|

市场调查报告书

商品编码

1637781

亚太地区雷射雷达:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

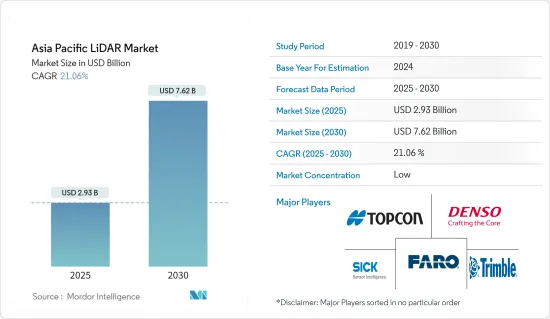

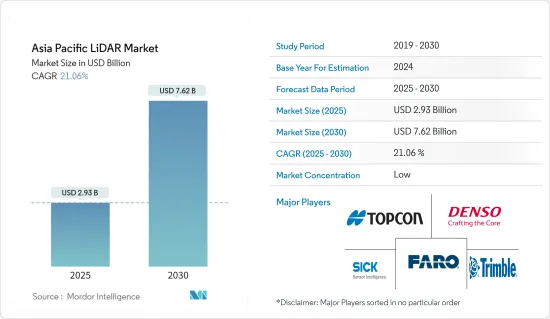

亚太地区 LiDAR 市场规模预计在 2025 年为 29.3 亿美元,预计到 2030 年将达到 76.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 21.06%。

基于 LiDAR 的地图测绘解决方案非常灵活,可用于固定和移动车辆。这使得越来越多的行业采用该技术,特别是在工程、建筑、环境和探勘应用领域,证明了该技术的有效性和需求。

主要亮点

- 这些光达也用于实地宣传活动规划和森林座舱罩测绘。西班牙科学家利用雷射雷达资料提高了年度和季节性测绘精度(从 73% 提高到 83%)。此外,LiDAR 市场的另一个主要驱动力是无人机在航太、国防和自动化等多种应用领域的应用日益广泛,这促使各组织对无人机研究进行投资。

- 在该地区,雷射雷达系统与无人机的应用也正在国防、地质勘测、污染监测、交通、能源和建筑领域部署。此外,预测期内印度和中国等国家预计将加快对国防无人机技术的投资,平均投资额将增加 70 亿美元。

- 在马来西亚,政府正在使用雷射雷达绘製水位深度、沿海地区的洪水风险以及运河堵塞修復要求。该地区各国政府越来越多地采用 LiDAR 系统,预计将对预测期内的市场成长产生积极贡献。

- 日本三菱电机公司推出了一种用于自动驾驶汽车的紧凑型 LiDAR 解决方案,体积约为 900cc,采用 MEMS 技术,可增强自动驾驶汽车的水平视野范围和行人侦测能力。该公司还计划开发体积仅为 350cc 或更小的紧凑型 LiDAR。

- 此外,新冠肺炎疫情导致世界各地实施封锁。这扰乱了汽车零件的製造过程和出口。此外,系统昂贵的特性也为这些系统的采用带来了挑战。福特和百度等公司正在投资这些系统,以开发低成本的光达系统。

亚太地区 LiDAR 市场趋势

地面光达预计将实现最高成长

- 地面雷射雷达系统广泛应用于近距离和高精度应用,尤其是建筑修復、设施清单、侵蚀测绘、稳定性检测以及製造业的各种应用。静态和动态变化经常与 GPS 参考技术一起纳入探勘、工程和其他移动式製图系统中,以提高精度和准确度。

- 地面固定雷射雷达成本相对较低,因此这些设备可以避免在机载系统和车载雷射雷达扫描器中使用 IMU。这些特性使得地面雷射雷达在工业、紧急和灾害管理以及发生不良事件时的测绘方面具有成本效益。

- 地面雷射雷达系统的低成本,加上较不严格的测绘和测量法规,预计将推动该领域的成长。

- 可以使用地面雷射扫描(TLS)资料中的高解析度积雪/土壤深度和积雪/土壤深度变化图来量化雪崩/山体滑坡多发地区的雪崩/山体滑坡负荷模式。

- 在该地区,汽车产业正在成为移动地面雷射雷达系统的一个应用领域。根据印度公路运输和公路部的规定,到2022年,所有新车(包括大型车辆)都必须配备ADAS系统。因此,政府的这些倡议必将支持该市场的成长。

航太和国防工业的不断发展预计将推动市场成长

- LiDAR 在航太和国防工业的应用有限。儘管如此,仍有研究潜力确定 LiDAR 技术在国防工业的应用范围。在国防工业中,使用无人机监视未开发区域至关重要,而使用 LiDAR 技术透过障碍物分析资料对于识别异常起着关键作用。

