|

市场调查报告书

商品编码

1636615

东南亚国协智慧家庭:市场占有率分析、产业趋势、成长预测(2025-2030)ASEAN Smart Homes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

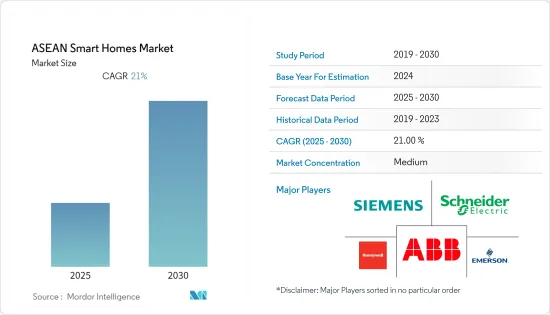

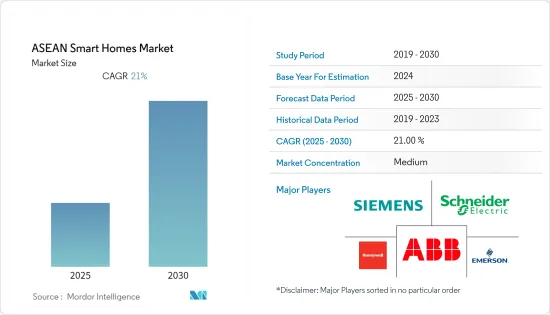

东南亚国协智慧家庭市场预计在预测期内复合年增长率为21%

主要亮点

- 由于远距工作和在家工作的增加,COVID-19 进一步增加了对家庭自动化的需求。东南亚多个城市已形成国家经济救助措施的有效实施管道。由于大规模的社会援助计画需要时间来设计和实施,事实证明,拥有更好数位基础设施的城市在向目标受益者提供救援物资方面相对更有效。

- 此外,由于疫情后对智慧家庭产品的需求增加,一些解决方案提供者的收益增加。 2020 年 5 月,当地厨具品牌 MMX Malaysia 报告称,其销售额在 COVID-19 期间翻了两番。主要需求是烹调器具和调理台。

- 市场上几家现有企业的扩张活动也是推动智慧家庭市场成长的主要因素。智慧家庭生态系统正在快速扩张,亚马逊以约 10 亿美元收购连网门铃和摄影机製造商 Ring 就是一个例子。

- 近年来,随着智慧家庭的出现,视讯监控系统在住宅领域越来越受到关注。本部分介绍的监控系统用于多种目的,包括监控和存取控制。这些系统还包括运动侦测和夜视等功能。

东南亚国协智慧家庭市场趋势

该地区消费者数位教育的增加

- 在东南亚,随着网路使用者数量的增加,数位意识正在迅速提高。不断改善的网路连线网路和数位市场趋势正在影响该地区网路用户的成长。

- 该地区的消费者不熟悉智慧家居,也不知道如何整合它们,因为这是一个全新的范例。人们发现,采用智慧家庭服务的潜在障碍之一是缺乏对智慧家庭技术的足够了解。

- 新加坡等国家透过智慧家庭实现节能的调查(能源政策报告)发现,人们投资智慧技术的主要动机是节能和舒适,其次是安全问题。将感测器整合到灯和扬声器等常见产品中变得越来越普遍,相反,人们期望失去与操作的互动并简化消费者的使用案例,而家用电子电器产品越来越倾向于解决这一问题。

- 根据印尼物联网论坛资料显示,大约嵌入了4亿个感测器设备,其中16%在零售业,15%在医疗产业,11%在保险业,10%在银行和证券业工业、零售、美容、电脑维修业约占8%。约7%用于政府办公,6%用于交通,5%用于公共产业,4%用于房地产、商业和农业服务,其余3%用于住宅。随着工作空间变得数位化,我们希望消费者在家中也能数位化同样的事情。

网路普及率不断上升,政府对整合智慧科技的兴趣日益浓厚

- 政府引进智慧家庭技术的倡议是预测期内推动市场成长的主要趋势之一。在东南亚国协,中国资本正透过大型基础设施计划加速涌入,这些项目主要包含智慧城市元素,如森林城市新山、新克拉克城、新马尼拉湾珍珠城以及泰国东部经济走廊等。中国也对该地区规划的新城镇计划表现出浓厚的兴趣,包括印尼的东加里曼丹新首都和仰光新城。

