|

市场调查报告书

商品编码

1637731

LiDAR:全球市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

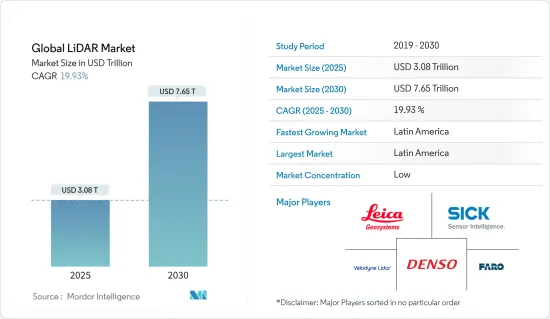

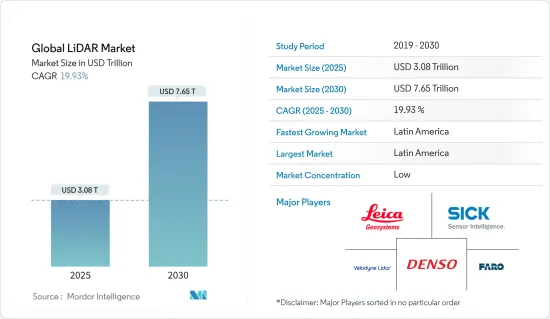

预计 2025 年全球 LiDAR 市场规模为 3.8 兆美元,到 2030 年将达到 7.65 兆美元,预测期内(2025-2030 年)的复合年增长率为 19.93%。

推动 LiDAR 市场成长的主要因素之一是 LiDAR 系统在无人机中的使用日益增多、LiDAR 在工程和建筑应用中的使用、LiDAR 在地理资讯系统 (GIS) 应用中的使用、4D LiDAR 的出现、关于在各种用途上使用商业无人机的法规。无人机和自动驾驶汽车的安全问题以及价格低廉、轻巧的摄影测量设备的普及阻碍了市场扩张。

主要亮点

- 在全球范围内,特别是在开发中国家,工程和土木工程建设活动的规模和范围正在大幅扩张,以适应不断增长的人口。从测绘到进行计划可行性研究,建筑活动的每个阶段都需要越来越多的技术。 LiDAR 技术可以轻鬆准确地对大面积区域进行详细测量。此外,全球定位系统辅助雷射扫描器和高灵敏度摄影机可协助工程师设计符合计划标准的方案并进行准确的可行性评估。因此,许多 LiDAR 服务提供者应运而生。

- 在石油天然气和采矿业,LiDAR 技术使科学家和测绘专业人员能够以比以往更高的精度、准确度和灵活性对各种尺度的建筑和自然环境进行勘测。政府对自动化的激励措施以及在救灾和管理等政府部门各项活动中采用雷射雷达的倡议也推动了该行业的发展。在印度,运输部已要求在修建新高速公路之前使用光达系统进行勘测。

- 无人机,又称为无人驾驶飞行器(UAV),由于成本低、应用范围广,在许多行业中得到越来越广泛的应用。 LiDAR 无人机最初是作为研究大气成分、云层、地球结构和气溶胶的仪器而开发的。它仍然是全球气候观测的有力工具。 NOAA 和其他研究机构操作这些仪器来收集资料并更好地了解气候变迁。

- 汽车领域的先进技术发展是光达市场的主要推动力。企业正在探索各种技术的整合,而LiDAR技术可能发挥关键作用。

- 部署该技术的高成本阻碍了该市场的成长。预计未来几年,LiDAR 系统将成为自动无人机和汽车的标准配备。自动驾驶汽车技术的快速创新和政府不断增加的支持预计将在预测期结束前推动 5 级自动驾驶汽车的早期部署。随着产业向完全自动驾驶汽车迈进,对光达系统的依赖性越来越强。

