|

市场调查报告书

商品编码

1637718

氟树脂薄膜:市场占有率分析、产业趋势/统计、成长预测(2025-2030)Fluoropolymer Films - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

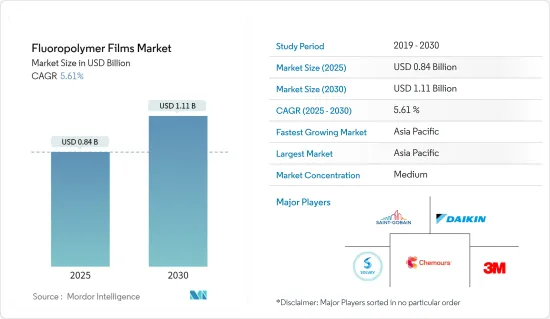

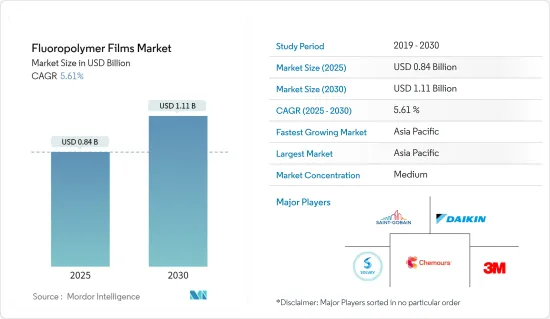

氟聚合物薄膜的市场规模预计到2025年为8.4亿美元,预计到2030年将达到11.1亿美元,预测期内(2025-2030年)复合年增长率为5.61%。

主要亮点

- 2020 年,由于 COVID-19 爆发和随后的关闭,市场放缓。然而,2021 年和 2022 年市场势头强劲。

- 商业建筑和药品包装对薄膜的需求不断增长预计将在预测期内推动市场发展。

- 与各种类型的含氟聚合物薄膜相关的环境和健康危害预计将阻碍预测期内的市场成长。

- 由于中国、印度和日本等国家的消费增加,预计亚太地区将在预测期内主导全球市场。

- 太阳能电池板安装的增加以及医疗灭菌中含氟聚合物薄膜的日益采用预计将为该市场提供机会。

氟树脂薄膜市场趋势

电子和半导体行业预计将成为成长最快的最终用户产业

- 半导体产业是最早在半导体生产中采用含氟聚合物的产业之一。含氟聚合物有助于达到製造微晶片和其他电子设备所需的纯度。

- 凭藉其卓越的耐化学性,含氟聚合物提高了日益小型化的微处理器和其他电气元件的功能、可靠性和使用寿命。全氟烷氧基烷烃(PFA)是氟树脂的一种,可以进行熔融加工。这意味着 PFA 可以透过射出成型或吹塑成型进行加热、熔化和成型。

- 电子工业持续取得显着的进步和发展。行动电话、可携式运算设备、游戏系统和其他个人电子设备的生产将继续推动对电子元件的需求。

- 根据世界半导体贸易统计,预计2022年全球半导体市场规模将达5,800亿与前一年同期比较,年成长率为4.4%。 2021年全球半导体市场规模为5,558.9亿美元,较2020年的4,403.9亿美元成长26.23%。

- 根据半导体产业协会(SIA)的数据,儘管下半年因经济放缓和通膨而放缓,但2022年全球半导体销售额仍成长3.2%。

- 日本电子情报技术产业协会(JEITA)预计,2022年全球电子资讯产业产值预计为34,368亿美元,较与前一年同期比较%记录了成长率。此外,预计2023年将达到3,4,368亿美元,与前一年同期比较增3%。

- 因此,这些因素预计将在预测期内推动含氟聚合物薄膜市场的成长。

亚太地区主导市场

- 亚太地区对电子产品的需求主要来自中国、印度和日本。此外,中国低廉的人事费用和灵活的政策使其成为电子製造商强大且有利的市场。

- 2022年,电子电气市场比2021年成长10%成长13%。 2023年预计成长率为7%。中国的市场规模是世界上最大的,比工业国家市场的总合还要大。

- 印度启动了一项综合计划,以发展国内半导体和显示器製造生态系统。政府宣布支出 7,600 亿印度卢比(100 亿美元)。

- 政府将为设立显示器工厂和半导体工厂提供计划成本50%的财政支持,为化合物半导体工厂提供资本支出50%的财政支持。

- 同时,日本于 2022 年 11 月宣布,将投资 700 亿日圆(5 亿美元)成立索尼集团公司和 NEC 公司的合资企业,将日本打造成先进晶片的生产基地。

- 根据国际汽车生产组织(OICA)预测,2022年该地区汽车产量将达到50,020,793辆,比2021年的46,768,800辆成长7%。 2022年最大的生产国是中国,其次是日本、印度和韩国。

