|

市场调查报告书

商品编码

1637722

欧洲炭黑:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Carbon Black - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

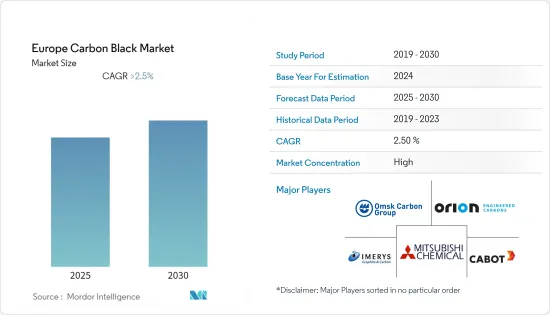

预计欧洲炭黑市场在预测期内将维持超过2.5%的复合年增长率。

儘管该市场受到了该地区 COVID-19 大流行的负面影响,包括需求和生产力下降、供应链中断和区域性停工,但该市场在 2021 年出现了显着增长,并在 2022 年继续增长。

主要亮点

- 从中期来看,欧洲轮胎产业的成长、纺织业应用的扩大以及特种炭黑的市场渗透是推动市场的关键因素。

- 另一方面,绿色轮胎的崛起和原物料价格的波动是预测期内限制目标产业成长的主要因素。

- 电动车的普及预计将在不久的将来为市场提供利润丰厚的成长机会。

- 德国是该地区最大的轮胎生产国,在该地区占据市场主导地位。预计该地区在预测期内也将经历最快的成长。

欧洲炭黑市场趋势

扩大轮胎和工业橡胶製品的应用

- 炭黑用作橡胶中的填充材,可显着提高耐磨性和拉伸强度,使轮胎使用寿命更长。

- 此外,炭黑有助于将热量从轮胎胎面和带束层转移出去,从而延长轮胎的使用寿命。炭黑还可以保护轮胎免受紫外线和臭氧的影响,从而影响轮胎的使用寿命。

- 轮胎中的炭黑还具有提高橡胶组合物的导电性的优点。据化学工程师称,不含炭黑的轮胎使用寿命可能为 5,000 英里或更短。结果,大多数驾驶员每年必须更换轮胎一到两次,这对大多数消费者来说是不受欢迎的。

- 除轮胎外,各种工业橡胶产品的成型和挤出也需要炭黑,包括输送机、垫圈、空气弹簧、索环、隔振器和软管。炭黑为此类产品提供弯曲强度。

- 欧洲拥有超过 91 个轮胎製造厂、15 个研发中心和 12 家营运中的主要轮胎製造商。此外,西欧、中欧和东欧预计近期将增加乘用车、轻型商用车、中重型商用车的产量。

- 根据欧洲轮胎和橡胶工业协会(ETRMA)发布的统计数据,2021年替换轮胎市场录得正成长。消费者(汽车、SUV、轻型商用车)、卡车以及马达和Scooter细分市场分别成长了 14%、12% 和 14%。

- 因此,考虑到上述因素,预计在预测期内轮胎和工业橡胶製品领域对炭黑的需求将会增加。

德国主导市场

- 德国预计将成为欧洲炭黑的主要市场。轮胎、橡胶、印刷油墨和塑胶等各种最终用途产业对炭黑的需求不断增加,预计将推动德国炭黑市场的发展。

- 德国是欧洲最大的通用橡胶製品(GRG)和轮胎生产国。 Continental AG、Dunlop GmbH、Michelin Reifenwerke AG &Co KGaA、Pirelli Deutschland GmbH 和 Freudenberg Group 是全国轮胎和非轮胎产品的主要製造商。德国轮胎行业的领导者正在同时扩张和收缩,以应对欧洲市场的变化。

- 德国是欧洲最着名的汽车製造国。该国引领欧洲汽车市场,拥有 41 个组装和引擎生产厂,占欧洲汽车总产量的三分之一。

- 根据OICA(国际汽车工业协会)统计,2021年该国汽车产量为33,086,692辆,与前一年同期比较减少12%。

- 然而,为了推动德国汽车产业向前发展并改善现状,新联合政府于2021年11月宣布了2030年引进150亿辆纯电动车的目标。这项措施预计将增强对汽车产业化学品和材料(包括炭黑)的需求。

- 2022 年,德国印刷油墨专家 Epstein 与包装材料长期供应商 GFV Verschlusstechnik GmbH &Co.KG 合作开发了一种用于 UV 油墨和涂料的新型塑胶。智慧印刷解决方案、适用于所有基材的油墨和数位印刷技术预计将推动德国印刷油墨市场的成长,对该领域使用的炭黑需求产生正面影响。

- 这些积极的特征预计将在整个预测期内推动德国炭黑市场的发展。

欧洲炭黑产业概况

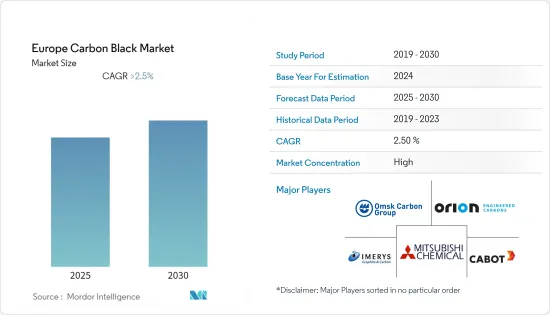

欧洲炭黑市场是一体化的。市场的主要参与企业包括(排名不分先后)卡博特公司、三菱化学公司、鄂木斯克碳集团、Orion Engineered Carbons 和 Imerys Graphite & Carbon。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 欧洲轮胎工业的成长

- 扩大在纺织业的应用

- 提高专门食品炭黑的市场渗透率

- 抑制因素

- 绿色轮胎的兴起

- 原物料价格波动

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 炉黑

- 气黑

- 灯黑

- 热感黑

- 目的

- 轮胎及工业橡胶製品

- 塑胶

- 墨粉和印刷油墨

- 涂层

- 纤维

- 其他的

- 地区

- 德国

- 英国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Birla Carbon

- Black Bear Carbon BV

- Cabot Corporation

- Cancarb

- Carbon Black Kft.

- Continental Carbon Company

- Imerys Graphite & Carbon

- Mitsubishi Chemical Corporation

- Omsk Carbon Group

- Orion Engineered Carbons

- PHILLIPS CARBON BLACK LIMITED

- Tokai Carbon Co. Ltd.

第七章 市场机会及未来趋势

- 电动车的扩张

The Europe Carbon Black Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The market was/is negatively impacted due to the COVID-19 pandemic in the region, including decreased demand and productivity, supply chain disruptions, and regional lockdowns; however, the market showed significant growth in 2021 and continued to grow in 2022.

Key Highlights

- Over the medium term, the major factor driving the market studied is the growing tire industry in Europe, growing application in fiber and textile industries, and increasing market penetration of specialty carbon black.

- On the flip side, the rising prominence of green tires and volatility in the prices of raw materials are the key factors anticipated to restrain the growth of the target industry over the forecast period.

- Adopting electric cars will likely create lucrative growth opportunities for the market soon.

- Germany dominated the market across the region due to the most significant production of tires. Also, the region is projected to witness the fastest growth during the forecast period.

Europe Carbon Black Market Trends

Increasing Application for Tires and Industrial Rubber Products

- Carbon black is used as a filler in rubber; it dramatically improves abrasion resistance and tensile strength, resulting in a tire that lasts longer.

- Furthermore, the carbon black helps conduct heat away from the tread and belts of the tires, extending the tire's lifespan. The carbon black also protect the tires from UV radiation and ozone, which can affect tire life.

- Carbon black in tires has the benefit of making rubber compositions more electrically conductive. According to chemical engineers, a tire built without carbon black would likely last 5000 miles or less. As a result, most drivers would have to replace their tires one to two times per year, which would be undesirable to most consumers.

- Other than tires, carbon black is also required for various molded and extruded industrial rubber products, such as conveyor belts, gaskets, air springs, grommets, vibration isolation devices, and hoses. It provides flex strength in such products.

- Europe has more than 91 tire manufacturing facilities, 15 R&D centers, and 12 leading tire manufacturers which are currently in operation. Furthermore, the production and sales of passenger cars, light commercial vehicles, and medium and heavy commercial vehicles in all of Western, Central, and Eastern Europe are expected to increase in the near future.

- As per the stats released by The European Tyre & Rubber Manufacturers Association (ETRMA), the replacement tire market registered a positive growth rate in 2021. The consumer (passenger cars, SUVs, and light commercial vehicles), truck, and motor & scooter segments reported 14%, 12%, and 14% growth respectively.

- Therefore, considering the aforementioned factors, the demand for carbon black is expected to rise from the tires and industrial rubber products segment during the forecast period.

Germany to Dominate the Market

- Germany is expected to be the leading market for carbon black in Europe. The increasing demand for carbon black from various end-use industries, such as tire, rubber, printing inks, and plastic, is expected to drive the carbon black market in Germany.

- Germany is the largest producer of general rubber goods (GRG) and tires in Europe. Continental AG, Dunlop GmbH, Michelin Reifenwerke AG & Co KGaA, Pirelli Deutschland GmbH, Freudenberg Group, etc., are some of the major manufacturers of the tire and non-tire products in the country. The major players in the German tire industry are expanding and contracting simultaneously in response to market changes in Europe.

- Germany has the most prominent automotive industry in Europe. The country leads the European automotive market, with 41 assembly and engine production plants that contribute to one-third of the total automobile production in Europe.

- According to OICA (International Organization of Motor Vehicle Manufacturers), in 2021, the country produced 33,08,692 vehicles, which decreased by 12% from the previous year; thereby, it restricted the demand for carbon black from this segment in the short term.

- However, to advance the automotive sector in Germany and improve its current situation, the new coalition government in November 2021 announced a target to bring in 15 billion battery electric vehicles in the country by 2030, equivalent to around 1.6 million battery vehicles a year. The initiatives are expected to bolster the demand for chemicals and materials in the automotive sector, including carbon black.

- In 2022, Eppstein, a Germany-based specialist in Printing ink, innovated a new plastic for its UV inks and coatings along with its long-term supplier of packaging material, GFV Verschlusstechnik GmbH & Co. KG. Smart printing solutions, ink for all substrates, and digital printing technology are likely to drive the growth of the printing inks market in Germany, thereby positively affecting the demand for carbon black utilized in this segment.

- Such positive attributes are expected to drive the market for carbon black in Germany through the forecast period.

Europe Carbon Black Industry Overview

The Europe Carbon Black Market is consolidated in nature. Some of the major players in the market (in no particular order) include Cabot Corporation, Mitsubishi Chemical Corporation, Omsk Carbon Group, Orion Engineered Carbons, and Imerys Graphite & Carbon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Tire Industry in Europe

- 4.1.2 Growing Application in Fiber and Textile Industries

- 4.1.3 Increasing Market Penetration of Specialty Black

- 4.2 Restraints

- 4.2.1 Rising Prominence of Green Tires

- 4.2.2 Volatility in Prices of Raw Materials

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Furnace Black

- 5.1.2 Gas Black

- 5.1.3 Lamp Black

- 5.1.4 Thermal Black

- 5.2 Application

- 5.2.1 Tires and Industrial Rubber Products

- 5.2.2 Plastics

- 5.2.3 Toners and Printing Inks

- 5.2.4 Coatings

- 5.2.5 Textile Fibers

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 Italy

- 5.3.4 France

- 5.3.5 Russia

- 5.3.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Birla Carbon

- 6.4.2 Black Bear Carbon B.V.

- 6.4.3 Cabot Corporation

- 6.4.4 Cancarb

- 6.4.5 Carbon Black Kft.

- 6.4.6 Continental Carbon Company

- 6.4.7 Imerys Graphite & Carbon

- 6.4.8 Mitsubishi Chemical Corporation

- 6.4.9 Omsk Carbon Group

- 6.4.10 Orion Engineered Carbons

- 6.4.11 PHILLIPS CARBON BLACK LIMITED

- 6.4.12 Tokai Carbon Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growth in the Adoption of Electric Cars