|

市场调查报告书

商品编码

1636605

亚太地区分散式天线系统 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Asia-Pacific Distributed Antenna System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

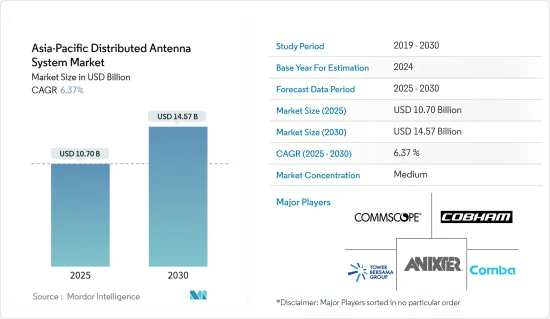

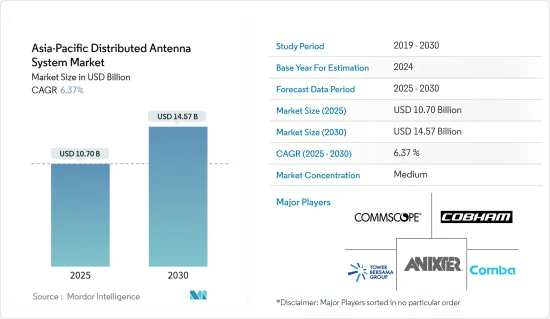

亚太地区分散式天线系统市场规模预计到2025年为107亿美元,预计到2030年将达到145.7亿美元,预测期内(2025-2030年)复合年增长率为6.37%。

DAS 的采用率已显着提高,并且与单天线系统相比具有多种优势。然而,这是透过引入高成本和复杂系统来实现的。然而,DAS 正在多个地区使用,以帮助企业获得其应用程式所需的覆盖范围。

主要亮点

- 分散式天线系统已存在多年,但无线网路在建筑物内的持续部署以及智慧家庭和连网型设备中的潜在应用加速了 Masu 系统的市场推出。

- 此外,DAS和小型基地台是新的5G通讯标准中预计部署的核心基础设施之一。透过在建筑物内安装DAS,可以增强建筑物内的无线讯号。在许多情况下,体育场馆和企业场所等大型设施将越来越多地采用这些解决方案。

- 由于住宅和商业设施的增加、政府项目的增加、支持 5G 的智慧型手机的增加、自带设备的普及以及企业移动性的改善,预计该市场将会成长。

- DAS 解决方案的成本因时间和范围而异。例如,用于同时检查行动电话覆盖范围的无源 DAS 价格低廉,可能只需几百到几千美元。然而,用于增强一个或多个行动服务供应商网路的室内覆盖范围的有源 DAS 的成本较高。

- COVID-19 的爆发推迟了 5G 在各个地区的推出,但与此同时,为了满足对更快连接解决方案的需求激增,该技术变得更加重要。疫情期间,通讯基础设施部署和需求预计将大幅增加。疫情过后,公共互联需求增加,市场蓬勃发展。

亚太地区分散式天线系统市场趋势

对公共连结的需求不断增长推动市场成长

- 公共网路对于保护高层建筑、隧道、购物中心、停车场、机场等场所的人员至关重要。分散式天线系统 (DAS) 系统标准在过去十年中透过国家、州和地方立法显着扩展。

- 此外,法律法规以及国际规范委员会和国家消防协会制定的新公共建筑规范要求公共建筑如中继器、双向放大器和主动DAS等内部无线解决方案的需求不断增加

- 整合系统不仅具有较低的实施成本,而且蜂窝和公共DAS 之间也存在自然的互动。此外,安装单独的单元将比整合的方法占用更多的空间。 2023年2月,全球无线解决方案供应商京信通讯系统控股有限公司宣布推出基地台。京信通讯在整个产品生命週期中融入绿色低碳设计原则,提供先进的直升机馈电绿色天线,帮助营运商实现全球碳中和目标。

- 波束成形和 MIMO 等 DAS 的快速发展有望提高通讯速度。音讯会议不会断线或延迟,您可以立即连线而不会受到任何干扰。该地区还存在一些伙伴关係和合作,为进一步的技术进步铺平了道路。例如,诺基亚和中国移动联合开发了这款5G低成本混合分散式室内系统来应对这些挑战。此智慧室内覆盖系统利用诺基亚 5G Pico 远端无线电头端系统、被动 DAS 天线和低功耗蓝牙 (BLE) 技术。与传统的纯被动 DAS 系统相比,此新解决方案还降低了实施成本,同时提供比 DAS 更高的容量。该地区的 5G 连接也在迅速增长。据 GSMA 称,5G行动连线的网路份额预计将从 2022 年的 4% 增长到 2030 年的 41%。

中国可望主导亚太分散式天线系统市场

- 随着智慧型手机的高使用率以及 AR/VR、自动驾驶和每台智慧型手机的分散式天线系统流量等 5G 服务的快速采用,中国将在亚太分散式天线系统 (DAS) 市场占据主导地位。

