|

市场调查报告书

商品编码

1637751

泰国太阳能:市场占有率分析、产业趋势、成长预测(2025-2030)Thailand Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

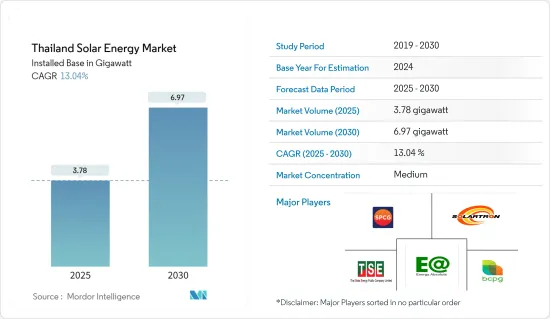

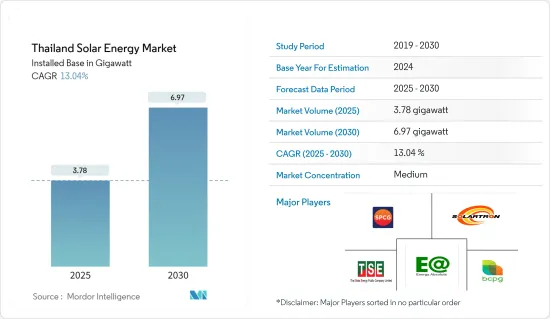

泰国太阳能市场规模(装置量)预计将从2025年的3.78吉瓦扩大到2030年的6.97吉瓦,预测期间(2025-2030年)复合年增长率为13.04%。

主要亮点

- 从长远来看,支持措施、电价上涨、技术进步、企业需求和能源安全目标等因素预计将在预测期内推动泰国太阳能市场的发展。

- 另一方面,电网限制、基础设施差异和能源储存挑战严重阻碍了预测期内太阳能市场的成长。

- 泰国的目标是到 2037 年实现 30%的可再生能源,这为太阳能市场带来了重大机会。此外,Energy Absolute 等公司对智慧电网技术、能源储存系统整合和大规模电池生产的投资将进一步促进太阳能发电工程和电网稳定性。

泰国太阳能市场趋势

光伏(PV)领域预计将主导市场

- 由于太阳能模组成本下降以及系统适用于发电和热水等多种应用的多功能性,预计光伏(PV)领域将在预测期内占据重要的市场占有率。

- 根据国际可再生能源机构(IRENA)统计,2019年至2023年,泰国装置容量从2,979MW增加到3,181MW,期间成长率为6.78%。此外,由于政府主导的太阳能发电量的增加和太阳能发电成本的下降,预计泰国的太阳能发电领域将显着增长。

- 近年来,泰国太阳能发电工程大幅增加。这些倡议符合政府对再生能源的雄心勃勃的承诺,其目标是到 2037 年将再生能源在发电结构中的份额从 20% 增加到 50%。

- 例如,2024 年 10 月,TotalEnergies ENEOS 在泰国完成了一个 1.8 MWp浮体式太阳能发电系统,作为其与 S. Kijchai Enterprise 的第二个计划。系统配备3,000多个模组,每年发电2,650兆瓦时,减少二氧化碳排放1,125吨。该计划由 TotalEnergies ENEOS 根据长期购电协议资助和营运。

- 此外,2024年5月,海湾能源开发私人有限公司与泰国发电局(EGAT)签署了为期25年的长期购电协议(PPA),将建设25座太阳能发电厂,总合为1,353兆瓦。计划是能源监管委员会更大的可再生能源计划的一部分,计划于 2024 年至 2029 年在上网电价补贴的基础上开始商业运营,提供具有成本效益的发电解决方案。

- 由于这些发展,预计太阳能发电领域在预测期内将在泰国占据主导市场占有率。

政府扶持措施带动市场

- 泰国政府鼓励全国采用可再生能源,力求在七年内将温室气体排放减少 20-25%。各国政府也透过提供各种奖励和监管支持来支持太阳能市场。

- 泰国设定了 2037 年可再生能源占电力结构 30% 的目标。到 2023 年,我们将安装 12,547 兆瓦的可再生能源容量,高于 2015 年的 7,902 兆瓦。

