|

市场调查报告书

商品编码

1636620

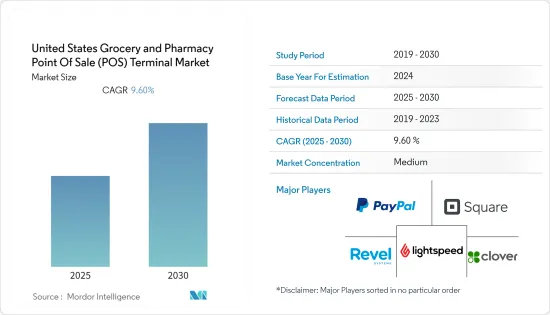

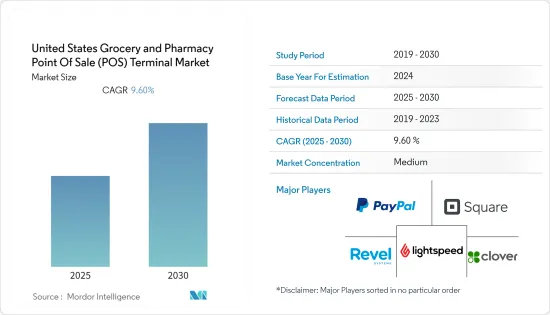

美国杂货和药房 POS 终端 -市场占有率分析、行业趋势、统计、成长趋势预测(2025-2030)United States Grocery And Pharmacy Point Of Sale (POS) Terminal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

美国杂货和药房 POS 终端市场预计在预测期内复合年增长率为 9.60%

主要亮点

- 近年来,在消费者转向无现金交易的推动下,POS 终端经历了强劲成长。由于直接透过智慧型手机进行非接触式付款的需求,行动 POS (mPOS) 终端在过去几年中变得越来越重要。易用性显示了市场成长之路。而且,应用范围的不断扩大,正在偏远地区和新市场掀起数位付款浪潮,创造巨大潜力。

- POS系统软体和硬体均已改进,确保交易安全和便携性。透过对端到端加密技术的投资正在加强付款闸道,我们相信这将有助于建立消费者信任并影响产品需求。将 POS 系统与多功能软体结合还可以为最终用户提供安全付款、员工资料储存和消费者资料分析。该产品能够作为有效的员工管理工具来追踪员工绩效,进一步推动了需求。

- 无线网路连接、成本降低和网路覆盖范围扩大的需求不断增长,推动了零售业对可携式或行动 POS 设备的需求。在预测期内,智慧型手机和平板电脑的使用量预计将增加,从而推动对行动 POS 解决方案的需求。随着近距离场通讯(NFC) 和 Europay、MasterCard 和 Visa (EMV) 等新付款方式的日益普及,零售商预计将更新其设备以支援这些技术。例如,Apple Pay 在美国的采用预计将提高人们对 NFC 的认识,并加速采用支援 NFC 的智慧型手机进行零售付款以及杂货店和药房的结帐。

- 由于存在大量已知和未知的威胁以及 POS 系统资料对网路犯罪分子的价值,POS 安全非常困难。此外,随着新的 POS 恶意软体的定期创建或更新,针对 POS 系统的威胁数量持续增长。预计这将抑制预测期内美国对 POS 的需求。

- 此外,COVID-19 的爆发极大地改变了消费者的购物方式,影响了零售和药房 POS。消费者也越来越多地使用多种销售方式,包括路边取货、虚拟咨询、非接触式付款、社交商务和透过社群媒体购物。根据最新的零售专家和消费者调查,这些新行为预计将在预测期内持续下去。这些趋势正在影响美国对 POS 终端的需求。

美国杂货和药局POS终端市场趋势

硬体部门占主要份额

- 硬体组件包括独立 POS 终端(交易支援单元)和具有附加交易功能的整合式 POS 系统。大多数传统硬体都是模组化的,但一体式设备的采用使得销售内建付款终端、扫描器和印表机的固定设备和可携式POS 平板电脑成为可能。

- 多年来,POS系统硬体不断发展和完善,以确保交易安全和便携性。此外,为了确保付款闸道的安全,POS 供应商正在增加端对端加密技术的支出,相信这将有助于建立消费者信任并推动产品需求。此外,连接到 POS 系统的多用途软体为最终用户提供安全付款、员工资讯储存和客户资料分析。

- 由于安全威胁,市场上设计的大多数新硬体都专注于促进更顺畅的交易。然而,疫情造成的强制隔离加速了具有专用认证功能的非接触式付款的市场发展。儘管摄影机和指纹感测器的增加迫使外形尺寸变大,但这已被透过追求微电子技术实现小型化的工业进步所抵消。

- 多年来,POS系统硬体不断发展和完善,以确保交易安全和便携性。此外,为了确保付款闸道的安全,POS 供应商正在增加端对端加密技术的支出,预计这将有助于建立消费者信任并推动产品需求。此外,与 POS 系统连接的多用途软体为最终用户提供安全付款、员工资讯储存和客户资料分析。

不断增长的零售自动化趋势推动了对先进数位解决方案的需求飙升

- 零售杂货店正在采用 POS 终端机来吸引更多顾客。这些设备使结帐过程变得快速、简单,从而帮助加快客户的购物体验。一些主要零售品牌正在其商店安装行动 POS 终端,为顾客提供轻鬆的购物体验。超级市场越来越多地使用 POS 终端机来实现员工、库存和客户管理的自动化。

- 美国超级市场的自助服务趋势允许业主在没有收银员的情况下保持商店营业。此外,随着 COVID-19 大流行的持续,零售商正在逐步实施非接触式付款技术以防止病毒传播。北美智慧卡和行动钱包的使用正在增加,预计这将增加行业收益。

- 零售商正在采用行动 POS 软体程式远端存取其设施,减少因员工缺勤造成的收益损失。这使得业主能够频繁地收到有关其零售店内正在进行的工作的最新资讯。它还允许您追踪和组织实体店和线上市场中的产品。市场领导正在推出支援 NFC 和 EMV 合规性的零售 POS 终端软体,以帮助客户更快、更安全地进行付款。

- 零售的成长预计将支持预测期内 POS 终端的成长。例如,根据美国人口普查局的数据,2021 年 12 月杂货月销售额为 71,845,000 美元,而 2021 年 1 月为 63,171,000 美元。

美国杂货和药局POS终端产业概况

- 2022 年 2 月:Apple 在 iPhone 上推出 Tap to Pay。此功能使美国各地数以百万计的商家(从小型企业到大型零售商)能够使用 iPhone 无缝、安全地使用 Apple Pay、非接触式签帐金融卡以及其他数位服务,您现在只需轻轻一按即可使用您的钱包。这减轻了拥有硬体和付款终端的负担。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 对美国杂货和药房 POS 终端市场的影响

- 付款处理费洞察

- 主要杂货店和药房供应商和 POS 解决方案清单(视公共资讯的可用性而定)

第五章市场动态

- 市场驱动因素

- 消费者变成无现金

- 改进的 POS 硬体和软体解决方案

- 市场问题

- 网上付款的安全问题

第六章 市场细分

- 按成分

- 硬体

- 软体

- 按类型

- 固定POS机

- 行动POS/EFT-POS终端

- 按最终用户产业

- 杂货

- 药局

第七章 竞争格局

- 公司简介

- PayPal

- Clover

- Route4Me

- Square

- Revel Systems

- Loyverse POS

- Epos Now

- Odoo

- Stripe

- Cashier Live LLC.

- CELERANT TECHNOLOGY CORP.

- LightSpeed

- Shopify

- Transaction Data Systems, Inc.

- GOFRUGAL

- Epicor

- Chetu Inc.

- LS Retail ehf.

- Retail Management Solutions, LLC

- McKesson Corporation

- Worldline

- POS Hardware Vendor Share

- POS Software Vendor Share

第八章 市场未来展望

简介目录

Product Code: 91437

The United States Grocery And Pharmacy Point Of Sale Terminal Market is expected to register a CAGR of 9.60% during the forecast period.

Key Highlights

- The POS terminals have observed strong growth in the past years, driven by the consumer shift toward cashless transactions. Mobile POS (mPOS) terminals have become increasingly prominent over the last few years due to the demand for contactless payments, which can be done directly from smartphones. The ease of use has provided avenues for the market to grow. Moreover, the broadening scope of application has created the massive potential for the digital payment wave in remote areas and newer markets.

- Software and hardware in the POS system have been modified to ensure safe transactions and portability. Payment gateways have been strengthened through investments in end-to-end encryption technology, which will assist in building consumer confidence and influence product demand. A POS system coupled with multipurpose software would also offer the end-user secure payment, employee data storage, and consumer data analysis. Demand has increased further due to the product's ability to function as an efficient employee management tool for tracking employee performance.

- The demand for portable or mobile POS equipment in the retail industry is driven by the rising demand for wireless Internet connectivity, decreased costs, and expanded network coverage. Over the projection period, it is predicted that rising smartphone and tablet usage would fuel demand for mobile point-of-sale solutions. Retailers are anticipated to update their equipment to comply with these technologies when new payment methods like Near Field Communication (NFC) and Europay, MasterCard, and Visa (EMV) become popular. For instance, the introduction of Apple Pay in the US has raised awareness of NFC, which is anticipated to accelerate the uptake of NFC-capable smartphones for payment to retailers, and settling grocery and pharmacy bills.

- POS security is difficult due to the sheer volume of known and unknown threats and the value that POS system data holds for cybercriminals. Furthermore, the number of threats to POS systems continues to rise as new POS malware is created or updated regularly. This is expected to hinder the demand for POS in the United States during the forecast timeframe.

- Furthermore, the COVID-19 pandemic has significantly altered how consumers shop, affecting the retail and pharmacy POS. Consumers have also increased their use of numerous sales methods, such as curbside pickup, virtual consultations, contactless payment, and social commerce or shopping via social media. According to the most recent retail experts and shopper surveys, this new behavior is expected to persist over the forecast period. Such trends have influenced the demand for POS terminals in the United States.

US Grocery & Pharmacy Point of Sale Terminal Market Trends

Hardware Segment Account for a Significant Share

- Hardware components include standalone POS terminals (transaction enablement units) and an integrated POS system with additional transactional capabilities. While much legacy hardware has traditionally been modular, the introduction of All-In-One units has enabled the market deployment of fixed units and portable POS tablets with built-in payment terminals, scanners, and printers.

- Over the years, the hardware of the POS system has been developed and modified to ensure safe transactions and portability. Also, to safeguard payment gateways, POS suppliers have expanded their expenditures on end-to-end encryption technology, which will assist in creating consumer confidence and drive product demand. Additionally, multipurpose software connected with a POS system would provide the end-user with secure payment, employee information storage, and customer data analysis, the second most common payment method, followed by cash payment.

- Due to security threats, most new hardware designed for the market is centered on facilitating smoother transactions.However, the forced separation caused by the pandemic has accelerated the development of contactless payments with dedicated authentication features. The addition of cameras and fingerprint sensors forces larger form sizes, but this is offset by industry developments allowing facturers to go smaller in the pursuit of micro-electronics.

- Over the years, the hardware of the POS system has been developed and modified to ensure safe transactions and portability. Also, to safeguard payment gateways, POS suppliers have expanded their expenditures on end-to-end encryption technology, which will assist in creating consumer confidence and drive product demand. Additionally, multipurpose software connected with a POS system would provide the end-user with secure payment, employee information storage, and customer data analysis.

The Growing Trend of Retail Automation will Surge the Demand for Advanced Digital Solutions

- Retail grocers have adopted POS terminals to attract more customers. These devices help to speed up the customer shopping experience by making the checkout process faster and easier. Several major retail brands have installed mobile POS terminals in their stores to provide customers with an easy shopping experience. Supermarkets increasingly use POS terminals to automate employee, inventory, and customer management.

- The self-service trend in supermarkets in the United States has allowed owners to keep their stores open in the absence of cashiers. Retailers are also gradually implementing non-contact payment technology in the ongoing COVID-19 to prevent the virus spread. The increased use of smart cards and mobile wallets in North America will boost industry revenue.

- Retailers are employing mobile POS software programs to remotely access their establishments and reduce the factors contributing to decreased revenues, owing to the non-availability of staff. This gives the owners frequent updates on the work done within retail locations. It also makes it possible to track and organize the products in both physical and online marketplaces. Market leaders have introduced retail POS terminal software compatible with NFC and EMV compliance, enabling customers to make payments more quickly and securely.

- Increasing retail sale will support the growth of POS terminal in teh forecast time frame. For instance, accrding to US Census Bureau, the monthly grosery sales in December 2021 was USD 71.845 million compared to USD 63.171 million in January 2021.

US Grocery & Pharmacy Point of Sale Terminal Industry Overview

- February 2022: Apple launches Tap to Pay on iPhone. This capability will empower millions of merchants across the US, from small businesses to large retailers, to use their iPhone to accept seamlessly and securely Apple Pay, contactless debit and credit cards, and other digital wallets through a simple tap to their iPhone. This will reduce the burden of having hardware or a payment terminal.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 Impact of COVID-19 on the US Grocery and Pharmacy POS Terminal Market

- 4.5 Payment Processing Charges Insights

- 4.6 List of Major Grocery and Pharmacy Vendors and POS solution implemented (subject to availability of information from public domain)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Consumer Shift Towards Cashless Transaction

- 5.1.2 Improvement in POS Hardware and Software Solution

- 5.2 Market Challenges

- 5.2.1 Security Concern over Online Payment

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Type

- 6.2.1 Fixed POS

- 6.2.2 Mobile POS/EFT-POS Terminals

- 6.3 By End-user Industry

- 6.3.1 Grocery

- 6.3.2 Pharmacy

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PayPal

- 7.1.2 Clover

- 7.1.3 Route4Me

- 7.1.4 Square

- 7.1.5 Revel Systems

- 7.1.6 Loyverse POS

- 7.1.7 Epos Now

- 7.1.8 Odoo

- 7.1.9 Stripe

- 7.1.10 Cashier Live LLC.

- 7.1.11 CELERANT TECHNOLOGY CORP.

- 7.1.12 LightSpeed

- 7.1.13 Shopify

- 7.1.14 Transaction Data Systems, Inc.

- 7.1.15 GOFRUGAL

- 7.1.16 Epicor

- 7.1.17 Chetu Inc.

- 7.1.18 LS Retail ehf.

- 7.1.19 Retail Management Solutions, LLC

- 7.1.20 McKesson Corporation

- 7.1.21 Worldline

- 7.2 POS Hardware Vendor Share

- 7.3 POS Software Vendor Share

8 MARKET FUTURE OUTLOOK

02-2729-4219

+886-2-2729-4219