|

市场调查报告书

商品编码

1637855

中国巨量资料技术的投资机会-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Investment Opportunities of Big Data Technology in China - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

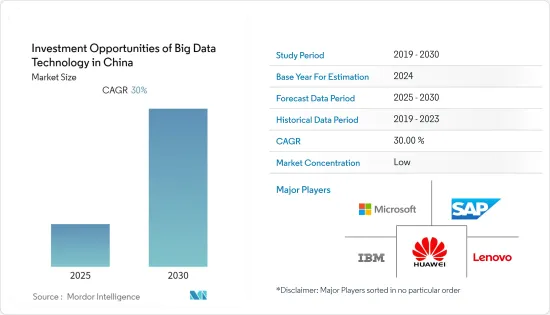

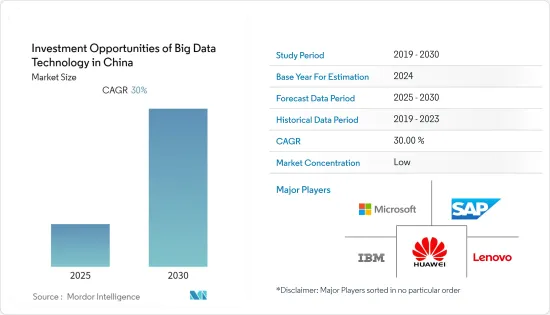

中国巨量资料技术投资机会市场预计在预测期间内复合年增长率为30%

主要亮点

- 中国的多家公司正大力投资巨量资料实施。网路搜寻公司百度、电子商务公司阿里巴巴和京东以及社群媒体公司腾讯都围绕着巨量资料开发了经营模式和营运。

- 此外,中国的巨量资料分析正在以两种方式帮助企业:建立更新的经营模式以及有效的产品和生产计画。在中国,行动付款系统作为经营模式被广泛使用,绕过了银行卡产生技术。此类行动付款管道有利于资料生成,并且可以轻鬆整合许多线上和线下服务。

- 为了最大限度地提高巨量资料的采用率,中国企业正在推出用于资料管理的一体化巨量资料平台。同样,使用者也见证了采用此类技术后收益统计的改善。

- 与美国同业相比,中国企业采用云端运算的速度较慢,原因是工作负载迁移的复杂性和成本,以及安全和监管问题。

- 此外,在 COVID-19 大流行期间,近乎即时地提取、可视化此类情报并采取行动的要求尤其重要,包括努力限制其传播并帮助企业生存,正逐渐成为一项关键任务目标。随着许多公司开始采用在家工作和远距工作文化,产生大量资料并为资料分析带来新的机会,巨量资料和商业分析行业预计将成长。

中国巨量资料技术投资机会市场趋势

客户分析需求将呈指数级增长,推动市场成长

- 巨量资料的使用可以让公司更了解他们的基本客群。有关客户的多维资料使公司能够更深入地了解客户的想法、为什么需要产品以及他们选择(或不选择)某些品牌而不是其他品牌的原因。

- 消费者分析使您能够对行销、销售、包装或产品本身做出明智的改变。结合市场分析,公司可以预测客户需求,确定产品生命週期,减少过剩,同时确保有足够的供应来满足需求。

- 考虑到中国消费市场规模庞大,产生的资料量庞大且将持续成长。巨量资料是有效管理这些负载的最佳方法,对于参与市场竞争的公司来说变得越来越重要。

- 中国各地的公司都致力于建立未来的智慧供应链,利用资料、自然语言处理、影像识别和机器学习来更好地预测消费者的需求并实现最高水平的技术效率。

- 客户分析对于 BFSI、汽车和医疗保健等领域至关重要,这些领域 B2C 元素仍然占据市场主导地位,并且还有很大的扩展空间。然而,鑑于该行业的重要性以及市场竞争的日益激烈,零售业和线上零售可能需要最多的客户分析。根据政府机构国家统计局的数据,今年中国网路零售约为人民币 1,325,227 亿元(合 4,714.39 美元),成长 1.2%。

零售刺激市场成长

- 海量资料驱动人工智慧。因此,它也自然会渗透到零售和消费品领域。中国的许多巨量资料公司声称可以帮助负责人、零售商和电子商务公司管理资料并进行库存预测、细分客户以及个人化客户参与参与。

- 此外,全国各地的商店都在利用物联网设备和解决方案来追踪存量基准、分析客户资料并改善客户互动。此类技术进步有助于改善整个供应链的产品追踪并更好地了解消费行为。

- 此外,以「提高效率」、改善整体客户体验为目标,阿里巴巴与零售巨头百联集团达成策略联盟与合作。双方将探索新零售机会,利用巨量资料整合线下门市、产品、物流和付款工具。

- 此外,中国消费者对奢侈品的投资比其他任何地方都更加数位化。据麦肯锡公司称,使用资料分析来个性化客户电子商务体验的时尚公司将其数位销售额增长了 30-50%。自去年年底以来,奢侈品牌可能会更加积极参与与资料管理公司建立在中国的合作。

中国巨量资料技术投资机会产业概况

中国丰富的资料空间竞争激烈,参与企业包括IBM中国有限公司、SAP中国有限公司、华为技术有限公司、微软(中国)和联想(北京)有限公司等。过去十年中涌现了几家公司,并对行业产生了巨大影响。西方竞争对手的增加迫使中国企业将目光转向海外。

- 2022年10月,智慧云端网路透过创新技术升级CloudFabric 3.0、CloudCampus 3.0、CloudWAN 3.0三大场景能力,企业业务变革驱动企业ICT基础设施发展,IP网路将成为IT与CT之间的桥樑。生产、行政流程,形成工业数位转型的互联互通基础。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

第六章 市场促进因素

- 资料爆炸:非结构化、半结构化、复杂

- 改进演算法开发

- 客户分析的必要性

第七章 市场限制因素 市场限制因素

- 缺乏普遍意识和专业知识

- 资料安全问题

第八章市场区隔

- 按发展

- 本地

- 云

- 按公司规模

- 大公司

- 小型企业

- 按解决方案

- 客户分析

- 诈欺检测/管理

- 营运情报

- 预测性维护

- 资产管理

- 其他解决方案

- 按最终用户产业

- BFSI

- 医疗保健

- 零售

- 製造/汽车

- 航太/国防

- 资讯科技/通讯

- 政府机构

- 其他的

第9章 竞争格局

- 公司简介

- IBM China Company Limited

- SAP China

- Huawei Technologies Co.

- Microsoft (China) Co., Ltd.

- Lenovo(Beijing)Limited

- Alibaba Cloud Computing Company

- Inspur Group Limited

- Baidu, Inc.

- Neusoft Corporation

- JD.com, Inc.

第十章投资分析

第十一章 市场机会及未来趋势

简介目录

Product Code: 47943

The Investment Opportunities of Big Data Technology in China Market is expected to register a CAGR of 30% during the forecast period.

Key Highlights

- Various organizations in the country are also investing significantly in adopting Big Data. The Internet search company Baidu, e-commerce companies Alibaba and JD, and social media company Tencent developed their business models and operations around Big Data.

- Furthermore, Big Data Analytics in China assists businesses in two ways: creating newer business models and effective product/production planning. China is experiencing an extensive use of mobile payment systems as a business model, bypassing the card generation of technology. Such mobile payment platforms facilitate the generation of data and simple integration for many online to offline services.

- To maximize the adoption of Big Data, companies in China are launching all-in-one Big Data platforms for data management. Similarly, users have witnessed an improvement in their revenue statistics by adopting such technologies.

- The companies in China have been slower to adopt cloud computing compared to the US firms, citing the complexity and cost of workload migrations and added security and regulatory issues.

- Moreover, The requirement to extract, visualize, and act on this intelligence in near-real-time is gradually becoming a mission-critical goal, particularly amid the COVID-19 epidemic, including efforts to restrict its spread and aid firms in staying afloat. Since many businesses have started to adopt work-from-home and remote working cultures, which produce enormous volumes of data and open up new opportunities for data analytics, the big data and business analytics industry is expected to grow.

China Big Data Technology Investment Opportunities Market Trends

Need for Customer Analytics to Increase Exponentially Driving the Market Growth

- The usage of big data lets enterprises understands their customer base better. Multi-dimensional data on customers allows businesses to dig deeper into how they think, why they need a product, and why they chose (or didn't choose) a specific brand over another.

- Consumer analysis can enable informed changes to marketing, sales, packaging, or the product itself. Blending it with market analytics lets businesses project customer needs, identify product life cycles, and provide enough supply to match demand while reducing the surplus.

- Given the enormous scale of China's consumer markets, the amount of data produced is vast and will continue to increase. Big data is the best approach to manage these loads effectively, and it is becoming increasingly crucial for businesses competing in the market.

- Companies all around China are concentrating on creating the smart supply chains of the future that will use data, natural language processing, image recognition, and machine learning to predict better consumer wants and reach the highest level of technological efficiency.

- Customer analytics will be crucial in sectors like BFSI, Automotive, and Healthcare, where the B2C component still dominates the market and offers significant room for expansion. However, given the importance of the industry and growing market competitiveness, the retail sector and online retail sales will require customer analytics the most. Approximately 132,522.7 billion yuan (4714.39 USD) were spent on online retail sales in China this year, an increase of 1.2 percent, according to the National Bureau of Statistics of China, a government organization.

Retail to Stimulate the Market Growth

- Considerable data power AI. Thus it stands to reason that it will keep permeating the retail and consumer products sectors. Many big data firms in China assert to help marketers, retailers, and eCommerce firms manage their data so they can forecast inventory, segment customers, and personalize customer engagement.

- Additionally, national shops use IoT devices and solutions to track stock levels, analyze customer data, and improve customer interactions. These technological advancements improve product tracking across the supply chain and aid in better understanding consumer behavior.

- Moreover, With the goal of "elevating efficiency" and improving the overall customer experience, Alibaba and the retail conglomerate Bailian Group has a strategic partnership and collaboration. The two companies have looked into new retail opportunities and will use Big Data to integrate offline stores, products, logistics, and payment tools.

- Additionally, luxury customer investments in China are far more digital than anywhere else. According to McKinsey & Co., fashion companies that harness data analytics to personalize customer e-commerce experiences have grown their digital sales anywhere from 30 to 50 percent. By the end of the last year and beyond, luxury brands will be more actively involved in setting up China-based collaborations with data management companies.

China Big Data Technology Investment Opportunities Industry Overview

The Chinese ample data space is highly competitive, with players such as IBM China Company Limited, SAP China, Huawei Technologies Co., Microsoft (China) Co., Ltd., and Lenovo (Beijing) Limited. Several companies have emerged in the last ten years and left their impact on the industry. Due to the increased western competition, Chinese businesses have been pushed to turn outside China for prospects.

- October 2022 - Intelligent Cloud-Network Upgrades Capabilities in Three Scenarios Based on Innovative Technologies, these capabilities are CloudFabric 3.0, CloudCampus 3.0, and CloudWAN 3.0, where changes in enterprise business are driving the development of enterprise ICT infrastructure, and IP networks serving as the bridge between IT and CT and covering all production and office procedures of enterprises, constitute the connectivity foundation for digital industrial transformation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

6 Market Drivers

- 6.1 Data Explosion: Unstructured, Semi-structured and Complex

- 6.2 Improvement in Algorithm Development

- 6.3 Need for Customer Analytics

7 Market Restraints

- 7.1 Lack of General Awareness And Expertise

- 7.2 Data Security Concerns

8 MARKET SEGMENTATION

- 8.1 By Deployment

- 8.1.1 On-Premise

- 8.1.2 Cloud

- 8.2 By Enterprise Size

- 8.2.1 Large Enterprise

- 8.2.2 Small & Medium Enterprise

- 8.3 By Solution

- 8.3.1 Customer Analytics

- 8.3.2 Fraud Detection and Management

- 8.3.3 Operation Intelligence

- 8.3.4 Predictive Maintenance

- 8.3.5 Asset Management

- 8.3.6 Other Solutions

- 8.4 By End-user Industry

- 8.4.1 BFSI

- 8.4.2 Healthcare

- 8.4.3 Retail

- 8.4.4 Manufacturing and Automotive

- 8.4.5 Aerospace & Defense

- 8.4.6 IT & Telecommunication

- 8.4.7 Government

- 8.4.8 Other End-user Industries

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 IBM China Company Limited

- 9.1.2 SAP China

- 9.1.3 Huawei Technologies Co.

- 9.1.4 Microsoft (China) Co., Ltd.

- 9.1.5 Lenovo (Beijing) Limited

- 9.1.6 Alibaba Cloud Computing Company

- 9.1.7 Inspur Group Limited

- 9.1.8 Baidu, Inc.

- 9.1.9 Neusoft Corporation

- 9.1.10 JD.com, Inc.

10 INVESTMENT ANALYSIS

11 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219