|

市场调查报告书

商品编码

1636610

北美程序化广告:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Programmatic Advertisement - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

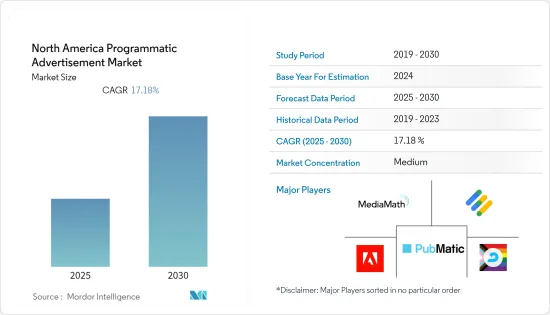

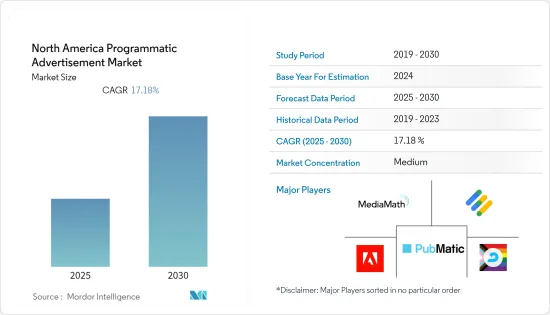

预测期内,北美程序化广告市场预计将以 17.18% 的复合年增长率成长。

主要亮点

- 广告商期望他们使用的广告技术具有更好的效能和功能。内容发布者和品牌拥有者可以使用程式化广告来搜寻和应用相关讯息,从而提高受众户外数位广告体验的价值和效能。

- 只有十分之一的北美行销专业人士完全了解程序化广告。为了满足该行业的快速成长,对人才的需求不断增加。

- 随着品牌和代理商努力应对不断变化的需求和内部程式化广告技术,技能短缺可能会持续很长一段时间。例如,由于这项令人兴奋的技术进步,程序化电视很快将需要更多专业人才和培训。

- 此外,随着社交网路和其他线上串流媒体服务的扩张,影片在过去几年中实现了稳步增长。自 2015 年以来,加拿大数位市场的影片广告成长了 6 倍以上。根据《霍华德商业评论》报道,到 2022 年,影片预计将首次超过其他传统数位展示广告支出。预计到 2022年终,近 75% 的数位广告影片将以程式化方式购买。

- 此外,美国AI 企业 SaaS 广告平台 ALFI 在 2021 年开展的一项研究发现,使用自动化和机器学习技术购买数位广告并即时向细分受众展示的数位广告预计将在未来几年内大幅增长。 。

- 程序化广告提供了多种好处,包括即时洞察广告宣传的有效性、增强的定位能力、更高的广告库存透明度、提高预算利用率和有效的广告诈骗管理,所有这些都在推动市场的发展。然而,对程序化广告支出缺乏了解预计将在预测期内阻碍行业成长。

- IAB 的分析显示,3 月第一波疫情来袭时,各大品牌一夜之间削减了高达 30% 的支出,四分之一的公司完全停止了活动。结果许多人预测这次危机将比2008年的金融危机严重得多。随着 2020 年接近年终,大多数企业都在减少广告支出,有些甚至停止了广告支出。

北美程序化广告市场趋势

行动普及率上升推动市场

- 数位广告是某些数位平台将资料收益的主要方式之一。全球数位平台持续巩固其在北美等市场的中流砥柱地位。

- 根据联合国贸易和发展会议《2021年数位经济报告》,到2022年,数位广告支出预计将成长到所有媒体广告支出的60%,几乎是2013年的两倍。到那时,预计五大数位平台将占所有数位广告支出的 70% 以上。

- 到 2026 年,5G行动资料流程量预计将超过 4G 及更老的技术。由于高效率的网路、高阶的用户设备、以及价格合理的庞大资料包,北美和欧洲的资料消费量超过全球其他地区,而5G技术的全球行动订阅率却很低。

- 根据GSMA行动经济报告,北美的用户渗透率预计到2021年将达到84%,预计2025年将达到85%。同时,据报道,2021 年智慧型手机普及率将达到 82%,预计到 2025 年将达到 85%。行动装置普及率的成长促使北美许多程序化广告公司采用行动广告,因为其覆盖范围更广。

5G、AI 和 ML 等技术的采用可望扩大市场

- 机器学习AI演算法比非AI演算法更适合程式化广告的即时环境。大型资料集也可以被人工智慧系统快速处理。综合起来,这些因素将决定人工智慧如何影响程式化广告的许多方面。

