|

市场调查报告书

商品编码

1636616

智慧型手机显示面板:全球市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Smartphone Display Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

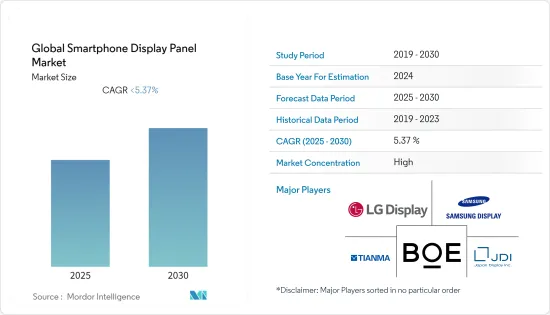

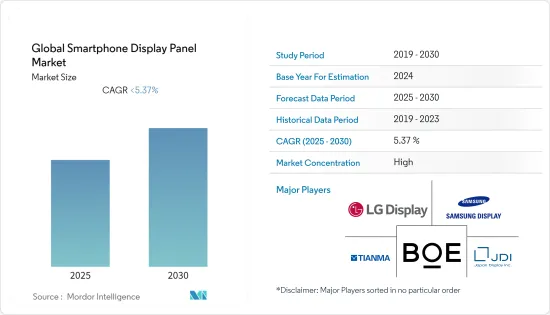

预测期内,全球智慧型手机显示面板市场预计将以略低于 5.37% 的复合年增长率成长。

主要亮点

- UHD 内容的可用性、对 4K 和 8K 显示器的需求不断增加、智慧型手机中 OLED 显示器的使用不断增加、对软性显示器面板的需求不断增加以及对建设新的 OLED 和 LCD 面板製造设施的投资不断增加。

- 在家工作和线上教育等趋势正在增加对智慧型手机和其他设备的需求。根据爱立信的《行动资料流程量》 ,到 2021年终,每部智慧型手机的资料使用量预计将达到 11.4GB。报告称,目前影片流量占所有行动资料流量的69%,预计2027年将上升到79%。除了线上观看之外,手机游戏也推动了智慧型手机的使用,从而推动了需求。这对智慧型手机显示面板的销量产生了直接影响。

- 在家工作的常态越来越被接受;区域金融机构正在加紧设计财政政策,以在新冠疫情期间提振显示器市场;越南、韩国、墨西哥、将製造工厂转移到受影响较小的国家等因素其他东南亚国家等地区正在推动新冠疫情后显示面板市场的成长。

- 为了避免过度依赖中国原料,约200家美国公司正致力于将製造地从中国转移到印度和其他亚洲国家。例如,苹果公司正考虑将部分製造工厂从中国迁至印度,以确保生产的连续性。台湾公司纬创不仅关注印度,也将目光瞄准越南和墨西哥。继在印尼设立新工厂后,另一家 iPhone组装Pegtron 也透露了其计划于 2021 年开始在越南生产 iPhone 的野心。透过使供应链更具弹性,该技术可以提高性能并最大限度地降低供应链风险。

- 折迭式萤幕等其他智慧型手机也正在成为一种趋势。 2021 年 8 月推出后仅两个月,Galaxy Z Fold3 和 Flip3 全球销售就已超过 200 万台。中国智慧型手机製造商 OPPO 于 2021 年 12 月推出了首款折迭式旗舰智慧型手机 OPPO Find N,获得了许多好评。预计未来几年全球智慧型手机製造商将推出更多旗舰折迭式智慧型手机。此外,三星显示器预计折迭式技术的推出将对智慧型手机业务产生重大影响,2021 年至 2027 年间,全球折迭式行动电话市场预计将以 21.3% 的速度成长。

智慧型手机显示面板市场趋势

AMOLED LTPO柔性引领市场

- LTPO 代表低温多晶氧化物。 LTPO 是一种 AMOLED 背板技术,它能够透过最佳萤幕技术实现动态刷新显示器的新功能。这使得企业可以使用高刷新率萤幕而不牺牲电池寿命。然而,这种面板价格昂贵。

- LTPO面板最大的优点就是其更新率的可变性。高更新率虽然对于游戏等活动很有用,但会影响电池寿命。持续的高更新率会很快耗尽行动电话的电池。这就是为什么现代智慧型手机上的 LTPO 面板需要具有可变更新率的原因。例如,OnePlus 9 Pro 支援 120Hz。 6.7 吋 AMOLED 面板的刷新率范围为 1Hz 至 120Hz。在玩游戏等主动任务时,它以 120Hz 运行,但在观看影片时切换到 24Hz。当使用者查看照片或阅读文字时,显示器的更新率会降低至 1Hz。其结果是延长了电池寿命。

