|

市场调查报告书

商品编码

1637757

亚太地区化妆品包装:市场占有率分析、产业趋势、成长预测(2025-2030)Asia Pacific Cosmetic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

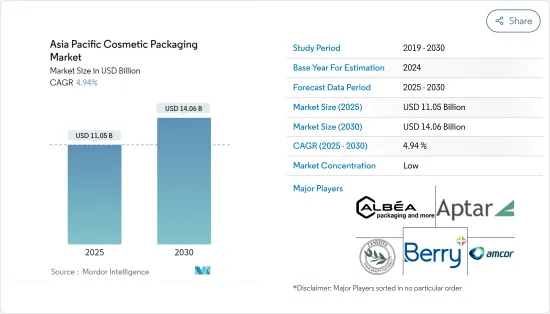

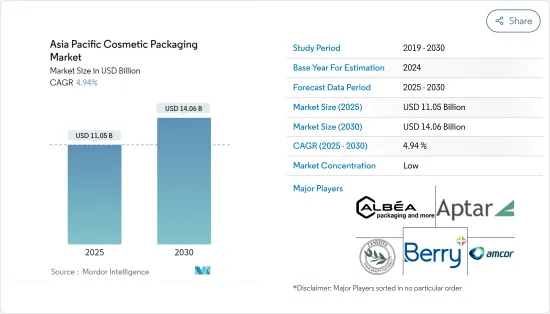

亚太地区化妆品包装市场规模预计到2025年为110.5亿美元,预计到2030年将达到140.6亿美元,预测期内(2025-2030年)复合年增长率为4.94%。

主要亮点

- 亚太化妆品包装市场正在经历显着成长,这主要是由于中国、印度、日本和印尼等主要国家的基本客群不断扩大。有几个重要因素促成了这种成长。随着该地区消费者的美学意识不断增强,他们对整装仪容和美容趋势的了解也越来越多,对化妆品的需求也不断增加。

- 价格实惠的化妆品的出现使得这些产品更容易被更广泛的消费者所接受,并且市场提供了不同价格分布的多种选择。电子商务的成长也发挥着重要作用。网路零售平台的兴起使得消费者购买化妆品变得更加容易,从而促进了消费的成长。

- 许多亚洲国家的快速都市化导致生活方式的改变和可支配收入的增加,进一步推动了对化妆品的需求。此外,不断的产品创新,包括开发适合亚洲皮肤类型和偏好的新型和改进化妆品,正在大大扩大市场。

- 许多国际品牌正在该地区推出新的化妆品系列,为许多国内和全球包装製造商提供了机会。例如,2024 年 4 月,凯莉詹纳 (Kylie Jenner) 的凯莉化妆品 (Kylie Cosmetics) 通过与 House of Beauty 合作进入印度。这家领先的美容公司将国际美容品牌引入印度丝芙兰。此次合作标誌着该品牌首次与 House of Beauty 等印度全通路专家合作。 Kylie Cosmetics 目前仅在全国 25 家丝芙兰印度店和网路商店有售。

- 永续性问题的日益加剧以及消费者对塑胶对环境和健康的负面影响的认识不断增强,可能会阻碍市场的成长。然而,由于塑胶包装的多功能性和成本效益,许多化妆品公司使用塑胶包装。在化妆品行业,塑胶用作主要包装材料,例如容器、软袋、盖子、封口和喷嘴。这种对塑胶的持续依赖预计将支持市场成长。

- 同时,纸质化妆品包装在亚太地区越来越受欢迎。亚洲和世界各地的品牌都在推出纸包装产品,以满足消费者对永续选择不断增长的需求。这种向纸质包装的转变反映了更广泛的行业趋势,即转向更环保的解决方案。随着消费者环保意识的增强,化妆品公司可能会根据这些偏好调整其包装策略,从而重塑未来几年的市场格局。

亚太地区化妆品包装市场趋势

塑胶瓶和容器领域预计将推动市场成长

- 塑胶瓶和容器是化妆品包装最常用和首选的材料之一。许多化妆品都用塑胶瓶和容器包装,因为这种材料易于成型、结构化、设计能力和保护性能。塑胶的多功能性使製造商能够创造出各种形状和尺寸,以满足不同化妆品的需求。

- 此外,塑胶包装以其轻质结构、耐用性和成本效益而闻名。这些特性使塑胶瓶和容器成为化妆品行业製造商和消费者的有吸引力的选择。该材料能够保持产品完整性并延长保质期,这使其在化妆品包装解决方案中广受欢迎。

- 此外,人们对永续性的兴趣日益浓厚,促使许多公司使用回收材料对个人护理品和化妆品的包装进行创新。 2024 年 7 月,Berry Global Group Inc. 推出了美容和个人保健产品的 B 圆形包装系列,在许多聚丙烯 (PP) 产品中采用了 Berry 的 CleanStream 再生塑胶。