- 此外,由于储蓄累积、利率下降以及对个人出行的日益偏好促使消费者购买新车,2022 年 1 月至 9 月印度的乘用车销售仍然强劲。受此影响,2022年前第三季印度新车註册量成长约20.2%,达到280万辆。 「Aatma Nirbhar Bharat」和「印度製造」计画等政府改革也支持了该国的汽车工业。

- 因此,亚太国家的这些趋势预计将在预测期内推动市场成长。

含氟聚合物薄膜产业概况

含氟聚合物薄膜市场已部分细分。受调查的主要企业(排名不分先后)包括 3M、DAIKIN INDUSTRIES, Ltd.、科慕公司、索尔维和圣戈班。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 商业建筑业需求不断增长

- 药品包装需求增加

- 其他司机

- 抑制因素

- 与不同类型的含氟聚合物薄膜相关的环境和健康危害

- 其他限制因素

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 类型

- PTFE(四氟乙烯树脂)

- PVDF(聚二氟亚乙烯)

- FEP(氟化乙烯丙烯)

- ETFE(聚乙烯四氟乙烯)

- PFA(全氟烷氧基烷烃)

- PVF(聚氟乙烯)

- 其他的

- 目的

- 阻隔膜

- 离型膜

- 微孔膜

- 安全膜

- 最终用户产业

- 汽车、航太和国防

- 建造

- 包装

- 工业的

- 电子和半导体

- 其他的

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- American Durafilm

- Arkema Group

- AGC Inc.

- DAIKIN INDUSTRIES, Ltd.

- DuPont

- Fluortek AB

- Fluoro-Plastics

- Polyflon Technology Limited

- Saint-Gobain

- Solvay

- The Chemours Company

第七章 市场机会及未来趋势

- 增加太阳能板安装

- 含氟聚合物薄膜在医疗灭菌中的采用增加

简介目录

Product Code: 46272

The Fluoropolymer Films Market size is estimated at USD 0.84 billion in 2025, and is expected to reach USD 1.11 billion by 2030, at a CAGR of 5.61% during the forecast period (2025-2030).

Key Highlights

- In the year 2020, the market saw a slowdown due to the outbreak of Covid-19 and subsequent lockdowns. However, in the years 2021 and 2022, the market has gained momentum.

- The growing demand for films from commercial construction and pharmaceutical packaging is expected to drive the market during the forecast period.

- Environmental and health hazards associated with different types of fluoropolymer films will hinder market growth during the forecast period.

- Asia-Pacific is expected to dominate the global market during the forecast period owing to the increasing consumption in countries such as China, India, and Japan.

- Increasing installations of solar panels and the rising adoption of fluoropolymer films in medical sterilization will act as an opportunity for the market.

Fluoropolymer Films Market Trends

Electronics and Semiconductor Industry is Expected to be the Fastest Growing End-user Industry

- The semiconductor industry is one of the early adopters of fluoropolymers for the manufacturing of semiconductors. Fluoropolymers help to achieve the purity required in the production of microchips and other electronics due to their property of resistance to purity required in the production of microchips and other electronics.

- Due to superior chemical resistance, fluoropolymers improve the functionality, reliability, and lifespan of ever-smaller microprocessors and other electrical components. PerfluoroalkoxyAlkane (PFA), a type of fluoropolymer, is melt-processable. This means PFA can be heated to melt and later can be shaped through injection molding or blow molding.

- The electronics industry is continuously making remarkable progress and development. The production of cellular phones, portable computing devices, gaming systems, and other personal electronic devices will continue to spark the demand for electronic components.

- According to World Semiconductor Trade Statistics, the global semiconductor market was estimated to be USD 580 billion in 2022, registering a growth rate of 4.4% year on year. The global semiconductor market size accounted for USD 555.89 billion in 2021, registering a growth of 26.23% compared to USD 440.39 billion in 2020.