- LTPO 技术现在已成为旗舰机型的标准配备。首批采用此技术的智慧型手机包括 OnePlus 9 Pro 和三星 Galaxy S21 Ultra。即使到 2022 年,LTPO AMOLED 面板也可能出现在高阶智慧型手机市场。但与任何新技术一样,随着时间的推移,它可能会进入其他市场。不过,LTPO 并不限于智慧型手机。它也包含在 Apple Watch Series 5 及更高版本中。

- 维信诺已完成LTPO研发计划,准备于2021年终开始生产LTPO OLED面板。然而,2022 年 2 月,该公司推出了其首款 LTPO AMOLED 显示屏,提供 1Hz 至 120Hz 的动态刷新率。维信诺表示,首批采用这种突破性显示器的行动电话很快就会上市。维信诺合肥第6代柔性AMOLED工厂生产最新的LTPO AMOLED萤幕。

- 2022 年 2 月-iQOO 9 系列(包括 Qoo 9 Pro、iQOO 9 和 iQOO 9 SE)在印度推出,扩大了 iQOO 的产品阵容。它具有旗舰 Snapdragon 8 Gen 1 处理器、万向节相机技术、具有 120Hz 更新率的 AMOLED 显示器、三后置相机设定等。 iQOO 9 Pro 拥有 6.78 吋 E5 AMOLED 显示屏,采用 LTPO 2.0 技术。

中国占很大市场份额

- 根据国家机构的最新资料,中国智慧型手机市场去年已从 2020 年疫情引发的低迷中復苏,但总销量仍低于 2019 年的水平。 2021年,作为全球最大的智慧型手机市场中国向国内用户出货了3.428亿部设备,较2020年增长15.9%。根据中国资讯通讯研究院 (CAICT) 的数据,去年的成长与 2020 年该产业的低迷形成了鲜明对比, 与前一年同期比较出货量年减 20%,至 2.957 亿部。不过,2019 年智慧型手机供应量为 3.72 亿部,2021 年的出货量可能会低于疫情前的水准。

- 中国智慧型手机显示器产业崛起的原因之一是中国政府对科技和电子公司的大力支持。中国企业受惠于庞大的国内市场和大量政府补贴。中国政府也承认了许多基础设施和财务利益。例如,中国的显示器製造商可享有免费的土地、建筑物、水和电,其企业税率(正式名称为企业所得税 (EIT))相对较低,为 25%。此外,从其他国家进口的设备和消耗品也享有零关税。因此,中国显示器製造商的生产成本低于韩国製造商。

- 京东方科技集团和维信诺科技股份有限公司等国内显示面板製造商正在大力发展柔性主动矩阵有机发光二极管 (AMOLED),这是一种更灵活的 OLED 类型。京东方推出多款全球首创、独特的柔性显示面板,应用于荣耀Magic 3系列、Vivo iQOO 8等高阶旗舰智慧型手机设备。

- 2017年,京东方科技在中国合肥建设其首座10.5代液晶面板厂时,该公司仅贡献了计划总投资460亿元人民币(70亿美元)的6.5%。其余则来自合肥市政府相关企业和政府担保的银行贷款。据韩国DB集团旗下的大型证券公司和投资银行DB Financial Investments称,自2010年以来的10年间,京东方科技获得了超过2兆元人民币(17亿美元)的政府间接补贴。收入的59%。

- 京东方似乎正在为三星电子的 A13 和 A23廉价智慧型手机系列生产面板。预计三星也将向京东方提案生产其下一代旗舰设备的显示面板。由于三星的旗舰设备采用了尖端的 LTPO 技术 OLED 萤幕,三星电子已要求京东方首先检验其技术。

智慧型手机显示面板产业概况

智慧型手机显示面板市场集中度较高,三星显示、京东方、LG显示器等少数几家企业占据了大部分市场。机械的技术力、研发、建造和初始开发成本使得其他供应商难以进入市场。

- 2021年12月,天马微电子在武汉天马G6产业基地宣布与小米合作。两家公司的新合作将专注于行动装置创新显示技术的研发。两家公司已同意建立一个联合实验室,所有显示技术研究将在该实验室内进行。

- 2021年12月,维信诺完成LTPO研发计划并开始生产LTPO OLED显示器。这将使该公司能够在高阶智慧型手机显示器类别中与三星和其他主要 OLED 製造商展开竞争。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 科技趋势

- 产业价值链/供应链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 市场挑战

第六章 市场细分

- 依技术分类

- TFT LCD LTPS 刚性

- TFT LCD a-Si 刚性

- AMOLED LTPS 刚性

- AMOLED LTPS 柔性

- AMOLED LTPO 柔性

- TFT LCD 氧化物刚性

- 按地区

- 美国

- 中国

- 日本

- 韩国

第七章 竞争格局

- 公司简介

- Samsung Display

- BOE Technology Group Co. Ltd

- Tianma Group

- Japan Display Inc.