- 包括 MediaMath 和 Xandr 在内的市场公司正在推测一系列可能性,包括人工智慧如何根据消费者资料调整竞标策略,并帮助负责人为他们想要赢得的广告资源选择合适的竞标价格。程序化广告具有许多优势,因此对其非常感兴趣。这将提高您的投资报酬率并降低您的广告成本。

- 透过将竞标限制在最合格的竞标,人工智慧还可以帮助识别更有可能在可用广告空间中成功的广告商。对出版商来说,这是一个优势。

- 根据GSMA行动经济报告,在北美,2G和3G网路普及率分别为3%和6%。到2021年,4G占比将达到78%,5G占比将达到13%。到2025年,预计5G将占总量的63%,4G占31%,2G占2%,3G占4%。

北美程序化广告产业概况

北美程序化广告市场相当分散,由几位大型参与者组成。 PubMatic、MediaMath、Google Ad Manager、Adobe Advertising Cloud 和 AdRoll 等在市场上占有较大份额的主要参与者正专注于透过采用各种技术来扩大基本客群。

- 2021 年 10 月 - 总部位于美国的PubMatic 和Semasio 以无缝整合买方和卖方受众及情境定位的统一定位而闻名,两家公司已合作为媒体买家提供用户和页面级别的受众可寻址性。宣布扩大伙伴关係关係,将使我们能够提高

- 2021 年 11 月-总部位于纽约的 MediaMath 将其需求端平台 (DSP) 与 IBM Watson Advertising Weather Targeting 集成,以提高数位广告的准确性和有效性,同时遵守新的隐私标准。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业相关人员分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 新冠疫情对国内程序化广告市场的影响

第五章 市场动态

- 市场驱动因素

- 数位媒体推动广告成长

- 人工智慧和机器学习的广泛应用推动了程序化广告

- 智慧型手机日益普及

- 市场挑战

- 程式化广告技能短缺

- 与 RTB 相关的风险,例如缺乏对生态系统的了解 个人资料的处理

第六章 市场细分

- 按交易平台

- 即时竞价(RTB)

- 私人市场担保

- 自动保固

- 固定利率

- 按广告媒介

- 数字显示

- 行动显示器

- 按公司规模

- 中小型企业

- 大型企业

第七章 竞争格局

- 公司简介

- PubMatic, Inc.

- MediaMath

- Google Ad Manager

- Adobe Advertising Cloud

- AdRoll

- Amobee, Inc.

- Xandr

- The Trade Desk

- Magnite, Inc.

- Digital Remedy

第八章投资分析

第九章:未来市场展望

简介目录

Product Code: 91404

The North America Programmatic Advertisement Market is expected to register a CAGR of 17.18% during the forecast period.

Key Highlights

- Advertisers expect better performance and capabilities from the advertising technology they use. Content publishers and brand owners may utilize programmatic advertising to locate and apply the relevant messages to improve the value and effectiveness of a viewer's digital out-of-home advertising experience.

- Only one in ten marketing specialists in North America fully comprehends programmatic advertising. To keep up with this industry's rapid growth, there is a steady rise in the demand for qualified talent.

- As companies and agencies grapple with shifting needs and internal programmatic advertising technologies, there will be a skills scarcity for a very long time. For instance, programmed TV will soon require more specialist personnel and training as a result of this exciting technological advancement.

- Further, with the expansion of social networks and other online stream services, videos have shown the steady growth over the past years. Canadian digital market has witnessed a more than six-fold increase in video ads since 2015. In 2022, video is predicted to overcome other traditional digital display spend for the first time,according to Harward Business Review . It is estimated that nearly 75% of digital ad video will be bought programmatically by the end of 2022.

- Moreover, the use of automation and machine learning technology to purchase and show digital advertisements to segmented audiences in real-time is projected to climb drastically over the next three years, according to research conducted in 2021 from ALFI, a US based AI enterprise SaaS advertising platform.

- Programmatic advertising provide various benefits, including real-time insights into the effectiveness of ad campaigns, enhanced targeting capabilities, increased transparency on ad inventory, improved budget usage, and effective ad fraud management, all of which help drive the market. On the other hand, a lack of understanding of programmatic advertising expenditure is expected to hamper industry growth during the projection period.

- When the first wave of COVID-19 hit in March, according to an IAB analysis, brands cut spending by up to 30% overnight, with one in four suspending activity completely. Many expected that the consequences will be far worse than the financial crisis of 2008. As approached to the end of 2020, the majority of businesses have cut, or in some cases, ceased, their advertising expenditures.

