|

市场调查报告书

商品编码

1637802

欧洲绿色资料中心 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Green Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

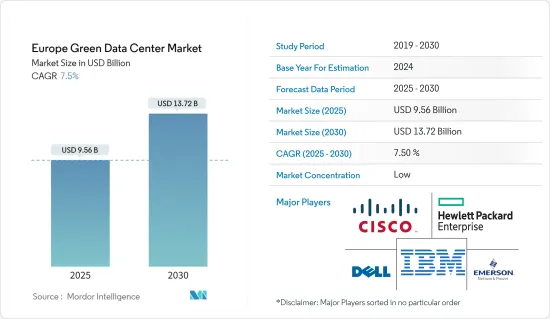

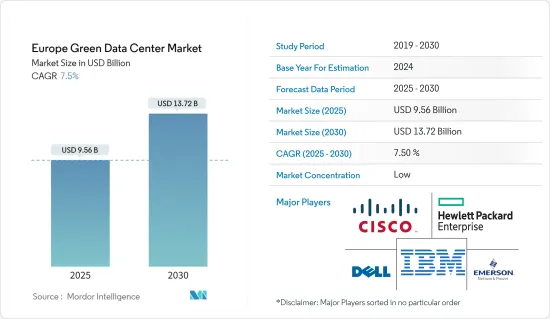

欧洲绿色资料中心市场规模预计到2025年为95.6亿美元,预计2030年将达到137.2亿美元,预测期间(2025-2030年)复合年增长率为7.5%。

主要亮点

- 资料中心技术的创新与设计的新发展相结合,使资料中心的排放和功耗减少了近 80%。这是一个重要的数字,它说服欧洲企业投资相对昂贵且环保的技术和基础设施,并在未来获得相当高的回报。

- 欧洲的绿色转型在很大程度上得益于资料中心。就脱碳营运的进展和对气候中和的大胆承诺而言,资料中心产业已经是最发达的最终用途产业之一。同时,数位服务使所有经济领域的公司能够创新、提高效率、生产永续的产品和服务,并实现符合欧洲绿色交易目标的雄心勃勃的气候目标。欧盟委员会制定了指导方针,帮助提高资料中心的能源效率,回收热能等废能,并促进可再生能源的使用,目标是到 2030 年实现碳中和。

- 西方和北欧国家在永续性和永续能源管理方面领先于其他欧洲国家,尤其是俄罗斯和东欧传统上在采用永续性和效率实践方面进展缓慢。由于国家电力公司提供 15 年的能源价格可见性,冰岛已成为资料中心的热门枢纽。地质和物理安全的位置以及自然的外部空气冷却是有效能源管理的关键因素。

- 由欧盟委员会主导的产品环境足迹 (PEF) 试点实施将为当今的资料中心产业提供环境产品足迹的许多实际好处。儘管如此,大部分潜力将在几年内实现。这鼓励公司采用最大限度减少环境足迹的流程和程序,同时又不影响将产品推向市场以适应不断发展的技术趋势的重要性。

欧洲绿色资料中心市场趋势

节能冷却系统推动市场发展

- 资料中心的成长和密度增加了对高效冷却的需求。这些系统类型是基础设施有限的机构的标准配置。这些因素正在推动节能冷却系统的采用并不断增加市场需求。

- 资料中心设备需要冷却。尺寸、位置和资料中心设计都会影响您选择的冷却方法。为了减少能源消费量和碳足迹,同时优化 PUE、WUE 和 ERE,不仅必须最大限度地减少资料中心设备的容量,还必须最大限度地减少停机时间。

- PUE 越低,效果越好,1.00 是绝对最高水准。由欧盟资助的BodenTypeDC计划建造的一个经过测试和检验的资料中心,称为博登类型资料中心(BTDC)。 BTDC One 的 PUE 已低于 1.02。欧盟资料中心的平均PUE超过1.5。运作依靠可再生能源运行,并依赖无需製冷剂的自然空气和蒸发冷却技术。

- 使用有效的资料中心冷却技术可以延长伺服器的运作。在需要 99.99% 或更高运转率的专业环境中,过热可能是灾难性的,伺服器层级的故障可能会影响企业和使用者。

- 根据Cloudscene预测,到2024年2月,德国将拥有522个资料中心,领先欧洲。资料中心对于集中组织的 IT 运作至关重要,本质上是容纳电脑系统的建筑物。在全球范围内,美国拥有压倒性的实力,拥有超过5000个资料中心设施。