- 新冠肺炎疫情已影响全球各行各业。汽车产业是 LiDAR 的主要采用者之一。疫情导致各生产工厂关闭,影响了需求。半导体材料的短缺使情况变得更加糟糕。

LiDAR 市场趋势

机器人车辆是市场驱动力之一

- 该产业正在探索在无人驾驶汽车、自动导引运输车(AGV)、自动导引运输车和无人机中使用 LiDAR 技术。 ADAS(进阶驾驶辅助系统)是高阶驾驶辅助系统的缩写。 LiDAR 是目前自动驾驶和自主汽车开发中使用的最尖端科技之一。自主无人机、机器人和车辆可以使用 LiDAR(光检测和测距)进行导航、障碍物侦测和防撞。

- LiDAR 让自动驾驶汽车、自动导引运输车和其他无人机能够做出更准确的决策,不受人为错误的影响,也更不容易发生碰撞。近年来,由于技术进步和 LiDAR 感测器相对成本的降低,这一数字有所增加。 LiDAR 让自动驾驶汽车可以 360 度俯瞰世界。它还提供高度精确的深度资讯。

- AGV 上的 LiDAR 感测器发出一系列雷射脉衝,测量物体与车辆之间的距离。这些编译的资料创建了工作区域的 360° 环境地图。透过这种映射,AGV 无需任何额外的基础设施即可在设施内导航。

- 在机器人车辆上使用 LiDAR 需要使用多个 LiDAR 来绘製车辆周围环境的地图。使用 LiDAR 需要高度的感测器冗余以确保乘客安全。完全自动驾驶的乘用车和机器人汽车尚未适当开发,而 LiDAR 预计也将在其中发挥关键作用。

- 用于机器人导航的雷射雷达提供了有关车辆在环境和物体上的位置的重要距离测量资讯。电子商务的快速扩张和对职场安全的日益关注,推动了自主移动机器人 (AMR) 和自动导引运输车(AGV) 市场的显着增长。这些因素预计将推动机器人车辆对雷射雷达应用的需求。

- 例如,智慧型雷射雷达感测器系统供应商RoboSense于2022年11月发表了新产品RS-LiDAR-E1(E1)。 RS-LiDAR-E1是一款基于我们自主研发的自订晶片和快闪记忆体技术平台的360°视角快闪固态雷射雷达。 E1帮助伙伴弥补智慧驾驶感知方面的缺口,提升无人驾驶和自动驾驶汽车的全场景感知能力,是实现自动驾驶核心能力的关键。

- 此外,在户外操作的移动机器人可以依靠光达等感测技术以及 GPS 等地理定位功能来确定其当前位置和目的地。 LiDAR 感测器被归类为导航或避障感测器。机器人车辆具有广泛的应用范围,随着电子商务销售额的成长,其需求预计也会增加。预计电子商务销售额的成长将推动机器人汽车光达市场的发展。

- 例如,Velodyne Lidar 于 2022 年 6 月宣布,波士顿动力公司将根据多年协议在机器人中使用其雷射雷达感测器。该公司表示,其光达感测器使先进的移动机器人(AMR)能够在各种条件下自主运行,包括变化的温度和暴雨。机器人可以使用感测器获取即时 3D 感知资料,以进行定位、映射、物件分类和物件追踪。

拉丁美洲可望占据主要市场占有率

- 拉丁美洲森林茂密,被誉为新兴经济体,为扩张和探索提供了巨大的机会。该地区的原始自然风光加上光达技术预计将见证所研究市场的强劲成长。

- 根据联合国粮食及农业组织(FAO)统计,拉丁美洲和加勒比地区总面积的49%被森林覆盖。该地区森林面积8.91亿公顷,约占世界森林面积的22%。该地区拥有全球57%的原始森林,对于保护生物多样性至关重要。

- 此外,根据粮农组织的数据,14% 的森林面积被归类为生产性森林。该地区丰富的森林资源为雷射雷达技术在林业中的应用创造了广阔的前景。配备光达的无人机可用于这些森林地区,以创建显示人类活动影响的 3D 模型。此外,LiDAR 穿透树木覆盖的能力使其在该地区的森林茂密地区非常有用。

