|

市场调查报告书

商品编码

1637810

印度塑胶产业:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Plastic Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

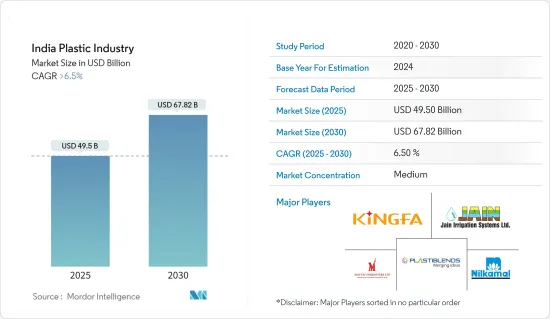

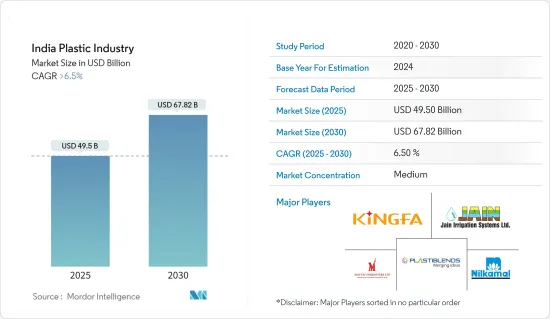

印度塑胶产业预计将从 2025 年的 495 亿美元成长到 2030 年的 678.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 6.5%。

印度塑胶产业是该国经济中最重要的产业之一。塑胶工业的起源可以追溯到 1957 年,当时印度首次生产聚苯乙烯。自那时起,印度的塑胶消费量增加了23倍,达到约2,200万吨。人均塑胶消费量也从1公斤增加到15公斤。印度约占全球塑胶使用量的6%,是继中国和美国之后的第三大塑胶消费国。预计未来几十年经济成长和人口成长将继续推动印度的塑胶使用。

据估计,到 2060 年,印度的塑胶消费量可能达到 1.6 亿吨以上,是目前在全球塑胶消费量中所占份额的两倍多。印度塑胶业僱用了约4000万名工人。约有3万家加工厂和2,000家出口商。其中85-90%为中小企业。印度塑胶产业生产的产品种类繁多,包括塑胶、油毡、家居用品、麻线、钓网和地板材料。我们也生产医疗用品、包装用品、塑胶薄膜、管道和原料。该国主要出口塑胶原料、薄膜、片材、编织袋、织物、防水布等。报告显示,印度30个邦/联邦属地共有4953个註册单位从事塑胶製造和回收,9个邦/联邦属地有823个未註册单位。这些塑胶产品出口到150多个国家,主要集中在欧洲、非洲和亚洲。

由于包装、汽车、建筑、消费品和其他领域对塑胶产品的需求不断增加,印度塑胶产业预计未来几年将实现成长。随着环保塑胶的发展,技术发展和对永续性的日益重视也促进了该行业的发展。政府推动製造业发展的措施和不断壮大的中阶进一步促进了印度塑胶消费的成长。

印度塑胶市场的趋势

包装领域占据市场最大份额

包装占印度塑胶市场的最大份额。由于新产品发布对塑胶包装的需求,印度的包装产业在二线城市蓬勃发展。国内外公司都在采取合资、合作等策略,对市场成长有正面影响。包装产业的成长主要归功于低碳排放树脂的低成本和灵活性。去年,印度塑胶包装产量达到 416 万吨,高于前年的 400 万吨,产量与前一年同期比较增 3.97%。由于包装商品消费量不断增加、可支配收入不断增加以及电子商务的成长,印度的塑胶包装产业正在快速成长。此外,一些主要企业还提供各种各样的塑胶包装选择。该行业的技术也在不断发展,从而产生了新的创新包装解决方案。

塑胶出口成长将对市场成长产生正面影响

根据最新的塑胶出口资料,去年塑胶材料出口达到 134 亿美元,与前一年同期比较增 33.3%。去年出口额最大的产品是塑胶原料,占出口绝对值的30%以上。与前一年同期比较增长了26.5%。去年5月,印度塑胶和油毡出口额为10.72亿美元。同期,医用塑胶、塑胶薄膜及片材出口量大幅增加,管材及管件出口量也增加。玻璃钢及复合材料、包装用品、杂项商品的出口也大幅成长。去年4月至5月的出口总额比去年同期增加2.5%,达到21.74亿美元,其中塑胶出口总额达63.75亿美元。去年,塑胶原料出口成长了 32.4%,医疗用品出口成长了 24.7%,管道及配件出口增加了 17.8%。

印度塑胶产业概况

由于国内塑胶树脂製造商有限,印度塑胶市场趋于整合。市场的主要企业包括 Jain Irrigation Systems Ltd、Kingfa Science &Technology India Ltd、Mayur Uniquoters Ltd、Nilkamal Ltd、Plastiblends India Ltd 和 Responsive Industries Ltd。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 电子商务的成长推动市场成长

- 市场限制

- 环境问题和监管压力

- 市场机会

- 技术进步带来市场机会

- 洞察产业技术进步

- 深入了解影响市场的各种监管发展

- 深入了解影响市场的政府法规

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场区隔

- 按类型

- 传统塑料

- 工程塑料

- 生质塑胶

- 依技术分类

- 吹塑成型

- 挤压

- 射出成型

- 其他技术

- 按应用

- 包装

- 电气和电子

- 建筑和施工

- 汽车和运输设备

- 家居用品

- 家具和床上用品

- 其他用途

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Jain Irrigation Systems Ltd

- Kingfa Science & Technology India Ltd

- Mayur Uniquoters Ltd

- Nilkamal Ltd

- Plastiblends India Ltd

- Responsive Industries Ltd

- Safari Industries India Ltd

- Supreme Industries Ltd

- VIP Industries Ltd

- Wim Plast Ltd(Cello)

第七章 未来市场趋势

第 8 章 免责声明与发布者

The India Plastic Industry is expected to grow from USD 49.50 billion in 2025 to USD 67.82 billion by 2030, at a CAGR of greater than 6.5% during the forecast period (2025-2030).

The plastic industry in India is one of the most important industries in the country's economy. The plastic industry traces its roots back to 1957 when polystyrene was first produced in India. Plastic consumption in India grew by 23-fold since then, reaching about 22 million tons. Per capita plastic consumption also grew from 1 kg per capita to 15 kg per inhabitant. India accounts for about 6% of global plastic use and is the third largest consumer of the material after China and the US. Economic growth and a growing population are expected to continue to drive plastic use in India over the coming decades.

According to estimates, India's plastic consumption could reach over 160 million metric tons (MT) by 2060, which would be more than double its current share in global plastic consumption. About 40 lakh workers are employed in the Indian plastics industry. The processing units and the exporters are about 30,000 and 2,000, respectively. Of these, 85 to 90% are small and medium enterprises (SMEs). The Indian plastics industry produces a wide range of products, such as plastic and linoleum, houseware products, cordage, fishnets, and floor coverings. It also creates medical items, packaging items, plastic films, pipes, and raw materials, among others. The country mainly exports plastic raw materials, films, sheets, woven sacks, fabrics, tarpaulin, etc. According to the source report, there are 4,953 registered plastic manufacturing/recycling units engaged in plastic activities in 30 states/Union territories of India and 823 non-registered plastic manufacturing/recycling units in 9 states/UTs. These plastic products are exported to more than 150 nations, mostly in Europe, Africa, & Asia.

India's plastic industry is expected to grow in the coming years as the demand for plastic products in packaging, automotive and construction, consumer goods, and other sectors continues to grow. Technological developments and a growing emphasis on sustainability through the development of environmentally friendly plastics are also contributing to the industry's growth. Government initiatives promoting manufacturing and a growing middle class are further contributing to the growth of plastic consumption in India.