- 无论资料中心管理员打算拥有冷通道还是热通道,资料中心都容易出现热点,因此需要快速有效的解决方案。这需要使用空气冷却系统和液体冷却技术,可以轻鬆改变整个系统中冷空气的使用方式。总体而言,这使得资料中心能够更有效地成长。

- 与传统的空气冷却系统相比,基于液体的冷却方法可以节省高达 98% 的伺服器冷却所需能源。资料中心的液冷系统比传统空气冷却系统占用的空间减少 60%。具有液体冷却系统的伺服器非常可靠,并且可以比传统伺服器运行更长的时间。配备液冷系统的 200kW 边缘资料中心可将边缘资料中心整体用电量减少 40% 以上,从而减少 700,000 公斤二氧化碳排放。

能源效率和碳中和推动绿色资料中心的采用

- 据国际能源总署称,资料中心吸收了全球1%的电力,到2025年将消耗全球电力供应的五分之一。儘管大部分能源消耗是为伺服器供电,但伺服器也会产生热量,因此必须进行冷却。需要暖通空调和冷却系统来冷却整个系统,这需要使用更多的电力。因此,需要节能係统和技术来减少电力使用和碳排放。

- 绿色资料中心负责在环保的同时优化利用电脑资源。在资料中心,低功耗伺服器比传统伺服器更节能。它使用智慧型手机计算技术来平衡性能和能源使用。

- 欧洲绿色交易旨在使欧洲成为第一个实现碳中和的大陆。绿色转型和数位转型应该被视为相辅相成的。欧盟委员会的论文《塑造欧洲的数位未来》指出,资料中心必须在 2030 年之前实现碳中和。

- 欧盟 (EU) 已将节能云端运算作为主要关注点。为了在 2030 年实现碳中和,资料中心必须提高能源效率,利用热能等废能,并使用更多的可再生能源。据 Cloudscene 称,到 2023 年,欧洲将占云端入口的大部分,其中 Equinix 和 Digital Realty 是该地区领先的云端服务供应商。 Equinix 是全球领先的云端入口供应商,拥有 249 个云端入口。

- 一群欧洲领先的资料中心营运商签署了绿色资料中心协议,承诺在欧盟 (EU) 当局核准资料中心永续性立法之前进行自我规范。这种令人不快的可能性已经笼罩欧盟工业一年多了。 《气候中性资料中心协议》设定了资料中心效率和可再生能源目标以及实现这些目标的雄心勃勃的目标。也制定了一个框架来衡量实现这些目标的进展。

欧洲绿色资料中心产业概况

随着供应商透过采用策略联盟和併购等无机成长策略来扩大其足迹,欧洲绿色资料中心市场被细分。主要参与企业包括 IBM、思科系统公司和戴尔技术公司。

2022年9月,OVHcloud的新资料中心将在德国林堡建成。新大楼于 2022 年 4 月首次宣布,占地面积超过 6,000平方公尺(64,580 平方英尺),可容纳 40,000 台伺服器,OVH 称这相当于 100Exabyte的储存容量。 OVH 强调新设施的环保性。该公司表示,新资料中心的电力将 100% 来自可再生能源。 OVHcloud也采用了取得专利的水冷技术,伺服器的废热用于加热相邻办公室的地板。

2022年7月,欧洲物流房地产公司P3 Logistic Parks正在德国哈努规划一座大型资料中心园区。将在 10 年内开发至少 8 个资料中心模组,建筑面积约为 200,000平方公尺(210 万平方英尺),现场供电功率为 180 兆瓦 (MW)。施工将分阶段进行。据 P3 称,符合规格的园区将以可持续的方式开发和运营,并将完全由可再生能源供电。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- 产业价值链分析

- COVID-19 对市场的影响

- 行业法规政策

第五章市场动态

- 市场驱动因素

- 资料储存需求增加

- 重视能源效率

- 市场限制因素

- 增加初始投资

第六章 市场细分

- 服务

- 系统整合

- 监控服务

- 专业服务

- 其他的

- 解决方案

- 力量

- 伺服器

- 管理软体

- 网路科技

- 冷却

- 其他解决方案

- 使用者

- 主机託管提供者

- 云端服务供应商

- 公司

- 按行业分类

- 医疗保健

- 金融服务

- 政府机构

- 通讯/IT

- 其他行业

第七章 竞争格局

- 公司简介

- Fujitsu Ltd

- Cisco Technology Inc.

