|

市场调查报告书

商品编码

1637771

亚太地区聚氯乙烯(PVC) -市场占有率分析、产业趋势、成长预测(2025-2030 年)Asia-Pacific Polyvinyl Chloride (PVC) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

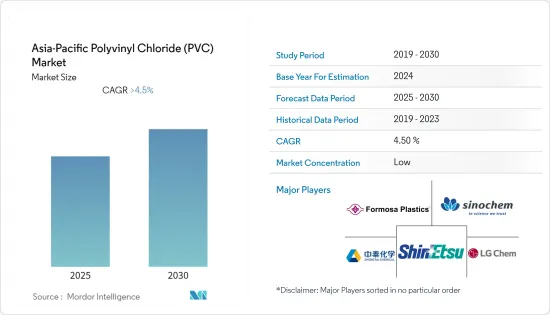

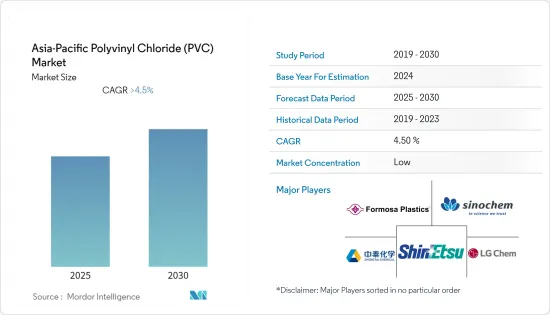

预计亚太地区聚氯乙烯市场在预测期内复合年增长率将超过 4.5%

主要亮点

- COVID-19 对 2020 年市场产生了负面影响。不过,预计2022年市场将达到疫情前水平,并持续稳定成长。

- 电动车的加速使用和建筑行业需求的增加预计将推动市场成长。然而,PVC生产、使用和处置过程中对人类健康和环境的有害影响预计将阻碍市场成长。

- PVC 回收製程的增加预计将创造市场机会。印度、中国和印尼等新兴国家的需求不断增长,推动了 PVC 管道和配件的需求。

亚太地区聚氯乙烯(PVC) 市场趋势

建筑业的需求增加

- 亚太地区的建筑业是世界上最大的。该地区的人口增长、中等收入阶层的壮大和都市化带来了健康的增长率。

- 近年来,亚太地区办公空间市场蓬勃发展,也是商业建筑领域最大的市场之一。印度和中国对办公空间的需求多年来一直在增加。

- 科技、电子商务以及银行和金融服务公司的需求显着增加了对办公空间的需求,导致该地区出现了新的办公大楼建设。例如,中国是购物中心建设的顶尖国家。中国约有4,000家购物中心,预计到2025年还将开幕7,000家。

- 中国的成长主要是由住宅和商业设施的快速扩张所推动的。中国正鼓励并持续推动都市化进程,预计2030年都市化率将达到70%。此外,2021年中国建筑业产值达到高峰约4.27兆美元。因此,这些因素往往会增加该地区对 PVC 的需求。此外,根据韩国统计局的数据,2021年国内外建筑公司订单金额达2,459亿美元。

- 印度也在扩大其商业部门。该国正在进行多个计划。例如,耗资 9 亿美元的 CommerzIII 商业办公综合大楼于 2022 年第一季开工。该计划涉及在孟买戈尔冈建造一座43层的商业办公综合体,允许占地面积为2,60,128平方米。预计完工日期为 2027 年第四季。

- 因此,由于上述因素,预计PVC的需求在预测期内将会增加。

中国主导市场

- 由于建筑、汽车、电子、包装和其他最终用户行业的需求增加,预计中国将强劲成长。

- PVC在建筑领域的使用量不断增加,相信将为PVC提供庞大的市场。根据中国国家统计局(NBS)预计,2021年全国建筑产值将达到25.92兆元人民币(4.1兆美元),比2020年增加11%以上,使得市场需求不断增加

- 中国也是电动车市场的全球领导者,新型电动车销量大幅成长。 2021年中国电动车销量总合,较2020年的130万辆成长154%。

- 此外,根据中国汽车工业协会(CAAM)的数据,2022年12月新能源汽车产量年增96.9%。因此,电动车市场的扩张预计将增加该国对 PVC 的需求。

- 因此,所有上述因素预计将在预测期内推动该国的 PVC 需求。

亚太地区聚氯乙烯(PVC) 产业概况

亚太地区聚氯乙烯(PVC)市场本质上是细分的。该市场的主要企业包括台塑公司、信越化学公司、LG化学、新疆中泰化学公司和中化控股有限公司。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业需求不断增长

- 其他司机

- 抑制因素

- 对人类和环境的有害影响

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(市场规模(基于数量))

- 产品类型

- 硬质聚氯乙烯

- 软聚氯乙烯

- 低烟PVC

- 氯化聚氯乙烯

- 目的

- 管道和配件

- 薄膜片材

- 电线电缆

- 瓶子

- 型材、软管、管材

- 其他的

- 最终用户产业

- 建筑/施工

- 车

- 电力/电子

- 包装

- 鞋类

- 医疗保健

- 其他的

- 地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Chemplast Sanmar Limited

- East Hope Group

- Formosa Plastics Corporation

- Hanwha Solutions

- INEOS

- LG Chem

- Reliance Industries Limited

- Shin-Etsu Chemical Co., Ltd.

