|

市场调查报告书

商品编码

1637719

己内酰胺 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Caprolactam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

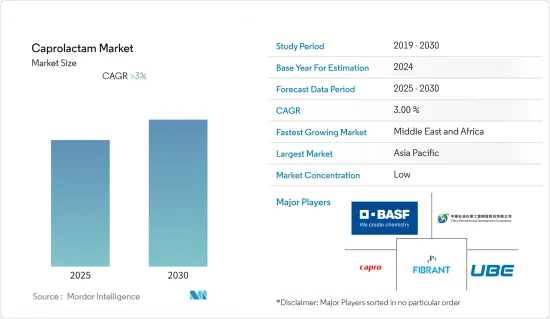

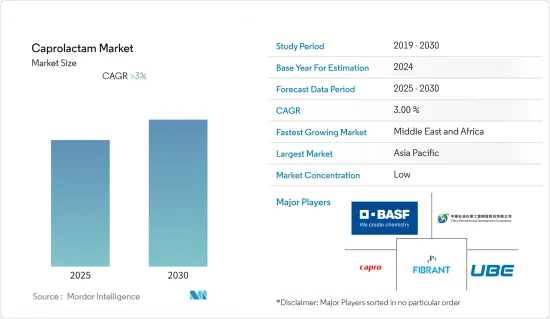

预计己内酰胺市场在预测期内复合年增长率将超过 3%。

由于COVID-19的爆发,己内酰胺市场受到了负面影响。世界各地的封锁限制了供应链,并严重阻碍了工业扩张。然而,市场去年有所復苏,预计未来几年将大幅成长。

主要亮点

- 短期来看,尼龙6产能扩张是推动市场成长的关键因素。

- 另一方面,己内酰胺的毒性和尼龙6替代品的存在可能会阻碍市场成长。

- 在整个预测期内,越来越多地关注己内酰胺回收可能是一个机会。

- 亚太地区主导全球市场,其中中国、印度和韩国等国的消费量最高。

己内酰胺市场趋势

对纺织品和地毯的需求增加

- 己内酰胺是製造尼龙 6 合成纤维的单体,尼龙 6 广泛用于纺织工业製造不织布。

- 由尼龙 6 製成的布料色彩鲜艳、重量轻、坚固耐用。在常压下很容易染色,颜色鲜艳、深邃。雪纺、欧根纱等织物的光泽和透明度归功于尼龙6。

- 由尼龙 6 树脂製成的地毯纤维耐用、有弹性且不褪色。尼龙 6 为地毯製造商提供了广泛的颜色和设计选择。此外,由尼龙 6 製成的地毯具有耐磨损、耐挤压和耐消光的特性,同时赋予最终产品持久的性能。尼龙 6 是地毯製造中使用的最耐用、用途最广泛的纤维。

- 在全球纺织业中,化纤占2021年纺织品总产量的77%以上,占较大比例。

- 根据德国化纤工业协会Industrievereinigung Chemiefaser统计,2021年全球合成纤维总产量为8,820万吨,较2020年成长约9%。

- 此外,2021年全球合成化学纤维(尼龙6、聚酰胺等)产量增加9.2%,达8,090万吨。

- 德国、西班牙、法国、义大利和葡萄牙等欧洲国家的纺织业约占世界纺织业的五分之一,价值约1,600亿美元。

- 由于其特性,纺织和地毯行业对尼龙6的需求不断增加,这将有利于预测期内的市场研究。

亚太地区主导市场

- 亚太地区在全球市场占据主导地位,占约70%的高份额。由于中国和印度等国家纺织工业的成长,该地区己内酰胺的消费量正在增加。

- 中国是全球最大的尼龙6生产国。中国最大的六家尼龙生产商包括广东新会美达尼龙、BASF(中国)和力恆(长乐)聚酰胺科技。以GDP计算,中国是世界第二大经济体。

- 根据中国工业与资讯化部统计,2022年1月至10月中国纺织品出口1,257亿美元,较去年同期成长6.9%。此外,2022年1月至10月,中国主要纺织企业营业收入总合达4.28兆元人民币(约6,116.5亿美元),较去年同期成长1.6%。

