expected to foster the consumption of IBC and steel drums as they are perceived as safe packing solutions for such products. Additionally, the health risks posed by chemicals upon leakage and leaching, followed by the demand for a solution that prevents exposure to the external environment, continue to rise, driving the market's growth in the region.

- Moreover, with the landscape of the chemical industry changing globally, China is expected to drive its chemical industry to the next stage of development by taking the lead by leveraging technology innovation and trade and prevailing in the international market.

Chemical Packaging Industry Overview

The chemical packaging market is moderately competitive and consists of several global and regional players. These players account for a considerable market share and focus on expanding their client base worldwide. These players focus on R&D activities, strategic alliances, and other organic and inorganic growth strategies to stay in the market landscape over the forecast period.

In November 2022, Greif, Inc. entered into a binding agreement to acquire Lee Container Corporation, Inc., for a purchase price of USD 300 million, excluding tax benefits, with an estimated net present value of roughly USD 30 million. Lee Container Corporation, Inc. manufactures high-performance barrier and conventional blow-molded containers, primarily in the chemicals segment. The Lee purchase strengthens its dedication to expanding the jerrycan and small plastic bottle footprint and gives its company a new growth engine.

In August 2022, Mauser Packaging Solutions announced that the company continues expanding the number of items it can produce under the Infinity Series while investing in machinery and software that promote the circular economy. The business most recently invested in a new multi-layer plastic drum machine to facilitate the usage of recycled resin in the company's Infinity Series plastic drum product line.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Chemical Packaging Market

- 4.4.1 Effect of Decline in Industrial and Manufacturing Activity

- 4.4.2 Supply-side Challenges in Catering to High-growth Markets

- 4.4.3 Changes in Trade Activity in a Few Regions

- 4.4.4 Macro-economical Factors Pertinent to Regional Markets, Among Others

- 4.5 Coverage on the Current Scenario and Growth Trajectory of the Chemicals Sector in the Major Markets

- 4.6 Key Innovations and Advancements in the Chemical Packaging Domain

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Fixed IBC's in Industrial Establishments to Drive Demand

- 5.1.2 Recovery in Industrial and Manufacturing Activity Augurs Well for the Market Growth

- 5.1.3 Material Advancements have Led to Lighter Weight Alternatives and Use of Sustainable Products

- 5.2 Market Challenges

- 5.2.1 Price Variance due to Dependence on Raw Material Prices

- 5.2.2 Rising Environmental Wastage Regulations

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bags and Sacks

- 6.1.2 Intermediate Bulk Containers (IBC)

- 6.1.3 Pails and Drums

- 6.1.4 Flexible IBCs and Related Flexible Packaging Products

- 6.1.5 Other Product Types

- 6.2 By Application

- 6.2.1 Commodity Chemicals

- 6.2.2 Specialty Chemicals

- 6.2.3 Petrochemicals

- 6.2.4 Other Applications (Advanced Chemicals, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Grief Inc.

- 7.1.2 Mauser Packaging Solutions

- 7.1.3 Mondi Group

- 7.1.4 ProAmpac

- 7.1.5 Environmental Packaging Technologies

- 7.1.6 Hoover CS

- 7.1.7 ALPLA-Werke Alwin Lehner GmbH & Co. KG

- 7.1.8 SolvChem Custom Packaging

- 7.1.9 Bulk-Pack Group

- 7.1.10 LC Packaging Group

- 7.1.11 Brainerd Chemicals Group