|

市场调查报告书

商品编码

1637825

企业快闪记忆体:市场占有率分析、产业趋势与成长预测(2025-2030 年)Enterprise Flash Storage - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

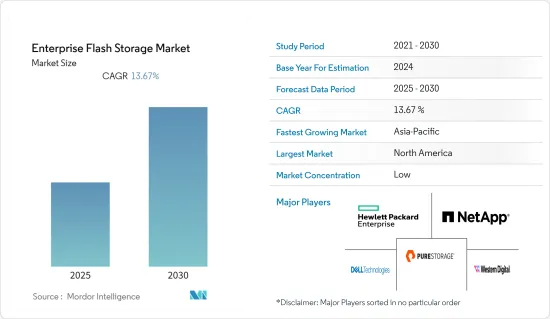

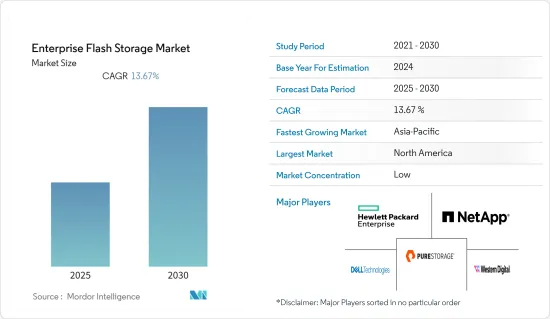

预测期内,企业快闪记忆体市场预计将实现 13.67% 的复合年增长率

主要亮点

- 云端技术的日益普及加上企业产生的资料量的不断增加预计将推动市场的发展。全球各地企业资料中心对快闪记忆体的需求日益增长。它在功耗、效能、扩充性和易于管理性方面具有优势,从而提高了其采用率。

- 非挥发性记忆体标准(NVMe)等变化正在推动企业快闪储存市场的成长。即时分析和要求苛刻的资料库系统等关键任务应用程式可以轻鬆在快闪记忆体系统上运行。虚拟伺服器、金融系统、虚拟桌面平台和收集大量资料的资料分析应用程式也是如此。

- 在数位化需求的推动下,它有望为 BFSI 和 IT 服务等各种终端用户产业带来价值,从而增加全球对超级资料中心的需求。同时,新的企业储存投资受到公共云端资源和全球更新企业基础设施的需求所推动。

- Flash 正在改变游戏规则,提供支援本地、边缘和公共云端基础架构消费的混合云端环境。快闪记忆体的另一个优点是它的灵活性和比传统可移动储存更动态的环境中部署的能力,例如作为物联网设备、摄影机和感测器的快取或持久缓衝区。快闪记忆体储存正在推动大小型组织的 IT 转型。

- 全球疫情大流行以及封锁导致的资料消费激增,导致记忆体和储存产品短缺且价格上涨,与资料中心营运的需求形成竞争。儘管已经恢復了有限的生产,但现有的库存很快就被大型科技公司囤积起来。驱动器供应商预计,由于库存低、等待时间长和生产问题,闪存驱动器的高价格将持续到明年。

企业快闪记忆体市场趋势

IT和通讯业占据较大的市场占有率

- IT和通讯业是快闪记忆体市场中最大的细分市场,预计在预测期内将实现最高收益。由于技术进步,预计未来几年客户端和企业市场对快闪记忆体设备的需求将保持稳定。这些因素可能会增加以更低价格获得更好技术的可能性。

- 储存设备使用量的快速成长是由于企业产生和处理的资料量的不断增加。 SSD 主要用于消费性设备或为伺服器和储存阵列提供小幅效能提升。

- HDD尚未完全渗透市场并且仍然占有相当大的份额。在云端和线上驱动器发展之前,IT 产业高度依赖硬碟来储存资料。快闪记忆体设备市场正在经历显着的成长率。这种转变正在缓慢地发生,但它被认为是一种有效的实体储存资料的解决方案,比任何其他专门用于储存的线上资料库都能提供更高的资料安全性。

- 随着高密度快闪记忆体技术的发展,全快闪储存解决方案可以在很小的资料中心空间内提供更快的效能和更高的容量。随着 IT 世界中资料量的不断增长,企业可以透过简化管理并减少空间、电力和冷却使用,从长远来看节省大量成本。

- 资料正在成为各种规模企业的关键差异化因素,企业越来越多地使用数据透过更明智的决策来推动竞争优势和收益。因此,越来越多的企业,无论大小,都开始转向人工智慧和机器学习来增强多种功能。

