|

市场调查报告书

商品编码

1906897

工业物联网(IIoT):市场占有率分析、产业趋势与统计、成长预测(2026-2031)Industrial Internet Of Things (IIoT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

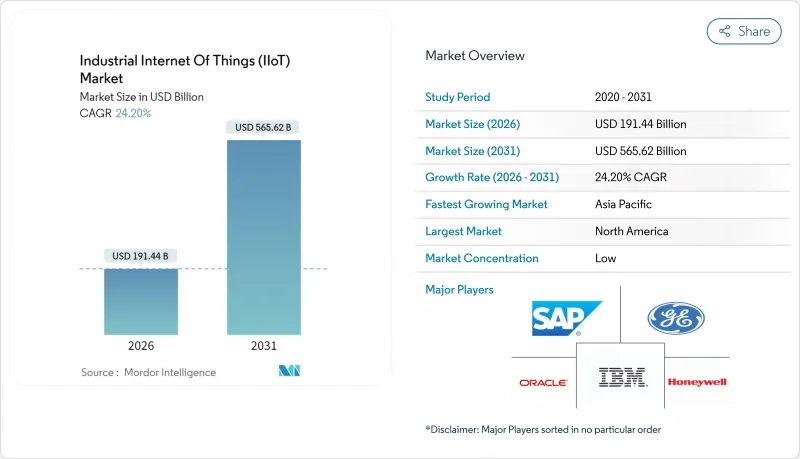

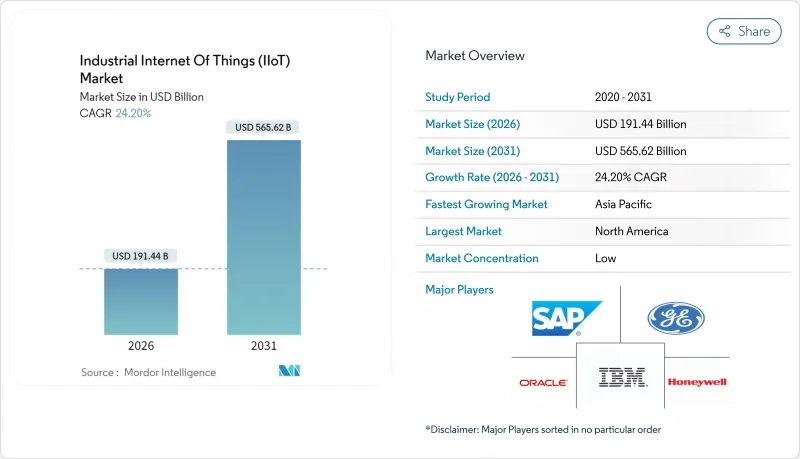

工业物联网 (IIoT) 市场规模预计将从 2025 年的 1,541.4 亿美元成长到 2026 年的 1914.4 亿美元,到 2031 年将达到 5,656.2 亿美元,2026 年至 2031 年的复合年增长率为 24.2%。

这一成长轨迹反映了感测器价格的快速下降、私有5G的广泛部署以及基于晶片组的边缘AI设计,这些设计能够在营运现场实现即时分析。製造商正在加速采用这些技术,以从被动维护转向预测性维护,提高整体设备效率(OEE),并缓解供应链衝击。虽然云端资源对于车队级分析仍然至关重要,但对于延迟敏感的控制迴路,混合边缘云端架构更受欢迎。随着基于结果的服务模式成为常态,操作技术供应商和云端超大规模资料中心业者之间的合作日益密切,竞争格局也因此呈现出变化。

全球工业物联网 (IIoT) 市场趋势与洞察

先进的传感器整合和更低的设备成本

单元级感测器的价格持续下降,而嵌入式处理器不断增强神经网路加速功能,使得诸如意法半导体 (STMicroelectronics) 的 STM32N6 MCU 等人工智慧设备无需独立加速器即可进行现场推理。製造商越来越多地采用非侵入式感测器覆盖传统设备,尤其是在现有工厂中,而不是更换整个系统。低功耗广域通讯技术(例如 LoRaWAN)将覆盖范围扩展到远端设备,而智慧感测器自诊断功能则将生命週期事件日誌汇总到分析中心。更高的可视性带来了更高的投资报酬率,并加速了因维修成本而停滞的计划。因此,工业IoT市场正在吸引更多注重成本的中型工厂,从而扩大基本客群。