- 正在开发用于水雷战的机载雷射水雷探测系统 (ALMDS) 等更高分辨率的系统,以收集更多细节,从而识别目标并穿越森林冠层和其他障碍物。短程雷射雷达用于识别危险区域中气体、液体和其他生物威胁的存在。

- 凭藉快速检测和即时响应的能力,LiDAR 技术比工业中实施的其他传统技术具有关键优势。

- 此外,各种政府措施也影响该市场的成长。例如,印度政府计划对东北各州的所有道路进行雷射雷达勘测。这也可能有助于促进该市场的本地供应商的发展。

- 由于 LiDAR 系统在国防、地质勘测、能源和建筑领域的广泛应用,预计印度和中国等各国在预测期内将在国防无人机技术上平均投资 70 亿美元。

亚太地区光达产业概况

由于亚太地区有许多参与者,因此该地区的 LiDAR 市场竞争非常激烈。大多数主要供应商都对其研发部门投入了大量资金,以独树一帜,区别于其他竞争对手。该市场的主要供应商包括 Topcon Corporation、Denso Corporation 和 Leishen Intelligent Systems。

- 2022 年 9 月 - Hexagon 的子公司 Leica Geosystems 推出了 Leica DMC-4,这是一款有效的机载成像感测器,可提供无与伦比的影像质量,可用于具有挑战性的测绘场景。此合作关係可为客户提供适用于各种应用的灵活、有效的大尺寸解决方案。

- 2022 年 1 月-YellowScan 与监测设备供应商 EcoTech Ltd. 合作。透过此次合作,Ecotech 将扩大其在生态系统监测、林业、农业、测绘和测量等领域的研究和应用。该业务还将迎合中国市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 扩大在政府部门的应用

- 汽车业采用率不断提高

- 市场限制

- LiDAR 系统高成本

第六章 市场细分

- 按产品

- 机载光达

- 地面光达

- 按组件

- GPS

- 雷射扫描仪

- 惯性测量单元

- 其他组件

- 按最终用户

- 工程

- 车

- 工业的

- 航太和国防

第七章 竞争格局

- 公司简介

- Leica Geosystems AG

- Topcon Corporation

- Neptec Technologies Corp.

- Sick AG

- Trimble Inc.

- Denso Corporation

- Faro Technologies Inc.

- Hesai Technology

- Benewake

- RoboSense LiDAR

- Leishen Intelligent Systems

第八章投资分析

第九章:市场的未来

The Asia Pacific LiDAR Market size is estimated at USD 2.93 billion in 2025, and is expected to reach USD 7.62 billion by 2030, at a CAGR of 21.06% during the forecast period (2025-2030).

LiDAR-based mapping solutions are agile and can be used on a stationary or moving vehicle. Owing to this, they are being adopted by a growing number of industries, especially for application in engineering, construction, environment, and exploration, proving the effectiveness and, therefore, demand for this technology.

Key Highlights

- These LiDARs are also used for the planning of field campaigns and mapping under the forest canopy. Spain-based scientists improved the annual and seasonal mapping accuracy with LiDAR data (from 73% to 83%). Moreover, another major driving factor for the LiDAR market is the increasing use of drones for multiple applications, such as aerospace and defense and automation, which are leading organizations to invest in drone research.

- In this region, LiDAR system applications are also being deployed in defense, geological surveys, pollution monitoring, transport, energy, and construction sectors, coupled with drones. Additionally, countries such as India and China are expected to increase, speeding an average of USD 7 billion in drone technology for defense in the forecast period.

- In Malaysia, the government has been using LiDAR to map the water table depth, flood risk in coastal areas, and canal-blocking restoration requirements. The increase in such adoption of LiDAR systems by governments across different countries in the region is expected to positively contribute to the market's growth over the forecast period.

- Japan's Mitsubishi Electric Corporation unveiled a new compact LiDAR solution for autonomous vehicles, equipped with MEMS that can enhance the horizontal vision span and pedestrian detection capabilities of the self-driving vehicle, with a volume of around 900cc. The company is also planning to develop a smaller LiDAR variant with a volume of just 350cc or less.

- Furthermore, the COVID-19 pandemic led to lockdowns all over the world. This disrupted the exports of automotive parts as well as the manufacturing process. Moreover, the expensive nature of the systems is challenging the adoption of these systems. Companies such as Ford and Baidu were investing in these systems to develop low-cost LiDAR systems.

APAC LiDAR Market Trends

Ground-based LiDAR Expected to Witness The Highest Growth

- The ground-based LiDAR systems have been widely used in close-range and high accuracy applications, especially in architectural restoration, facilities inventory, erosion mapping, stability detection, and various applications in the manufacturing industry. Static and dynamic variations are frequently incorporated in the exploration, engineering, and other mobile mapping systems, along with the GPS referencing techniques for precision and accuracy.

- The ground-based fixed LiDARs are relatively less costly, as these devices can avoid the use of IMU in air-borne systems or LiDAR scanners mounted on vehicles. Such features make the use of ground-based LiDAR cost-effective for the industries and can do the mapping in case of emergency and disaster management, in case of occurrence of any unwanted events.

- low costs associated with ground-based LiDAR systems, coupled with lesser stringent regulations for mapping or survey, are expected to drive the growth of this segment.

- High-resolution snow/soil depth and snow/soil depth change maps can be used from terrestrial laser scanning (TLS) data to quantify loading patterns of avalanche/landslides, in snow/landslide-prone regions, for use in both pre-control plannings and in post-control assessment in case of such events, which increases the application base of such products suitable to a diverse base of end-users.

- The automotive sector is emerging as an application area for mobile ground-based LiDAR systems within this region. According to the Ministry of Road Transport and Highways of India, the installation of the ADAS system is mandatory in all new vehicles (heavy-duty included) by 2022. Hence these types of government initiatives will definitely support the growth of this market.

Growing Aerospace and Defense Industry Expected to Drive Market Growth

- LiDAR has made limited leeway in the aerospace and defense industry. Still, there is potential for research to determine the extent of usage of LiDAR technology in the defense industry. The use of drones to monitor unexplored territory is crucial in the defense industry, and the use of LiDAR technology to analyze data through obstacles plays a vital role in identifying anomalies.

- Higher resolution systems are deployed to collect details to identify targets and movement through the forest canopies and other obstacles, such as Airborne Laser Mine Detection System (ALMDS) for the counter-mine warfare. Short-range LiDARs are utilized for identifying the presence of gases and liquids and other bio-threats in hazardous locations.

- The ability to detect rapidly and respond in real-time gives the LiDAR technology a significant edge over the other conventional technologies which have been implemented in the industry

- Moreover, different government initiatives are also influencing the growth of this market. For instance, The Indian government is also planning to carry LiDAR surveys for all the roads in the northeastern states. It will also help to promote the local providers for this market.

- Owing to the extensive use of the LiDAR system in defense, geological surveys, and energy and construction sectors, different countries such as India and China, are expected to increase speeding an average of USD 7 billion in drone technology for defense in the forecast period.

APAC LiDAR Industry Overview

The Asia Pacific Lidar market is highly competitive due to the presence of many players within this region. Most major vendors invest heavily in their research and development sections to create a unique differentiation from their other competitors. Some major vendors for this market are Topcon Corporation, Denso Corporation, Leishen Intelligent Systems, etc.

- September 2022 - Hexagon subsidiary Leica Geosystems revealed the Leica DMC-4, an effective airborne imaging sensor that offers unmatched image quality for use in challenging mapping scenarios. Customers would gain from this collaboration by receiving a flexible and effective large-format solution for a range of application uses.

- January 2022 - A provider of monitoring devices, EcoTech Ltd., and YellowScan have partnered. The business would expand its study and applications in ecological monitoring, forestry, agriculture, mapping, and surveying through this partnership. The business would also cater to the China market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Industry Attractiveness - Porter's Five Forces Analysis

- 4.1.1 Threat of New Entrants

- 4.1.2 Bargaining Power of Buyers

- 4.1.3 Bargaining Power of Suppliers

- 4.1.4 Threat of Substitute Products

- 4.1.5 Intensity of Competitive Rivalry

- 4.2 Industry Value Chain Analysis

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Applications in the Government Sector

- 5.1.2 Increasing Adoption in the Automotive Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of the LiDAR Systems

6 MARKET SEGMENTATION

- 6.1 Product

- 6.1.1 Aerial LiDAR

- 6.1.2 Ground-based LiDAR

- 6.2 Components

- 6.2.1 GPS

- 6.2.2 Laser Scanners

- 6.2.3 Inertial Measurement Unit

- 6.2.4 Other Components

- 6.3 End User

- 6.3.1 Engineering

- 6.3.2 Automotive

- 6.3.3 Industrial

- 6.3.4 Aerospace and Defense

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Leica Geosystems AG

- 7.1.2 Topcon Corporation

- 7.1.3 Neptec Technologies Corp.

- 7.1.4 Sick AG

- 7.1.5 Trimble Inc.

- 7.1.6 Denso Corporation

- 7.1.7 Faro Technologies Inc.

- 7.1.8 Hesai Technology

- 7.1.9 Benewake

- 7.1.10 RoboSense LiDAR

- 7.1.11 Leishen Intelligent Systems