- 人工智慧和机器学习应用依赖大量资料来运作。这些应用程式需要大量资料才能有效和准确。此外,必须即时处理资料并储存以供以后在 ML 和深度学习 (DL) 中使用。储存可能成为实用化人工智慧和机器学习应用的瓶颈。可以透过适当的存储来缓解这一问题。快闪记忆体和硬碟的混合用于摄取和即时处理,其中硬碟可提供充足的资料储存和扩充性。

- 企业也使用快闪记忆体来备份高效能应用程式需求。快闪记忆体(尤其是 NVMe 快闪记忆体)因其快速恢復而闻名。在发生网路攻击、停电或其他中断时,快速恢復上线至关重要,而快闪记忆体对于此类使用案例至关重要。企业分别使用快闪记忆体和 HDD 的组合来满足其热储存和冷储存需求。

- 通讯,随着4K/8K视讯、VR/AR应用、智慧製造、远端巡检、5G等技术对智慧安防等企业服务的支持,人工智慧将成为IT领域的重要参与者。正在向服务创新平台转变,资料储存和处理量可望从T比特级提升至P比特级,进一步推动市场成长。

亚太地区成长强劲

- 资讯科技和电脑技术的蓬勃发展产生了传输和储存大量资料的需求,从而推动了该地区的需求。由于印度企业数量的增加和国际储存供应商进入市场,预计亚太地区的采用率将最高。

- 快闪记忆体正在推动各种规模的企业实现 IT 产业的转型。全快闪储存具有多种优势,包括更低的延迟、每个驱动器更高的 IOPS、工作负载整合、更小的硬体占用空间、最小化的功耗和降低的管理成本。该地区正在不断增加云端运算的采用,以满足竞争激烈的市场中对业务创新、敏捷性和扩充性日益增长的需求。

- 目前,印度是亚太地区继中国之后成长第二快的云端服务市场。数位化颠覆预计将推动印度快闪记忆体储存的发展,尤其是在计程车产业、政府、医院、公共教育和製造业领域。此外,随着物联网越来越普及,所有感测器都会产生一定程度的资料,这些数据需要储存在某个地方进行分析,预计这也将推动该国对快闪记忆体的采用。

- Pure Storage 是一家提供全球最先进资料储存技术和服务的 IT 先驱,该公司于 2022 年 6 月在班加罗尔开设了新的印度研发中心。该中心致力于改变储存和资料管理的创新。据该公司称,这些是印度可以发挥全球作用的领域。

- 世界的数位转型正在刺激资料的增加,尤其是影片、影像和音讯檔案等非结构化资料的增加。 Pure Storage 提供广泛的资料管理解决方案,包括 FlashArray、FlashBlade、FlashStack、AIRI、Pure as-a-Service、Portworx、Pure1、Evergreen、Pure Cloud Block Store 和 Purity。我们位于印度的研发中心为大多数产品线的持续创新做出了贡献。

企业快闪储存产业概览

企业快闪记忆体市场本质上竞争激烈。由于大大小小的参与者众多,市场集中度很高。所有主要参与者都拥有相当大的市场份额,并致力于扩大全球消费群。该市场的主要参与者包括 Pure Storage, Inc.、StorCentric, Inc.、Oracle Corporation、Dell, Inc. 和 Hewlett-Packard Enterprise Development LP。公司正在建立多种伙伴关係并投资于新产品的推出,以增加市场占有率并在预测期内获得竞争优势。

2022年5月,NetApp宣布与NVIDIA在人工智慧基础设施解决方案方面展开多年合作。 NetApp 宣布 NetApp 全快闪 NVMe 储存和平行檔案系统 BeeGFS 通过 NVIDIA DGX SuperPOD 认证。 NVIDIA DGX SuperPOD 是一个 AI资料中心基础架构平台,作为承包解决方案交付给 IT 部门,以支援当今企业面临的最复杂的 AI 工作负载。 DGX SuperPOD 简化了部署和管理,同时提供了几乎无限的效能和容量可扩展性。

2022年3月,西部数据与三星就下一代高速储存技术展开合作。此次合作旨在标准化并广泛采用下一代资料放置、处理和结构 (D2PF) 储存技术。换句话说,这两个品牌正在合作解决下一代 SSD 技术和分区储存解决方案生态系统。三星和西部数据已致力于开发高速储存解决方案,两家公司都专注于企业、云端应用和分区储存生态系统。分区储存是一类储存设备,其中主机和储存设备协作以提供低延迟的高容量储存。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对企业快闪记忆体市场的影响

第五章 市场动态

- 市场驱动因素

- 混合快闪记忆体阵列的演变和全Flash阵列销售的崛起

- 储存容量增加和价格下降使 HDD 更偏好

- 市场挑战

- 相容性和最佳储存效能问题

第六章 市场细分

- 按类型

- 全Flash阵列

- 混合快闪记忆体阵列

- 按最终用户产业

- 资讯科技/通讯

- 车

- BFSI

- 卫生保健

- 防御

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Pure Storage, Inc.