- 2024年8月,泰国核准了公共部门节能计划,旨在每年节省5.85亿度。该计划采用能源服务公司(ESCO)模式,透过长期合约安装太阳能板和其他节能措施。

- 2024 年 7 月,工业部长 Pimpattla Wichaikul 访问日本,推动泰国循环经济,专注于永续发展目标 (SDG) 和碳中和。此次合作还包括太阳能电池板的回收,作为生物、循环和绿色 (BCG) 经济模式的一部分,旨在加强永续资源管理。

- 2023年5月,泰国发电局(EGAT)为湄宏顺府智慧电网先导计画下的3MW太阳能发电厂和4MW电池储能(BESS)计划举行了商业营运(COD)仪式。

- 此外,2023年3月,泰国国家能源政策委员会(NEPC)在上网电价补贴制度下引入了清洁电力的购买配额。上网电价补贴制度下的税率为:地面太阳能发电每度2.1679泰铢,太阳能发电+蓄电池每度2.8331泰铢。对于这两种类型的发电厂,上网电价补贴期均为 25 年。

- 因此,政府的措施和倡议预计将在预测期内推动泰国太阳能市场的发展。

泰国太阳能产业概况

泰国的太阳能市场是半集中的。市场主要企业(排名不分先后)包括 Energy Absolute Public Company Limited、SPCG Public Company Limited、Solartron PCL、Thai Solar Energy PLC 和 BCPG Public Company Limited。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年太阳能装置容量及预测

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 泰国电费上涨与能源安全目标

- 政府对引进太阳能的支持措施

- 抑制因素

- 电网限制、基础设施差异和能源储存挑战

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔-技术

- 光伏(PV)

- 聚光型太阳热能发电(CSP)

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略及SWOT分析

- 公司简介

- SPCG Public Company Limited

- BCPG Public Company Limited(BCPG)

- Thai Solar Energy PLC

- B. Grimm Power Public Company Limited

- Solaris Green Energy Co. Ltd.

- Energy Absolute PCL

- Solartron PLC

- Marubeni Corporation

- Black & Veatch Holding Company

- Jinkosolar Holding Co. Ltd.

- Trina Solar Co., Ltd.

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 智慧电网发展与电网扩建

The Thailand Solar Energy Market size in terms of installed base is expected to grow from 3.78 gigawatt in 2025 to 6.97 gigawatt by 2030, at a CAGR of 13.04% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as supportive policies, rising electricity prices, technological advancements, corporate demand, and energy security goals will likely drive Thailand's solar energy market during the forecast period.

- On the other hand, grid limitations, infrastructure gaps, and energy storage challenges significantly hinder the growth of the solar energy market during the forecast period.

- Nevertheless, Thailand's goal of achieving 30 percent renewable energy by 2037 presents significant opportunities for the solar energy market. Furthermore, The integration of smart grid technologies, energy storage systems, and Investments by companies like Energy Absolute in large-scale battery production further support solar projects and grid stability.

Thailand Solar Energy Market Trends

Solar Photovoltaic (PV) Segment Expected to Dominate the Market

- The solar PV segment is likely to hold the major market share during the forecast period, owing to the declining costs of solar modules and the versatility of these systems for various applications, like electricity generation and water heating.

- According to the International Renewable Energy Agency (IRENA), From 2019 to 2023, Thailand's Solar Photovoltaic (PV) Installed Capacity increased from 2979 MW to 3181 MW, with the growth rate over this period being 6.78 percent. Moreover, the solar PV segment is expected to witness massive growth with the increasing solar PV encouraged by government initiatives and falling solar PV costs in Thailand.

- In recent years, Thailand has seen a significant uptick in solar energy projects. These initiatives align with the government's ambitious commitment to renewables, which targets a 50 percent share in the power generation mix by 2037, up from an earlier goal of 20 percent.