- 根据世界贸易组织(WTO)的数据,印度是第三大纺织品製造国。 IBEF预计,到2029年,印度纺织品市场规模预计将达到2,090亿美元,纺织业的市场需求可望进一步增加。

- 越南、台湾和孟加拉等其他国家在纺织业中占有很大份额,预计己内酰胺需求在预测期内将快速成长。

- 除纺织业外,主要用于汽车工业的工业纱线、树脂和薄膜对己内酰胺的需求也很大。

- 根据国际汽车製造组织(OICA)的数据,亚太地区汽车工业成长了6%,达到46,732,784辆。

己内酰胺产业概况

全球己内酰胺市场细分,五家主要企业约占35%的份额(基于产能)。该市场的主要参与企业包括(排名不分先后)中国石化开发公司、Fibrant、 BASF SE、Capro Co 和 UBE Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 扩大尼龙6产能

- 抑制因素

- 己内酰胺毒性

- 尼龙 6 替代品的存在

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 原料

- 苯酚

- 环己烷

- 最终产品

- 尼龙6树脂

- 尼龙6纤维

- 其他最终产品

- 目的

- 工程树脂/薄膜

- 工业丝

- 纺织品/地毯

- 其他的

- 最终用户产业

- 车

- 地毯

- 纺织品

- 其他的

- 地区

- 亚太地区

- 中国

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率分析

- 主要企业策略

- 公司简介

- AdvanSix Inc.

- Alpek SAB de CV

- BASF SE

- Capro Co.

- China Petrochemical Development Corporation

- China Petroleum & Chemical Corporation(Sinopec)

- Domo Chemicals

- Fertilisers And Chemicals Travancore Limited(FACT)

- Fibrant

- Fujian Jinjiang Petrochemical

- Juhua Group Corporation

- Lanxess

- PJSC Kuibyshevazot

- Shandong Haili Chemical Industry Co. Ltd

- Sumitomo Chemical Co. Ltd

- Toray Industries Inc.

- UBE Corporation

- Xuyang Group

第七章 市场机会及未来趋势

- 越来越关注己内酰胺回收

- 其他机会

The Caprolactam Market is expected to register a CAGR of greater than 3% during the forecast period.

Due to the outbreak of COVID-19, the caprolactam market was negatively impacted. Owing to the lockdown in various countries across the world, there were supply chain constraints that significantly obstructed the expansion of the industry. However, the market recovered last year, and it is expected to grow at a significant rate in the coming years.

Key Highlights

- Over the short term, the growing production capacity of Nylon 6 is the major driving factor favoring the market's growth.

- On the flip side, the toxicity of caprolactam and the presence of substitute products for Nylon-6 will likely hinder the market growth.

- Increasing focus on recycling caprolactam will likely act as an opportunity over the forecast period.

- Asia-Pacific dominated the market across the world, with the largest consumption from countries, such as China, India and South Korea.

Caprolactam Market Trends

Increasing Demand for Textile and Carpets

- Caprolactam is the monomer for the production of a chemical fiber called Nylon 6, which is extensively used in the textile industry to produce non-woven fabrics.

- Fabric made from nylon 6 is colorful and lightweight, and strong and durable. It can be easily dyed at normal atmospheric pressure and produces bright and deep shades. Fabrics, such as chiffon and organza, owe their luster and translucent appeal to nylon 6.

- Carpet fiber made from nylon 6 resin is durable, resilient, and colorfast. Nylon 6 offers a great range of colors and design options to carpet manufacturers. Furthermore, carpets made from nylon 6 are resistant to abrasion, wear and tear, and crushing and matting while granting long-lasting performance to the end product. Nylon 6 is the most durable and versatile fiber used to manufacture carpets.

- In the global textile industry, chemical fiber accounts for the major share accounting for more than 77% of the total production volume of textile fiber in the year 2021.

- As per the Industrievereinigung Chemiefaser (German Chemical Fiber Industry Association) in the year 2021, the total global production volume for chemical fibres was 88.2 million metric tons, registering an increase of around 9% as compared to the year 2020.