- StorCentric, Inc.

- Oracle Corporation

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Nimbus Data

- Western Digital Corporation

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Hitachi Vantara LLC

- NetApp

第八章投资分析

第九章:市场的未来

The Enterprise Flash Storage Market is expected to register a CAGR of 13.67% during the forecast period.

Key Highlights

- The growing adoption of cloud technology, coupled with growth in the amount of data generated by enterprises, is expected to drive the market. The adoption of flash storage is in demand in enterprise data centres globally. There are advantages in terms of power consumption, performance, scalability, and ease of management that boost the adoption rate.

- Non-Volatile Memory Express (NVMe) and other changes have helped the market for enterprise flash storage grow. Mission-critical applications, including real-time analytics and demanding database systems, can be performed easily with flash storage systems. So can virtual servers, financial systems, virtual desktop platforms, and data analytics applications that gather vast amounts of data.

- Aided by the demand for digitization, it is expected to contribute value to different end-user industries, such as BFSI and IT services, and raise the global need for mega data centers. On the other hand, new enterprise storage investments were made because of the need for public cloud resources and a global enterprise infrastructure update.

- Flash is becoming the game changer in delivering hybrid-cloud environments to support on-premise, the edge, and public cloud infrastructure consumption. Another benefit of flash storage is its flexibility and ability to be deployed into more dynamic environments than traditional removable storage, such as a cache or persistent buffer for IoT devices, cameras, and sensors. Flash storage is enabling IT transformation in a variety of organizations of all sizes.

- The global pandemic, COVID-19, and the surge in data consumption due to the lockdown have led to a shortage and higher prices for memory and storage products to counter the demand for data center operations. Although limited production has resumed, the current supply is quickly being stockpiled by large technology companies. Drive vendors expect that the high price of flash drives will continue into next year because of low stock, long wait times, and problems with production.

Enterprise Flash Storage Market Trends

IT & Telecom Sector to Hold Significant Market Share

- The IT and telecom industry is the largest market value segment in the flash storage market and is expected to be the highest earner during the forecast period.The demand for flash devices will remain stable in the client and enterprise markets for the next few years, owing to technological advancements. These factors will likely increase the availability of better technology at lower prices.

- The rapid growth in the usage of storage devices is justified by the companies' increased amount of data generated and processed. SSDs were mostly used in consumer devices or to give a server or storage array a little boost in performance.

- HDDs are still not exhausted in the market and still hold a considerable share. The IT industry relied immensely on hard drives to store data before the evolution of the cloud and online drives. The growth rate of flash storage devices is significantly increasing in the market. This transformation is slowly underway but is considered an effective solution to store data physically, which enables data security more than any other online database used explicitly for storage.

- With the development of high-density flash technologies, all-flash storage solutions offer faster performance and higher capacity in a fraction of the data center footprint. As the amount of data in the IT field continues to grow, businesses can save a lot of money over time by making management easier and using less space, power, and cooling.

- Data is becoming an essential differentiator for businesses of all sizes, and they are increasingly leveraging it to accelerate competitiveness and revenue through better and more informed decision-making. As a result, more and more companies, big and small alike, are using artificial intelligence and machine learning to enhance their competence across several functions.

- Artificial intelligence and machine learning applications rely on large volumes of data to function. These applications need a large amount of data for effectiveness and accuracy. Moreover, the data must be processed in real-time and stored for later use in ML and deep learning (DL). Storage can become the bottleneck for the practical usage of artificial intelligence and machine learning applications. This can be mitigated using the right storage: a mix of flash and hard drives-flash-based for ingesting and real-time processing, and a hard disk for ample data storage and scalability.

- Enterprises are also using flash for backup of high-performance application requirements. Flash storage (especially NVMe flash) has become famous for fast restores. In the wake of a cyberattack, power outage, or any other disruption, it is crucial to be back online quickly, and flash storage can become indispensable in such use cases. Enterprises use a mix of flash and HDD for hot and cold storage requirements, respectively.

- Additionally, with the advent of support for 4K/8K video, VR/AR applications, and enterprise services such as smart manufacturing, remote inspection, and intelligent security protection leveraging technologies such as 5G, AI is transforming the traditional support tools within the IT and telecom sectors into service innovation platforms where data storage and processing volumes are expected to grow from T-bit level to P-bit level, further leveraging the growth of the market.

