|

市场调查报告书

商品编码

1637735

电磁流量计:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Electromagnetic Flowmeter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

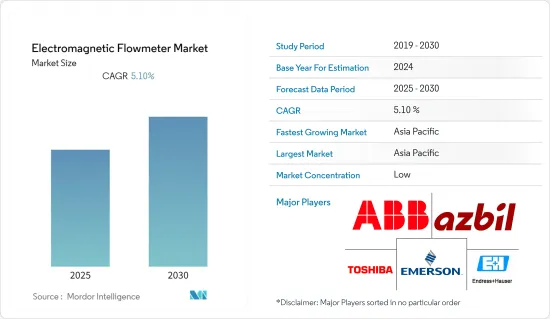

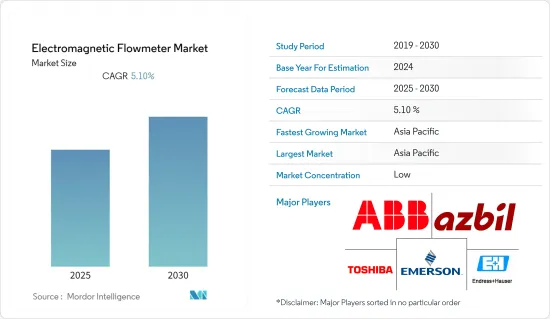

预计预测期内磁流量计市场复合年增长率为 5.1%。

主要亮点

- 电磁流量计广泛用于测量导电液体。使用电磁流量计可以轻鬆测量电导率最低为 10 μS/cm 的液体。由于磁流量计没有活动部件,因此与其他流量计相比,它们需要的维护更少。一般来说,它们可用于任何管线尺寸,具有良好的精度并且没有压力下降。它主要用于0.2%到0.5%的精度至关重要的工业领域。

- 磁流量计在各个公共和私营部门的应用非常广泛,包括污水处理、供水、废水测量、泥浆和其他高密度液体测量。此外,电池供电的磁流量计的引入消除了电源问题,并扩大了小规模工业的应用范围。

- 污水处理需求的不断成长也是推动该市场成长的主要因素。随着工厂的扩张,许多废弃物管理组织都在投资磁流量计。

- 2021 年 6 月,KROHNE Inc. 推出了 TIDALFLUX 2300 F,这是一款电磁流量计,可在 10% 到 100% 完成的管道中提供可靠的流量测量。它采用非接触式感测器,不受表面漂浮油脂的影响。 TIDALFLUX 2300 F 具有很强的耐化学性和耐磨性,尺寸可适合最大 64 英吋的管道。 TIDALFLUX 2300 F 非常适合运送都市废水和工业污水。

- 新冠疫情的爆发促使磁流量计市场重新评估传统的生产流程,从根本上推动了整个生产线的数位转型和工业4.0的实践。製造商也被迫设计和部署多种新的灵活方法来监控他们的产品和品管。新冠肺炎疫情已对全球大、中、小型产业造成了经济混乱。政府实施封锁措施以最大程度地减少病毒传播,导致各行各业受到打击。

电磁流量计的市场趋势

用水和污水产业将经历最高成长率

- 在工业环境中,磁流量计主要用于水资源管理。经过数十年在感测器和讯号处理领域的持续研究和开发,我们已经研发出了先进的电磁流量计,它可以透过测量、控制和调节技术最佳地整合到高度复杂的应用中。

- 电磁流量计用于测量已处理和未处理的污水、製程用水、水和化学品。它们的耗电量相对较低,有些型号只需要 15 瓦。因此,随着对水基础设施的投资增加,磁流量计的采用预计也会增加。

- 一旦校准到适用于水的程度,磁流量计就可以用来测量其他导电流体,而无需进行额外的校正。这是相对于其他类型流量计的一大优势。

- 此外,电磁流量计可以测量电导率低至 1 μS/cm 的水。对于电导率较低的流体,例如去离子水,只有具有高激励电流和高激励频率的双频磁流量计才能处理此类应用。

- 美国环保署负责执行联邦清洁水和安全饮用水法、协助市政污水处理厂,并参与旨在保护流域和饮用水源的污染防治工作。根据美国人口普查局的数据,到 2022 年美国用水和污水系统的销售额预计将达到约 147 亿美元。

- 此外,大多数磁流量计都具有高频双频激励作为可选功能。即使在低电导率水等要求严格的应用中,这也确保了测量极为稳定。

亚太地区成为快速成长的市场

- 据世卫组织称,减少污水产生量和引入现场排放和污水技术是改善污水管理的两种策略。

- 印度品牌股权基金会称,2021 年 12 月,印度已完成其雄心勃勃的计划的一半,该计划将于 2024 年前为 60 万个村庄的所有 1.92 亿户家庭提供安全饮用水。作为这个耗资约 500 亿美元的计划的一部分,数十万承包商和工人正在安装超过 250 万英里的管道,由约 18,000 名政府工程师监督。