- Sinochem Holdings Corporation Ltd.

- Westlake Corporation

- Xinjiang Zhongtai Chemical Co. Ltd

第七章 市场机会及未来趋势

- 增加PVC回收工艺

简介目录

Product Code: 46940

The Asia-Pacific Polyvinyl Chloride Market is expected to register a CAGR of greater than 4.5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The accelerating usage of electric vehicles and growing demand from the construction industry is expected to fuel the market's growth. However, hazardous impacts on humans and the environment during PVC production, usage, and disposal are projected to hinder the market's growth.

- The rising PVC recycling processes shall create opportunities in the market. The demand for PVC pipes and fittings is driven by increasing demand from developing countries such as India, China, Indonesia, etc.

Asia-Pacific Polyvinyl Chloride (PVC) Market Trends

Growing Demand from the Construction Sector

- The construction sector in the Asia-Pacific region is the largest in the world. It is growing at a healthy rate, owing to the region's rising population and increasing middle-class incomes and urbanization.

- The Asia-Pacific region has been a thriving market for office spaces in recent years and one of the largest markets for the commercial construction sector. The demand for office spaces in India and China has been growing for many years.

- With the demand from technology, e-commerce, and banking-financial service companies, office space requirements are significantly rising, resulting in the construction of new offices in the region. For example, China is one of the leading countries with respect to the construction of shopping centers. China has almost 4,000 shopping centers, while 7,000 more are estimated to be open by 2025.

- China's growth is fueled mainly by rapid residential and commercial building expansion. China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030. Also, China's construction output peaked in 2021 at a value of about USD 4.27 trillion. As a result, these factors tend to increase the demand for PVC in the region. Furthermore, according to Statistics Korea, construction orders collected by local builders at home and overseas totaled USD 245.9 billion in 2021.

- Also, India is expanding its commercial sector. Several projects have been going on in the country. For instance, the CommerzIII Commercial Office Complex construction worth USD 900 million started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,60,128 m2 in Goregaon, Mumbai. The project is expected to be completed in Q4 2027.

- Therefore, the aforementioned factors, the demand for PVC is expected to increase during the forecast period.

China to Dominate the Market

- China is expected to witness significant growth with the increasing demand from construction, automotive, electronics, packaging, and other end-user industries.

- The increasing usage of PVC in the construction sector will provide a huge market for PVC. According to the National Bureau of Statistics (NBS) of China, the output value of the construction works in the country accounted for CNY 25.92 trillion (USD 4.01 trillion) in 2021, representing an increase of more than 11% compared to 2020, thereby enhancing the demand for the market studied.

- China is also a global leader in the electric car market, with a significant increase in the sales of new electric vehicles. A total of 3.3 million units of electric vehicles (EVs) were sold in China in 2021, registering an increase of 154% compared to 1.3 million units sold in 2020.

- Further, according to the China Association of Automobile Manufacturing (CAAM), the production of new electric vehicles (NEVs) in the country witnessed a year-on-year increase of 96.9% in December 2022. Thus, the expanding EV market is expected to increase the demand for PVC in the country.

- Hence, all the abovementioned factors are expected to drive the demand for PVC in the country during the forecast period.

Asia-Pacific Polyvinyl Chloride (PVC) Industry Overview

The Asia-Pacific polyvinyl chloride (PVC) market is fragmented in nature. Some of the major players in the market include Formosa Plastics Corporation, Shin-Etsu Chemical Co. Ltd, LG Chem, Xinjiang Zhongtai Chemical Co. Ltd, and Sinochem Holdings Corporation Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Construction Sector

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Hazardous Impact on Humans and the Environment

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Rigid PVC

- 5.1.2 Flexible PVC

- 5.1.3 Low-smoke PVC

- 5.1.4 Chlorinated PVC

- 5.2 Application

- 5.2.1 Pipes and Fittings

- 5.2.2 Films and Sheets

- 5.2.3 Wires and Cables

- 5.2.4 Bottles

- 5.2.5 Profiles, Hoses, and Tubings

- 5.2.6 Other Applications

- 5.3 End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Electrical and Electronics

- 5.3.4 Packaging

- 5.3.5 Footwear

- 5.3.6 Healthcare

- 5.3.7 Other End-User Industries

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 South Korea

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chemplast Sanmar Limited

- 6.4.2 East Hope Group

- 6.4.3 Formosa Plastics Corporation

- 6.4.4 Hanwha Solutions

- 6.4.5 INEOS

- 6.4.6 LG Chem

- 6.4.7 Reliance Industries Limited

- 6.4.8 Shin-Etsu Chemical Co., Ltd.

- 6.4.9 Sinochem Holdings Corporation Ltd.

- 6.4.10 Westlake Corporation

- 6.4.11 Xinjiang Zhongtai Chemical Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising PVC Recycling Processes

02-2729-4219

+886-2-2729-4219