促进预测性维护和OEE提升

营运经理将计划外停机视为策略风险。持续的状态资料为机器学习模型提供支持,能够提前数週检测异常情况,并将计划外停机时间减少两位数百分比。振动、热和声学特征使维护团队能够专注于优先任务,从而将有限的人力资源释放出来,用于更高价值的活动。数位双胞胎迭加技术可以模拟多条生产线的服务场景,从而优化备件库存和技术人员调度。在流程工业中,避免的停机就能避免数百万美元的生产损失,因此,即使资本支出受到限制,预测系统仍然是预算中的优先事项。

OT网路安全与旧有系统漏洞

在网路出现之前的工业控制设备如今部署在融合网路中,扩大了攻击面。设备生命週期的延长使得PLC更容易受到未打补丁的攻击。各部门正在安装检验的物联网节点,从而创建了绕过中央安全控制的「影子OT」。低程式码开发平台加速了应用程式的部署,但缺乏管治,它们会导致不安全程式码的扩散。负责人在权衡生产力提升和网路风险之间做出选择,通常会推迟联网升级,直到纵深防御和零信任框架到位。

细分市场分析

到2025年,硬体将占工业IoT市场份额的46.15%,其中感测器、网关和工业用电脑是核心组成部分。感测器和致动器构成状态监控的基础,而边缘闸道则负责预处理遥测资料和管理频宽。然而,服务和连接方面的复合年增长率将达到25.12%,这凸显了整合挑战正在如何重塑采购决策。专业服务团队正在对现有设备维修,使其符合最新通讯协定,而託管服务正在吸引那些缺乏内部OT-IT人才的中型工厂。

事实上,随着硬体供应商越来越多地将设备管理入口网站和远端监控订阅服务捆绑销售,产品和服务之间的界线正变得日益模糊。系统整合商透过运营他们之前部署的基础设施来获得持续收入。低程式码仪表板正逐渐成为主流,使维运团队无需编写程式码即可建立自订视觉化介面,从而减少对企业IT部门的依赖。因此,工业IoT市场正从一次性资本投资转向生命週期伙伴关係。

云端平台凭藉其低廉的初始成本和灵活的分析能力,将在2025年占据工业IoT市场52.91%的份额。然而,纯云环境无法满足10毫秒以下的控制要求。因此,混合边缘云端部署正以25.28%的复合年增长率快速成长。製造商在现场处理振动频谱和机器视觉帧,并将汇总后的信息传输到云端,以优化其整个设备群。

私有 5G 骨干网路将透过提供确定性、低延迟的上行链路来加速这种融合。容器化的微服务使工程师能够将 AI 模组放置在计算连续体的任何位置,从而符合製药和国防等行业的资料主权规则。虽然纯本地部署模式仍将在高度监管的细分市场中继续存在,但混合架构将成为工业IoT市场下一代部署的常态。

区域分析

北美先进的製造业基础、雄厚的创业融资以及对私有5G试点计画的早期应用,正推动其在2025年占据38.36%的市场份额。联邦政府推行的促进製造业回流和增强供应链韧性的项目,正在推动对国内供应链透明度的需求。法规结构,特别是美国食品药物管理局(FDA)的流程监控规则,正在推动生命科学工厂的即时品质记录。

亚太地区正以24.98%的复合年增长率成长,这得益于全球最大的电子生产群集以及政府补贴降低了初始部署成本。中国的一线城市正主导,而印度的技术中心则正向邻近的东协出口商拓展低成本的整合服务。跨境零件贸易促进了互通解决方案的实现,进一步扩大了工业IoT市场。