- 向永续包装的转变反映了该行业对消费者对环保产品日益增长的需求的回应。公司投资研发来创造包装解决方案,减少对环境的影响,同时保持产品品质和安全。在包装中使用回收材料可以最大限度地减少废弃物,并有助于循环经济,即资源重复利用和回收,而不是在使用一次后就被丢弃。

- 2024年1月及2月中国塑胶製品产量约1,189万吨,高于2023年11月的670万吨。塑胶产量的显着增长导致塑胶罐和容器的製造显着扩大。因此,该细分市场在化妆品行业中变得越来越重要。塑胶包装产量的增加直接影响亚洲化妆品包装市场并推动其成长和市场发展。有了更多的塑胶包装选择,化妆品公司能够满足对其产品不断增长的需求,进一步刺激该地区的市场扩张。

印度预计将出现显着成长

- 近年来,在消费者兴趣不断增长的推动下,印度化妆品市场经历了快速增长。消费者兴趣的成长极大地促进了市场的扩张。可支配收入的增加、整装仪容意识的增强以及社交媒体的影响等因素在这一增长中发挥关键作用。

- 此外,国内外化妆品品牌在各个零售通路的不断增加也进一步刺激了市场发展。对天然和有机化妆品的需求不断增长也推动了市场的发展,反映出消费者对更健康、更永续的选择的偏好不断变化。

- 印度消费者在化妆品上的支出持续成长,推动了加工和包装奢侈品的趋势。这种成长是由可支配收入的增加、生活方式的改变以及整装仪容意识的提高所推动的。护肤和彩妆行业正在稳步增长,对脸部保养和医学护肤品的需求强劲。人们对皮肤健康日益增长的兴趣以及社交媒体对美容标准的影响正在推动这一趋势。

- 法国美容及化妆品零售商欧莱雅印度公司报告称,2023 财年总利润约为 6.048 亿美元,较上年同期的 3.4512 亿美元大幅增长。这一显着增长反映了印度化妆品市场的整体扩张以及对国际品牌日益增长的偏好。该公司的成功归功于其多样化的产品系列、有效的营销策略以及迎合不同消费群体的能力。

- 消费的成长为包装製造商带来了许多机会。随着化妆品需求的增加,对创新、有吸引力和功能性包装解决方案的需求也在增加。包装製造商面临的挑战是开发提供环保选项、用户友好设计并延长产品保质期的包装。这一趋势预计将推动包装行业的创新,并导致专门针对化妆品领域的新材料、设计和技术的开发。

- 印度消费者在化妆品上的支出持续成长,推动了加工和包装奢侈品的趋势。护肤化妆品和装饰化妆品稳定成长,脸部保养和医学护肤需求旺盛。抗衰老产品和污染防治产品也有很大的成长潜力。该市场受益于丰富的包装塑胶材料来源,这有利于本地製造商,有可能增加化妆品包装材料的可用性并降低成本。

亚太地区化妆品包装产业概况

由于 Albea Group、Berry Global Inc. 和 AptarGroup Inc. 等大量国际、区域和本地参与企业的存在,亚太化妆品包装市场仍处于细分状态。透过创新、市场渗透和竞争策略广告成本所获得的永续竞争优势是影响市场的关键因素。

- 2024 年 6 月,全球永续包装公司 Berry World Group 为美容、家居和个人护理市场推出了可客製化的矩形多米诺瓶子。这款 250 毫升瓶子采用 100% 回收 (PCR) 塑胶製成。 Domino 瓶子具有 75 毫米宽的前部和可自订的方面,可在所有四个侧面上列印。这种设计使品牌能够创造出对货架产生巨大影响的独特包装。侧板可以进行压花或压花纹理,为消费者提供触感。

- 2024年5月,负责任包装解决方案开发和製造的全球领导者Amcor与拥有135年历史的化妆品、护肤和个人护理公司雅芳(AVON)宣布,将推出雅芳经典沐浴凝胶——小黑裙。将在中国推出一款名为「Amplima Plus」的补充袋。回收后,这种可回收包装可减少 83% 的碳排放、88% 的水消费量和 79% 的可再生能源使用。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 化妆品需求的成长推动了该地区市场的成长

- 创新和包装推动市场成长和消费者兴趣

- 市场限制因素

- 人们对化妆品包装中使用塑胶的环境问题日益关注

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸

- 依产品类型

- 塑胶瓶和容器

- 玻璃瓶/容器

- 金属容器

- 折迭式纸盒

- 瓦楞纸箱

- 管和棒

- 盖子和塞子

- 泵浦和分配器

- 滴管

- 安瓿

- 软质塑胶包装

- 依化妆品类型

- 彩妆品

- 护肤

- 男士美容

- 除臭剂

- 其他化妆品类型(香水、除毛剂、婴儿和儿童护理、防晒护理)

- 按国家/地区

- 中国

- 日本

- 印度

- 印尼

- 澳洲和纽西兰

第七章 竞争格局

- 公司简介

- Albea Group

- HCP Packaging UK Ltd

- Berry Global Inc.