- 除了林业技术应用外,该地区还拥有丰富的农业用地。粮农组织将拉丁美洲和加勒比海地区定位为全球粮食安全的支柱,其使命是推动农业粮食体系转型,到2050年养活100亿人口。这些雄心勃勃的目标,加上该地区农产品出口的增加,预计将推动该行业的技术应用。

光达产业概览

LiDAR 市场比较分散,有许多大大小小的参与者在竞争。透过产品和技术发布、策略伙伴关係、收购、扩张和合作,这些参与者正在寻求在市场上获得竞争优势。市场的主要企业包括 Sick AG、Teledyne Optech、Quanergy Systems Inc、Velodyne LiDAR、3D Laser Mapping Ltd、Denso Corporation 等。

- 2024 年 2 月-约翰迪尔宣布与 Hexagon 旗下公司 Leica Geosystems 建立策略伙伴关係,协助加速重型建设产业的数位转型。约翰迪尔与徕卡测量系统之间的合作充分利用了两家公司的优势,为世界各地的建筑专业人士提供新技术和服务。

- 2023 年 5 月 - SICK AG 宣布将以资产管理外壳 (AAS) 的形式向消费者和合作伙伴提供来自 40,000 多个 SICK 感测器的标准化资讯。 SICK 已表明其愿意为工业数位化进程做出重大贡献。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场驱动因素

- 无人机的快速发展和用途不断扩大

- 汽车业采用率不断提高

- 市场挑战

- LiDAR 系统高成本

- 产业价值链

- 技术简介

- 测量过程选项

- 雷射选项

- 光束控制选项

- 检测器选项

- COVID-19 市场影响

第五章 市场区隔

- 按应用

- 机器人车辆

- ADAS

- 环境

- 地形

- 风

- 农业和林业

- 工业

- 按类型

- 航空(地形和水深)

- 地面类型(移动/静止)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 公司简介

- Leica Geosystems AG(Hexagon AB)

- Sick AG

- Trimble Inc.

- Quanergy Systems Inc.

- Faro Technologies Inc.

- Teledyne Optech

- Velodyne LiDAR Inc.

- Topcon Corp.

- RIEGL Laser Measurement Systems GmbH

- Leosphere(Vaisala)

- Waymo

- RoboSense LiDAR

- Denso Corporation

- Innoviz Technologies Ltd

- Neptec Technologies Corp.(Maxar)

第七章 市场展望

The Global LiDAR Market size is estimated at USD 3.08 trillion in 2025, and is expected to reach USD 7.65 trillion by 2030, at a CAGR of 19.93% during the forecast period (2025-2030).

One of the primary factors augmenting the LiDAR market growth is the increasing use of LiDAR systems in UAVs, the use of LiDAR in engineering and construction applications, the use of LiDAR in geographical information systems (GIS) applications, the emergence of 4D LiDAR, and the loosening of regulations surrounding the use of commercial drones in various applications. The market's expansion is being held back by safety concerns around UAVs and autonomous vehicles, as well as the accessibility of affordable and lightweight photogrammetry devices.

Key Highlights

- Globally, and especially in developing nations, the size and scope of engineering and civil construction activities have greatly increased to accommodate the growing population. All stages of building activities, from surveying and mapping to conducting project feasibility studies, call for an increasing amount of technology. LiDAR technologies can easily and accurately give a detailed survey of vast areas. Additionally, global positioning system-assisted laser scanners and extremely sensitive cameras assist engineers in creating designs that meet project criteria and accurate feasibility assessments. Many LiDAR service providers have expanded as a result of this.

- In the oil and gas and mining sector, LiDAR technology allows scientists and mapping professionals to examine built and natural environments across a wide range of scales with greater accuracy, precision, and flexibility than ever before. The encouragement from the government in automation and the adoption of LiDAR in various government sector activities, like flood relief and management, are also driving the industry's growth. In India, the Transport Ministry mandated the use of LiDAR systems in surveying areas before constructing a new highway.

