|

市场调查报告书

商品编码

1637836

中东和非洲黏合剂和密封剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)MEA Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

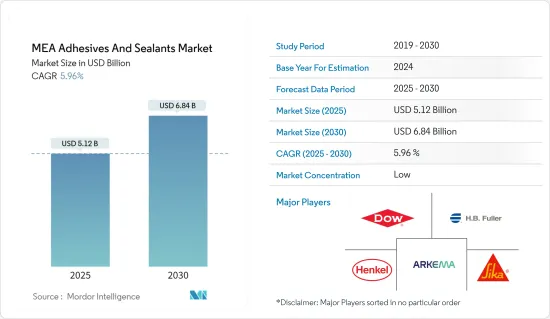

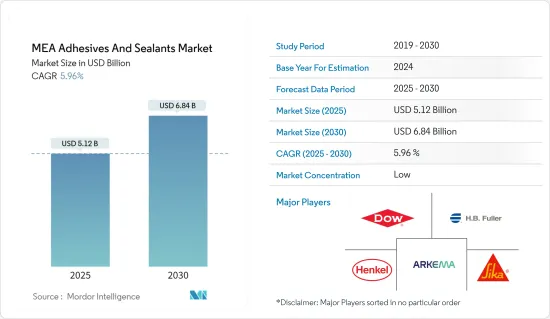

中东和非洲黏合剂和密封剂市场规模预计在 2025 年为 51.2 亿美元,预计到 2030 年将达到 68.4 亿美元,预测期内(2025-2030 年)复合年增长率为 5.96%。

COVID-19 疫情扰乱了原料供应链,对黏合剂和密封剂市场产生了负面影响。疫情过后,建筑、医疗保健和包装行业的需求增加预计将重振黏合剂和密封剂市场。

主要亮点

- 短期内,对黏合剂和密封剂的需求主要受到建设产业需求成长、医疗保健基础设施建设增加以及包装行业使用量增加的推动。

- 然而,对化学品使用的环境问题的日益担忧可能会阻碍市场的成长。

- 生物基黏合剂的创新和发展以及向复合材料黏合剂黏合的转变可能会为该地区的黏合剂和密封剂市场创造机会。

- 沙乌地阿拉伯是该地区最大的黏合剂和密封剂市场,消费主要由建筑、医疗保健和包装等终端用户产业推动。

中东和非洲胶合剂和密封剂市场的趋势

包装终端用户产业主导市场

- 包装产业是黏合剂和密封剂市场的最大消费者。包装产业正见证着食品和饮料、化妆品、消费品和文具等终端用户产业的强劲需求。

- 根据全球创新指数(GII),2022年中东和非洲美容及个人护理产业的市场规模约为354.5亿美元。

- 此外,由于人口增长、对优质产品的需求、都市化以及消费者对技术的偏好,对化妆品、食品和饮料的需求预计还会增长。从而刺激了包装产业的需求。

- 根据国际货币基金组织 (IMF) 的数据,2023 年至 2028 年间,阿联酋的消费者在食品和非酒精饮料上的支出预计将增加 99.6 亿美元,即 17.36%。预计到 2028 年,食品相关支出将达到 673 亿美元。

- 根据加拿大农业和农业食品部的数据,2022年阿联酋人均食品和非酒精饮料的年度支出为 2,337.2 美元。预计到 2023 年将升至 2,400 美元以上。

- 此外,到 2025 年,中东和非洲的奢侈品包装市场价值预计将升至 12 亿美元以上。奢侈品包装是指任何奢侈品品牌商品的包装。最近的市场发展包括永续和生物分解性的包装。

- 因此,随着全部区域包装行业的强劲增长,预测期内对黏合剂和密封剂市场的需求预计也将增加。

沙乌地阿拉伯主导市场

- 沙乌地阿拉伯在该地区黏合剂和密封剂消费中占据主导地位。建设活动、汽车产量的增长以及医疗保健和航太工业的消费增加是推动该国黏合剂和密封剂消费的主要因素。

- 沙乌地阿拉伯政府的各项建设计划包括耗资5,000亿美元的未来特大城市「Neom」计划,以及红海计划一期,预计于2022年完工。投资组合还包括分布在五个岛屿的14 家豪华和超豪华酒店,共有3,000 间客房,两个内陆度假村,Qiddiya 娱乐城,超豪华健康目的地Amaala,让·努维尔在埃尔奥拉的Charmant 度假村,其中包括住宅部的 Sakai住宅和吉达塔。预计预测期内此类计划将推动各种建筑业应用对黏合剂的需求。

- 根据世界卫生组织预测,沙乌地阿拉伯的医疗保健支出预计2022年将达到607亿美元,2027年将达到771亿美元。

- 沙乌地阿拉伯正在向电动车领域投资超过 2.2 亿美元,并运营三家工厂,这可能会在未来几年增加对汽车黏合剂的需求。例如,汽车产量预计将从 2021 年的 9,800 辆增加到 2028 年的 12,800 辆。预计这将推动该国黏合剂和密封剂市场的发展。

- 根据沙乌地阿拉伯统计总局的数据,2022 年沙乌地阿拉伯「建筑施工」产业的销售收入约为 288.7 亿美元。

- 因此,预计所有这些趋势将在预测期内推动该国黏合剂和密封剂市场的成长。

中东和非洲胶合剂和密封剂产业概况

中东和非洲的黏合剂和密封剂市场是一个分散的市场。市场的主要企业(不分先后顺序)包括阿科玛 (Arkema)、汉高 (Henkel AG &Co.KGaA)、西卡 (Sika AG)、HB Fuller Company 和陶氏 (Dow)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 沙乌地阿拉伯建设产业的需求不断成长

- 扩大包装行业的应用

- 其他驱动因素

- 限制因素

- 日益严重的环境问题

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章 市场区隔(以金额为准的市场规模)

- 黏合剂:树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- 乙烯-醋酸乙烯共聚物・

- 其他树脂

- 黏合剂:依技术分类

- 热熔胶

- 反应性

- 溶剂型

- UV固化型

- 水性

- 密封剂:树脂

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 其他树脂

- 最终用户产业

- 航太

- 车

- 建筑和施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

- 地区

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Arkema

- AVERY DENNISON CORPORATION

- Dow

- Henkel AG & Co. KGaA

- HB Fuller Company

- Huntsman International LLC

- Illinois Tool Works Inc.