North America Programmatic Advertisement Market Trends

Increased Mobile Penetration Drives the Market

- Digital advertising is one of the primary ways that certain digital platforms monetise their data. Global digital platforms have kept strengthening their position as the market's main force including North America.

- As per UNCTAD Digital Economy Report 2021, digital advertising spending is anticipated to increase to 60% of all media advertising spending by 2022, which is about twice as much as it was in 2013. By then, it's anticipated that the top five digital platforms would account for more than 70% of all digital advertising spending.

- By 2026, it is predicted that 5G mobile data traffic would outpace that of 4G and older technologies. Due to their efficient networks, high-end user devices, and reasonably priced huge data packages, North America and Europe consume more data globally than other regions while having lower worldwide mobile subscription rates for 5G technology.

- As per GSMA Mobile Economy Report, in North America, subscriber penetration in 2021 was reported to be 84% and is anticipated to 85% in 2025. While smartphone adoption in 2021 was reported as 82% and is anticipated to be 85% in 2025. Such kind of growth in mobile penetration leads most of the North American programmatic companies to adopt mobile advertisement to have greater reach.

Adoption of Technologies such as 5G, AI & ML are anticipated to Grow the Market

- Machine learning AI algorithms are far more suited to the real-time environment of programmatic advertising than non-AI algorithms because they can learn from and modify their behavior in response to new patterns they detect. Large datasets may be processed swiftly by AI systems as well. Together, these elements affect how AI affects many facets of programmatic advertising.

- Companies in the market such as MediaMath, Xandr, etc. show interest in AI for programmatic advertisement due to various benefits such as AI may assist marketers in adjusting their bid strategy in light of consumer data and helping them choose the appropriate bid price for the ad space they wish to acquire. This increases ROI and lowers ad spending.

- By restricting the auction to the most qualified bidders, AI may also assist in identifying which advertisers are more likely to be successful with their offers for the available ad space. This is advantageous to the publishers.

- As per GSMA Mobile Economy Reports, in North America, 2G, 3G network adoption rate shares as 3%, 6% respectively. While 4G holds major share accounted 78% and 5G as 13% in 2021. While it is anticipated that 5G contributes to 63% share followed by 4G with 31% and 2G, 3G with 2%, 4% shares in 2025.

North America Programmatic Advertisement Industry Overview

The North America Programmatic Advertisement market is moderately fragmented and consists of several major players. The major players with a prominent share in the market such as PubMatic, MediaMath, Google Ad Manager, Adobe Advertisement Cloud, AdRoll, etc., are focusing on expanding their customer base across foreign countries through the adoption of various technologies.

- October 2021 - US-based companies PubMatic and Semasio, a prominent player in Unified Targeting which seamlessly combines audience and contextual targeting on the buy- and the sell-side, announced an expanded partnership that enables media buyers to increase audience addressability at a user- and page-level.

- November 2021 - NewYork based MediaMath has integrated its demand-side platform (DSP) with IBM Watson Advertising Weather Targeting to offer increased digital advertising precision and effectiveness while addressing new privacy standards.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness-Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Programmatic Advertising Market in the Country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Digital Media driving Advertisement Growth

- 5.1.2 Increased Adoption of AI and ML drives Programmatic Advertisement

- 5.1.3 Increased penetration of Smart Phones

- 5.2 Market Challenges

- 5.2.1 Lack of Skill in Programmatic Advertisement

- 5.2.2 Risks involved in RTB such as Limited Understanding of Ecosystem Processing Personal Data

6 MARKET SEGMENTATION

- 6.1 By Trading Platform

- 6.1.1 Real Time Bidding (RTB)

- 6.1.2 Private Marketplace Guaranteed

- 6.1.3 Automated Guaranteed

- 6.1.4 Unreserved Fixed-rate

- 6.2 By Advertising Media

- 6.2.1 Digital Display

- 6.2.2 Mobile Display

- 6.3 By Enterprise size

- 6.3.1 SMB's

- 6.3.2 Large Enterprises

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PubMatic, Inc.

- 7.1.2 MediaMath

- 7.1.3 Google Ad Manager

- 7.1.4 Adobe Advertising Cloud

- 7.1.5 AdRoll

- 7.1.6 Amobee, Inc.

- 7.1.7 Xandr

- 7.1.8 The Trade Desk

- 7.1.9 Magnite, Inc.

- 7.1.10 Digital Remedy

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219