- TCL China Star

- Innolux

- AUO

- Sharp Corporation

- Century

- IVO

- LG Display

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 90738

The Global Smartphone Display Panel Market is expected to register a CAGR of less than 5.37% during the forecast period.

Key Highlights

- With the availability of UHD content, increasing demand for 4K and 8K displays, increasing use of OLED displays in smartphones, rising demand for flexible display panels, and increasing investments in the construction of new OLED and LCD panel manufacturing facilities.

- The trends such as Work from home and online education have increased the demand for smartphones along with other devices. According to Ericsson Mobile data traffic outlook, the data usage per smartphone was expected to reach 11.4 GB by the end of 2021. Video traffic currently accounts for 69% of all mobile data traffic, with that percentage expected to rise to 79% by 2027, according to the same report. Alongside online viewing, mobile gaming has also increased the usage of smartphones and the demand for smartphones. Therefore a direct impact on the sales of smartphone display panels.

- The growing acceptance of the work-from-home norm, the increasing focus of regional financial institutions on designing fiscal policies to keep the display market afloat during the COVID-19 crisis, and the shifting of manufacturing units to less affected regions such as Vietnam, Korea, Mexico, and other Southeast Asian countries are all factors driving the growth of the post-COVID-19 display panel market.

- To avoid overdependence on China for raw materials, some 200 US corporations are focusing on relocating their manufacturing base from China to India and other Asian countries. Apple, for example, aims to relocate some of its manufacturing plants from China to India to ensure continued production. Wistron, a Taiwanese company, is eyeing India, as well as Vietnam and Mexico. After establishing a new plant in Indonesia, another iPhone assembler, Pegtron, has revealed ambitions to begin manufacturing operations in Vietnam by 2021. By making supply chains more resilient, this technique improves performance and minimizes supply chain risks.

- Other smartphones, such as foldable screens, are also coming into trend. In just two months after its launch in August 2021, the Galaxy Z Fold3 and Flip3 sold over 2 million units around the world. OPPO, a Chinese smartphone manufacturer, released its first foldable flagship smartphone, the OPPO Find N, in December 2021, to mostly excellent reviews. Global smartphone manufacturers are expected to release more flagship foldable phones in the coming years. Furthermore, the introduction of foldable technology is predicted to have a significant impact on the smartphone business, with the worldwide foldable phone market expected to increase at a rate of 21.3% between 2021 and 2027, according to Samsung Display.

Smartphone Display Panel Market Trends

AMOLED LTPO Flexible to drive the market

- LTPO stands for low-temperature polycrystalline oxide. LTPO is an AMOLED backplane technology that allows the best screen technology to unlock a new capability of dynamically refreshing the display. This allows companies to use high refresh rate screens without sacrificing battery life. However, such panels are costlier.

- The biggest advantage of LTPO panels is their variability with refresh rates. Higher refresh rates, though helpful in activities like Gaming, put a toll on the battery life. A continuously high refresh rate will drain the phone battery in no time; therefore, LTPO panels in modern smartphones have to change refresh rates. For instance, The OnePlus 9 Pro supports 120Hz. The 6.7-inch AMOLED panel refreshes at a rate of 1Hz to 120Hz. When performing active stuff like Gaming, it runs at full 120Hz; however, when viewing videos, it switches to 24Hz. The display decreases the refresh rate to 1Hz when the user is viewing a photo or reading text. As a result, the battery life is improved.

- For flagship phones, LTPO technology has become the standard. Some of the first smartphones that used this technology were the OnePlus 9 Pro and Samsung Galaxy S21 Ultra. In 2022, LTPO AMOLED panels will still be found in the premium smartphone market. However, like with all newer technologies, it will eventually filter down to the rest of the market. However, LTPO is not limited to smartphones. Apple Watch Series 5 and later have it.

- Visionox has completed its LTPO R&D project and is ready to begin producing LTPO OLED panels by the end of 2021. In February 2022, however, the company unveiled its first LTPO AMOLED display, which can deliver a dynamic refresh rate of 1Hz to 120Hz. The first phones with these revolutionary displays are expected to be introduced soon, according to Visionox. Visionox's Hefei 6-Gen flexible AMOLED plant produces the latest LTPO AMOLED screens.