- Drones, or unmanned aerial vehicles (UAV's), are witnessing growing adoption across many industries, owing to their low cost and vast array of applications. LiDAR drones were first developed as an instrument for studies on atmospheric composition, clouds, earth structures, and aerosols. They remain a powerful tool for climate observations around the world. Collecting this data, NOAA and other such research organizations operate these instruments to enhance understanding of climate change.

- The growing technological developments in the automotive sector is the major driving factor of the LiDAR market. The companies are looking for an amalgamation of various technologies, and LiDAR technology might play a vital role.

- High costs associated with the deployment of this technology are restraining the growth of this market. LiDAR systems are expected to become standard installations in autonomous drones and cars, expected to be deployed over the coming years. With fast-moving innovations in autonomous vehicle technologies and increasing support from the government, the early deployment of Level 5 autonomous vehicles is expected by the end of the forecast period. With the industry moving toward the complete autonomous range of vehicles, the dependence on LiDAR systems is growing.

- The COVID-19 outbreak affected industries around the world. The automotive industry is one of the significant adopters of LiDAR. The outbreak has resulted in the shutdown of various production plants impacting the demand. Semiconductor materials scarcity has further aggravated the situation.

LiDAR Market Trends

Robotic Vehicles are among the Factors Driving the Market

- This segment is considering using LiDAR technology in robotic cars, automotive guided vehicles (AGVs), uncrewed vehicles, and drones. ADAS (Advanced Driver Assist System) is an acronym for Advanced Driver Assist System. LiDAR is one of the most advanced technologies currently being used to develop self-driving cars and autonomous vehicles. LiDAR (Light Detection And Ranging) can be used by autonomous drones, robots, and vehicles for navigation, obstacle detection, and collision avoidance.

- LiDAR enables self-driving vehicles, AGVs, and other drones to make precise judgments without human error, making them less susceptible to crashes. This has increased in recent years due to technological advancements and the relative cost reduction of LiDAR sensors. A self-driving car can see the world with a continuous 360-degree view thanks to LiDAR. It also allows for highly accurate depth information.

- When mounted on an AGV, a LiDAR sensor sends out a series of laser pulses that measure the distance between objects and the vehicle. This compiled data creates a full 360° environmental map of the operational area. The resulting mapping allows the AGV to navigate the facility without additional infrastructure.

- Using LiDAR in robotic vehicles entails using multiple LiDARs to map the vehicle's surroundings. The use of LiDAR is required for a high level of sensor redundancy to ensure the safety of its passengers. The proper development of fully autonomous or robotic vehicles for passengers is still in the works, and LiDAR is expected to play a significant role in these as well.

- LiDAR for robotic navigation provides critical distance measurement information about the environment and the vehicle's position on objects. Rapidly expanding e-commerce and a greater emphasis on workplace safety are driving massive growth in the Autonomous Mobile Robot (AMR) and Automatic Guided Vehicle (AGV) markets. Such factors will drive up demand for LiDAR applications in robotic vehicles.

- For example, RoboSense, a Smart LiDAR Sensor Systems provider, held a new product launch in November 2022, RS-LiDAR-E1 (E1), a flash solid-state LiDAR that sees 360° based on its in-house, custom-developed chips, and flash technology platform. E1 will help partners bridge the gap in smart driving perception and improve the all-scenario perception capability of automated and autonomous vehicles as a critical piece to realizing the core functions of autonomous driving.

- Furthermore, mobile robots operating outside can rely on geolocation capabilities such as GPS, as well as sensing technologies such as Lidar, to determine where they are and where they are going. LiDAR sensors are classified as navigation or obstacle avoidance sensors. The demand for Robot vehicles is expected to increase as E-commerce sales increase due to their wide range of applications. The market for LiDARs for robotic vehicle applications will be fueled by an increase in E-commerce sales.

- For instance, Velodyne Lidar Inc. announced in June 2022 that Boston Dynamics would use its lidar sensors in its robots as part of a multi-year agreement. According to the company, its Lidar sensors enable mobile robots (AMR) to operate autonomously in a variety of conditions, including changing temperatures and rainstorms. Robots can use their sensors to obtain real-time 3D perception data for localization, mapping, object classification, and object tracking.