欧洲正努力在严格的资料隐私法和永续性指令之间寻求平衡。 GDPR推动架构朝向本地边缘处理发展,而2050年碳中和目标则要求进行详细的能源计量。德国汽车巨头正在采用基于TSN的OPC UA进行IT-OT基础设施集成,这为整个欧洲经济区提供了一个可供复製的参考模型。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 先进的传感器整合和更低的设备成本

- 促进预测性维护和OEE提升

- 政府主导的智慧製造倡议

- 面向重工业的专用 5G 园区网络

- 基于ESG的能源消费量基准

- 基于晶片组的工业边缘人工智慧加速器

- 市场限制

- OT网路安全与旧有系统漏洞

- 缺乏跨厂商互通性标准

- 现有系统缺乏数位双胞胎人才

- 低程式码物联网应用会增加影子IT风险

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按组件

- 硬体

- 感测器和致动器

- 边缘网关和工业用电脑

- 工业机器人和控制器

- 软体

- 设备管理平台

- 分析与视觉化

- MES/SCADA数位双胞胎软体

- 服务和连接

- 专业且综合

- 託管服务

- 连结服务(行动通讯业者、低功耗广域网路、卫星通讯)

- 硬体

- 按部署模式

- 本地部署

- 云

- 混合/边缘云端

- 透过连接技术

- 有线(乙太网路、PROFINET、Modbus-TCP)

- 短距离无线通讯(BLE、Wi-Fi 6/6E)

- 蜂窝通讯(4G LTE-M、专用 5G)

- LPWAN(LoRa WAN、Sigfox、NB-IoT)

- 按最终用户行业划分

- 个人作品

- 工艺製造

- 石油和天然气

- 公共产业(电力、水)

- 运输/物流

- 采矿和金属

- 医疗和药品

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Ltd.

- Mitsubishi Electric Corporation

- SAP SE

- Siemens AG

- Honeywell International Inc.

- Emerson Electric Co.

- OMRON Corporation

- International Business Machines Corporation

- Robert Bosch GmbH

- Oracle Corporation

- PTC Inc.

- Telit IoT Platforms Limited

- NXP Semiconductors NV

- Cisco Systems Inc.

- Infineon Technologies AG

- Rockwell Automation Inc.

- Advantech Co. Ltd.

- Schneider Electric SE

- ABB Ltd.

- Hitachi Ltd.

- General Electric Company

- Intel Corporation

- Arm Ltd.

第七章 市场机会与未来展望

The industrial internet of things market is expected to grow from USD 154.14 billion in 2025 to USD 191.44 billion in 2026 and is forecast to reach USD 565.62 billion by 2031 at 24.2% CAGR over 2026-2031.

The growth trajectory reflects a sharp decline in sensor prices, wider private-5G roll-outs, and chiplet-based edge-AI designs that allow real-time analytics at the point of operation. Manufacturers are accelerating deployments to move from reactive to predictive maintenance, improve overall-equipment-effectiveness, and cushion supply-chain shocks. Cloud resources remain pivotal for fleet-wide analytics, yet hybrid edge-cloud architectures are being favored for latency-sensitive control loops. Competitive dynamics reveal stronger collaboration between operational-technology vendors and cloud hyperscalers as outcome-based service models become the norm.

Global Industrial Internet Of Things (IIoT) Market Trends and Insights

Integration of Advanced Sensors and Falling Device Costs

Unit-level sensor prices keep falling while embedded processors add neural acceleration, enabling AI-ready devices such as STMicroelectronics' STM32N6 MCU that runs in-situ inference without a discrete accelerator. Manufacturers, especially in brownfield plants, now blanket legacy assets with non-intrusive sensors instead of complete system swaps. Low-power wide-area options like LoRaWAN extend coverage to remote assets, and smart-sensor self-diagnostics feed lifetime event logs into analytics hubs. Expanded visibility drives stronger return-on-investment cases, speeding projects that previously stalled due to retrofit costs. Consequently, the industrial internet of things market enjoys a larger addressable base among cost-sensitive mid-tier factories.