- HP Inc.

- Dell EMC Inc.

- Hitachi Ltd

- Schneider Electric SE

- IBM Corporation

- Eaton Corporation

- Emerson Network Powers

- GoGrid LLC

第八章投资分析

第9章市场的未来

The Europe Green Data Center Market size is estimated at USD 9.56 billion in 2025, and is expected to reach USD 13.72 billion by 2030, at a CAGR of 7.5% during the forecast period (2025-2030).

Key Highlights

- The technological innovations in data center technology, coupled with new developments in design, are enabling data centers to cut emissions and decrease power consumption by almost 80%. These are significant figures convincing European firms to invest in relatively expensive, greener technologies and infrastructure to reap considerably higher rewards in the future.

- The European green transition is largely made possible by data centers. In terms of progress toward decarbonizing its operations and making bold commitments to becoming climate-neutral, the data center sector is already among the most developed end-use sectors. At the same time, digital services are enabling businesses in all economic sectors to innovate, increase efficiency, create sustainable products and services, and achieve their ambitious climate targets in line with the objectives of the European Green Deal. The European Commission has created guidelines to assist data centers in becoming more energy-efficient, recovering waste energy, such as heat, and using more renewable energy sources, with the goal of becoming carbon-neutral by 2030.

- Western and Northern European countries are ahead of the rest of Europe regarding sustainability and sustainable energy management, particularly Russia and Eastern Europe, which have traditionally been slow adopters of sustainability and efficiency practices. Iceland is becoming a hot hub for data centers due to the 15-year visibility into energy pricing provided by the National Power Company. A geologically and physically secure location with natural outside cooling is one of the key factors in its effective energy management.

- The Product Environmental Footprint (PEF) pilot, led by the European Commission, is set to provide many tangible benefits of the Environmental Product Footprint for the data center industry today. Still, the majority of the potential will be realized in later years. This is set to drive companies to incorporate processes and procedures that minimize their environmental footprint while not compromising the importance of bringing products to the market that meet evolving technology trends.

Europe Green Data Center Market Trends

Energy efficient cooling systems will Drive the Market

- The increased number of data centers and higher density in data centers have created a demand for effective cooling. These system types are standard in institutions with limited infrastructure. Such factors are propelling the deployment of energy-efficient cooling systems and hence increasing the market demand.

- Data center equipment needs to be kept cool. The size, location, and data center design all influence the cooling method to be selected. In order to reduce energy consumption and the carbon footprint while optimizing PUE, WUE, and ERE, as well as the capacity of data center equipment, as well as downtime must be minimized.

- The lower the PUE, the greater the effectiveness, with 1.00 being the absolute highest level of effectiveness. A tested and validated data center called Boden Type Data Center (BTDC), the EU-funded BodenTypeDC project constructed. The BTDC One has achieved a PUE of less than 1.02. Data centers in the EU have an average PUE above 1.5. It operates on renewable energy and depends on free air and evaporative cooling technologies without the necessity for refrigerants.

- Server uptime is increased with the use of effective data center cooling technology. Any failure at the server level will have effects on businesses and users since overheating can be disastrous in a professional setting that demands more than 99.99% uptime.

- According to Cloudscene, In February 2024, Germany boasted 522 data centers, leading the pack in Europe. Data centers, pivotal for centralizing organizations' IT operations, are essentially buildings that house computer systems. Globally, the United States takes the crown, hosting a staggering with over 5,000 data center facilities.

- Whether the data center manager intends for a cold aisle setup or a hot aisle to be present, hot spots can emerge in data centers quickly, necessitating the need for fast and effective solutions. This demands utilizing air-cooling systems or liquid cooling technologies that allow for simple adaptation of the way cold air is utilized in the whole system. Overall, this enables a data center to scale up more efficiently.

- Compared to traditional air-cooled systems, liquid-based cooling methods can save up to 98% of the energy needed to cool servers. Datacenter liquid-based cooling systems use 60% less room than traditional air-cooled systems. Because liquid-based Cooling Systems servers are so reliable, they may be operated for far longer periods than traditional servers. A 200 kW edge data center with liquid-based cooling systems can cut its carbon emissions by 700,000 kg of CO2 by reducing the whole edge data center electricity usage by 40% or more.