- In February 2022 - The iQOO 9 series, which comprises the Qoo 9 Pro, iQOO 9, and iQOO 9 SE, was launched in India, expanding iQOO's offering. Highlights include the flagship Snapdragon 8 Gen 1 processor, Gimbal camera technology, 120Hz refresh rate AMOLED display, and triple rear camera configuration. The display on the iQOO 9 Pro is a 6.78-inch E5 AMOLED with LTPO 2.0 technology.

China to hold a significant share in the market

- According to the newest data from a state agency, China's smartphone market recovered last year following a pandemic-induced dip in 2020, albeit total sales have yet to reach 2019 levels. In 2021, China, the world's largest smartphone market, shipped 342.8 million devices to domestic users, up 15.9% from 2020. According to the China Academy of Information and Communications (CAICT), last year's rise contrasted with the sector's poor performance in 2020, when shipments fell 20% year on year to 295.7 million. However, with 372 million smartphones supplied in 2019, shipments in 2021 will fall short of pre-pandemic levels.

- One of the reasons for the rise of the Chinese smartphone display sector is the Chinese government's significant backing of its tech and electrical companies. Chinese enterprises benefit from their large local market as well as hefty government subsidies. The Chinese government has also granted numerous infrastructure and financial benefits. For example, Chinese display producers receive free land, buildings, water, and electricity, and their corporate tax rate is also relatively lower than its set corporate tax or officially known as the Enterprise Income Tax (EIT), which is 25%. They also have zero tariffs on the equipment and supplies they import from other countries. As a result, Chinese display makers have lower production costs than their South Korean counterparts.

- Domestic display panel makers like BOE Technology Group Co Ltd and Visionox Technology Inc are betting big on flexible active-matrix organic LED, or AMOLED, a sort of more flexible OLED. BOE has introduced a variety of world-first and unique flexible display panels, which have been used in premium flagship smartphone devices like Honor's Magic 3 series and Vivo's iQOO 8.

- When BOE Technology built its first 10.5-generation LCD factory in Hefei, China, in 2017, the company contributed only 6.5% of the overall CNY 46 billion (USD 7 billion) invested in the project. The rest came from Hefei city government-owned firms and bank loans backed by government guarantees. According to DB Financial Investments, a major securities firm and investment bank under the DB Group in South Korea, BOE Technology received over CNY 2 trillion (USD 1.7 billion) indirect government subsidies for ten years starting in 2010, accounting for 59% of the company's net income for the decade.

- BOE is apparently working on panels for Samsung Electronics' A13 and A23 cheap smartphone series. Furthermore, Samsung is expected to propose that BOE manufacture the display panels for its next-generation flagship handsets. Samsung Electronics has demanded that BOE validate their technology first because the Samsung flagships employ cutting-edge LTPO technology OLED screens.

Smartphone Display Panel Industry Overview

The smartphone display panel market is highly concentrated, with a few players like Samsung Display, BOE, and LG Display dominating a major portion of the market. The high technology, Research & development, and high initial development cost in construction and machinery make the market difficult for other vendors to penetrate.

- In December 2021 - Tianma Microelectronics announced a partnership with Xiaomi Corporation at the Wuhan Tianma G6 Industrial Base. The two companies' new alliance will focus on researching and developing innovative display technologies for mobile devices. Both firms have agreed to establish a collaborative laboratory where all display technology research would be conducted.

- In December 2021 - Visionox completed its LTPO research and development project and started producing LTPO OLED displays. This will allow the company to compete in the high-end smartphone display category against Samsung and other major OLED manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technological Trends

- 4.4 Industry Value Chain/Supply Chain Analysis

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.2 Market Challenges

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 TFT LCD LTPS Rigid

- 6.1.2 TFT LCD a-Si Rigid

- 6.1.3 AMOLED LTPS Rigid

- 6.1.4 AMOLED LTPS Flexible

- 6.1.5 AMOLED LTPO Flexible

- 6.1.6 TFT LCD Oxide Rigid

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 China

- 6.2.3 Japan

- 6.2.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Samsung Display

- 7.1.2 BOE Technology Group Co. Ltd

- 7.1.3 Tianma Group

- 7.1.4 Japan Display Inc.

- 7.1.5 TCL China Star

- 7.1.6 Innolux

- 7.1.7 AUO

- 7.1.8 Sharp Corporation

- 7.1.9 Century

- 7.1.10 IVO

- 7.1.11 LG Display

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219