- 该地区的 DAS 市场预计将受到网路用户数量增加、行动资料流量成长以及致力于改善通讯基础设施以满足消费者无缝连接需求的政府机构数量增加的推动。

- 各国政府也正在介入,共用通讯业者的持有 ,并确保所有通讯业者的消费者能够在任何需要的地方获得所需的频宽。这些新技术正在该全部区域广泛采用。

- 此外,医疗保健、工业和组织对室内分散式天线系统的日益接受度预计将成为中国室内分散式天线系统市场的推动力。此外,智慧型手机的日益普及也是该地区室内分散式天线系统需求的主要驱动力。

- 根据CNNIC统计,2022年12月中国网民规模与前一年同期比较增加3,500万人。超过10亿人上网,中国约75.6%的人口使用网路。渗透率是指能够使用某种通讯媒介的人口百分比。截至 2023 年 1 月,全球平均网路普及率为 64.4%。中国的网路普及率也高于亚太国家的平均。

亚太地区分散式天线系统产业概况

亚太地区分散式天线系统市场为半固体市场,主要企业包括 Anixter, Inc.、Cobham PLC、CommScope Inc.、PT Tower Bersama Infrastructure TBK 和 Comba Telecom Systems Holdings Ltd.。市场参与企业正在采取伙伴关係和收购等策略来增强其产品供应并获得可持续的竞争优势。

2023年3月,京信通讯系统控股公司旗下的京信网路系统公司被中国移动香港(CMHK)选中,为Lawsgroup We的关键技术资产KTR 350开发、建设和开发5G室内覆盖系统。 。 KTR 350是一栋位于香港观塘道350号的全新29层智慧商业大厦,总占地面积达20万平方呎。这是中国移动香港与Lawsgroup战略合作的首个大型计划。随着Comba ComFlex Pro分散式天线系统(DAS)解决方案的推出,Lawsgroup可以扩展和增强KTR350的5G室内网路覆盖范围,同时满足所有先进的系统标准。

2022 年 12 月,康普宣布采用基础设施经销商计划,这是其新服务供应商通路合作伙伴计画的第一个组成部分。经销商计划透过提供经销商专用工具、教育材料和客户发展机会来表彰康普长期通路合作伙伴。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 公共互联需求增加

- 相容于多个通讯和最新技术

- 市场问题

- 升级成本高

第六章 市场细分

- 按类型

- 室内数据采集系统

- 户外数据采集系统

- 按国家/地区

- 中国

- 日本

- 韩国

- 其他亚太地区

第七章 竞争格局

- 公司简介

- Anixter, Inc.

- Cobham PLC

- CommScope Inc.

- PT Tower Bersama Infrastructure TBK

- Comba Telecom Systems Holdings Ltd

- PT MAC Sarana Djaya

- Boingo Wireless Inc

- American Tower Corporation IP LLC.

- Bird Technologies

第八章投资分析

第9章 未来展望

The Asia-Pacific Distributed Antenna System Market size is estimated at USD 10.70 billion in 2025, and is expected to reach USD 14.57 billion by 2030, at a CAGR of 6.37% during the forecast period (2025-2030).

The DAS adoption rate has increased dramatically, providing several advantages over single antenna systems. However, this is achieved at a higher cost and by deploying a complicated system. However, DAS is used across various areas to enable businesses to get the coverage necessary for applications.

Key Highlights

- Although distributed antenna systems have existed for many years, the increased deployment of wireless networks within buildings with potential applications across smart homes and connected devices has encouraged the implementation of DAS systems increasingly in the market.

- Also, DAS and small cells are one of the core infrastructures upon which the new 5G communication standard is expected to be deployed. DAS can be installed in buildings to boost wireless signals inside them. Often, large facilities, such as stadiums or company premises, are expected to adopt these solutions for the upcoming technology increasingly.

- Due to an increase in residential structures and commercial facilities, a growing number of government programs, an increase in 5G-enabled smartphones, the popularity of Bring Your Device, and more enterprise mobility encourage, the market to grow.

- The cost of a DAS solution varies based on the time and range. For example, passive DAS used to identify the coverage of cellular carriers simultaneously is at the lower end and may cost only a couple of hundreds or thousands of dollars; however, active DAS used for enhancing in-building coverage of one or more mobile service provider networks comes at higher costs.

- The COVID-19 outbreak delayed the 5G deployment in various regions, and the importance of the technology gained traction during the time to cope with the surge in demand for faster connectivity solutions. The deployment and demand for telecommunication infrastructure were expected to boost during the pandemic significantly. Post-pandemic, the market grew rapidly with increased demand for public security connectivity.

APAC Distributed Antenna System Market Trends

Increase in Demand for Public Security Connectivity Drives the Market Growth

- High-rise buildings, tunnels, shopping malls, parking garages, and airports, among others, all have public safety networks vital to people's protection. The DAS( Distributed Antenna System) system standard has seen tremendous national, state, and local law expansion in the last decade.