- DS Smith PLC

- Zenvista Packagings

- AptarGroup Inc.

- Amcor Group

- Takemoto Yohki Co. Ltd

- QUADPACK Group

- Gerresheimer AG

第八章投资分析

第9章市场的未来

The Asia Pacific Cosmetic Packaging Market size is estimated at USD 11.05 billion in 2025, and is expected to reach USD 14.06 billion by 2030, at a CAGR of 4.94% during the forecast period (2025-2030).

Key Highlights

- The Asia-Pacific cosmetic packaging market is experiencing significant growth, primarily driven by expanding customer bases in major economies such as China, India, Japan, and Indonesia. Several vital factors fuel this growth. Rising beauty consciousness among consumers in the region has led to increased awareness of personal grooming and beauty trends, resulting in higher demand for cosmetic products.

- The availability of affordable cosmetics has made these products accessible to a broader consumer base, with the market offering a wide range of options at various price points. The growth of e-commerce has played a crucial role, as the rise of online retail platforms has made it easier for consumers to purchase cosmetic products, contributing to increased consumption.

- Rapid urbanization in many Asian countries has led to changing lifestyles and increased disposable income, further driving the demand for cosmetic products. Additionally, continuous product innovation, including developing new and improved cosmetic formulations tailored to Asian skin types and preferences, has expanded the market significantly.

- Many international brands are launching new cosmetic lines in the region, providing opportunities for numerous domestic and global packaging manufacturers. For instance, in April 2024, Kylie Cosmetics by Kylie Jenner expanded into India through a partnership with House of Beauty. This leading beauty specialty company introduces international beauty brands to India and Sephora. This partnership marks the first time the brand has collaborated with an Indian omnichannel specialist like House of Beauty. Kylie Cosmetics is now available exclusively in 25 Sephora India stores nationwide and online.

- Growing sustainability concerns and increasing consumer awareness regarding the adverse effects of plastic on the environment and health may hinder market growth. However, many cosmetic companies use plastic packaging for its versatility and cost-effectiveness. Plastic remains a primary packaging material in the cosmetics industry for containers, flexible pouches, caps, closures, and nozzles. This ongoing reliance on plastic is expected to support market growth.

- Simultaneously, paper-based cosmetics packaging has gained traction in Asia-Pacific. Both Asian and global brands are introducing products in paper packaging to meet the rising consumer demand for sustainable options. This shift toward paper-based packaging reflects a broader industry trend toward more environmentally friendly solutions. As consumers become more environmentally conscious, cosmetic companies adjust their packaging strategies to align with these preferences, potentially reshaping the market landscape in the coming years.

Asia Pacific Cosmetic Packaging Market Trends

The Plastic Bottles and Containers Segment is Expected to Drive the Market Growth

- Plastic bottles and containers are among the most commonly used and preferred materials for cosmetic packaging. Many cosmetic products come in plastic bottles and containers due to the material's ease of molding, structuring, design capability, and protective properties. Plastic's versatility enables manufacturers to create various shapes and sizes to meet different cosmetic product needs.

- Also, plastic packaging provides lightweight construction, durability, and cost-effectiveness. These attributes make plastic bottles and containers an attractive choice for manufacturers and consumers in the cosmetics industry. The material's ability to preserve product integrity and extend shelf life further contributes to its popularity in cosmetic packaging solutions.

- Further, due to increasing sustainability concerns, many companies are innovating personal care and cosmetic packaging with recycled materials. In July 2024, Berry Global Group Inc. launched its B Circular packaging range for beauty and personal care products, featuring Berry's CleanStream recycled plastic for many polypropylene (PP) products.

- This shift to sustainable packaging reflects the industry's response to growing consumer demand for eco-friendly products. Companies invest in research and development to create packaging solutions that reduce environmental impact while maintaining product quality and safety. Using recycled materials in packaging helps minimize waste and contributes to the circular economy, where resources are reused and recycled rather than discarded after a single use.

- In January and February 2024, China produced approximately 11.89 million metric tons of plastic products, an increase from 6.70 million metric tons in November 2023. This significant growth in plastic production has led to a notable expansion in manufacturing plastic jars and containers. As a result, this segment has become increasingly important within the cosmetics industry. The rise in plastic container production has directly impacted the cosmetic packaging market in Asia, driving its growth and development. The increased availability of plastic packaging options has enabled cosmetic companies to meet the rising demand for their products, further stimulating the market's expansion in the region.

