|

市场调查报告书

商品编码

1637786

中东和非洲的网路安全 -市场占有率分析、行业趋势/统计、成长预测(2025-2030)MEA Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

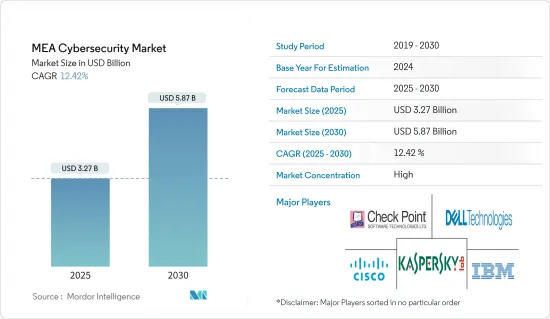

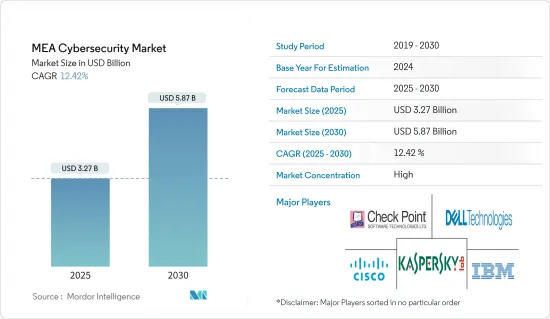

中东和非洲网路安全市场规模预计到 2025 年为 32.7 亿美元,预计到 2030 年将达到 58.7 亿美元,预测期内(2025-2030 年)复合年增长率为 12.42%。

主要亮点

- 在当前的市场情况下,网路安全丛集可以透过地方政府的故意、通常自上而下的行动来成长,政府法规和政策对其市场发展至关重要。许多私人公司正在将业务转移到云端平台。

- 以石油为基础的沙乌地阿拉伯拥有沿岸地区最大的经济体,并致力于成为最重要的 IT 市场。多项政府措施以及国家转型计画 (NTP) 正在支持该地区 IT 的快速发展。沙乌地阿拉伯拥有油田,并占据地缘政治高度紧张的地区,使其成为网路犯罪分子的热门目标。根据 NTP倡议,政府预算申请40 亿沙特里亚尔。主要关注领域是网路安全、智慧电网和控制关键基础设施的地理空间 IT 系统。这种政府支持为IT安全公司在该国发挥积极作用奠定了基础。

- 根据 Help AG 去年发布的市场状况报告,光是阿拉伯联合大公国的攻击就增加了 183%。该国所有部门都多次遭受攻击,包括政府、石油、卫生和电信。分散式阻断服务 (DDoS) 规模持续成长,阿联酋记录达 254.3Gbps。此外,该国越来越多的中小企业和网路安全供应商专注于提供创新解决方案。因此,供应商预计将推出新产品作为其竞争策略的一部分。例如,总部位于阿联酋的座标公司宣布为中小型企业提供自适应客製化网路安全。

- 支持卡达应对当前和新出现的威胁和风险的努力,并支持卡达国家资讯通讯技术计划,为各部门提供安全可靠的线上环境,并根据战略主旨保护国家关键资讯基础设施。 )由国家网路安全委员会(NCSC)制定。 NCSC 是根据总理决定 (18) 成立的,主要目的是为政府最高层的网路安全合作提供管治结构。

- 中东和非洲的网路安全人力资源数量较少。儘管如此,鑑于该地区的商业活动水平很高,它仍然是最容易受到网路攻击的地区之一。此外,该地区的许多专业人士需要获得更多经验来应对日益严重的网路威胁。例如,Fircroft 表示,中东地区约有 30% 的网路安全工作者拥有 10 年以上的产业经验。相比之下,60%的专业人士拥有5年以上的经验。

- 在新冠肺炎 (COVID-19) 期间采用远距工作的公司遭受的攻击数量增加。据 IBM 称,远距工作是违规因素的违规行为的平均成本比远距工作不是因素的违规行为高出 105 万美元。根据 Proofpoint 2021 年进行的一项调查(受访者:拥有 200 名或以上员工的组织的首席资讯安全安全官(CISO),N=1,400 人),阿联酋约76% 的CISO、约69% 的CISO 表示遭受有针对性的攻击自 2021 年远距工作在全球广泛普及以来,这种情况有所增加。