Asia-Pacific to Witness Significant Growth

- The global boom in IT and computer technology has triggered the need for the transfer and Storage of vast amounts of data, subsequently pushing up the demand in the region. Owing to a growing number of enterprises In India and international storage vendors entering the market, Asia-Pacific is expected to witness the highest adoption rate.

- Flash storage is enabling IT industries' transformation for organizations of all sizes. All-flash Storage offers a variety of benefits, from lowering latency and increasing IOPS per drive to consolidating workloads, shrinking hardware footprints, minimizing power consumption, and reducing the cost of management. The region is seeking cloud adoption to leverage the increasing need for business innovation and agility and the ability to scale in the competitive market, followed by government initiatives toward digital India.

- Currently, India is immediately after China as the fastest-growing cloud services market across the Asia Pacific. Digital disruption is expected to drive flash storage in India, especially in taxi industries, government, hospitals, public education, and manufacturing. Furthermore, IoT, where every sensor produces some amount of data that needs to be stored somewhere to do analytics, is also expected to drive flash storage adoption in the country as IoT penetration increases.

- Pure Storage, an IT pioneer that delivers the world's most advanced data storage technology and services, inaugurated its new India Research and Development Center in Bangalore in June 2022. The center's prime focus is on innovations transforming Storage and data management. According to the company, these are the areas where India can play a global role.

- The global digital transformation is fueling data growth, specifically unstructured data such as video, picture, and audio files. Pure Storage has a broad portfolio of data management solutions, including FlashArray, FlashBlade, FlashStack, AIRI, Pure as-a-Service, Portworx, Pure1, Evergreen, and Pure Cloud Block Store and Purity. The India research and development center will contribute to the continued innovation in most of these product lines.

Enterprise Flash Storage Industry Overview

The Enterprise Flash Storage Market is very competitive by nature. The market is highly concentrated due to the presence of various small and large players. All the major players account for a large share of the market and are focusing on expanding their consumer base across the world. Some of the significant players in the market are Pure Storage, Inc.; StorCentric, Inc.; Oracle Corporation; Dell, Inc.; Hewlett-Packard Enterprise Development LP; and many more. The companies are increasing their market share by forming multiple partnerships and investing in introducing new products, thus earning a competitive edge during the forecast period.

In May 2022, NetApp collaborated with NVIDIA on artificial intelligence infrastructure solutions for many years. NetApp announced the certification of NetApp all-flash NVMe storage and the BeeGFS parallel file system with the NVIDIA DGX SuperPOD. The NVIDIA DGX SuperPOD is an AI data center infrastructure platform delivered as a turnkey solution for IT to support the most complex AI workloads facing today's enterprises. DGX SuperPOD simplifies deployment and management while providing virtually limitless scalability for performance and capacity.

In March 2022, Western Digital Corporation and Samsung collaborated on next-generation fast storage technologies. The collaboration aims to standardize and drive broad adoption of next-generation data placement, processing, and fabric (D2PF) storage technologies. In other words, the two brands are collaborating to work on next-gen SSD technology and an ecosystem for zoned storage solutions. Samsung and Western Digital have already indulged in developing high-speed storage solutions, and the companies are focusing on enterprise, cloud applications, and the Zoned Storage ecosystem. Zoned storage is a category of storage devices that allows hosts and storage devices to cooperate to deliver high-capacity storage with low latencies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Enterprise Flash Storage Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Hybrid Flash Arrays and Increased Sales of All Flash Arrays

- 5.1.2 Increased Storage Capacity and Price Reduction Leading to Preference Over HDDs

- 5.2 Market Challenges

- 5.2.1 Compatibility and Optimum Storage Performance Issues

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 All-Flash Array

- 6.1.2 Hybrid Flash Array

- 6.2 By End-user Industry

- 6.2.1 IT & Telecom

- 6.2.2 Automotive

- 6.2.3 BFSI

- 6.2.4 Healthcare

- 6.2.5 Defense

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pure Storage, Inc.

- 7.1.2 StorCentric, Inc.

- 7.1.3 Oracle Corporation

- 7.1.4 Dell Inc.

- 7.1.5 Hewlett Packard Enterprise Development LP

- 7.1.6 Nimbus Data

- 7.1.7 Western Digital Corporation

- 7.1.8 IBM Corporation

- 7.1.9 Huawei Technologies Co., Ltd.

- 7.1.10 Hitachi Vantara LLC

- 7.1.11 NetApp