Push for Predictive Maintenance and OEE Improvement

Operations heads see unplanned downtime as a strategic liability. Continuous condition data equips machine-learning models that flag anomalies weeks in advance, cutting unscheduled stoppages by double-digit percentages. Vibration, thermal, and acoustic signatures guide maintenance crews toward prioritized tasks, freeing scarce labor for higher-value assignments. Digital-twin overlays simulate service scenarios across multiple lines, optimizing spare-parts inventory and technician dispatch. In process industries, every avoided shutdown saves millions in lost throughput, explaining why predictive systems draw premium budgets despite capital discipline.

OT Cybersecurity and Legacy System Vulnerabilities

Industrial-control gear that predates the internet now sits on converged networks, enlarging the attack surface. Extended equipment lifecycles mean patches may never be issued, leaving PLCs exposed. Departments sometimes install unvetted IoT nodes, creating "shadow OT", that bypass central security controls. Low-code development platforms accelerate application rollout but, without governance, can propagate insecure code. Operators must weigh production gain against cyber risk, often delaying internet-connected upgrades until layered defenses and zero-trust frameworks are in place.

Other drivers and restraints analyzed in the detailed report include:

- Government-backed Smart-Manufacturing Initiatives

- Private 5G Campus Networks in Heavy Industry

- Lack of Cross-Vendor Interoperability Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware retained 46.15% of industrial internet of things market share in 2025, anchored by sensors, gateways, and industrial PCs. Sensors and actuators form the backbone of condition monitoring, while edge gateways pre-process telemetry to manage bandwidth. However, Services and Connectivity is registering a 25.12% CAGR, underlining how integration pain points are reshaping procurement decisions. Professional-service teams retrofit brownfield assets to modern protocols, and managed offerings attract mid-market factories that lack in-house OT-IT talent.

In practice, hardware vendors increasingly bundle device-management portals and remote-monitoring subscriptions, blurring product-service boundaries. Systems integrators earn annuities from operating the infrastructure they once commissioned. As low-code dashboards become mainstream, operational teams build custom visualizations without coding, reducing reliance on enterprise IT. The industrial internet of things market thus gravitates toward life-cycle partnerships rather than one-time capital purchases.

Cloud platforms accounted for 52.91% of industrial internet of things market size in 2025 by offering elastic analytics at lower upfront cost. Yet pure cloud cannot meet sub-10-millisecond control requirements; hence, hybrid edge-cloud deployments are growing at 25.28% CAGR. Manufacturers process vibration spectra or machine-vision frames on-site and forward aggregated insights to the cloud for fleet-level optimization.

Private-5G backbones accelerate this fusion by providing deterministic, low-latency uplinks. Containerized microservices let engineers drop AI modules anywhere along the compute continuum, conforming to data-sovereignty rules in pharmaceuticals and defense. On-premises only models persist in niche, high-regulation niches, but hybrid architectures are expected to become the default for next-generation roll-outs in the industrial internet of things market.

The Industrial Internet of Things Market Report is Segmented by Component (Hardware, Software, and Services and Connectivity), Deployment Model (On-Premises, Cloud, and Hybrid/Edge-Cloud), Connectivity Technology (Wired, Short-Range Wireless, Cellular, and LPWAN), End-User Vertical (Discrete Manufacturing, Process Manufacturing, Oil and Gas, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 38.36% share in 2025 stems from its advanced manufacturing base, strong venture funding, and early adoption of private-5G pilots. Federal programs that incentivize reshoring and resilience amplify demand for visibility across domestic supply chains. Regulatory frameworks, notably FDA process-monitoring rules, push real-time quality logging in life-sciences plants.

Asia Pacific, growing at 24.98% CAGR, benefits from the world's largest electronics production clusters and government subsidies that lower initial deployment costs. China's tier-one cities spearhead large-scale smart factories, while India's tech centers extend low-cost integration services to neighboring ASEAN exporters. Cross-border component trade encourages interoperable solutions, further enlarging the industrial internet of things market.

Europe balances stringent data-privacy laws with sustainability directives. GDPR steers architectures toward local edge processing, and the continent's 2050 carbon-neutral goal mandates granular energy metering. Germany's automotive primes adopt OPC UA over TSN to converge IT-OT backbones, providing reference models replicated across the European Economic Area.