- 据马来西亚投资发展局 (MIDA) 称,马来西亚政府已开始强制在 2020 年之前使用工业化建筑系统 (IBS),作为推动智慧家庭技术采用的第一步。鼓励投资者利用与智慧家庭技术相关的激励措施,例如投资税收以及电气和电子产品及零件的激励措施。

- 同样,2021 年 7 月,新加坡政府重申致力于继续投资于释放数位革命全部潜力的计划和倡议,并将继续投资于研发以支持该市的技术力。

- 政府的智慧城市措施也推动了智慧家庭市场的成长。胡志明市专注于新技术,力求在 2025 年成为智慧城市。在河内、胡志明市、岘港等越南大城市,智慧公寓正成为欢迎新科技的现代居民的新趋势。施耐德电机在印尼巴淡岛营运智慧工厂,生产电力和 IA 产品,并于 2017 年在越南开设了一家耗资 4,500 万美元的製造工厂,生产智慧家庭的电子产品和布线。

- 同样,泰国也有望成为东南亚国家联盟(ASEAN)10个成员国中第一个在2020年下半年全面商用部署第五代宽频网路(5G)的国家。 5G的出现预计将进一步加速物联网的普及。

- 此外,2020年12月,日本政府宣布计画向日本企业在东南亚地区开发智慧城市计划提供2,500亿日圆资金。目标城市包括河内、胡志明市、雅加达、曼谷、新加坡和吉隆坡。

东南亚国协智慧家居产业概况

目前,东南亚国协的智慧家庭市场较为细分,但竞争十分激烈,全球和参与企业参与企业在争夺该地区的业务一角。主要供应商包括西门子、施耐德、伊顿、LG、索尼、三星和谷歌。

市场的关键驱动力是添加现代技术和客製化以吸引最终用户。供应商主要专注于提供创新产品和解决方案,以优化能源消耗并支援建筑物的高级自动化。伙伴关係和协作在市场上很常见,通常是为了增强产品供应。

- 2020年12月-涂鸦智慧与Near加强伙伴关係,共同开拓新加坡物联网市场。 Near自2018年底开始与涂鸦智慧合作,是新加坡首个由涂鸦支持的官方智慧照明品牌,涂鸦参与了Near产品开发週期的各个方面,从PCB设计到UI定制,已成为必不可少的组成部分。

- 2020 年 11 月 - 大金新加坡与 L3 业务集团签署谅解备忘录,为所有住宅计划开发提供大金智慧解决方案。透过此次伙伴关係,大金新加坡将为该地区的住宅计划提供家庭自动化解决方案,包括私人公寓和着名的公共住宅开发项目,例如新加坡建屋发展局的第一个智慧和永续发展城镇,具有绿色特色和智慧技术的登加镇(Tengah Township)。此次合作也将促使 FIbaro 解决方案在大金的计划中采用。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 重视家庭能源效率

- 安防和照明领域的高需求

- 一体化智慧家庭概念的出现

- 市场限制因素

- 由于市场的性质,智慧家庭产品被认为是便利主导的,而不是由需求主导的。

- 大规模的更换週期和加剧的竞争给製造商带来了挑战。

- 比较分析:东协与其他国家

- 主要相关人员分析

第六章 马来西亚智慧家庭市场

- 目前的市场状况

- 主要市场影响者

- 市场区隔

- 依产品类型

- 照明产品

- 能源管理

- 安全

- 连接性

- 能源管理系统

- 家庭娱乐和智慧家用电子电器

- 依产品类型

- 主要基础指标

- 马来西亚主要产品供应商和系统整合企业发展分析

第七章 泰国智慧家庭市场

- 目前的市场状况

- 主要市场影响者

- 市场区隔

- 依产品类型

- 照明产品

- 能源管理

- 安全

- 连接性

- 能源管理系统

- 家庭娱乐和智慧家用电子电器

- 依产品类型

- 关键指标

- 泰国主要产品供应商和系统整合企业发展分析

第八章 新加坡智慧家庭市场

- 目前的市场状况

- 主要市场影响者

- 市场区隔

- 依产品类型

- 照明产品

- 能源管理

- 安全

- 连接性

- 能源管理系统

- 家庭娱乐和智慧家用电子电器

- 依产品类型

- 主要基础指标

- 在新加坡营运的主要产品供应商和系统整合商分析

第九章 印尼智慧家庭市场

- 目前的市场状况

- 主要市场影响者

- 市场区隔

- 依产品类型

- 照明产品

- 能源管理

- 安全

- 连接性

- 能源管理系统

- 家庭娱乐和智慧家用电子电器

- 依产品类型

- 关键指标

- 印尼主要产品供应商和系统整合商分析

第十章 越南智慧家庭市场

- 目前的市场状况

- 主要市场影响者

- 市场区隔

- 依产品类型

- 照明产品

- 能源管理

- 安全

- 连接性

- 能源管理系统

- 家庭娱乐和智慧家用电子电器

- 依产品类型

- 主要基础指标

- 在越南运营的主要供应商和系统整合商分析

第十一章竞争格局

- 公司简介

- Cisco Systems Inc.

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- Google Inc.

- Samsung Electronics Co. Ltd

- LG Electronics Inc.

- Sony Corporation

- Xiaomi Corporation

- Smart home Indonesia

- Karsyte

- Koble

- Fibaro

- Doorbird

- IBM Corporation

第十二章市场展望

- 投资分析

- 市场机会及未来趋势

The ASEAN Smart Homes Market is expected to register a CAGR of 21% during the forecast period.

Key Highlights

- Covid-19 has further enhanced the demand for home automation due to the growing remote working and work from home scenarios. Several cities in South East Asia witnessed effective implementation channels of nationwide economic relief packages. As large-scale social assistance programs take time to design and deliver, cities equipped with better digital infrastructure were found to be relatively efficient in the targeted delivery of relief to intended beneficiaries.

- Further, several solution providers viewed an increase in revenues owing to the growing demand for smart home products triggered by the pandemic. In May 2020, MMX Malaysia, a local kitchen appliance brand, reported that its sales quadrupled during the COVID-19. The major demand was coming from Cookware and Cooktops products.

- Also, expansion activities of several market incumbents is another major factor driving the growth of the smart homes market. The smart home ecosystem is experiencing rapid expansion, represented by Amazon's acquisition of Ring, a maker of internet-connected doorbells and cameras, for an estimated USD 1 billion.

- The emergence of smart homes has increased the prominence of video surveillance systems in the residential segment in the past few years. The surveillance systems implemented in this sector have varied applications, such as monitoring and access control. These systems are also equipped with features, such as motion detection and night vision.

ASEAN Smart Homes Market Trends

Increasing Digital Education of Consumers in the Region

- Digital awareness is currently developing rapidly in line with the increase of internet users in the Southeast Asian region. The internet connectivity network that continues to improve and the existence of trending digital markets affect internet users' growth in the region.

- Consumers in the region are unfamiliar with smart homes and have little knowledge about how to incorporate them in the smart home sense seeing as smart homes were a totally novel paradigm. One of the possible obstacles to smart home service implementation has been discovered to be insufficient familiarity with smart home technology.

- Research on energy conservation through smart homes in countries like Singapore in an Energy Policy report reflected that people's investments in smart technology were primarily motivated by energy savings and comfort, followed by security concerns. The integration of sensors into common goods such as lamps and speakers has been slowly becoming the norm, in lieu of an increasing tendency for appliances that anticipate a loss of interaction with their operations and work towards simplifying use cases for their consumers.

- According to data from the Indonesian Internet of Things Forum, approximately 400 million sensor devices are embedded, of which 16% are employed in retail, 15% in healthcare, and 11% in insurance, 10% in banking and securities, as well as someof the retail, beauty and computer maintenance industries which around 8%. Also, about 7% in government, 6% in transportation, 5% in public utilities, 4% in real estate and commercial and agricultural services, and the remaining 3% is used for housing. Increasingly digital workspaces are expected to encourage consumers to similarly digitize their homes.