India Plastic Market Trends

Packaging Segment Holds the Highest Share in the Market

Packaging accounts for the largest proportion of the plastics market in India. The packaging segment in India is thriving in second-tier cities because of the need for plastic packaging for the launch of new products. Both domestic and foreign companies are adopting strategies like joint ventures and partnerships with a positive effect on the growth of the market. The growth of the packaging industry is mainly due to the low cost and flexibility of resins with a low carbon footprint. Last year, India's plastic packaging production volume reached 4.16 mt in volume, up from 4 mt of the previous year, registering a 3.97 % Y-O-Y growth by volume. The Indian plastic packaging segment is growing at a rapid pace due to the increasing consumption of packaged goods, increasing disposable income, and e-commerce growth. Moreover, several key players are offering a wide variety of plastic packaging options. Technological developments are also taking place in the industry, resulting in the development of new and innovative packaging solutions.

Growth in the Export of Plastic with a Positive Impact on Market Growth

According to the latest plastic export data, exports of plastic material amounted to USD 13.4 billion last year, a year-on-year (YoY) increase of 33.3% from the previous year. The most extensively exported type last year was plastic raw materials, accounting for more than 30% of the absolute exports. It recorded a YoY increase of 26.5%. During May last year, India's exports of plastic and linoleum were valued at USD 1,072 million. In the same period, the volume of exports of medical plastics and plastic films and sheets increased significantly, as did those of pipes and fittings. The volume of exports of FRP and composite materials, packaging goods, and miscellaneous products also increased significantly. The total volume of exports for April and May last year increased by 2.5% YoY to USD 2,174 million, bringing the total value of plastics exports to USD 6.375 billion. In the last year, the volume of plastics exports of plastic raw materials, medical items, and pipes and fittings grew by 32.4%, 24.7%, and 17.8%, respectively.

India Plastic Industry Overview

The Indian plastics market is consolidated due to the limited presence of plastic resin manufacturers in the country. Some of the key players in the market include Jain Irrigation Systems Ltd, Kingfa Science & Technology India Ltd, Mayur Uniquoters Ltd, Nilkamal Ltd, Plastiblends India Ltd, and Responsive Industries Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in E-Commerce is driving the market growth

- 4.3 Market Restraints

- 4.3.1 Envirnomental Concerns and Regulatory Pressures

- 4.4 Market Opportunities

- 4.4.1 Technological Advancement will create opportunities in the Market

- 4.5 Insights into Technological Advancements in the Industry

- 4.6 Insights on Various Regulatory Trends Shaping the Market

- 4.7 Insights on Government Regulations Shaping the Market

- 4.8 Value Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Traditional Plastics

- 5.1.2 Engineering Plastics

- 5.1.3 Bioplastics

- 5.2 By Technology

- 5.2.1 Blow Molding

- 5.2.2 Extrusion

- 5.2.3 Injection Molding

- 5.2.4 Other Technologies

- 5.3 By Applicatiopn

- 5.3.1 Packaging

- 5.3.2 Electrical and Electronics

- 5.3.3 Building and Construction

- 5.3.4 Automotive and Transportation

- 5.3.5 Housewares

- 5.3.6 Furniture and Bedding

- 5.3.7 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Jain Irrigation Systems Ltd

- 6.2.2 Kingfa Science & Technology India Ltd

- 6.2.3 Mayur Uniquoters Ltd

- 6.2.4 Nilkamal Ltd

- 6.2.5 Plastiblends India Ltd

- 6.2.6 Responsive Industries Ltd

- 6.2.7 Safari Industries India Ltd

- 6.2.8 Supreme Industries Ltd

- 6.2.9 VIP Industries Ltd

- 6.2.10 Wim Plast Ltd (Cello)*