中东和非洲网路安全市场趋势

云端领域预计将高速成长。

- 云端基础的资安管理服务的日益使用正在简化中东企业网路安全措施的实施。云端安全是指保护云端资料、应用程式和基础架构免受威胁的技术、策略、控制和服务。作为现代化的网路安全解决方案,云端安全不同于传统安全。 IT 模型包括扩展速度、资料储存、最终用户系统介面以及与其他网路资料和系统的接近性等内容。

- 云端运算改变了企业使用、共用和储存资料、应用程式和工作负载的方式。然而,云端运算也带来了新的安全威胁和挑战。随着大量资料流入云端和公共云端服务,风险也在增加。阿联酋的云端市场仍处于起步阶段,私有 LaaS 的引进被认为是迈向更广泛的云端采用的重要的第一步。如果在该地区开设云端资料中心,预计云端的采用将会加速,对云端安全的需求也会增加。此外,该地区国家正在走向云端运算的未来,这也将推动对云端安全的需求。

- 中东和非洲的供应商需要利用云端基础的解决方案进行创新,以抓住市场机会。我们还希望建立全球资料中心以提高云端弹性、满足资料隐私法规并与公共云端(AWS、Azure)整合以提高可扩展性。例如,巴林经济发展委员会(EDB)与中国跨国高科技公司的云端运算子公司腾讯云端签署了谅解备忘录(MoU),以促进巴林王国IDC的发展并建立互联网资料中心(IDC),支持其迅速崛起为中东和北非地区云端和IDC 领域的中心。此类公共云端基础设施的建立预计将推动中东和北非地区对云端基础的解决方案的需求。

- 然而,与中东地区相比,非洲在云端解决方案的部署方面仍需迎头赶上。盗版仍然是一个主要障碍,因为许多公司正在使用盗版软体的旧版本地版本。然而,这使得企业面临多种威胁。随着全部区域安全威胁的频率和复杂性不断增加,该地区的供应商正在提供云端 UTM,为组织提供全天候保护和云端可扩展性。云端 UTM 消除了本地防火墙管理的复杂性,并提供卓越的识别和威胁管理。例如,最近,阿联酋综合电信公司 (EITC) 推出了云端统一威胁管理 (UTM) 服务,这是一种网路安全解决方案,可将组织的边界安全地扩展到所有站点。

- 据 Turbonomic 称,56% 的受访者表示,他们将在 2021 年使用 Microsoft Azure 进行云端服务。亚马逊网路服务(AWS)在 2020 年之前一直位居榜首,但被微软超越。此外,不使用任何云端的受访者比例从 2021 年的 4% 增加到去年的 8%。

BFSI可望引领市场

- 中东和非洲正在更广泛的经济发展背景下以及银行业内部经历数位转型。在 COVID-19 之前,该地区的 BFSI数位化率较低,但随着 COVID-19 的威胁和不确定性消退,金融服务业开始快速采用数位化以保持竞争力,以满足不断增长的客户期望。利用云端和人工智慧(AI) 等技术。

- 阿拉伯联合大公国银行业联合会 (UBF) 将于 2021 年加入 49 家银行的行列,宣布启动一项新倡议,以应对未来所有网路威胁。作为该倡议的一部分,所有成员银行将被要求无缝收集、分析和共用网路威胁的资料,从而实现匿名报告和警报管理。该倡议为金融机构提供了对当前网路威胁情势的全面了解。这使得金融机构能够更好地准备和应对任何威胁。

- 富查伊拉国家银行 (NBF) 制定了稳健的网路安全策略,重点是三大支柱:身分验证保护、资料保护和文化。此外,作为该银行网路弹性计画的一部分,它还进行了各种类型的网路攻击模拟,包括红队演习、桌面网路攻击模拟和网路钓鱼模拟,以在专家的帮助下开发其网路弹性能力。