Latin America is Expected to Hold Significant Market Share

- Latin America has dense forest cover and can be identified as a developing economy, indicating significant expansion and excavation opportunities. Owing to the native nature of the region, coupled with LiDAR technology, the region is expected to witness solid growth in the studied market.

- According to the Food and Agriculture Organization (FAO) of the United Nations, 49% of the total area of Latin America and the Caribbean is covered by forests. The region's forest cover includes 891 million hectares, representing approximately 22% of the global forest area. The region is home to 57% of the world's primary forests, which makes it vital for biodiversity and conservation.

- Furthermore, according to FAO, 14% of the total forest area has been earmarked for productive functions. The region's significant forest resources create a wide-open prospect for the adoption of the Lidar technology for its adoption in forestry. LiDAR-equipped drones can be used over these forest areas to create 3D models that illustrate the impact of human activity. Furthermore, owing to the capacity of LiDAR to penetrate tree cover makes it exceptionally useful for the region's thick forest-covered area.

- In addition to the applications of technology in forestry, the region is marked for its farming lands. FAO has titled Latin America and the Caribbean as the pillar for world food security with a mission of driving the necessary agri-food systems transformation to feed 10 billion people by 2050. Such ambitious goals, coupled with increasing regional agricultural exports, are expected to support the adoption of the technology in the sector.

LiDAR Industry Overview

The LiDAR Market is fragmented due to many large and small players churning the competition in the market. Through product and technology launches, strategic partnerships, acquisitions, expansion, and collaboration, these players try to gain a competitive edge in the market. Key players in the market are Sick AG, Teledyne Optech, Quanergy Systems Inc., Velodyne LiDAR, 3D Laser Mapping Ltd, Denso Corporation, etc.

- February 2024 - John Deere announced a strategic partnership with Leica Geosystems, part of Hexagon, to assist in accelerating the digital transformation of the heavy construction industry. The collaboration between John Deere and Leica Geosystems would leverage the strengths of both companies to bring new technologies and services to construction professionals worldwide.

- May 2023 - SICK AG announced that it would provide standardized information from over 40,000 SICK sensors in the form of Asset Administration Shells (AAS) to consumers and partners. SICK demonstrated its aspiration to contribute significantly to the advancement of industrial digitalization.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Market Drivers

- 4.3.1 Fast Paced Developments and Increasing Application of Drone

- 4.3.2 Increasing Adoption in the Automotive Industry

- 4.4 Market Challenges

- 4.4.1 High Cost of The LiDAR Systems

- 4.5 Industry Value Chain

- 4.6 Technology Snapshot

- 4.6.1 Measurement Process Options

- 4.6.2 Laser Options

- 4.6.3 Beam Steering Options

- 4.6.4 Photodetector Options

- 4.7 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Robotic Vehicles

- 5.1.2 ADAS

- 5.1.3 Environment

- 5.1.3.1 Topography

- 5.1.3.2 Wind

- 5.1.3.3 Agriculture and Forestry

- 5.1.4 Industrial

- 5.2 Type

- 5.2.1 Aerial (Topographic and Bathymetric)

- 5.2.2 Terrestrial (Mobile and Static)

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Leica Geosystems AG (Hexagon AB)

- 6.1.2 Sick AG

- 6.1.3 Trimble Inc.

- 6.1.4 Quanergy Systems Inc.

- 6.1.5 Faro Technologies Inc.

- 6.1.6 Teledyne Optech

- 6.1.7 Velodyne LiDAR Inc.

- 6.1.8 Topcon Corp.

- 6.1.9 RIEGL Laser Measurement Systems GmbH

- 6.1.10 Leosphere (Vaisala)

- 6.1.11 Waymo

- 6.1.12 RoboSense LiDAR

- 6.1.13 Denso Corporation

- 6.1.14 Innoviz Technologies Ltd

- 6.1.15 Neptec Technologies Corp. (Maxar)