- According to the Semiconductor Industry Association (SIA), global semiconductor sales in the year 2022 rose by 3.2% despite the slowdown in the second half of the year caused to the economic slowdown and inflation.

- According to the Japan Electronics and Information Technology Industries Association (JEITA), the production by the global electronics and IT industry was estimated at USD 3,436.8 billion in 2022, registering a growth rate of 1% year on year, compared to USD 3,360.2 billion in 2021. Moreover, the industry is expected to reach USD 3,436.8 billion, with a growth rate of 3% year on year, by 2023.

- Hence, these factors will help to boost the market growth of fluoropolymers films over the forecast period.

Asia-Pacific to Dominate the Market

- The demand for electronics products in the Asia-Pacific region majorly comes from China, India, and Japan. Furthermore, China is a strong, favorable market for electronics producers, owing to the country's low labor cost and flexible policies.

- The electronics and electrical market increased by 13% in 2022 as compared to 2021, when the market saw a 10% rise. The estimated growth rate for 2023 is 7%. China's market is the largest in the world, even larger than the combined markets of all industrialized countries.

- India launched a comprehensive program for the development of semiconductors and display manufacturing ecosystems in the country. The government announced an outlay of INR 76,000 crore (USD 10 billion).

- Fiscal support of 50% of the project cost is provided by the government to set up display fabs and semiconductor fabs, and fiscal support of 50% of capital expenditure for compound semiconductors fab.

- Japan, on the other hand, in November 2022 announced that it would be investing JPY 70 billion (USD 500 million) in the joint venture between Sony Group Corp and NEC Corp to establish the country as a production hub for advanced chips.

- According to Organisation Internationale des Constructeurs d'Automobiles (OICA), automotive production in the region reached 50,020,793 units in 2022, increasing by 7% from 46,768,800 units produced in 2021. China was the largest producer in 2022, followed by Japan, India, and South Korea.

- Furthermore, in the first nine months of 2022, Indian passenger car sales remained strong due to the accumulation of savings, coupled with lower interest rates and an increasing preference for personal mobility, which convinced customers to buy new cars. As a result, new car registrations in India grew by around 20.2% in the first three quarters of 2022 to reach 2.8 million units. Also, Government reforms such as "Aatma Nirbhar Bharat" and "Make in India" programs supported the automotive industry in the country.

- Hence, such trends in various countries of the Asia-Pacific will drive market growth during the forecast period.

Fluoropolymer Films Industry Overview

The fluoropolymer film market is partially fragmented in nature. Some of the major players (not in any particular order) in the market studied include 3M, DAIKIN INDUSTRIES, Ltd., The Chemours Company, Solvay, and Saint-Gobain, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Commercial Construction Industry

- 4.1.2 Rising Demand for Pharmaceutical Packaging

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental and Health Hazards Associated with Different Types of Fluoropolymer Films

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 PTFE (Polytetrafluoroethylene)

- 5.1.2 PVDF (Polyvinylidene Fluoride)

- 5.1.3 FEP (Fluorinated Ethylene-Propylene)

- 5.1.4 ETFE (Polyethylenetetrafluoroethylene)

- 5.1.5 PFA (Perfluoroalkoxy Alkane)

- 5.1.6 PVF (Polyvinylfluoride)

- 5.1.7 Other Types

- 5.2 Application

- 5.2.1 Barrier Films

- 5.2.2 Release Films

- 5.2.3 Microporous Films

- 5.2.4 Security films

- 5.3 End-user Industry

- 5.3.1 Automotive, Aerospace, and Defense

- 5.3.2 Construction

- 5.3.3 Packaging

- 5.3.4 Industrial

- 5.3.5 Electronics and Semiconductor

- 5.3.6 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 American Durafilm

- 6.4.3 Arkema Group

- 6.4.4 AGC Inc.

- 6.4.5 DAIKIN INDUSTRIES, Ltd.

- 6.4.6 DuPont

- 6.4.7 Fluortek AB

- 6.4.8 Fluoro-Plastics

- 6.4.9 Polyflon Technology Limited

- 6.4.10 Saint-Gobain

- 6.4.11 Solvay

- 6.4.12 The Chemours Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Installations of Solar Panels

- 7.2 Rising Adoption of Fluoropolymer Films in Medical Sterilization

02-2729-4219

+886-2-2729-4219