- Furthermore, legislative regulations and new public safety building norms enacted by the International Code Council and the National Fire Protection Association drive demand for in-building wireless solutions for public safety, including repeaters, bidirectional amplifiers, and active DAS.

- The converged system is not only less expensive to deploy, but it also has natural interaction between cellular and public safety DAS. Furthermore, installing separate units would take up more room than an integrated approach. February 2023, Comba Telecom Systems Holdings Limited, a global wireless solutions provider, introduced its Green Base Station Antenna product series, offered by the new and innovative Helifeed Platform, which significantly increased antenna energy efficiency and optimized antenna energy consumption. Comba Telecom provides forward-thinking Helifeed Green Antennas to help operators achieve global carbon neutrality objectives, with green and low-carbon design principles embedded throughout the product life cycle.

- The communication speed would increase due to rapid advancements in DAS, such as Beamforming and MIMO. There are no choppy or lagging conference calls - connect instantly without interruption. The region also has several partnerships and collaborations, paving the way for further technological evolution. For instance, Nokia and China Mobile have jointly developed this 5G low-cost hybrid distributed indoor system to meet these challenges. The smart indoor coverage system leverages the Nokia 5G Pico Remote Radio Head system, passive DAS antennas, and Bluetooth Low Energy (BLE) technology. This new solution also reduces deployment costs compared to the traditional passive-only DAS systems while delivering greater capacity than DAS. The 5G connections are also increasing rapidly in this region. According to GSMA, 5G mobile connections were estimated to grow from a network share of 4% in 2022 to 41% by 2030.

China is Expected to Dominates the Asia Pacific Distributed Antenna System Market

- Because of its high smartphone usage and early adoption of 5G services in AR/VR, autonomous driving, and distributed antenna system traffic per smartphone, China dominates the Asia Pacific distributed antenna system (DAS) market.

- The DAS market in the region would be driven by the growing number of internet subscribers, increased mobile data traffic, and the increasing emphasis of government offices on improving telecommunications infrastructure to meet consumers' need for seamless connectivity.

- Even the government has stepped in to ensure that telecommunications providers share DAS held by them, ensuring that all operators' consumers have access to the required bandwidth everywhere. These new technologies are widely adopted throughout the region.

- Furthermore, the growing acceptance of indoor distributed antenna systems in the healthcare and industrial verticals and organizations would likely propel the China indoor distributed antenna systems market. Aside from this, the increasing popularity of smartphones is one of the significant driving demands for indoor distributed antenna systems in this region.

- According to CNNIC, China's internet population grew by 35 million in December 2022 compared to a year ago. Over one billion people had internet access, and about 75.6 percent of the Chinese population used the internet. The penetration rate denotes the share of the population that has access to a certain communication medium. The global average internet penetration rate was 64.4 percent as of January 2023. Internet penetration in China has also been above the average rate in Asia Pacific Countries.

APAC Distributed Antenna System Industry Overview

The Asia Pacific distributed antenna system market is semi-consolidated with the presence of major players like Anixter, Inc., Cobham PLC, CommScope Inc., PT Tower Bersama Infrastructure TBK, and Comba Telecom Systems Holdings Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In March 2023, Comba Network Systems, a division of Comba Telecom Systems Holdings, was selected by China Mobile Hong Kong (CMHK) to develop, construct, and provide a 5G interior coverage system for Lawsgroup's key technological property, KTR 350. KTR 350 is a new 29-story smart commercial building with a gross floor space of 200,000 square feet situated at 350 Kwun Tong Road in Hong Kong. It is the first major project under the strategic cooperation between CMHK and Lawsgroup. The deployment of the Comba ComFlex Pro Distributed Antenna System (DAS) Solution would allow Lawsgroup to extend and enhance the 5G indoor network coverage for KTR350 while meeting all advanced system criteria.

In December 2022, CommScope announced the introduction of its Infrastructure Distributor Program, the first component of its new Service Provider Channel Partner Program. The Distributor Program honors long-standing CommScope channel partners by giving distributor-specific tools, instructional materials, and client growth opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Demand for Public Security Connectivity

- 5.1.2 Supports Multiple Telecom Carriers and Upcoming Technologies

- 5.2 Market Challenges

- 5.2.1 High Cost to Upgrade

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Indoor DAS

- 6.1.2 Outdoor DAS

- 6.2 By Country

- 6.2.1 China

- 6.2.2 Japan

- 6.2.3 South Korea

- 6.2.4 Rest of Asia Pacific

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Anixter, Inc.

- 7.1.2 Cobham PLC

- 7.1.3 CommScope Inc.

- 7.1.4 PT Tower Bersama Infrastructure TBK

- 7.1.5 Comba Telecom Systems Holdings Ltd

- 7.1.6 PT MAC Sarana Djaya

- 7.1.7 Boingo Wireless Inc

- 7.1.8 American Tower Corporation IP LLC.

- 7.1.9 Bird Technologies