- 例如,总部位于艾哈默德巴德的 Cleantech 水务公司满足工业和生活需求,并为污水处理提供单一窗格分散式解决方案。该公司提供一系列污水处理和水处理解决方案,包括污水处理厂、中水处理厂、废水处理厂、工业水处理、逆渗透厂、压力砂滤系统、双介质过滤器等。

- 此外,亚洲水环境伙伴关係(WEPA)旨在透过提供必要的资讯和知识来加强水环境管治,从而改善水环境。这些因素对该地区的发展贡献巨大。

磁流量计产业概况

全球磁流量计市场竞争激烈。市场的主要企业包括 ABB 有限公司、Azbil 株式会社、Endress+Hausar AG、艾默生电气公司、东芝公司、霍尼韦尔国际公司和 KROHNE Messtechnik GmbH。为了在预测期内获得竞争优势,公司正在建立多种伙伴关係并投资新产品的推出以增加市场占有率。

2022 年 7 月,西门子希腊公司与拉里萨市政用水和污水公司 (DEYAL) 合作,确立了西门子在今年 IFAT 上的影响力,IFAT 是全球领先的用水和污水、废弃物和材料管理展览会。透过此旗舰计划,西门子提供用水和污水厂及网路管理以及农村灌溉解决方案。同时,西门子的节能泵浦、流量计和工业 4.0 解决方案已经显着节省了能源并减少了渗漏损失。

2021 年 11 月 ABB 的磁流量计涵盖整体水循环过程,从取水到处理、计量和分配。 ABB 为水循环的各个阶段提供广泛的磁流量计和测量产品。 ABB 与丹麦水环境 DHI 集团合作开发了一套数位解决方案,以便用水和污水公用事业能够更快、更准确地做出决策。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对磁流量计市场的影响

第五章 市场动态

- 市场驱动因素

- 水资源短缺和人口成长

- 灌溉创新

- 市场挑战

- 无法测量非导电流体

第六章 市场细分

- 按产品

- 线上电磁式流量计

- 小流量电磁式流量计

- 插入式电磁式流量计

- 按应用

- 用水和污水

- 化工和石化

- 发电

- 金属与矿业

- 石油和天然气

- 饮食

- 其他用途(纸浆和纸张、药品)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- ABB Ltd

- Azbil Corporation

- Endress+Hausar AG

- Emerson Electric Corporation

- Toshiba Corporation

- Honeywell International Inc.

- KROHNE Messtechnik GmbH

- OMEGA Engineering Inc.(Spectris PLC)

- Siemens AG

- Yokogawa Electric Corporation

第八章投资分析

第九章:市场的未来

The Electromagnetic Flowmeter Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- Electromagnetic flowmeters are being widely adopted to measure liquids that are conductive in nature. Liquids with a minimum conductivity of 10 μS/cm are easily measured using an electromagnetic flowmeter. As the electromagnetic flowmeter does not have any moving parts, it requires less maintenance than other flowmeters. It can generally be used for any line size, with good accuracy and no pressure loss. Primarily, industries are investing in flowmeters, where accuracy is of utmost importance, i.e., in the range of 0.2% to 0.5%.

- Sewage water treatment, water distribution, effluent measurement, slurry, and other dense liquid measurements in various public and private sectors are some of the highly adopted applications of electromagnetic flowmeters. Furthermore, introducing battery-powered electromagnetic flowmeters eliminates the power supply issues, expanding its scope among small industries.

- The growing need for wastewater treatment is also a significant factor driving the growth of the market studied. Many waste management organizations are investing in electromagnetic flowmeters as their plants are also expanding.

- In June 2021, KROHNE Inc. announced the TIDALFLUX 2300 F, an electromagnetic flowmeter that provides reliable flow measurement in pipes between 10 and 100% complete. It features a non-contact sensor that remains unaffected by oils and fats floating on the surface. TIDALFLUX 2300 F has high chemical and abrasion resistance and is available in diameter to fit pipes up to 64 inches. TIDALFLUX 2300 F is best-suitable for municipal or industrial wastewater transport applications.

- The outbreak of COVID-19 triggered the electromagnetic flowmeters market to re-evaluate its conventional production processes, fundamentally driving the digital transformation and Industry 4.0 practices across the production lines. The manufacturers are also forced to devise and deploy multiple new and agile approaches to monitor product and quality control. The COVID-19 pandemic created economic turmoil globally for small, medium, and large-scale industries. The government's lockdown was inflicted to minimize the virus' spread, resulting in sectors taking a hit.

Electromagnetic Flowmeter Market Trends

Water and Wastewater Industry to Witness the Highest Growth

- In industrial environments, an electromagnetic flowmeter is primarily used in water management. Decades of ongoing research and development in sensors and signal processing resulted in sophisticated electromagnetic flowmeters that can be integrated optimally into highly complex applications using measuring, controlling, and regulating technologies.

- Electromagnetic flowmeters are used to measure treated and untreated sewage, processed water, water, and chemicals. Their power usage is relatively low, with electrical power requirements as low as 15 watts for some models. Therefore, with increasing investments in water infrastructure, electromagnetic flowmeters are also expected to witness a rise in adoption.

- Once the electromagnetic flowmeter is calibrated to operate with water, it can be further used to measure the other conductive fluids with no additional correction. This is a significant advantage that different types of flow meters do not have.

- Furthermore, electromagnetic flowmeters enable the measurement of water with conductivity as low as 1 μS/cm. For low-conductivity fluids, like de-ionized water, only dual-frequency magmeters with high excitation currents and high excitation frequencies can perform such applications.

- The United States Environmental Protection Agency enforces federal clean water and safe drinking water laws, provides support for municipal wastewater treatment plants, and takes part in pollution prevention efforts aimed at protecting watersheds and sources of drinking water. According to the US census bureau, it is projected that the revenue of water, sewage, and other systems in the United States will amount to approximately USD 14.7 billion by 2022.

- Moreover, in most electromagnetic flowmeters, enhanced dual-frequency excitation with a high frequency is being made available as an optional feature. This ensures highly stable measurements in demanding applications, such as low-conductivity water.

Asia-Pacific to Emerge as the Fastest Growing Market

- The water and wastewater management industry is dominant in many countries of the Asia-Pacific region, and according to WHO, reducing wastewater generation and implementing on-site sewage and wastewater technology are two strategies that can improve wastewater management.

- According to India Brand Equity Foundation, in December 2021, India was halfway through an ambitious plan to deliver safe drinking water to all 192 million homes in 600,000 villages by 2024. Hundreds of thousands of contractors and laborers are installing more than 2.5 million miles of the pipe as part of the USD 50 billion projects, which about 18,000 government engineers oversee.

- For instance, Cleantech water, an Ahmedabad-based company, provides single-window decentralized solutions for wastewater treatment, catering to industrial and domestic needs. The company offers a variety of wastewater treatment and water treatment solutions, such as sewage treatment plants, grey water treatment plants, effluent water treatment plants, industrial water treatment, RO plants, pressure sand filter systems, and dual media filters.

- Furthermore, the Water Environment Partnership in Asia (WEPA) also aims to improve the water environment by offering information and knowledge necessary for enhancing water environment governance. Such factors have significantly contributed to the growth of the region.

Electromagnetic Flowmeter Industry Overview

The Global Electromagnetic Flowmeter Market is very competitive. Some of the significant players in the market are ABB Ltd, Azbil Corporation, Endress+Hausar AG, Emerson Electric Corporation, Toshiba Corporation, Honeywell International Inc., KROHNE Messtechnik GmbH, and many more. The companies are increasing the market share by forming multiple partnerships and investing in introducing new products to earn a competitive edge during the forecast period.

In July 2022, Siemens Greece partnered with the municipal water and sewerage company of Larissa (DEYAL), marking Siemens' presence at this year's IFAT, the world's leading trade fair for water, sewage, waste, and raw material management. Siemens provides water and sewage facility/network management and rural area irrigation solutions through this flagship project. In contrast, Siemens' high energy efficiency pumps, flowmeters, and Industry 4.0 solutions have already led to significant energy savings and seepage loss reductions.

In November 2021, ABB's electromagnetic flowmeters had the expertise to across the complete water cycle, from extraction and treatment to metering and distribution. The company has an extensive range of electromagnetic flow meters and measurement products for use throughout all cycle stages. ABB partnered with the Danish water environment DHI Group to develop a suite of digital solutions to enable faster and more accurate decision-making for water and wastewater utilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Electromagnetic Flowmeter Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Water Shortage and the Growing Population

- 5.1.2 Technological Innovations in Irrigation

- 5.2 Market Challenges

- 5.2.1 The Inability to Measure Non-conductive Fluids

6 MARKET SEGMENTATION

- 6.1 By Product

- 6.1.1 In-line Magnetic Flowmeters

- 6.1.2 Low Flow Magnetic Flowmeters

- 6.1.3 Insertion Magnetic Flowmeters

- 6.2 By Application

- 6.2.1 Water and Wastewater

- 6.2.2 Chemicals and Petrochemicals

- 6.2.3 Power Generation

- 6.2.4 Metals and Mining

- 6.2.5 Oil and Gas

- 6.2.6 Food and Beverages

- 6.2.7 Other Applications (Pulp and Paper, Pharmaceuticals)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Ltd

- 7.1.2 Azbil Corporation

- 7.1.3 Endress+Hausar AG

- 7.1.4 Emerson Electric Corporation

- 7.1.5 Toshiba Corporation

- 7.1.6 Honeywell International Inc.

- 7.1.7 KROHNE Messtechnik GmbH

- 7.1.8 OMEGA Engineering Inc. (Spectris PLC)

- 7.1.9 Siemens AG

- 7.1.10 Yokogawa Electric Corporation