- For instance, in October 2024, TotalEnergies ENEOS completed a 1.8 MWp floating solar PV system in Thailand, their second project with S. Kijchai Enterprise. The system, with over 3,000 modules, generates 2,650 MWh annually, reducing CO2 emissions by 1,125 tons, equivalent to planting 16,800 trees. This project is funded and operated by TotalEnergies ENEOS under a long-term PPA.

- Additionally, in May 2024, Gulf Energy Development Private Limited finalized 25-year-long power purchase agreements (PPAs) with the Electricity Generating Authority of Thailand (EGAT) to construct 25 solar PV farms, totaling 1,353 MW. These projects, part of a larger renewables scheme by the Energy Regulatory Commission, will receive feed-in tariffs and are expected to start commercial operations between 2024 and 2029, offering a cost-effective power solution.

- Owing to such developments, the solar PV segment is expected to have a dominant market share in Thailand during the forecast period.

Supportive Government Policies to Drive the Market

- The Thai government is encouraging renewable energy installations across the country to reduce greenhouse gas emissions by 20-25% in seven years. The government has also supported the solar power market by providing various incentives and regulatory support.

- Thailand has set a target for renewables to account for 30 percent of the power mix by 2037. In 2023, the country installed 12,547 MW of renewable energy capacity, which was higher than the 7,902 MW installed in 2015.

- In August 2024, Thailand approved an energy-saving scheme targeting public sector agencies, aiming to save 585 million kWh annually. The program will use the energy service company (ESCO) model to install solar panels and other energy-saving measures through long-term contracts.

- In July 2024, Industry Minister Pimphattra Wichaikul visited Japan to promote a circular economy in Thailand, focusing on sustainable development goals (SDGs) and carbon neutrality. The collaboration includes recycling solar panels as part of the Bio, Circular, and Green (BCG) economy model, aiming to enhance sustainable resource management.

- In May 2023, the Electricity Generating Authority of Thailand (EGAT), under the Smart Grid Pilot Project in Mae Hong Son Province, held a Commercial Operation Date (COD) ceremony for the 3 MW Solar Power Plant and 4 MW Battery Energy Storage System (BESS) Project.

- Moreover, in March 2023, Thailand's National Energy Policy Council (NEPC) introduced quotas for purchasing clean electricity via the Feed-in-Tariff Scheme, which will be implemented in two phases. The feed-in tariff rates are 2.1679 THB per unit for ground-mounted solar and 2.8331 THB per unit for solar + storage. Both types of power plants will have a 25-year term for the feed-in tariff.

- Therefore, supportive government policies and initiatives are expected to drive the Thailand solar energy market in the forecast period.

Thailand Solar Energy Industry Overview

The Thailand solar energy market is semi-concentrated. Some of the major companies in the market (in no particular order) include Energy Absolute Public Company Limited, SPCG Public Company Limited, Solartron PCL, Thai Solar Energy PLC, BCPG Public Company Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Solar Energy Installed Capacity and Forecast, until 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Electricity Prices and Energy Security Goals in Thailand

- 4.5.1.2 Supportive Government Policies to Adopt Solar Energy

- 4.5.2 Restraints

- 4.5.2.1 Grid Limitations, Infrastructure Gaps, and Energy Storage Challenges

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION - TECHNOLOGY

- 5.1 Solar Photovoltaic (PV)

- 5.2 Concentrated Solar Power (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 SPCG Public Company Limited

- 6.3.2 BCPG Public Company Limited (BCPG)

- 6.3.3 Thai Solar Energy PLC

- 6.3.4 B. Grimm Power Public Company Limited

- 6.3.5 Solaris Green Energy Co. Ltd.

- 6.3.6 Energy Absolute PCL

- 6.3.7 Solartron PLC

- 6.3.8 Marubeni Corporation

- 6.3.9 Black & Veatch Holding Company

- 6.3.10 Jinkosolar Holding Co. Ltd.

- 6.3.11 Trina Solar Co., Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Smart Grid Development and Grid Expansion