|

市场调查报告书

商品编码

1637870

精密农业-市场占有率分析、产业趋势/统计、成长预测(2025-2030)Precision Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

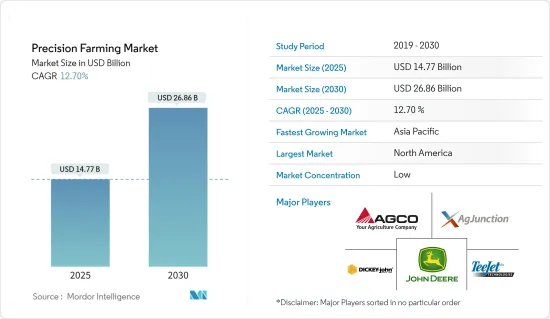

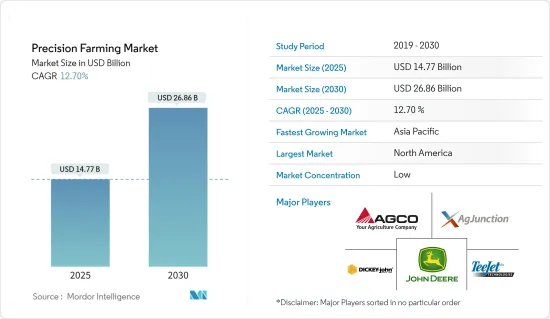

精密农业市场规模预计到2025年为147.7亿美元,预计2030年将达到268.6亿美元,预测期内(2025-2030年)复合年增长率为12.7%。

采用精密农业的主要驱动因素包括气候变迁、粮食需求增加、全球农业部门技术采用的增加以及政府利用新技术来提高农民效率的努力。

主要亮点

- 精密农业是一种农业管理概念,重点是观察、测量和应对田间作物变化。植物生产集中在由财产线、特定田地的预期作物产量、地理和环境因素所界定的区域。

- 预计到 2030年终,精密农业将成为重要趋势,超越农业领域的其他进步。透过行动应用程序,您可以透过遥感探测和地面通讯获取设备的即时资讯。 (VRT) 使农民能够根据天气变化做出更具体的土地管理决策,并更有效地使用种子、化肥和农药等投入品。

- 大多数广泛的市场供应商提供导引系统、气候/天气预报和输入分配设备。这家小型供应商主要针对智慧灌溉和田间监测技术,并专注于物联网解决方案。北美是技术的早期采用者,对精密农业中使用的许多创新技术的采用率很高。该地区在农业中大量采用了物联网、巨量资料、无人机和机器人技术。

- 此外,在研究期间,增加对驾驶人拖拉机、导引系统和GPS感测系统等技术的投资也有望有助于扩大精密农业市场规模。

- 高昂的成本使得小农很难采用该工具,并且仅限于大型农场。然而,可变施肥量 (VRA) 和控制交通系统 (CTF) 有助于提高作物养分利用率、改善作物品质并减少重复生产,从而提高生产经济效益。

- 然而,在 COVID-19 之后,遥感探测和农场管理软体技术的采用预计将导致更广泛的采用。公司已经转向无线平台来支援即时决策,包括作物健康监测、产量监测、灌溉调度、田间测绘和收穫管理。这可能会在预测期内推动所研究的市场需求。

精密农业市场趋势

土壤监测可望占有较大份额

- 可靠的通讯使土壤感测器能够测量土壤的基本特性并将其传输到显示单元。土壤感测器通常用于速度应用,并与 GPS 结合使用,根据土壤特性绘製田野地图。土壤感测器对于监测收穫期间作物的生长至关重要。

- 分析资料后,感测器即时提供资讯并相应地改变施用量。使用地图方法的传统模型被认为更有效。下一步,进行问题分析并应用可变利率。就工业研究而言,用于土壤监测目的整合的不同类型的感测器包括电磁、光学、机械、声学和电化学。

- 此外,随着世界各地先进农民越来越多地使用各种土壤监测感测器,地面监测系统预计将成为整个预测期内的主要需求。地面监测具有很高的市场占有率,因为它不需要大量的专业知识。智慧感测器技术的改进以及与物联网模组的整合正在推动综合农业的需求

- 此外,农业技术进步可能会进一步推动所研究市场的成长。据 ETNO 称,未来几年欧盟 (EU) 农业中的物联网活跃连接数量预计将增加。预计2022年连线数将达到4692万,2025年连线数将达到7026万。物联网设备在农业中的应用包括使用无人机进行监控和种子分发。

亚太地区市场将实现显着成长

- 预计该地区在预测期内将出现显着增长,特别是开发中国家的政府倡议鼓励使用旨在最大限度提高生产力的现代精密农业技术。

- IBEF 表示,在Pradhan Mantri Kisan Sampada Yojana 等政府倡议和1 兆美元基础设施发展计画的支持下,印度加工食品市场将从上个月的193,128.87 亿卢比增长到2025 年,预计将扩大到345,135.25 亿卢比。