- Furthermore, the global production of synthetic chemical fibers (nylon 6, polyamide, etc) increased by 9.2% in the year 2021 and reached 80.9 million metric tons.

- The textile industries of European countries such as Germany, Spain, France, Italy, and Portugal are valued at around one-fifth of the global textile industry registering a value of around USD 160 billion.

- Owing to its properties the demand for nylon 6 from the textile and carpet industry is observing a continuous increase and is likely to favour the market studied over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market with the highest share of almost 70%. With the growing textile industry in countries like China and India, the consumption of caprolactam is increasing in the region.

- China is the largest producer of nylon 6 worldwide. Some of the largest manufacturers of nylon 6 in China are Guangdong Xinhui Meida Nylon Co Ltd, BASF (China) Co. Ltd, Liheng (Changle) Polyamide Technology Co. Ltd, etc. In terms of GDP, China is the second-largest economy in the world.

- As per the Chinese Ministry of Industry and Information Technology, China's textile exports from January to October 2022 grew 6.9 % year on year (YoY) and reached USD 125.7 billion. Moreover, the combined operating revenue of the major Chinese textile enterprises increased by 1.6 % YoY to CNY 4.28 trillion (~ USD 611.65 billion) during the January-October 2022 period.

- According to the WTO (World Trade Organization), India is the third-largest textile manufacturing industry. In India, the production of fabric from the decentralized sector of the country was recorded as 74.27 billion sq. m. in 2020 and the overall production was registered at more than 76.29 billion sq. m. According to IBEF, the Indian textiles market is expected to reach USD 209 billion by 2029, which will further boost the demand for the market from textile sector.

- Other countries such as Vietnam, Taiwan, and Bangladesh enjoy a prominent share in the textile industry and are expected to upsurge the demand for caprolactam at a high pace over the forecast period.

- Along with textile industry, caprolactam also has significant demand from industrial yarn, and resin and films which are majorly used in the automotive industry.

- As per the Organisation Internationale des Constructeurs d'Automobiles (OICA) the automotive industry in the Asia-Pacific increased by 6% and reached to 46,732,784 vehicles.

Caprolactam Industry Overview

The global caprolactam market is fragmented, and the top five players account for around 35% share (in terms of production capacity) in the global market. Key players in the market include (not in any particular order) China Petrochemical Development Corporation, Fibrant, BASF SE, Capro Co., and UBE Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Production Capacity of Nylon 6

- 4.2 Restraints

- 4.2.1 Toxicity of caprolactam

- 4.2.2 Presence of substitute products for Nylon-6

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume )

- 5.1 Raw Material

- 5.1.1 Phenol

- 5.1.2 Cyclohexane

- 5.2 End Product

- 5.2.1 Nylon 6 Resins

- 5.2.2 Nylon 6 Fibers

- 5.2.3 Other End Products

- 5.3 Application

- 5.3.1 Engineering Resins and Films

- 5.3.2 Industrial Yarns

- 5.3.3 Textiles and Carpets

- 5.3.4 Other Applications

- 5.4 End-user Industry

- 5.4.1 Automotive

- 5.4.2 Carpet

- 5.4.3 Textile

- 5.4.4 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 South Korea

- 5.5.1.4 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AdvanSix Inc.

- 6.4.2 Alpek S.A.B. de CV

- 6.4.3 BASF SE

- 6.4.4 Capro Co.

- 6.4.5 China Petrochemical Development Corporation

- 6.4.6 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.7 Domo Chemicals

- 6.4.8 Fertilisers And Chemicals Travancore Limited (FACT)

- 6.4.9 Fibrant

- 6.4.10 Fujian Jinjiang Petrochemical

- 6.4.11 Juhua Group Corporation

- 6.4.12 Lanxess

- 6.4.13 PJSC Kuibyshevazot

- 6.4.14 Shandong Haili Chemical Industry Co. Ltd

- 6.4.15 Sumitomo Chemical Co. Ltd

- 6.4.16 Toray Industries Inc.

- 6.4.17 UBE Corporation

- 6.4.18 Xuyang Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Focus on Recycling Caprolactam

- 7.2 Other Opportunities