India is Expected to Register Significant Growth

- The Indian cosmetics market has experienced rapid growth in recent years, driven by increasing consumer engagement. This heightened consumer interest has significantly contributed to the market's expansion. Factors such as rising disposable incomes, growing awareness of personal grooming, and the influence of social media have played crucial roles in fueling this growth.

- Additionally, the increasing availability of both domestic and international cosmetic brands across various retail channels has further stimulated market development. The market has also benefited from the growing demand for natural and organic cosmetic products, reflecting changing consumer preferences toward healthier and more sustainable options.

- Consumer spending on cosmetics in India continues to rise, driving a trend toward processed, packaged, and premium products. This growth is attributed to increasing disposable incomes, changing lifestyles, and growing awareness of personal grooming. The skincare and decorative cosmetics segments are experiencing steady growth, with facial care and medical skincare products seeing robust demand. A growing focus on skin health and the influence of social media on beauty standards fuels this trend.

- L'Oreal India, the French beauty and cosmetic retailer, reported a total income of approximately USD 604.80 million for the financial year 2023, a significant increase from USD 345.12 million in the previous year. This substantial growth reflects the overall expansion of the cosmetics market in India and the increasing preference for international brands. The company's success can be attributed to its diverse product range, effective marketing strategies, and ability to cater to various consumer segments.

- This growing consumption creates numerous opportunities for packaging manufacturers. As the demand for cosmetics increases, so does the need for innovative, attractive, and functional packaging solutions. Packaging manufacturers are challenged to develop eco-friendly options, user-friendly designs, and packaging that enhances product shelf life. This trend is expected to drive innovation in the packaging industry, leading to the development of new materials, designs, and technologies specifically for the cosmetics segment.

- Consumer spending on cosmetics continues to grow in India, driving a trend toward processed, packaged, and premium products. Skincare and decorative cosmetics are experiencing steady growth, with facial care and medical skincare products seeing strong demand. Anti-aging products and those designed to protect against environmental pollution also offer significant growth potential. The market benefits from local and abundant sources of plastic materials for packaging, potentially increasing availability and reducing costs for cosmetic packaging materials, advantaging regional manufacturers.

Asia Pacific Cosmetic Packaging Industry Overview

The Asia-Pacific cosmetic packaging market remains fragmented due to numerous international, regional, and local players, such as Albea Group, Berry Global Inc., and AptarGroup Inc. Sustainable competitive advantages via innovation, market penetration levels, and the advertising expense power of competitive strategy are the main elements influencing the market.

- June 2024: Berry Global Group Inc., a global player in sustainable packaging, introduced a customizable, rectangular Domino bottle for the beauty, home, and personal care markets. The 250 ml bottle is manufactured using up to 100% post-consumer recycled (PCR) plastic. The Domino bottle features a 75-millimeter-wide front face and customizable side panels, allowing printing on all four sides. This design maximizes opportunities for brands to create distinctive packaging with significant shelf impact. The side panels can be further enhanced with textured embossing or debossing, offering a tactile experience for consumers.

- May 2024: Amcor, a global leader in developing and producing responsible packaging solutions, and AVON, a cosmetics, skincare, and personal care company with a 135-year history, announced the launch of the AmPrima Plus refill pouch for AVON's Little Black Dress classic shower gels in China. When recycled, the recyclable packaging will result in an 83% reduction in carbon footprint, 88% reduction in water consumption, and 79% reduction in renewable energy use.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Cosmetic Products Drives Market Growth in the Region

- 5.1.2 Innovation and Packaging Drive Market Growth and Consumer Engagement

- 5.2 Market Restraints

- 5.2.1 Rising Environmental Concerns Regarding Plastic Usage in Cosmetic Packaging

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Product Type

- 6.2.1 Plastic Bottles and Containers

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tubes and Sticks

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Droppers

- 6.2.10 Ampoules

- 6.2.11 Flexible Plastic Packaging

- 6.3 By Cosmetic Type

- 6.3.1 Color Cosmetics

- 6.3.2 Skin Care

- 6.3.3 Men's Grooming

- 6.3.4 Deodrants

- 6.3.5 Other Cosmetic Types (Fragrances, Depilatories, Baby and Child Care, and Sun Care)

- 6.4 By Country

- 6.4.1 China

- 6.4.2 Japan

- 6.4.3 India

- 6.4.4 Indonesia

- 6.4.5 Australia and New Zealand

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Albea Group

- 7.1.2 HCP Packaging UK Ltd

- 7.1.3 Berry Global Inc.

- 7.1.4 DS Smith PLC

- 7.1.5 Zenvista Packagings

- 7.1.6 AptarGroup Inc.

- 7.1.7 Amcor Group

- 7.1.8 Takemoto Yohki Co. Ltd

- 7.1.9 QUADPACK Group

- 7.1.10 Gerresheimer AG