Increasing Internet Penetration Rates, Encouraging Government Interest in the integration of Smart Technology

- The initiatives taken by the government in line with the adoption of smart home technologies are one of the major key trends driving the growth of the market over the forecast period. ASEAN countries have seen a surge in Chinese capital flows through massive infrastructure projects that have significant smart city elements, including Forest City Johor Bahru, New Clark City, New Manila Bay City of Pearl, and Thailand's Eastern Economic Corridor. China has also shown a great interest in the region's newly planned township projects, including Indonesia's new capital city in East Kalimantan and New Yangon City.

- According to the Malaysian Investment Development Authority (MIDA), the Malaysian government initiated mandatory compliance to use Industrialised Building Systems (IBS) by 2020 as the first step to encourage the adoption of smart homes technologies. Investors are encouraged to leverage the incentives related to smart homes technology, such as investment tax allowance, incentives for electrical and electronic products and components.

- On similar lines, in July 2021, the Singapore government reiterated its commitment to continuously invest on projects and initiatives that will unlock the full potential of the digital revolution, injecting about USD 70 million into R&D to support the city's technological capabilities.

- The smart city initiatives by the government is also augmenting the growth of the smart home market. Ho Chi Minh, City is focusing on new technologies to become a smart city by 2025. In big cities of Vietnam as Hanoi, Ho Chi Minh City, and Da Nang, smart apartments are becoming a new trend of modern residents who have welcomed the new technologies. Companies have also invested in developing the studied market in the region, Schneider Electric runs a smart factory in Batam, Indonesia for manufacturing power and IA products and opened a USD 45 million manufacturing plant in Viet Nam for the production of electronic products and wiring for smart homes in 2017.

- Similarly, Thailand is poised to be the first country among the Association of Southeast Asia Nations (ASEAN) ten members states, to roll out the fifth generation of broadband internet (5G) for full commercial use in late 2020. The arrival of 5G will further accelerate the adoption of IoT.

- Furthermore, In December 2020, The Japanese government announced plans to provide JPY 250 billion in funding to Japanese companies to develop smart city projects in the Southeast Asian region. The cities include Hanoi, Ho Chi Minh, Jakarta, Bangkok, Singapore and Kuala Lumpur.

ASEAN Smart Homes Industry Overview

The ASEAN smart homes market is currently fragmented but highly competitive, with the presence of established global and domestic players across the globe vying for a piece of the business in the region. Some major vendors include Siemens, Schneider, Eaton, LG, Sony, Samsung, and Google, among others.

The market is mainly driven by the addition of modern technologies and customizations to attract end-users. Vendors are concentrating primarily on offering innovative products and solutions that can optimize energy consumption and serve a high degree of automation in buildings. Partnerships and collaborations are common in the marketplace, generally to enhance offerings. A few include;

- December 2020 - Tuya Smart and Near strengthened their partnership to enhance the capitalization of the Singapore IoT Market. Near has been working with Tuya Smart since late 2018 and is the first official Singaporean smart lighting brand to be Powered by Tuya, Tuya has been involved in all aspects of Near's product creation cycle from PCB design to UI customization making it an integral component.

- November 2020 - Daikin Singapore signed an MOU with the L3 Business Group in November 2020 to provide Daikin Smart Solution for all residential project developments. The partnership will allow Daikin Singapore to implement Home Automation Solutions for Local Residential Projects in both Private Condominium and Prominent Public Housing Development such as the Singapore's HDB first Smart and Sustainable town, with green features and smart technologies, Tengah Township. The collaboration also ensues the use of FIbaro solutions in Daikin projects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Emphasis on Energy Efficiency Among Households

- 5.1.2 High demand in the Security and Lighting Sector

- 5.1.3 Emergence of the Concept of Integrated Smart Homes

- 5.2 Market Restraints

- 5.2.1 Due to the Nature of The Market, Smart Home-based Products Being Perceived to be Convenience-driven as Opposed to Need Driven

- 5.2.2 Large Replacement Cycles and Growing Competition Pose a Challenge for Manufacturers

- 5.3 Comparative Analysis - ASEAN vs Rest of the World

- 5.4 Key Stakeholder Analysis

6 Malaysia Smart Home Market

- 6.1 Current Market Scenario

- 6.2 Key Market Influencers

- 6.3 MARKET SEGMENTATION

- 6.3.1 By Product Type

- 6.3.1.1 Lighting Products

- 6.3.1.2 Energy Management

- 6.3.1.3 Security

- 6.3.1.4 Connectivity

- 6.3.1.5 Energy Management systems

- 6.3.1.6 Home Entertainment & Smart Appliances

- 6.3.1 By Product Type

- 6.4 Key Base Indicators

- 6.5 Analysis of the Key Product Vendors and System Integrators Operating in Malaysia

7 Thailand Smart Home Market

- 7.1 Current Market Scenario

- 7.2 Key Market Influencers

- 7.3 MARKET SEGMENTATION

- 7.3.1 By Product Type

- 7.3.1.1 Lighting Products

- 7.3.1.2 Energy Management

- 7.3.1.3 Security

- 7.3.1.4 Connectivity

- 7.3.1.5 Energy Management systems

- 7.3.1.6 Home Entertainment & Smart Appliances

- 7.3.1 By Product Type

- 7.4 Key Base Indicators

- 7.5 Analysis of the Key Product Vendors and System Integrators Operating in Thailand

8 Singapore Smart Home Market

- 8.1 Current Market Scenario

- 8.2 Key Market Influencers

- 8.3 MARKET SEGMENTATION

- 8.3.1 By Product Type

- 8.3.1.1 Lighting Products

- 8.3.1.2 Energy Management

- 8.3.1.3 Security

- 8.3.1.4 Connectivity

- 8.3.1.5 Energy Management systems

- 8.3.1.6 Home Entertainment & Smart Appliances

- 8.3.1 By Product Type

- 8.4 Key Base Indicators

- 8.5 Analysis of the Key Product Vendors and System Integrators Operating in Singapore

9 Indonesia Smart Home Market

- 9.1 Current Market Scenario

- 9.2 Key Market Influencers

- 9.3 MARKET SEGMENTATION

- 9.3.1 By Product Type

- 9.3.1.1 Lighting Products

- 9.3.1.2 Energy Management

- 9.3.1.3 Security

- 9.3.1.4 Connectivity

- 9.3.1.5 Energy Management systems

- 9.3.1.6 Home Entertainment & Smart Appliances

- 9.3.1 By Product Type

- 9.4 Key Base Indicators

- 9.5 Analysis of the Key Product Vendors and System Integrators Operating in Indonesia

10 Vietnam Smart Home Market

- 10.1 Current Market Scenario

- 10.2 Key Market Influencers

- 10.3 MARKET SEGMENTATION

- 10.3.1 By Product Type

- 10.3.1.1 Lighting Products

- 10.3.1.2 Energy Management

- 10.3.1.3 Security

- 10.3.1.4 Connectivity

- 10.3.1.5 Energy Management systems

- 10.3.1.6 Home Entertainment & Smart Appliances

- 10.3.1 By Product Type

- 10.4 Key Base Indicators

- 10.5 Analysis of the Key Product Vendors and System Integrators Operating in Vietnam

11 COMPETITIVE LANDSCAPE

- 11.1 Company Profiles

- 11.1.1 Cisco Systems Inc.

- 11.1.2 Siemens AG

- 11.1.3 Emerson Electric Co.

- 11.1.4 Honeywell International Inc.

- 11.1.5 Schneider Electric SE

- 11.1.6 Google Inc.

- 11.1.7 Samsung Electronics Co. Ltd

- 11.1.8 LG Electronics Inc.

- 11.1.9 Sony Corporation

- 11.1.10 Xiaomi Corporation

- 11.1.11 Smart home Indonesia

- 11.1.12 Karsyte

- 11.1.13 Koble

- 11.1.14 Fibaro

- 11.1.15 Doorbird

- 11.1.16 IBM Corporation

12 MARKET OUTLOOK

- 12.1 INVESTMENT ANALYSIS

- 12.2 MARKET OPPORTUNITIES AND FUTURE TRENDS