- 据AFDB称,ACRC计划有潜力使全部区域超过2.5亿弱势客户和2,000多家金融机构受益。此外,作为其性别倡议的一部分,ACRC 将专门致力于在五年内改善 2,000 至 2,500 万名女性的网路安全,并致力于僱用至少 39% 的女性。预计该地区 BFSI 部门对提高网路犯罪意识的投资将推动预测期内交付的解决方案的发展。

- 据米尔肯研究所称,到 2022 年,中东地区金融科技 (fintech) 公司的数量预计将增加到 465 家。 2017年,该地区仅有30家金融科技公司。该地区金融科技公司的缓慢成长为本地和国际参与企业创造了开发新解决方案以获得市场占有率的机会。

中东和非洲网路安全产业概况

中东和非洲网路安全市场竞争激烈,由多家大公司组成。从市场占有率来看,目前该市场由几家大型企业主导。这些拥有显着市场占有率的领先公司致力于在全球扩大基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。

2023年3月,国际民航组织与阿联酋政府宣布了航空网路安全和创新领域的新进展和进展。国际民航组织和阿联酋之间的伙伴关係预计将加强网路安全、加速器和民用航空未来创新的知识共用和经验。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动因素

- 网路安全事件快速增加

- 来自地下市场的持续威胁

- 市场限制因素

- 网路安全专家短缺

- 高度依赖传统认证方式且准备不足

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 技术简介

- 安全类型

- 网路

- 云

- 应用

- 终点

- 无线网路

- 其他安全类型

- 产业价值链分析

- COVID-19 市场影响评估

- 安全类型

第五章市场区隔

- 解决方案

- 威胁情报和回应管理

- 身份验证和存取管理

- 预防资料外泄管理

- 安全和漏洞管理

- 统一威胁管理

- 企业风险与合规

- 服务

- 託管服务

- 专业服务

- 部署

- 云

- 本地

- 最终用户

- 航太/国防

- BFSI

- 医疗保健

- 製造业

- 零售

- 政府机构

- 资讯科技/通讯

- 其他的

- 国家名称

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东/非洲

第六章 竞争状况

- 公司简介

- Cisco Systems Inc.

- Dell Technologies

- Kaspersky Lab

- IBM Corporation

- Check Point Software Technologies Ltd

- Palo Alto Networks Inc.

- Broadcom Inc.(Symantec Corporation)

- Trend Micro Inc.

- FireEye Inc.

- Paramount Computer Systems LLC

- DTS Solutions Inc

第七章 投资分析

第八章市场的未来

The MEA Cybersecurity Market size is estimated at USD 3.27 billion in 2025, and is expected to reach USD 5.87 billion by 2030, at a CAGR of 12.42% during the forecast period (2025-2030).

Key Highlights

- In the current market scenario, Cybersecurity clusters can grow organically or develop through intentional, often top-down actions taken by local governments, and government regulations and policies play a significant role in their development. Many private firms have been moving their operations to the cloud platform.

- Saudi Arabia, an oil-based economy, is the largest in the Gulf region and aims to be the most prominent IT market. Like the National Transformation Program (NTP), several government initiatives have supported the region's rapid IT development. Saudi Arabia is a popular target for cybercriminals due to its oil wells and occupancy of an area prevalent with geopolitical tensions. Under the NTP initiative, the government outlined SAR 4 billion for ICT development from 2016 until the previous year. The main focus areas are cybersecurity, smart grid, and geospatial IT systems to control significant infrastructure. Such a push from the government provides scope for IT security companies to flourish within the country.

- According to Help AG's State of the Market Report of the previous year, there was a 183% rise in attacks in the UAE alone. All sectors in the nation faced repeated attacks, including the government, oil, healthcare, and telecom. Distributed Denial of Service (ddos) has only increased in scale, according to the company, with the UAE measuring 254.3 Gbps. Further, the growth in the number of smes and cybersecurity vendors in the country is directing focus on offering innovative solutions. Thus, vendors are expected to adopt new launches as part of their competitive strategy. For example, UAE-based Coordinates announced Adaptive Bespoke Cybersecurity for SME.

- To support Qatar's efforts to address the current and emerging threats and risks, and in light of the strategic thrusts of Qatar's National ICT Plan to protect the national critical information infrastructure providing a safe and secure online environment for the different sectors, Qatar National Cyber Security Strategy (NCSS) was created by the National Cyber Security Committee (NCSC). The NCSC was primarily established under the Prime Minister's Decision No. (18) to provide a governance structure for collaboratively addressing cyber security at the highest levels of the government.

- The Middle East & Africa region have smaller numbers of cybersecurity workforces. Still, considering the region's high degree of business activities, it is one of the most attractive regions for cyber attacks. Also, most professionals in this region need to be more experienced in dealing with the intensity of incoming cyber threats. For instance, According to Fircroft, around 30% of all cybersecurity workforce in the Middle East have just over ten years of experience working in the industry. In comparison, 60% of these professionals have more than five years of experience.

- Enterprises adopting remote working during the covid-19 increased the number of attacks. According to IBM, the average cost was USD 1.05 million higher in breaches where remote work was a factor in causing the breach compared to those where remote work was not a factor. According to a study by Proofpoint in 2021 (N=1,400 respondents; Chief Information Security Officers (cisos) from organizations with more than 200 employees), about 76% CISO's from UAE and 69% of CISO's from KSA part of the study mentioned their business had seen more targeted attacks since enabling widespread remote working worldwide in 2021.

Middle East & Africa Cybersecurity Market Trends

Cloud Segment is expected to grow at a higher pace.

- The increasing use of cloud-based managed security services has even simplified the adoption of cybersecurity practices for Middle Eastern enterprises. Cloud security refers to the technologies, policies, controls, and services that protect cloud data, applications, and infrastructure from threats. Cloud security stands out from the legacy as a modernized cyber security solution. IT models include scaling speeds, data storage, end-user system interfacing, and proximity to other networked data and systems.

- Cloud computing has transformed how enterprises use, share, and store data, applications, and workloads. However, it has also introduced a host of new security threats and challenges. Significant data going into the cloud and public cloud services increases the exposure. The cloud market in UAE is still in the early stages, with the implementation of private laaS viewed as a critical first step towards broader cloud adoption. The opening of cloud data centers in the region is likely to boost cloud adoption, which would drive the demand for cloud security. Also, initiatives by the countries in the region to move towards a cloud computing future are poised to propel the demand for cloud security.

- To tap the market opportunities, vendors in MEA need to innovate cloud-based solutions. They also want to build global data centers to strengthen cloud resilience, meet data privacy regulations, and engage with the public cloud (AWS, Azure) for higher scalability.For instance, Bahrain Economic Development Board (EDB) signed a Memorandum of Understanding (MoU) with Tencent Cloud, the cloud computing subsidiary of the multinational Chinese tech firm, to drive the Kingdom of Bahrain's IDC development and support its rapid emergence as the MENA region's hub for the cloud and IDC sectors by opening an Internet Data Centre (IDC) in the country. Establishing such public cloud infrastructures is expected to drive the demand for cloud-based solutions in the MENA region.

- However, Africa still needs to catch up to the deployment of cloud solutions as compared to the Middle Eastern region. Piracy is still a big hurdle as many businesses use legacy on-prem versions of pirated software. However, this exposes the company to multiple threats. With security threats across the region increasing in frequency and sophistication, vendors in the area are offering Cloud UTM that provides organizations with around-the-clock protection and the cloud's scalability. It eliminates the complexity of managing on-premise firewalls and delivers superior identification and threat management. For instance, recently, du, from Emirates Integrated Telecommunications Company (EITC), has launched its Cloud Unified Threat Management (UTM) service, a cybersecurity solution that extends organizations' perimeters to all sites securely.

- According to Turbonomic, in 2021, 56 % of respondents said they use Microsoft Azure for cloud services. Amazon Web Services (AWS) topped the ranking until 2020 when Microsoft surpassed it. Furthermore, the percentage of respondents who do not use any cloud increased from 4% in 2021 to 8% in the last year.

BFSI is Expected to Drive the Market

- The Middle Eastern and African region is undergoing digital transformations from a broader economic development context and within the banking sector. Before COVID-19, BFSI digitalization rates in the area were low; however, as the threat and uncertainty from COVID-19 settled in, the financial services industry is started adopting digitization at a rapid pace and utilizing technologies such as cloud, artificial intelligence (AI), to meet rising customer expectations to remain competitive.

- The UAE Banks Federation (UBF), a professional body representing 49 banks as members in 2021, announced that it is launching a new initiative to combat all future cyber threats. As a part of this initiative, all the member banks will have to seamlessly collect, analyze and share data on cyber threats while allowing anonymous reporting and alert management. The initiative will enable financial institutions to gain an encompassing perceptive of the ongoing cyber threat landscape. It will allow them to better prepare and respond to all emergent threats.

- The National Bank of Fujairah (NBF) has built a robust cybersecurity strategy focusing on three main pillars: identity protection, data protection, and culture. Moreover, as part of the bank's cyber resiliency program, it conducts various types of cyberattack simulations like the Red Team exercise, Tabletop Cyber Attack Simulations, and Phishing simulations, among others, to measure our cyber resiliency capabilities with the help of specialists.

- According to AFDB, this ACRC project has the potential to benefit over 250 million vulnerable clients and over 2,000 financial institutions across the region. Moreover, as part of its gender promotion policy, ACRC will specifically target improving cybersecurity for 20 to 25 million women in five years and will aim to employ a workforce of at least 39% of women. Investments in the awareness of cybercrime in the BFSI sector in the region are expected to drive the development of solutions offered during the forecasted period.

- According to Milken Institute, in the Middle East area, the number of financial technology (FinTech) enterprises is predicted to grow to 465 by 2022. There were just 30 fintech companies in the region in 2017. The gradual growth of fintech firms in the region creates an opportunity for the local and international players to develop new solutions to capture the market share.

Middle East & Africa Cybersecurity Industry Overview

The cybersecurity market in the Middle East and Africa is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share are focusing on expanding their customer bases across foreign countries. These companies leverage strategic collaborative initiatives to increase their market shares and profitability.

In March 2023, the International Civil Aviation Organization announced new developments and progress in areas of aviation cybersecurity and innovation with the UAE Government. The ICAO-UAE partnership is expected to enhance knowledge sharing and experience in terms of cybersecurity, accelerators, and innovation in future civil aviation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapidly Increasing Cyber Security Incidents

- 4.2.2 Consistent Threats From the Underground Market

- 4.3 Market Restraints

- 4.3.1 Lack of Cyber Security Professionals

- 4.3.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot

- 4.5.1 Security Type

- 4.5.1.1 Network

- 4.5.1.2 Cloud

- 4.5.1.3 Application

- 4.5.1.4 End-point

- 4.5.1.5 Wireless Network

- 4.5.1.6 Other Security Types

- 4.5.2 Industry Value Chain Analysis

- 4.5.3 Assessment of Impact of COVID-19 on the Market

- 4.5.1 Security Type

5 MARKET SEGMENTATION

- 5.1 Solution

- 5.1.1 Threat Intelligence and Response Management

- 5.1.2 Identity and Access Management

- 5.1.3 Data Loss Prevention Management

- 5.1.4 Security and Vulnerability Management

- 5.1.5 Unified Threat Management

- 5.1.6 Enterprise Risk and Compliance

- 5.2 Service

- 5.2.1 Managed Services

- 5.2.2 Professional Services

- 5.3 Deployment

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 End User

- 5.4.1 Aerospace and Defense

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Manufacturing

- 5.4.5 Retail

- 5.4.6 Government

- 5.4.7 IT and Telecommunication

- 5.4.8 Other End users

- 5.5 Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 South Africa

- 5.5.4 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco Systems Inc.

- 6.1.2 Dell Technologies

- 6.1.3 Kaspersky Lab

- 6.1.4 IBM Corporation

- 6.1.5 Check Point Software Technologies Ltd

- 6.1.6 Palo Alto Networks Inc.

- 6.1.7 Broadcom Inc. (Symantec Corporation)

- 6.1.8 Trend Micro Inc.

- 6.1.9 FireEye Inc.

- 6.1.10 Paramount Computer Systems LLC

- 6.1.11 DTS Solutions Inc