- MAPEI SpA

- Permoseal(Pty)Ltd

- Sika AG

- The Industrial Group Ltd

第七章 市场机会与未来趋势

- 生物基胶黏剂的创新与发展

- 向复合黏合的转变

The MEA Adhesives And Sealants Market size is estimated at USD 5.12 billion in 2025, and is expected to reach USD 6.84 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The COVID-19 pandemic disrupted the raw materials supply chain network, negatively affecting the adhesives and sealants market. Post-pandemic, the rising demand for construction, healthcare, and packaging industries is excepted to revive the market for adhesives and sealants.

Key Highlights

- Over the short term, the demand for adhesives and sealants is extensively driven by the growing demand from the construction industry, increasing healthcare infrastructure, and growing usage in the packaging industry.

- However, the market growth is likely to be hindered by the rising environmental concerns regarding the usage of chemicals.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials will likely offer opportunities for the adhesives and sealants market in the region.

- Saudi Arabia is the region's largest market for adhesives and sealants, where the end-user industries, such as construction, healthcare, and packaging, majorly drive consumption.

MEA Adhesives and Sealants Market Trends

Packaging End User Industry to Dominate the Market

- The packaging segment is the largest consumer of the adhesives and sealants market. The packaging industry is witnessing strong demand from end-user industries, such as food and beverages, cosmetics, consumer goods, stationery, and others.

- According to the Global Innovation Index (GII), the beauty and personal care industry in Africa and the Middle East in 2022 was worth around USD 35.45 billion.

- Moreover, the demand for cosmetics and food and beverage products is expected to grow due to the growing population and demand for quality products, urbanization, and consumers inclining toward technology. Hence, fueling the demand for the packaging industry.

- According to the International Monetary Fund, overall consumer expenditure on food and non-alcoholic drinks in the United Arab Emirates is expected to rise by USD 9.96 billion (+17.36%) between 2023 and 2028. Food-related spending is expected to reach USD 67.3 billion in 2028.

- According to Agriculture and Agri-Food Canada, the annual per capita expenditure in the United Arab Emirates on food and non-alcoholic beverages was USD 2,337.2 in 2022. It was expected to rise to over USD 2.4 thousand by 2023.

- Additionally, the market value of luxury packaging in the Middle East and Africa is expected to rise to over USD 1.2 billion by 2025. Luxury packaging refers to any packaging for luxury brand items. Recent market developments include sustainable and biodegradable packaging.

- Hence, with such robust growth of the packaging industry across the Middle East and Africa region, the demand in the adhesives and sealants market is also expected to increase during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia dominates the consumption of adhesives and sealants in the region. Growing construction activities, automotive vehicle production, and increasing consumption in the healthcare and aerospace industries are the key factors driving the consumption of adhesives and sealants in the country.

- The Saudi Arabian government includes various construction projects, like a USD 500 billion futuristic mega-city 'Neom' project, the Red Sea Project - Phase 1, due to be completed in 2022. It also includes 14 luxury and hyper-luxury hotels that may comprise 3,000 rooms across five islands, and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, Jean Nouvel's Sharman resort in Al-Ula, Ministry of Housing's Sakai homes, and Jeddah Tower. Such projects will likely drive the demand for adhesives from various construction sector applications over the forecast period.

- According to the WHO, Saudi Arabia's healthcare spending was USD 60.7 billion in 2022 and is expected to be USD 77.1 billion in 2027.

- Saudi Arabia is investing more than USD 220 million in electric vehicles by operating three potential factories to increase automotive adhesives demand over the coming years. For instance, automotive production is expected to reach 12.8 thousand units by 2028 from 9.8 thousand units in 2021. It is expected to drive the market for adhesives and sealants in the country.

- According to the General Authority for Statistics (Saudi Arabia), in 2022, the revenue of the industry "construction of buildings" in Saudi Arabia was around USD 28.87 billion.

- Hence, all such trends are expected to drive the growth of the adhesives and sealants market in the country over the forecast period.

MEA Adhesives and Sealants Industry Overview

The Middle East and Africa Adhesives and Sealants Market is a fragmented market. Some of the key players in the market (not in any particular order) include Arkema, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, and Dow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in Saudi Arabia

- 4.1.2 Growing Usage in the Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Growing Environmental Concerns

- 4.2.2 Other Restrains

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

- 5.5 Geography

- 5.5.1 Saudi Arabia

- 5.5.2 South Africa

- 5.5.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 AVERY DENNISON CORPORATION

- 6.4.3 Dow

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 H.B. Fuller Company

- 6.4.6 Huntsman International LLC

- 6.4.7 Illinois Tool Works Inc.

- 6.4.8 MAPEI S.p.A

- 6.4.9 Permoseal (Pty) Ltd

- 6.4.10 Sika AG

- 6.4.11 The Industrial Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials