|

市场调查报告书

商品编码

1637837

结构绝缘板:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Structural Insulated Panels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

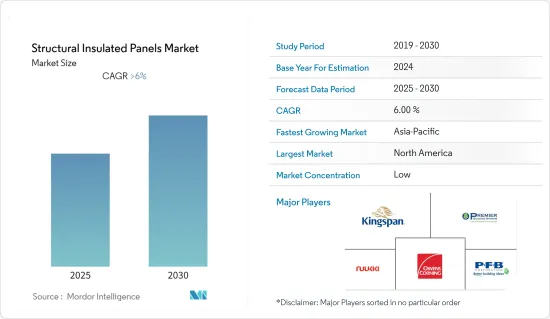

结构保温板市场预计在预测期内复合年增长率将超过 6%

建筑业是受COVID-19疫情影响较大的产业之一。由于缺乏资金、劳动力短缺和封锁规定,许多计划在 2020 年陷入停滞。然而,建筑业正在迅速復苏,预计未来几年将继续成长。

主要亮点

- 未来五到十年,预计建筑业需求的增加和冷库用途的扩大将推动市场。

- 另一方面,模组化建筑等建筑技术的改进可能会减缓市场成长。

- 然而,对绿色建筑的需求正在增加,这可能代表着市场成长的机会。

- 北美占据大部分市场,主要是由于加拿大和墨西哥建设计划较多。

结构保温板市场趋势

建筑墙体的需求增加

- 结构隔热板通常以 4-1/2 英吋和 6-1/2 英吋的厚度出售。儘管可以创建弯曲的墙板,但对于非正交配置,通常最好使用螺柱框架。

- 用作结构隔热墙板的面板的总体积远大于用作结构隔热屋顶板的体积。

- 定向纤维板在住宅中也是一种经济高效的选择。根据美国认证验住宅师协会 (NACHI) 的数据,对于典型的 2,400 平方英尺住宅,定向刨花板的成本比木材低 700 美元。

- 目前,一些新兴经济体的建筑业正在蓬勃发展。 2025年,中国计划投资1.43兆美元大型建设计划。据国家发改委称,上海计划投资387亿美元,广州已签署16个新基础建设计划,投资80.9亿美元。

- 2021 年,美国私部门新建住宅产量超过 7,760 亿美元,高于 2020 年的 6,289 亿美元。

- 随着2025年大阪世博会的举办,日本建筑业可望蓬勃发展。八重洲再开发计划将于2023年完工,一栋高390m、地上61层的办公大楼将于2027年完工。

- 2022年,德国宣布耗资30.8亿美元的德国与英国之间的NeuConnect互联计划,预计于2028年完工。欧洲投资银行将为该计划出资4.065亿美元。

- 因此,预计未来几年对建筑墙体的需求将会增加。

北美市场占据主导地位

- 北美地区主导了全球市场占有率。近年来,美国建筑业的私人建筑支出增加。

- 根据美国人口普查局的数据,2021 年 11 月美国建筑业总产值预计为 16,258.8 亿美元。此外,美国住宅预计为8,205.38亿美元,比去年同期成长3.4%。

- 2023年1月,美国运输部宣布将投资总计50亿美元用于全美9个大型建设计划。国家基础设施计划支持(大型)酌情津贴计划宣布,已为这九个大型企划的建设提供 12 亿美元。

- 此外,加拿大的建筑业在多伦多、蒙特娄和温哥华等几个主要城市都在成长。在这些城市,开发商取得了良好的投资收益,主要集中在高密度住宅计划。建设业最重要的地点是多伦多和蒙特娄,约占总收入的 25%。

- 根据 StatCan 的数据,加拿大建筑投资在 2021 年 10 月成长 1.6% 至 178 亿美元后,2021 年 11 月成长 1.2% 至 180 亿美元。这刺激了建筑工作并增加了对结构绝缘板的需求。

- 这些因素正在推动该地区结构隔热板的消费。

结构保温板产业概况

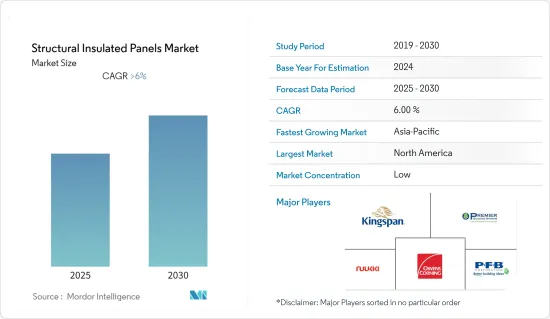

结构保温板市场高度细分,没有主要参与者占据较大份额。许多市场领导者都是生产结构隔热板并提供安装和维护服务的向前整合公司。主要参与企业(排名不分先后)包括 Kingspan Group、Rautaruukki Corporation、Premier Building Systems Inc. Premier SIPS、Owens Corning 和 PFB Corporation。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查先决条件

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 促进因素

- 建筑业的需求增加

- 冷库应用程式增加

- 抑制因素

- 模组化建筑技术等建筑技术的进步

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔(以金额为准的市场规模)

- 产品

- EPS(发泡聚苯乙烯)面板

- 硬质聚氨酯 (PUR) 和硬质聚异氰酸酯(PIR) 面板

- 玻璃绒板

- 其他产品(押出成型聚苯乙烯泡沫)

- 皮肤材质

- 定向纤维板(OSB)

- 合板

- 其他蒙皮材质(水泥板)

- 目的

- 建筑墙

- 屋顶

- 冷藏库仓库

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 欧洲其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 南非

- 其他中东/非洲

- 亚太地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alubel SpA

- ArcelorMittal

- Balex-Metal

- Cornerstone Building Brands

- DANA Group of Companies

- ITALPANNELLI SRL

- Jiangsu Jingxue Insulation Technology Co. Ltd.

- Kingspan Group

- Manni Group SpA

- METECNO

- Multicolor Steels (India) Pvt. Ltd.

- Nucor Building Systems

- Owens Corning

- Premium Building Systems

- PFB Corporation(Riverside)

- Rautaruukki Corporation

- Tata Steel

- Zamil Industrial Pre-Engineered Buildings Co. Ltd.

第七章 市场机会及未来趋势

- 绿建筑需求增加

The Structural Insulated Panels Market is expected to register a CAGR of greater than 6% during the forecast period.

The construction industry is one of the industries that was badly impacted by the COVID-19 outbreak. Because of a lack of funds, labor shortages, and lockdown regulations, many projects were halted in 2020. But the construction industry is getting better quickly and will continue to grow over the next few years.

Key Highlights

- Over the next five to ten years, the market is likely to be driven by the growing demand from the construction industry and the growing number of uses in cold storage.

- On the other hand, improvements in building technologies, like modular construction, are likely to slow the growth of the market.

- But the demand for green buildings is growing, which could be a chance for the market to grow.

- North America had the most of the market, mostly because there were more building projects in Canada and Mexico.

Structural Insulated Panels Market Trends

Increasing Demand from Building Walls

- Structural insulated wall panels are generally available in thicknesses of 4-1/2 inches and 6-1/2 inches. It is possible to make curved wall panels, but for non-orthogonal shapes, it is often better to use stud framing instead.

- The total volume of the panels used as structural insulated wall panels is much higher than the volume used as structural insulated roof panels.

- Also, oriented strand boards are a cost-effective alternative for home construction. As per the National Association of Certified Home Inspectors (NACHI), OSB costs USD 700 less than wood for a typical 2400-square-foot home.

- The building and construction industry is currently thriving in several emerging economies. China has planned an investment of USD 1.43 trillion in major construction projects until 2025. According to the National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In 2021, new home construction output in the U.S. private sector reached over USD 776 billion, which increased from USD 628.9 billion in 2020.

- The Japanese construction industry is expected to bloom as the country will host the 2025 World Expo in Osaka, Japan. In 2023 and 2027, respectively, the Yaesu redevelopment project and a 61-story, 390 meter-tall office tower will be finished.

- In 2022, Germany announced a USD 3.08 billion NeuConnect interconnector project connecting Germany with the United Kingdom, which is scheduled to be completed by 2028. The European Investment Bank will contribute USD 406.5 million to the project.

- So, these things are likely to increase the demand for building walls over the next few years.

North America to Dominate the Market

- The North American region dominated the global market share. The US construction industry has witnessed an increase in private construction spending over the years.

- According to the US Census Bureau, the total construction output in the United States was estimated at USD 1625.88 billion in November 2021. Also, non-residential construction in the US was estimated to be worth USD 820.538 billion, which is 3.4% more than it was during the same time last year.

- In January 2023, the U.S. Department of Transportation announced the investment of a total of USD 5 billion for nine mega-construction projects across the country. The National Infrastructure Project Assistance (Mega) discretionary grant program gave USD 1.2 billion to build these nine mega projects, which was announced by the government.

- Furthermore, the Canadian construction industry is witnessing growth in a few major cities, such as Toronto, Montreal, and Vancouver. In these cities, developers are registering good profits on investment, mainly with high-density residential projects. The most important places for construction are Toronto and Montreal, which bring in about 25% of the total revenue.

- StatCan says that investments in building construction in Canada went up by 1.2% to USD 18.0 billion in November 2021, after going up by 1.6% to USD 17.8 billion in October 2021. This drove construction work and increased demand for structural insulated panels.

- These factors are driving the consumption of structural insulated panels in the region.

Structural Insulated Panels Industry Overview

The structural insulated panels market is highly fragmented, with no major player accounting for a prominent share of the market. Most of the market leaders are forward-integrated, i.e., they produce structural insulated panels and provide installation and maintenance services. Some of the major players (not in any particular order) include Kingspan Group, Rautaruukki Corporation, Premier Building Systems Inc. (Premier SIPS), Owens Corning, and PFB Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Construction Sector

- 4.1.2 Increasing Cold Storage Applications

- 4.2 Restraints

- 4.2.1 Advancements in Building Technologies, such as Modular Construction Techniques

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Product

- 5.1.1 EPS (Expanded Polystyrene) Panel

- 5.1.2 Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

- 5.1.3 Glass Wool Panel

- 5.1.4 Other Products (Extruded Polystyrene Foam)

- 5.2 Skin Material

- 5.2.1 Oriented Strand Board (OSB)

- 5.2.2 Plywood

- 5.2.3 Other Skin Materials (Cement Board)

- 5.3 Application

- 5.3.1 Building Wall

- 5.3.2 Building Roof

- 5.3.3 Cold Storage

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.2.4 Rest of North America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alubel SpA

- 6.4.2 ArcelorMittal

- 6.4.3 Balex-Metal

- 6.4.4 Cornerstone Building Brands

- 6.4.5 DANA Group of Companies

- 6.4.6 ITALPANNELLI SRL

- 6.4.7 Jiangsu Jingxue Insulation Technology Co. Ltd.

- 6.4.8 Kingspan Group

- 6.4.9 Manni Group SpA

- 6.4.10 METECNO

- 6.4.11 Multicolor Steels (India) Pvt. Ltd.

- 6.4.12 Nucor Building Systems

- 6.4.13 Owens Corning

- 6.4.14 Premium Building Systems

- 6.4.15 PFB Corporation(Riverside)

- 6.4.16 Rautaruukki Corporation

- 6.4.17 Tata Steel

- 6.4.18 Zamil Industrial Pre-Engineered Buildings Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Green Buildings