- 在许多亚洲国家,服务供应商正在迅速采取行动改善应用方法,使亚洲农业成为研究市场供应商的重点。智慧拖拉机、无人机、整地服务、农作物喷粉、卫星图像、灌溉服务、手持式决策诊断等正在帮助该地区改善对小规模农民的决策支持,而无需投资昂贵的基础设施。

- 亚太地区的主要驱动因素包括产量和盈利的提高,这推动农民采用精密农业中的作物监测技术。

- 澳洲在该地区占有很大份额。市场尚未跟上作物日益增长的需求以及可变利率施用 (VRA) 市场的预期成长。该地区的机会包括无人机和无人机在精密农业实践中的应用以及日益严重的环境问题。

精密农业产业概况

精密农业市场高度分散,涉及众多参与企业。市场主要企业包括AgJunction Inc.、Raven Industries Inc.、DICKEY-john Corporation.、TeeJet Technologies.等。这些公司从事市场扩张活动,并采用有机和无机成长策略,以最大限度地提高不同地区的收益。

- 2023 年 10 月,迪尔公司将与瑞典的 Delaval 合作建立牛奶永续发展中心,并与挪威的 Yara 合作开发数位化精密农业工具以实现永续性。

- 2023年4月,全球农业设备供应商爱科公司与工业技术解决方案供应商海克斯康宣布结成策略联盟。此次合作的重点是扩大爱科的工厂组装和售后指导产品。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 评估 COVID-19 对产业的影响

第五章市场动态

- 市场驱动因素

- 使用人工智慧和物联网技术的土壤监测正在推动市场

- 新技术的出现

- 政府措施和新兴企业的崛起

- 市场问题

- 由于地区意识的差异,实施模式因地区而异。

- 市场机会

- 技术进步正在降低许多先进设备的成本。

- 支援光达的无人机等技术进步、资料分析和该领域云的出现

第六章 市场细分

- 依技术

- 引导系统

- 全球定位系统 (GPS)/全球卫星导航系统 (GNSS)

- 全球资讯系统(GIS)

- 遥感探测

- 可变利率技术

- 变数肥料

- 变速播种

- 变速农药

- 无人机和无人机

- 其他的

- 引导系统

- 按成分

- 硬体

- 软体

- 按服务

- 按用途

- 产量监控

- 可变利率应用

- 现场测绘

- 土壤监测

- 作物侦察

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 拉丁美洲

- 中东/非洲

- 北美洲

第七章 竞争格局

- 公司简介

- AGCO Corporation

- Ag Junction Inc

- John Deere

- DICKEY-john Corporation

- TeeJet Technologies

- Raven Industries Inc.

- Lindsay Corporation

- Topcon Precision Agriculture

- Land O'lakes Inc.

- BASF SE

- Yara International ASA

第八章投资分析

第9章 市场的未来

The Precision Farming Market size is estimated at USD 14.77 billion in 2025, and is expected to reach USD 26.86 billion by 2030, at a CAGR of 12.7% during the forecast period (2025-2030).

Some of the main drivers for adopting precision farming are climate change, growing demand for food, more technology adoption in global agriculture sector and government initiatives to improve farmers' efficiency by means of new technologies.

Key Highlights

- Precision farming is an agricultural management concept which focuses on the observation, measurement and response to crop variability between fields. Production of plants is focused on the areas defined by property lines, expected crop yields in a given field and geographical and environmental factors.

- Moroever, Precision farming, which will overtake other advances in agriculture by the end of 2030, is predicted to be an important trend. Through the mobile app, real time information on equipment is available through remote sensing and ground communication. (VRTs) has allows farmers to make more specific land management decisions, so that inputs like seeds, fertilisers and pesticides can be used more effectively in the context of changing weather conditions.

- Most broad-market vendors offer guidance systems, climate-weather predictions, and input applications equipment. Small vendors mainly target smart irrigation and field monitoring techniques specializing in IoT solutions. North America is the early adopter of technology and has a significant adoption rate of many innovative technologies used in precision farming. The region is a substantial adopter of IoT, big data, drones, and robotics in agriculture.

- Moreover, growing investments in technologies such as driverless tractors, guidance systems, and GPS sensing systems are also anticipated to contribute to the precision agriculture market scope growth during the study period.

- High costs have made it tough for small-scale farmers to deploy the tools, thereby, restricting them to only large farms. However, variable rate application (VRA) and controlled traffic systems (CTF) help in enhanced utilization of crop nutrients, improvement of crop quality, and the reduction of overlap, thus resulting in better production economy.

- However, more significant adoption could result from deploying remote sensing and farm management software technologies after COVID-19. Businesses have already started concentrating more on wireless platforms to support real-time decision-making for crop health monitoring, yield monitoring, irrigation scheduling, field mapping, and harvesting management. This may propel the studied market demand in the forecasted period.

Precision Farming Market Trends

Soil Monitoring is Expected to Hold Significant Share

- By means of reliable communication, soil sensors are capable of measuring the essential properties of soils and transmitting them to a display unit. In order to create field maps based on the soil's characteristics, soils sensors are usually used in combination with velocity applications or GPS. Soil sensors are essential for monitoring the viability of crop growth at harvest time.

- After analysing the data, sensors provide real time information which changes the application rate accordingly. It is considered that traditional models of using the map approach are more efficient. In the following steps, they enable a problem analysis to be carried out and variable rate applications to be adapted.The various type of sensors being integrated for soil monitoring purposes includes electromagnetic, optical, mechanical, acoustic, and electrochemical, as far as industrial research has reached.

- Moreover, in view of the increasing use of different soil monitoring sensors by forward thinking farmers from around the world, ground surveillance systems are expected to be a major demand throughout the forecast period. The market share of ground monitoring is high because it does not require a lot of expertise. Improvements in intelligent sensor technologies and their integration with the Internet of Things modules have led to a growing demand for integrated agriculture.

- Furthermore, technological advancement in farming may further propel the studied market growth. According to ETNO, the number of IoT active connections in agriculture was expected to increase in the European Union through the years. It was recorded at 46.92 million connections in 2022 and is expected to reach 70.26 million by 2025. Some uses for IoT devices in agriculture would be drone usage for surveillance or distributing seeds.

Asia-Pacific to Experience Significant Market Growth

- In particular due to government initiatives in developing countries encouraging the use of modern precision farming technologies, which is aimed at maximising productivity, this region is expected to experience significant growth over the projected period.

- According to IBEF, from INR 1,931,288.7 crore USD 263 billion last month on the back of government initiatives like Pradhan Mantri Kisan Sampada Yojana and plans for a 1 trillion dollar infrastructure, India's processing food market is projected to increase to INR 3,451,352.5 cr USD 470 billion by 2025.

- In many Asian countries, service providers are rapidly moving to improve their application methods and make Asia agriculture the main focus of study market vendors. Smart tractors, UAVs, ground leveling services, pesticide application, satellite imaging, irrigation services, and handheld decision diagnostics along with In this region, without investment in costly infrastructure, decision support is becoming more easily available for small farmers.

- The market growth is being driven by some of the main factors in Asia-Pacific are augmented yield and profitability, which are pushing farmers toward crop monitoring technology in precision farming.

- Australia holds the major share of market in this region. The market is yet to catch up with its growing demand for food crops and the anticipated growth in the variable rate applications (VRA) market. Some of the opportunities in the region are application of drones and unmanned aerial vehicles (UAVs) in precision farming practices and the growing environmental issues.

Precision Farming Industry Overview

The precision farming market is highly fragmented, with numerous participants involved. Key players in the market include AgJunction Inc., Raven Industries Inc., DICKEY-john Corporation., TeeJet Technologies., and others. These companies are engaged in market expansion activities and adopting organic and inorganic growth strategies to maximize their revenue across different regions.

- In October 2023, Deere & Co teams with 2 Sweden-based Delaval on the Milk Sustainability Center and Norway-based Yara on digital precision agriculture tools for sustainability, where the partnerships aim to help farmers track livestock and fertilizer data so they can make smarter business decisions that are better for the environment.

- In April 2023 AGCO Corporation, a one of global agriculture equipment provider, and Hexagon, an industrial technology solution provider declared their strategic collaboration. The collaboration is focused on the expansion of AGCO's factory-fit and aftermarket guidance offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness- Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment Of COVID-19 Impact On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Soil Monitoring using AI and IOT technologies to drive the market

- 5.1.2 Emergence of New Technologies

- 5.1.3 Government Initiative and Increasing Number of Startups

- 5.2 Market Challenges

- 5.2.1 Difference in Awareness in Different Regions is also Resulting in Varying Adoption Patterns in These Regions

- 5.3 Market Opportunities

- 5.3.1 Technological Advancement is Reducing the Cost of Many Advance Equipment

- 5.3.2 Advancement in Technologies, like LIDAR-enabled Drones, and Emergence of Data Analytics and Cloud in the Sector

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Guidance System

- 6.1.1.1 Global Positioning System (GPS)/ Global Satellite Navigation System (GNSS)

- 6.1.1.2 Global Information System (GIS)

- 6.1.2 Remote Sensing

- 6.1.3 Variable-rate Technology

- 6.1.3.1 Variable Rate Fertilizer

- 6.1.3.2 Variable Rate Seeding

- 6.1.3.3 Variable Rate Pesticide

- 6.1.4 Drones and UAVs

- 6.1.5 Other Technologies

- 6.1.1 Guidance System

- 6.2 By Component

- 6.2.1 Hardware

- 6.2.2 Software

- 6.2.3 Services

- 6.3 By Application

- 6.3.1 Yield Monitoring

- 6.3.2 Variable Rate Application

- 6.3.3 Field Mapping

- 6.3.4 Soil Monitoring

- 6.3.5 Crop Scouting

- 6.3.6 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Rest of Europe

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.3.5 Rest of the Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AGCO Corporation

- 7.1.2 Ag Junction Inc

- 7.1.3 John Deere

- 7.1.4 DICKEY-john Corporation

- 7.1.5 TeeJet Technologies

- 7.1.6 Raven Industries Inc.

- 7.1.7 Lindsay Corporation

- 7.1.8 Topcon Precision Agriculture

- 7.1.9 Land O'lakes Inc.

- 7.1.10 BASF SE

- 7.1.11 Yara International ASA