Energy Efficiency and Carbon Neutrality will drive the adoption of Green Data Centers

- According to the International Energy Agency, data centers absorb 1% of all worldwide electricity, and by 2025, they will consume 1/5 of the world's power supply. Most energy consumption is for powering the servers, but they also generate heat and must be cooled. HVAC and cooling systems are required to cool the entire system, which necessitates the use of additional power. As a result, to reduce power usage and carbon footprint, energy-efficient systems and technology are necessary.

- Green Data Centers are in charge of making optimum use of computer resources while also being environmentally friendly. In data centers, low-power servers are more energy-efficient than traditional servers. They employ smartphone computing technology to strike a balance between performance and energy usage.

- The European Green Deal aspires to make Europe the first continent to achieve carbon neutrality. Green and digital transformation should be viewed as complementary. The European Commission's paper "Shaping Europe's Digital Future" states that data centers must be carbon-neutral by 2030.

- The European Union has made energy-efficient cloud computing a primary focus. To be carbon-neutral by 2030, data centers must become more energy-efficient, utilize waste energy such as heat, and employ more renewable energy sources. According to Cloudscene, in 2023, Europe accounted for the majority of cloud on-ramps in the year, with Equinix and Digital Realty as leading cloud service providers for this in the region. Equinix was the leading cloud on-ramps provider with a global lead providing 249 cloud on-ramps.

- A group of Europe's major data center operators has formed and signed a green data center pact, pledging to self-regulate before European Union officials approve data center sustainability legislation. This uncomfortable possibility has hung over the bloc's industry for more than a year. The Climate Neutral Data Centre Pact, lays out efficiency and renewable energy goals for data centers and ambitious targets for achieving them. It creates a framework for measuring progress toward those objectives.

Europe Green Data Center Industry Overview

Europe green data center market is fragmented as vendors adopt inorganic growth strategies such as strategic partnerships and mergers and acquisitions to expand the market foothold. Key players are IBM, Cisco Systems, Inc., Dell Technologies Inc., etc.

In September 2022, A new data center of OVHcloud is being constructed in Limburg, Germany. The new building, which was first announced in April 2022, would have more than 6,000 square meters (64,580 sq ft) of floor space available for 40,000 servers, which OVH stated equates to a storage capacity of 100 exabytes. OVH highlighted the green qualities of the new facility. According to the company, the new data center will get 100 percent of its electricity from renewable sources. Also, OVHcloud will be using its patented water cooling technology, waste heat from the servers will be used for underfloor heating in the adjoining offices, and will have an ecological green roof with plants on the facades and trees on the site.

In July 2022, In Hanu, Germany, a sizable data center park is being planned by European logistics real estate company P3 Logistic Parks. At least eight data center modules will be developed on a building area of about 200,000 square meters (2.1 million square feet) over 10 years, with an electrical supply of 180 megawatts (MW) at the site. Construction will be done in phases. The on-spec campus, according to P3, would be developed and run sustainably, and it will be powered entirely by renewable energy.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Industry Regulation and Policies

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Data Storage

- 5.1.2 Focus on Energy Efficiency

- 5.2 Market Restraints

- 5.2.1 Higher Initial Investments

6 MARKET SEGMENTATION

- 6.1 Service

- 6.1.1 System Integration

- 6.1.2 Monitoring Services

- 6.1.3 Professional Services

- 6.1.4 Other Services

- 6.2 Solution

- 6.2.1 Power

- 6.2.2 Servers

- 6.2.3 Management Software

- 6.2.4 Networking Technologies

- 6.2.5 Cooling

- 6.2.6 Other Solutions

- 6.3 User

- 6.3.1 Colocation Providers

- 6.3.2 Cloud Service Providers

- 6.3.3 Enterprises

- 6.4 Industry Vertical

- 6.4.1 Healthcare

- 6.4.2 Financial Services

- 6.4.3 Government

- 6.4.4 Telecom and IT

- 6.4.5 Other Industry Verticals

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Ltd

- 7.1.2 Cisco Technology Inc.

- 7.1.3 HP Inc.

- 7.1.4 Dell EMC Inc.

- 7.1.5 Hitachi Ltd

- 7.1.6 Schneider Electric SE

- 7.1.7 IBM Corporation

- 7.1.8 Eaton Corporation

- 7.1.9 Emerson Network Powers

- 7.1.10 GoGrid LLC