- Amazon Web Services Inc.

- Telefonaktiebolaget LM Ericsson

- Fujitsu Ltd.

- Mitsubishi Electric Corporation

- SAP SE

- Siemens AG

- Honeywell International Inc.

- Emerson Electric Co.

- OMRON Corporation

- International Business Machines Corporation

- Robert Bosch GmbH

- Oracle Corporation

- PTC Inc.

- Telit IoT Platforms Limited

- NXP Semiconductors N.V.

- Cisco Systems Inc.

- Infineon Technologies AG

- Rockwell Automation Inc.

- Advantech Co. Ltd.

- Schneider Electric SE

- ABB Ltd.

- Hitachi Ltd.

- General Electric Company

- Intel Corporation

- Arm Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Integration of advanced sensors and falling device costs

- 4.2.2 Push for predictive maintenance and OEE improvement

- 4.2.3 Government-backed smart-manufacturing initiatives

- 4.2.4 Private 5G campus networks in heavy industry

- 4.2.5 ESG-driven energy-intensity benchmarking

- 4.2.6 Chiplet-based industrial edge AI accelerators

- 4.3 Market Restraints

- 4.3.1 OT cybersecurity and legacy system vulnerabilities

- 4.3.2 Lack of cross-vendor interoperability standards

- 4.3.3 Scarcity of brown-field digital-twin talent

- 4.3.4 Rising shadow-IT risk from low-code IoT apps

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Intensity of Competitive Rivalry

- 4.6.5 Threat of Substitutes

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Sensors and Actuators

- 5.1.1.2 Edge Gateways and IPCs

- 5.1.1.3 Industrial Robots and Controllers

- 5.1.2 Software

- 5.1.2.1 Device Management Platforms

- 5.1.2.2 Analytics and Visualization

- 5.1.2.3 MES/SCADA and Digital-Twin Software

- 5.1.3 Services and Connectivity

- 5.1.3.1 Professional and Integration

- 5.1.3.2 Managed Services

- 5.1.3.3 Connectivity Services (MNOs, LPWAN, Satellite)

- 5.1.1 Hardware

- 5.2 By Deployment Model

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.2.3 Hybrid/Edge-Cloud

- 5.3 By Connectivity Technology

- 5.3.1 Wired (Ethernet, PROFINET, Modbus-TCP)

- 5.3.2 Short-Range Wireless (BLE, Wi-Fi 6/6E)

- 5.3.3 Cellular (4G LTE-M, Private 5G)

- 5.3.4 LPWAN (LoRa WAN, Sigfox, NB-IoT)

- 5.4 By End-user Vertical

- 5.4.1 Discrete Manufacturing

- 5.4.2 Process Manufacturing

- 5.4.3 Oil and Gas

- 5.4.4 Utilities (Power, Water)

- 5.4.5 Transportation and Logistics

- 5.4.6 Mining and Metals

- 5.4.7 Healthcare and Pharmaceuticals

- 5.4.8 Other End-user Verticals

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Telefonaktiebolaget LM Ericsson

- 6.4.3 Fujitsu Ltd.

- 6.4.4 Mitsubishi Electric Corporation

- 6.4.5 SAP SE

- 6.4.6 Siemens AG

- 6.4.7 Honeywell International Inc.

- 6.4.8 Emerson Electric Co.

- 6.4.9 OMRON Corporation

- 6.4.10 International Business Machines Corporation

- 6.4.11 Robert Bosch GmbH

- 6.4.12 Oracle Corporation

- 6.4.13 PTC Inc.

- 6.4.14 Telit IoT Platforms Limited

- 6.4.15 NXP Semiconductors N.V.

- 6.4.16 Cisco Systems Inc.

- 6.4.17 Infineon Technologies AG

- 6.4.18 Rockwell Automation Inc.

- 6.4.19 Advantech Co. Ltd.

- 6.4.20 Schneider Electric SE

- 6.4.21 ABB Ltd.

- 6.4.22 Hitachi Ltd.

- 6.4.23 General Electric Company

- 6.4.24 Intel Corporation

- 6.4.25 Arm Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment