|

市场调查报告书

商品编码

1637717

菲律宾可再生能源 -市场占有率分析、产业趋势、成长预测(2025-2030)Philippines Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

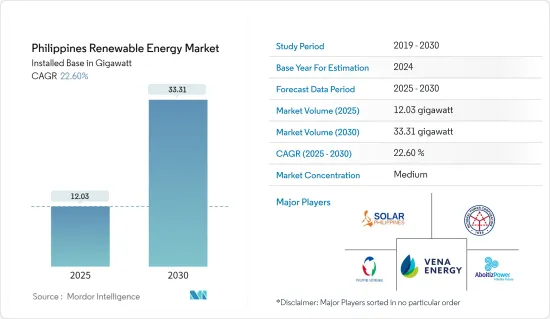

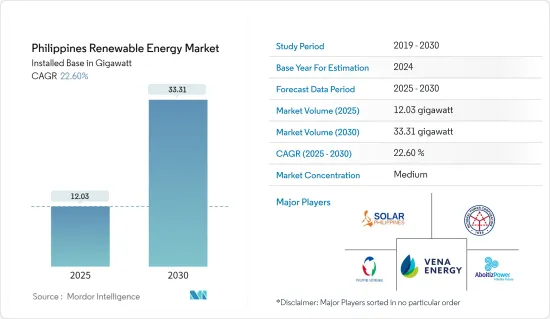

菲律宾可再生能源市场规模(装置量)预计将从2025年的12.03吉瓦扩大到2030年的33.31吉瓦,预测期间(2025-2030年)复合年增长率为22.6%。

主要亮点

- 从中期来看,可再生能源需求的增加、可再生能源关税的降低以及政府措施预计将在预测期内推动市场发展。

- 同时,该国低效率的电网基础设施和大量岛屿预计将抑制市场。

- 人们日益关注实现零排放目标,包括提高清洁发电目标,将为菲律宾可再生能源市场创造重大机会。

菲律宾可再生能源市场趋势

太阳能领域预计将显着成长

- 太阳能为菲律宾日益增长的能源需求提供了直接的解决方案。太阳能发电安装成本稳定下降,安装和试运行太阳能发电工程所需的时间很短,使得太阳能发电系统越来越受到菲律宾消费者和工业界的欢迎。截至2022年,菲律宾太阳能发电容量已达1,625MW。

- 该国不断增长的能源需求可以透过太阳能立即满足。由于太阳能发电安装成本的持续下降以及安装和试运行的便利性,太阳能发电系统越来越受到菲律宾消费者和企业的欢迎。由于较低的价格和有利的政府措施,该国在预测期内太阳能发电厂的安装量正在增加。

- 2023年1月,菲律宾太阳能新怡诗夏公司宣布计画将新怡诗夏省和布拉干省的土地转换为太阳能发电工程。该公司表示,将于 2023 年第一季开始准备 3,000 多公顷土地,并于同年第四季开始转换。

- 2022年1月,SolarPhilippinesNuevaEcija宣布与其母公司达成资产交换计划,使该公司能够开发10GW的太阳能发电工程。资产和股份交换须经过第三方评估。

- 综上所述,预计太阳能在预测期内将显着成长。

即将动工的计划带动市场需求

- 《国家可再生能源规划》设定了中期目标,旨在到2030年将可再生能源发电能力提高到15GW。菲律宾最近启动了多个产能扩张计划,预计在预测期内还会有更多项目。截至2022年,菲律宾可再生能源装置容量已达7,670MW。

- 2022年1月,Blue Circle和Cleantech Global Renewable获得了在菲律宾开发一座120万千瓦离岸风力发电电场的权利。该计划位于民都洛岛布拉拉考海岸附近。

- 2022 年 1 月,菲律宾政府启动竞标,在吕宋岛、米沙鄢群岛和棉兰老岛安装 2GW可再生能源产能。三个地区的目标分别为1,400MW、400MW和200MW。计划进一步分为太阳能、风能和生物质可再生能源发电厂,这些发电厂最终可能在预测期内推动该国的市场。

- 2023年2月,Alternergy Holdings Corp.宣布取得菲律宾塔布拉斯海峡离岸风力发电计划服务合约。该公司已获得菲律宾能源部 (DoE) 的订单,为其风电机组 Pililla AVPC Corp 在塔布拉斯海峡进行离岸风力发电。

- 许多其他计划正在开发中,预计将在预测期内投入运作,预计将推动市场成长。

- 基于上述情况,即将推出的可再生能源计划预计将在预测期内推动菲律宾可再生能源市场。

菲律宾可再生能源产业概况

菲律宾可再生能源市场的一体化程度较低。市场主要企业包括(排名不分先后)菲律宾地热生产公司、Aboitiz Power Corporation、国家电力公司、Vena Energy 和 SolarPhilippines Power Projects Holdings Inc.。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 可再生能源结构(2022)

- 2028年可再生能源装置容量及预测(单位:GW)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 政府有利措施

- 可再生能源需求增加

- 抑制因素

- 该国电网基础设施效率低下,岛屿数量众多

- 促进因素

- 供应链分析

- PESTLE分析

第五章市场区隔

- 类型

- 阳光

- 风力

- 水力发电

- 其他的

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Solar Philippines Power Projects Holdings Inc.

- Solenergy Systems Inc.

- Vena Energy

- Solaric Corp.

- Trina Solar Co. Ltd.

- Alternergy Philippine Holding Corp.

- AC Energy Inc.

- Vestas Wind Systems AS

- National Power Corporation

- Philippine Geothermal Production Company Inc.

- Aboitiz Power Corporation

第七章 市场机会及未来趋势

- 在日本稳定偏远地区开发浮体式光电站

The Philippines Renewable Energy Market size in terms of installed base is expected to grow from 12.03 gigawatt in 2025 to 33.31 gigawatt by 2030, at a CAGR of 22.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing demand for renewable energy, reduced tariffs on renewable energy, and government policies will likely drive the market during the forecast period.

- On the other hand, the country's inefficient grid infrastructure and many islands are expected to restrain the market.

- Nevertheless, the growing focus on achieving zero-emission targets, including targets for increasing clean power generation, will likely present significant opportunities in the Philippine renewable energy market.

Philippines Renewable Energy Market Trends

The Solar Energy Segment is Expected to Experience Significant Growth

- Solar energy provides an immediate solution to the country's growing energy needs. With steadily falling costs of solar power equipment and the short time needed to install and commission solar power projects, solar systems are increasingly becoming popular among consumers and industries across the Philippines. As of 2022, in the Philippines, solar energy capacity reached 1,625 MW.

- The nation's expanding energy requirements have an immediate solution in the form of solar energy. Solar power systems are becoming increasingly popular among consumers and businesses throughout the Philippines due to the continually decreasing costs of solar power equipment and the easy installation and commissioning times. Due to the decline in prices and favorable government policies, the country is witnessing increasing installations of solar energy power plants during the forecast period.

- In January 2023, Solar Philippines announced its plan to convert lands in Nueva Ecija and Bulacan for solar energy projects. According to the company, preparation for over 3,000 hectares will start in the first quarter of 2023, and conversion will start in the fourth quarter of that year.

- In January 2022, Solar Philippines Nueva Ecija Corporation announced plans for asset swaps with its parent company to enable Solar Philippines Nueva Ecija Corporation to develop 10 GW of solar projects. The asset-for-share is subject to a third-party valuation.

- Thus, considering the above points, solar energy will likely experience significant growth during the forecast period.

Upcoming Projects are Driving the Market Demand

- The National Renewable Energy Program has set indicative interim targets and seeks to increase the country's renewable energy-based capacity to an estimated 15 GW by 2030. The country has seen several projects recently to build capacity and will likely witness more during the forecast period. As of 2022, in the Philippines, renewable energy capacity reached 7,670 MW.

- In January 2022, Blue Circle and CleanTech Global Renewable Inc. secured the right to develop a 1.2 GW offshore wind park in the Philippines. The location of the project is off Bulalacao, Mindoro province.

- In January 2022, the Philippine government opened a tender to deploy 2 GW renewable energy capacity across the Luzon, Visayas, and Mindanao islands. The target for the three regions was 1,400 MW, 400 MW, and 200 MW, respectively. The projects are further slotted into solar, wind, and biomass-based renewable energy plants, which may ultimately drive the market in the country during the forecast period.

- In February 2023, Alternergy Holdings Corp. announced receiving three service contracts for its offshore wind projects over Tablas Strait in the Philippines. The company has secured awards from the Philippines Department of Energy (DoE) for its wind unit, Pililla AVPC Corp., for the Tablas Strait offshore wind.

- Many more projects are in development, slated to be commissioned during the forecast period, and are likely to aid the market's growth.

- Therefore, based on the above points, upcoming renewable energy projects are expected to drive the Philippine renewable energy market during the forecast period.

Philippines Renewable Energy Industry Overview

The Philippines' renewable energy market is moderately consolidated. Some of the major players in the market (in no particular order) include Philippine Geothermal Production Company Inc., Aboitiz Power Corporation, National Power Corporation, Vena Energy, and Solar Philippines Power Projects Holdings Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2022

- 4.3 Renewable Energy Installed Capacity and Forecast, in GW, till 2028

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Favorable Government Policies

- 4.6.1.2 Increasing Demand for Renewable Energy

- 4.6.2 Restraints

- 4.6.2.1 Inefficient Grid Infrastructure and A High Number Of Islands in the Country

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Solar

- 5.1.2 Wind

- 5.1.3 Hydro

- 5.1.4 Other Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Solar Philippines Power Projects Holdings Inc.

- 6.3.2 Solenergy Systems Inc.

- 6.3.3 Vena Energy

- 6.3.4 Solaric Corp.

- 6.3.5 Trina Solar Co. Ltd.

- 6.3.6 Alternergy Philippine Holding Corp.

- 6.3.7 AC Energy Inc.

- 6.3.8 Vestas Wind Systems AS

- 6.3.9 National Power Corporation

- 6.3.10 Philippine Geothermal Production Company Inc.

- 6.3.11 Aboitiz Power Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developing Floating PV Parks in the Stable Backwater Areas of the Country